Today, Carta released the Estimated Values functionality for LLCs, allowing companies to automatically calculate estimated values for interests issued to holders and show those values to shareholders in real-time.

“ Data shows that employee performance increases when businesses make employees owners,” says Vrushali Paunikar, chief product officer at Carta. “We firmly believe that it’s important to create more owners—and also to make sure that people can clearly see the value of their equity and the impact it can have on their future. We’re thrilled to make this possible for LLC interest holders.”

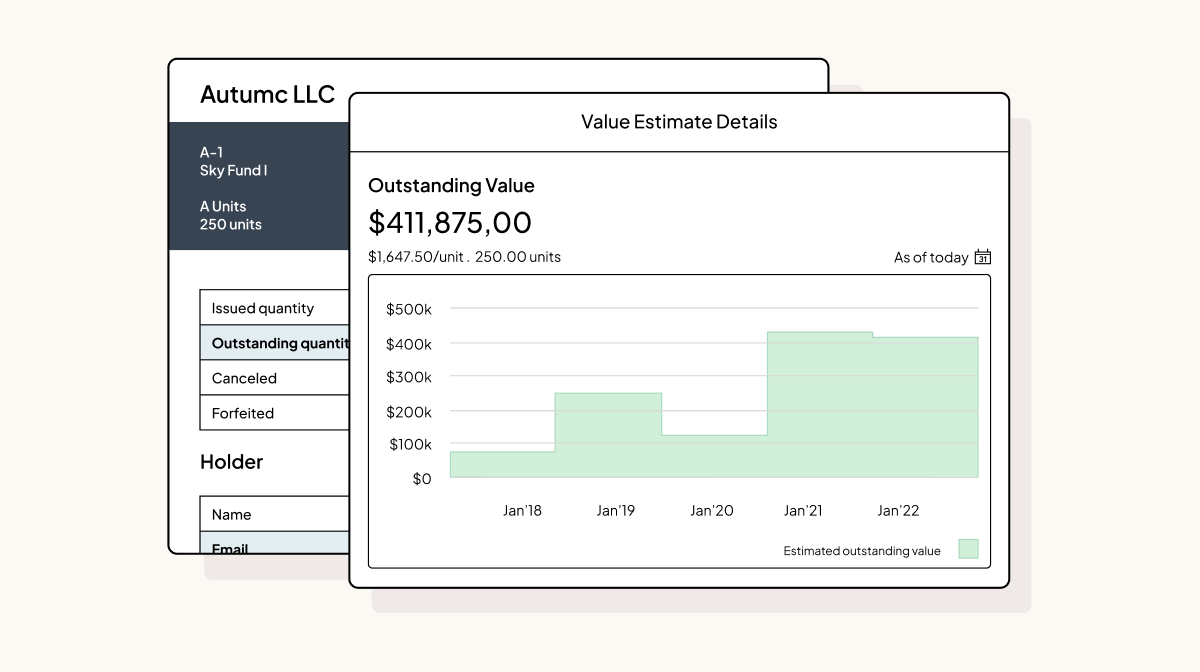

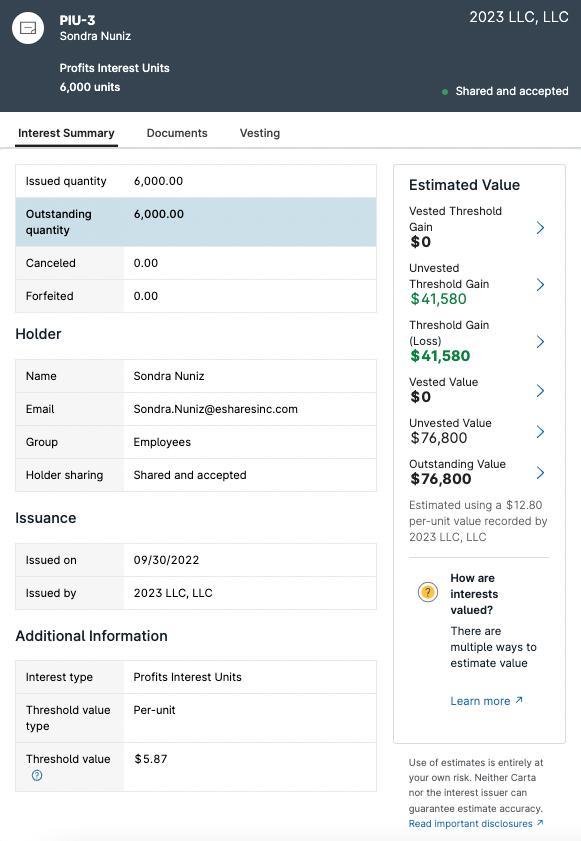

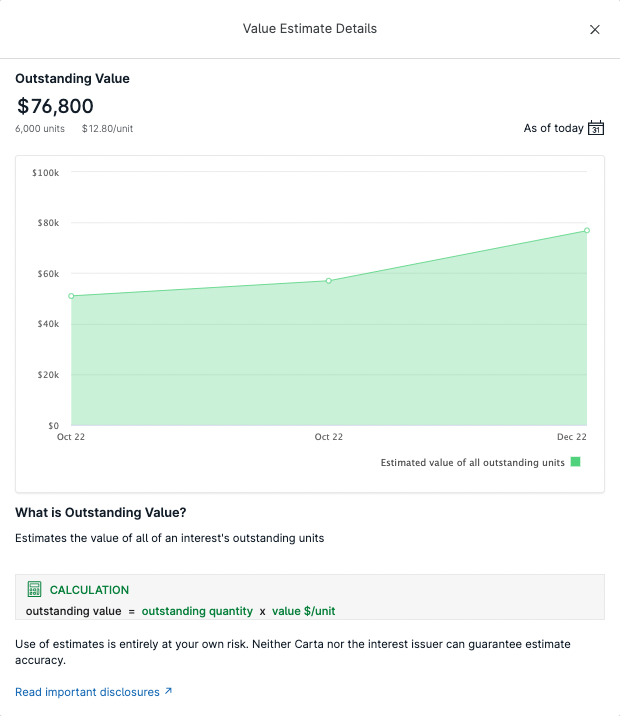

When a company enables Estimated Values, an interest holder can view the estimated value of their interest, and the calculation for that value. For outstanding value estimates, interest holders will also be able to see a time series graph showing how the outstanding value has changed over time.

The new feature will be available to all LLCs with their cap table and latest per-unit value on Carta. Per-unit values can be determined by Carta 409A valuations, or input manually by company Admins from other sources, such as a board determination or recent fundraise.

With company data already on the platform, Carta can automatically estimate the value of different types of equity and show it to the interest holder in their Carta portfolio. Depending on the type of interest issued, companies will have the option to enable:

-

Vested Value

-

Unvested Value

-

Vested Threshold Gain

-

Unvested Threshold Gain

-

Threshold Gain or Loss for Profits Interests

-

MOIC (Multiple on Invested Capital)

-

Outstanding Value

Get started

Current Admins: Learn how to enable estimated values.

Interest holders (investors and employees): Learn where to see the estimated value.