A common saying in the valuation industry is that a 409A valuation is both an art and a science. At Carta we combine art with science to produce over 200 AICPA compliant, audit-defensible valuation reports every month. This post breaks down the art and science behind a Carta 409A.

The Art: collecting data and selecting methodologies

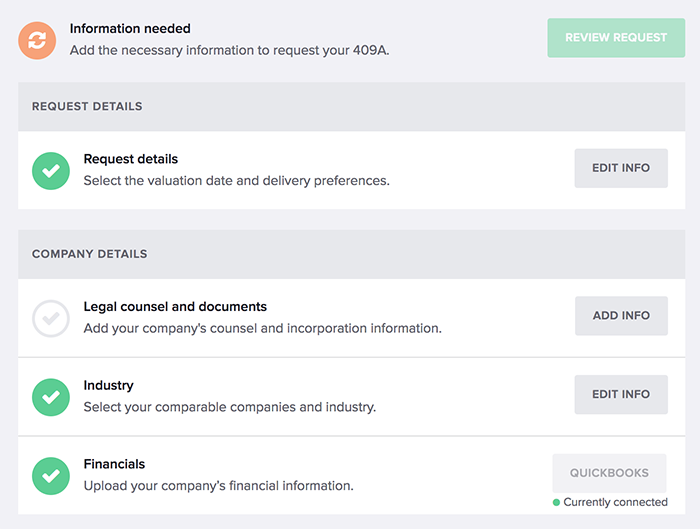

Companies begin the Carta 409A process by submitting a request form. The form includes structured data like peer public companies, projected financials, and balance sheets.

Companies can connect Carta to QuickBooks or Xero. Connected financials let the data to flow directly into Carta, eliminating the risk of data entry errors.

Once the request is submitted, a Carta analyst will schedule the kick-off call. Analysts review the request form before the call to address any outstanding questions. Any intangibles like projected changes to your business are covered on the call.

The Science: how we use software to inform decisions

Every valuation requires unique inputs and methodologies. These are selected and reviewed by our team of analysts. There are a few steps, however, that can be improved with software.

Determining volatility is one of them. Traditionally, valuation firms will select a list of peer public companies and manually pull their volatility measures. At Carta, our analysts still select the peer public companies, but use a software integration with Capital IQ to pull the volatility measures.

Valuations also require industry specific inputs, which are traditionally pulled manually into the report. Similar to the Capital IQ integration, our analysts use a dashboard that connects directly to IBIS World and pulls the relevant industry inputs.

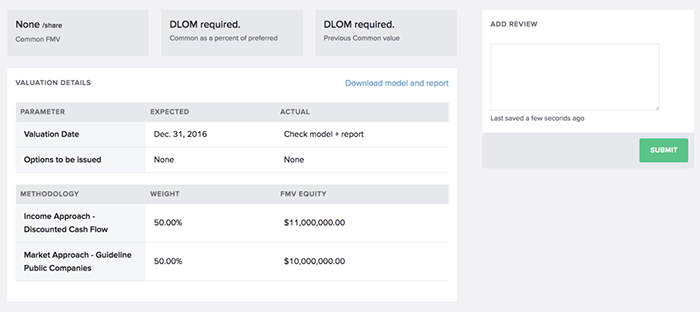

An important part of the valuation process is generating the option pricing model (OPM) and discount for lack of marketability (DLOM). In the past, these processes were done by hand and took hours to complete. On Carta, we can generate these calculations immediately because we have cap tables and financials saved as structured data.

All formulas are included in the reports. This allows analysts to review and adjust the OPM and DLOM if needed.

Art with Science: tying it together with a final review

The last step in every Carta 409A is the review process. Each report is reviewed by multiple analysts and a valuations manager to approve the report.

Our analysts conduct the entire review process from within a Carta dashboard, letting them communicate and share comments easily.

Once reviewed, the final draft is sent for the company’s approval. Any outstanding questions are answered on a final call before confirming the valuation price.

We hope this provides a better understanding of our valuations process and how software helps our team produce great results.