A few years ago, Captable.io was a great option for early-stage companies looking for free cap table management software. But now Carta has a free version too, and Carta offers more features and services that will help you save time, stay compliant, and communicate better with your shareholders.

If you’re an early-stage company with less than 25 stakeholders and $1M in funding, Carta Launch is available at no cost to you through your law firm.

Why choose Carta instead of Captable.io as an early-stage company?

Start on Carta, stay on Carta

As a growing company, the last thing you want to do when your equity management needs change is to switch over to a new platform. It’s a painful process when you have to migrate your entire cap table, ensure all the data is accurate, and introduce a new, unfamiliar solution to your employees, investors, and lawyers.

As your company grows, Carta has the features and services you need, like 409A valuations, scenario modeling, and investor updates. Captable.io doesn’t offer as many features and services to help your growing company.

Plus, Carta always updates your cap table automatically when you issue options, accept securities, or run tender offers. You’ll never need to enter things twice.

The best experience for employees, investors, and law firms

Employees and shareholders love Carta. With Carta, employees can accept securities, exercise options, and view their vesting progress. Unlike Captable.io, Carta provides a complete, online exercise flow on web and mobile that updates your cap table and shareholder’s portfolio automatically.

Over 90% of VC firms use Carta to accept securities, and many of them use Carta for portfolio management and fund administration services. You can securely and easily share information with your most valued shareholders via Carta, like your cap table, 409A valuations, and board consents. Captable.io doesn’t have tools to help you streamline communication with your investors and board.

How can Carta help as your company grows?

Stay compliant

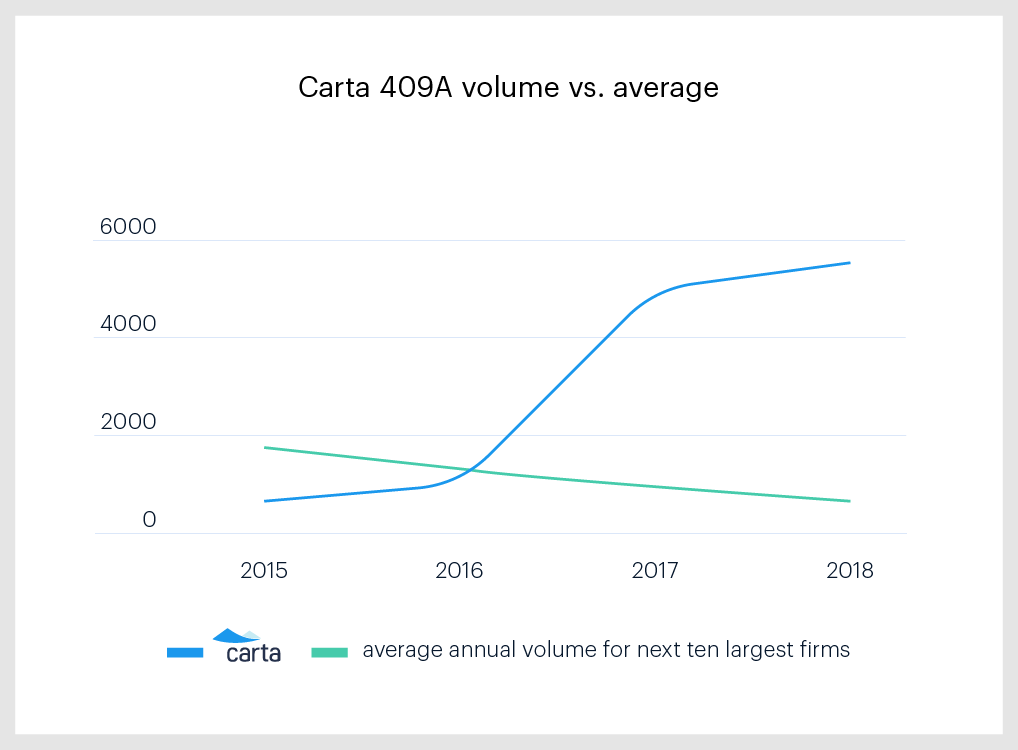

We’re the leading provider of 409A valuations, and 409As are included with every paid plan. Captable.io doesn’t include 409A valuations in any of their plans, and you’ll have to pay for each new 409A valuation. With Carta, when you raise a new round, we’ll provide an updated, audit-ready 409A valuation at no additional cost.

Plus, Carta uses an in-house team and leverages your cap table data to produce your 409A unlike Captable.io, who outsource their valuations.

Model your next round

Carta offers robust scenario modeling tools that pull data directly from your cap table, so it’s effortless to plan for financing rounds and exits. Unlike Captable.io, our tools and reports include sensitivity and breakpoint analysis modeling, payout and dilution modeling, and pro forma cap tables. Captable.io doesn’t offer complex modeling features, while these features are standard in Carta’s Growth plan.

Shareholder relations

Carta also offers tools that make it easy to communicate with your shareholders and board. With our investor updates feature, you can securely send updates with financials, key hires, customer wins, and company performance. We also make the process of getting consents from your board simple. You can easily send, track, and archive board consents on our platform. Lastly, running board meetings is easier with Carta. With all your board materials in one place, you can build meeting agendas, track attendance, and share documents for open or closed sessions to custom groups ahead of time.

More about Carta

Carta is an independent, private company founded in 2012, trusted by more than 12,000 companies. We’re an SEC-registered transfer agent backed by investors including Andreesen Horowitz, Lightspeed Ventures and Union Square Ventures. Our vision is to change how private markets operate by offering increased liquidity and transparency to shareholders. We’re constantly improving our products and services based on customer feedback and are committed to building the most comprehensive, easy-to-use platform for equity management.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta, Inc. (“Carta”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.