The closing process is the first interaction your limited partners (LPs) have with your fund or SPV after they decide to invest. Their subscription experience will set the tone for your relationship. Because you’ll be working with your LPs for the life of your fund—and ideally, for the life of your future funds—you’ll want that experience to be easy and efficient.

Our product team took feedback from more than 3,500 fund managers and LPs to improve the closing process for LPs. We redesigned Carta Closings to create an experience that’s uniquely tailored to LPs—saving them time, giving them more support, and enhancing your collaboration tools.

New workflows will save LPs’ time

A shorter, smarter investor questionnaire

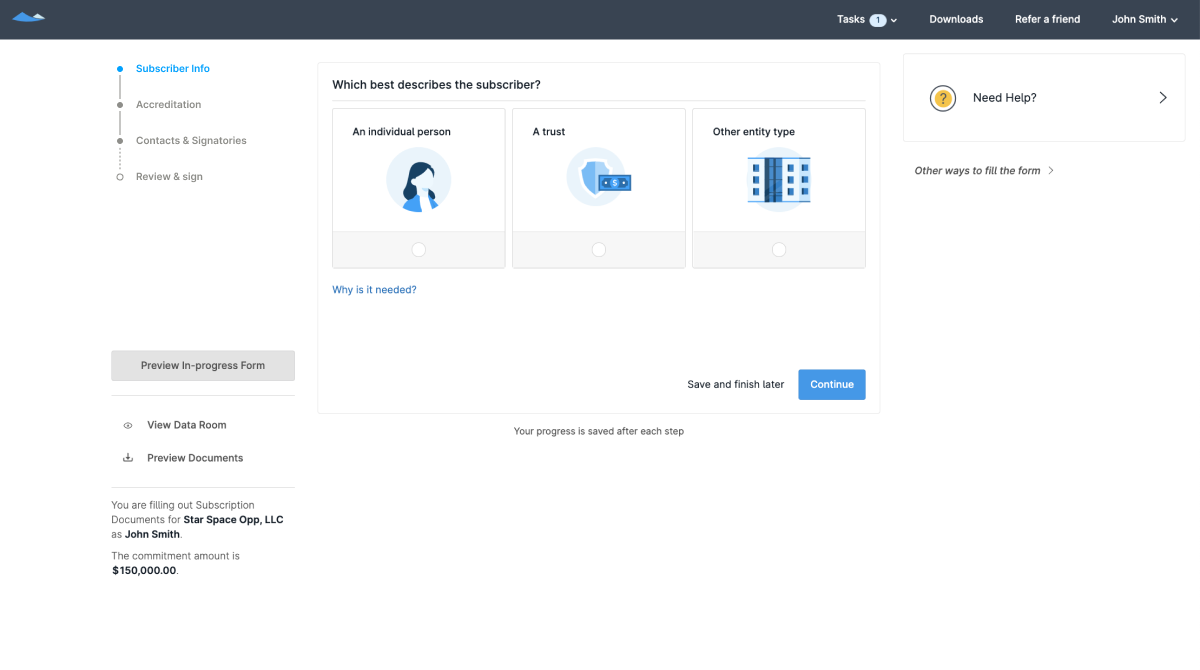

We reduced the time your LPs will spend on subscription documents. With the updated investor questionnaire, new LPs can close into a fund in four easy steps.

If any of your LPs have closed into a previous fund on Carta, they’ll find their questionnaire pre-filled. This allows them to complete the closing process with just a few clicks, and ensures they never have to enter the same information twice.

To save LPs even more time, we added a smarter workflow that adds or subtracts questions based on their responses to previous questions. For example, if an LP tells us they’re an individual investor (rather than a trust or another entity), they won’t see any questions that apply only to entities.

The shift from a standard questionnaire to a smart workflow eliminates the confusion that can arise when LPs see questions that don’t apply to them.

Beefed-up LP support

LPs aren’t all the same. Some might be new fund investors closing for the first time. Others might be institutional LPs who have filled out hundreds of subscription documents. Carta has built a closings process that provides support to your LPs regardless of their experience level. Two new features help guide LPs through the closing process and reduce unnecessary delays.

Dynamic support

Investor questionnaires can contain legal and industry terms that are confusing to LPs. Plus, some LPs are unclear why they have to answer specific questions, or provide certain information. Your LPs will no longer need to spend time researching unfamiliar terms online, or contacting you for assistance. In Carta Closings, your LPs will now see an in-app sidebar that provides answers to complex questions and defines terms throughout the questionnaire. This helps LPs understand the information they’re being asked to provide—and why it’s required.

Questionnaire prep

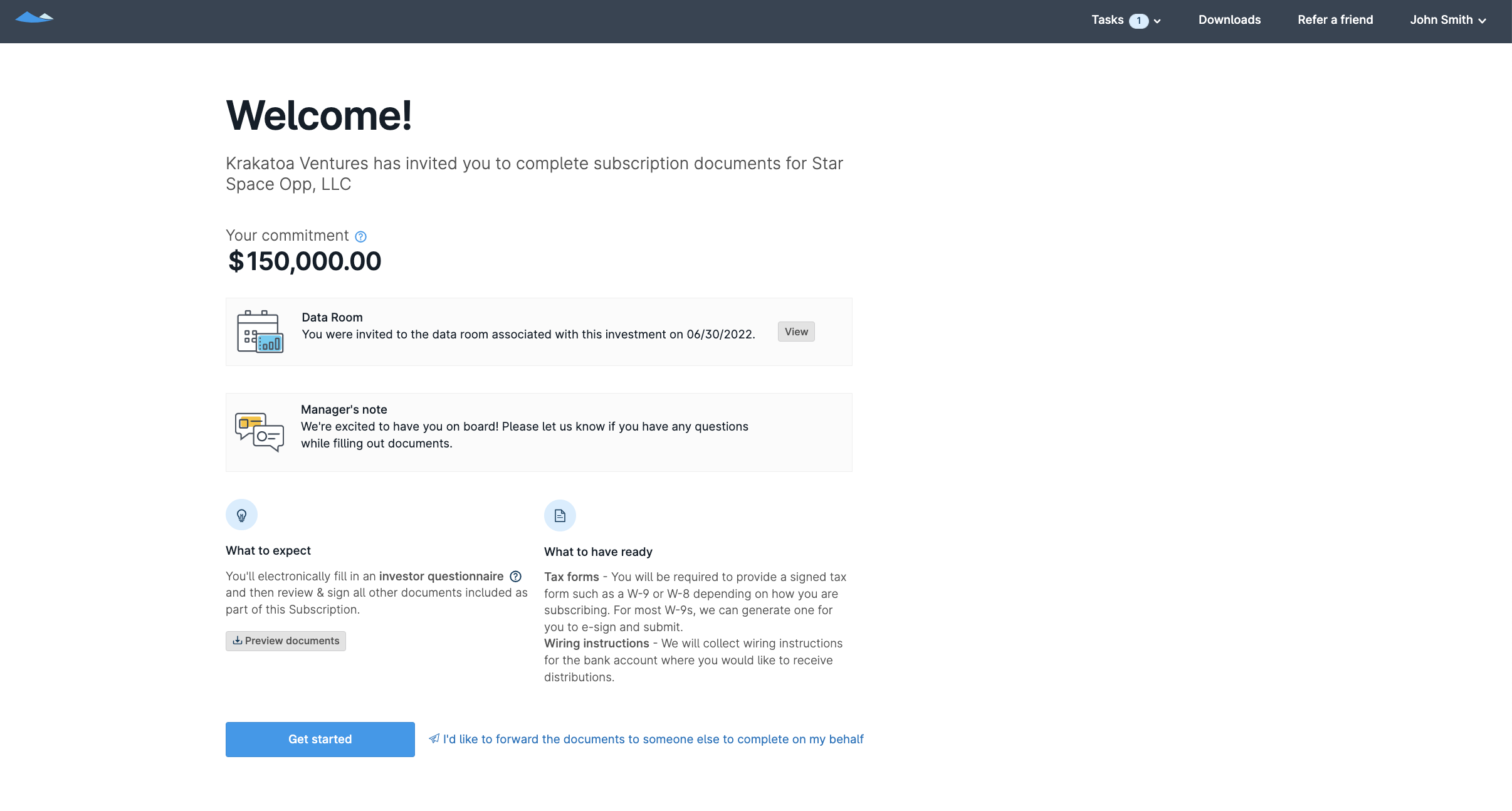

Two new support panels ensure that LPs have all the information they need to navigate closings:

-

What to have ready: LPs will see a complete list of tax documents and wiring instructions they’ll need on hand to complete their investor questionnaire.

-

What to expect:LPs can download a full preview of the fund’s offering documents, such as the operating agreement, side letters, and more.

In addition, LPs will now be able to preview the investor questionnaire at any point in the closing process. This will allow them to obtain necessary information or documents before they begin. And as they continue to fill out the questionnaire, LPs can preview how their answers are reflected in the final document.

More improvements

Enhanced collaboration

Sometimes your LPs will want someone else—like their lawyer or wealth manager—to prepare and review their subscription documents. In the past, this required an LP to email PDFs to their lawyer or wealth manager, who would then print, sign, scan, and return the form over unsecure email servers. Now, LPs can quickly send their subscription documents to someone else to complete in-app, and simply review and sign when they’re complete.

Integrated data room

GPs can now configure a data room specific to each closing where LPs can access fund documents before, during, and after the closing process. This seamless access to fund documents will help LPs save time and reduce the potential for error that can result from switching between windows, as they had to do before.

Coming soon to Carta Closings

More improvements to Carta Closings are on the way. In the coming months, the team will release two new features:

-

Questionnaire customization:You and your law partners will soon be able to add custom questions as an appendix to the investor questionnaire—or hide certain sections that may not be relevant to your close.

-

In-app commitment changes:You’ll be able to generate amendments to LP commitments directly in the Carta app. This will allow LPs to review and sign commitment increases on Carta.

Learn more

To learn more about the latest updates to Carta Closings, reach out to request a demo.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein. ©2022 eShares Inc., d/b/a Carta Inc. (“Carta”). All rights reserved. Reproduction prohibited.