With their latest updates to our closings tool, our product team made the closings process more efficient for you and your LPs.

Pre-filled W-9s

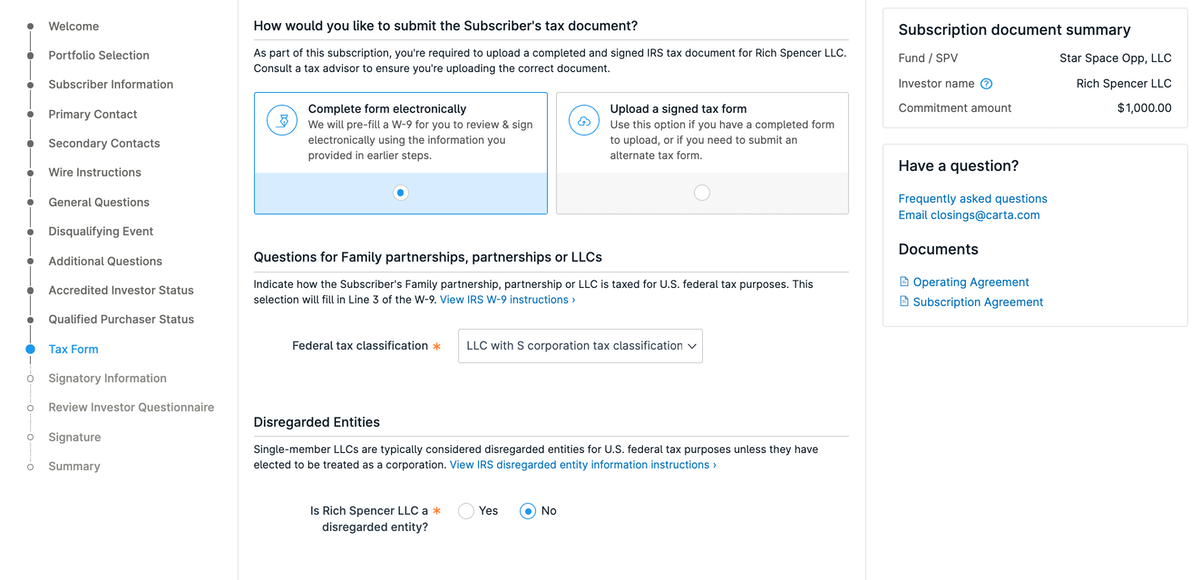

We made LP subscriptions easier than ever: LPs subscribing to funds and special-purpose vehicles (SPVs) using Carta’s closings tool can now e-sign a pre-filled W-9 when it comes time to fill out their subscription documents.

After all, having LPs submit a tax form is an important part of the closing process for any fund or SPV: It helps make sure that your tax team correctly prepares the LP’s K-1s. But filling out forms can be time-consuming and introduces room for human error. LPs in our network asked if we could reduce the friction caused by printing, signing, and uploading W-9s—so we streamlined the process by importing data for returning LPs.

How it works

For individuals

For U.S.-based LPs subscribing as individuals, Carta can now pre-fill a W-9 for them to review and e-sign in just three clicks. The W-9 is pre-filled based on the information the LP already provided as part of their subscription.

For partnerships and LLCs

For LPs subscribing as a partnership or through an LLC, we’ll ask some additional questions to ensure that we’re accurately representing LP federal tax classifications on the W-9.

In this initial release, we will not be pre-filling W-8s or W-8BEN-Es for non-U.S. LPs. Instead, those LPs will upload their own form.

Add existing LPs as prospects

We added new optimizations to the closings tool to save GPs time when they’re creating new fund entities.

A new feature in the closings tool allows fund GPs with existing LPs to add those partners as prospects for new funds. This will be a huge time saver for clients spinning up new SPVs and funds from their existing investor base.

How it works

Previously, if you were spinning up a new entity, you had to manually enter the partner names, contact first, last name, and email addresses for each LP—even if we already had that information in Carta. Now, you can easily add existing LPs as prospects either individually, or with our new bulk-add feature—without re-entering all their data.

Automated capital calls

We’ve made closings even easier with automated capital calls.

Now, GPs using Carta’s closings tool can enable Carta to automatically initiate a capital call when they onboard a new investor to the Carta platform. (No more asking your fund administrator to initiate a capital call after adding a new investor to their fund.)

How it works

Firms can choose whether to enable automatic capital calls in the closings tool. When you do, you’ll then set a standard amount to call, along with notice and wire instructions. If needed, you’ll be able to override the default capital call amount with a customized amount when you add a new LP.

Other recent improvements to closings

-

Autofill of single-add LPs: If you want to just add one new LP, a new typeahead feature will check the name you start typing against any existing LPs in your other entities. If you select one of the matches, we’ll auto-complete the partner name and show you any of the existing contacts associated with that partner.

-

Bulk-add LPs: This tool lets you see all the LPs in your other entities and quickly select and add them to your new entity.

-

Auto-fill contacts: Once you select existing LPs, we’ll show you the contacts already associated with that partner. You can select who you want to send docs to, or enter new information.

-

Name recognition improvement:We no longer require first name and last name for contact name recognition.

More new updates

We didn’t stop with the closings tool. Other updates to fund services include:

-

Subsequent close capital calls: In addition to pro rata capital calls, you can now call capital only from LPs whose commitments have changed since the last capital call—including new subscribers.

-

Crypto fund administration: We expanded our services to help you diversify into alternative assets.

-

In-app valuation updates: Unaudited funds can now review and make changes to their statement of investments (SOI) directly in Carta—no emails required.

-

Enhancements to Portfolio Insights: With new custom KPIs, you’ll be able to track non-financial metrics and add them to your portfolio company tearsheets.

Learn more about these improvements by checking out the enhanced capital call tool and a dive into the other recent updates to fund services. For a closer look at any of the new features, reach out to request a demo.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein. ©2022 eShares Inc., d/b/a Carta Inc. (“Carta”). All rights reserved. Reproduction prohibited.