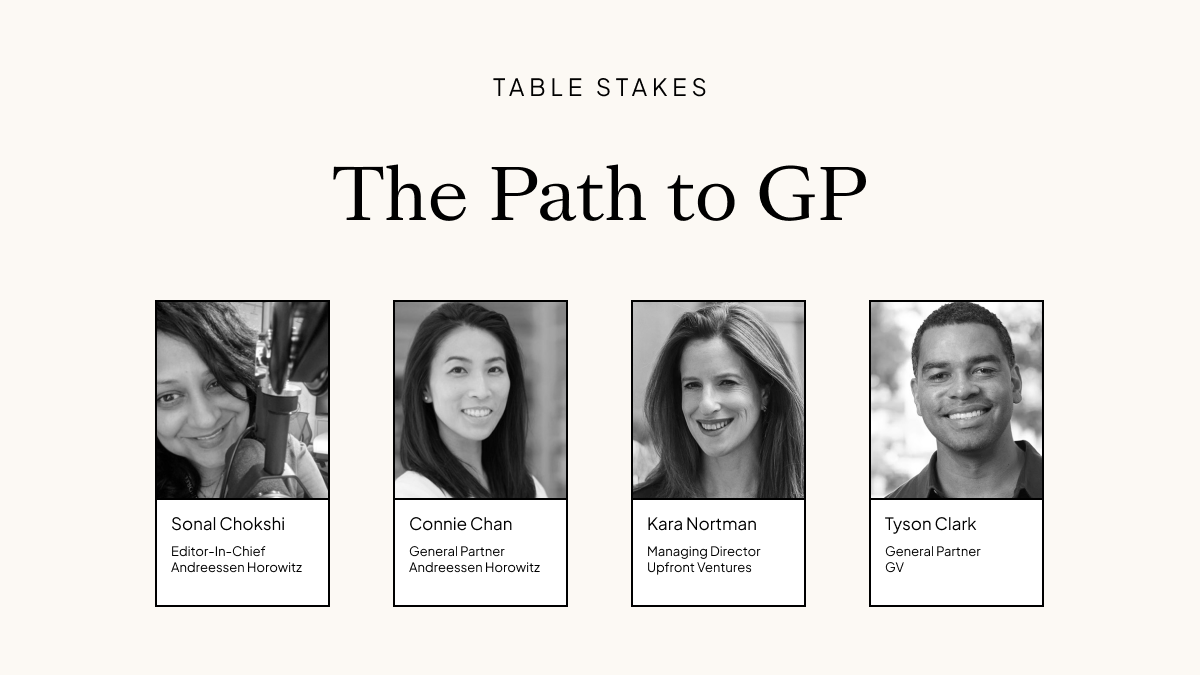

Ascending the ranks in venture capital can be a long and complex journey. At 2020 Table Stakes Summit, Sonal Chokshi, Editor in Chief at Andreessen Horowitz, interviews Tyson Clark, General Partner at GV, Kara Nortman, Managing Partner at Upfront Ventures and Connie Chan, General Partner at Andreessen Horowitz about their career paths and their views on achieving success as a venture capital investor.

Table Stakes 2020: The path to G.P.

(This transcript has been edited and condensed for length and clarity.)

What general partners do

Sonal: Welcome to our Path to GP panel today. I’m editor-in-chief at Andreessen Horowitz and I really believe deeply in the theme of Table Stakes, which is about fair equity distribution and how to drive change. For definition’s sake, a GP is not a general practitioner as in a doctor. Growing up with immigrant parents, I didn’t even know what venture capital was and I didn’t even know what a GP was until I came to Andreessen Horowitz. I think terminology matters because terminology is access.

A general partner, unlike other junior partners or associates, not only has fiduciary responsibility in a venture fund to their limited partners or LPs, which is who they raise money from and manage and deploy capital for. The GP is the primary investor in the portfolio on behalf of the fund, sometimes also taking board seats. It’s pretty powerful, not just quite literally for table stakes, but for shaping the future jobs, tech trends more, investments and governance decisions.

Curiosity, networks, and other critical skills

Sonal: If you could name one key skill that really set you up to be an investor, what would it be and why? And conversely, if you had to name one key skill that really helped others perceive you as an, as a potential GP, what would it be and why?

Connie:To be an investor, you have to deeply want to pursue truth. Whether you’re trying to evaluate whether or not a company is a great investment or how big the outcome can be, what are all the risk factors you have to take into consideration? You have to have this nagging thing that keeps you up at night. You also need to gain deep satisfaction from helping companies. I think these are important because they can sustain a long-term career in investing. Otherwise if you’re just in it for the perceived glamour, I’ll tell you, it’s not glamorous. It’s a lot of work.

In terms of what quality helped me with the outside perception was conviction. I was known as a person who if I didn’t like a deal that I was not working on, I would speak up and I would tell other people why. If I thought there was a great deal and I didn’t feel like the room was super supportive, I would also speak up. I joined the firm almost a decade ago. This is true a decade ago. Back then, you could feel very intimidated when you have these GPs on the covers of magazines and say, I actually disagree with you because I don’t think this product makes sense for X, Y, and Z reasons. So my answer is, it is the pursuit of truth, the curiosity to drive towards the truth and then the ability to speak up even before you had the so-called authority.

Kara:Venture capital is a job that is so romanticized and, candidly, it is so hard to find your way into a good firm. You may find yourself in a good firm and unhappy because you’re not at the right firm. It also may be because you don’t love the job. It’s really hard to match intrinsic and extrinsic motivations for some people. So the one skill I would say is joy.

When I was a founder, some days were a one and some days we’re a 10 and they were never in between. You wanted fifty-one percent of your days to feel like a 10. When you’re a VC, every day is a three to seven because you’re full of all of your founders’ days you work with. If you’re finding drudgery in it that’s actually a common feeling for people who’ve come into venture and then you feel even worse because you feel so lucky to have this job. So I would say, do you get in the flow state enough? Do you enjoy it? For the perception, the skill that people need to perceive you’re on the path to GP, is presence. Presence on boards in rooms and on boards. I think it is hard to learn presence, but you can learn to be more confident. I’d say presence and influence is earned with the founders you back, who really don’t need to listen to you. But if you have a relationship, they should.

Tyson: You can teach how to invest. You can teach how to interact on a board. But you can’t teach a network. You show up with your network. That is what is really differentiated about venture capitalists.

As we hire people, we look at the networks and we want to understand, does that sort of network add something that we don’t have? I think over time you can teach a venture capitalist to be a good board member or to be a good investor, but the network you show up with, that is something you can’t teach.

Tyson Clark, GV

Investment track record and networks

Sonal: Track record is important when it comes to being a VC. Can you guys give us some insights on the track record, and whether people should build expertise in a specific network or domain?

Connie:There are GPs at firms who were not doing investing roles beforehand. They were running products, they were running marketing, maybe they founded a company and there are quite a few GPs that didn’t do any angel investing beforehand. I wouldn’t say track record is like an absolute requirement. However, if you do work at a venture capital firm and have a long record and a career there, then yes, track record does matter because that is how they’re measuring your excellence. The question is how you show a track record of excellence in whatever career you were pursuing beforehand.

Kara:I would say track record is more of a retention tool than an acquisition tool. It is so different now I’m getting into venture than when I got in. I joined Battery Ventures when I was 23 in 1999 and I had absolutely nothing resembling a track record. I just had very large Excel models that look quite good.

What I tell people now, whether it’s networks or track record, or what do you need to be good at: understand the universe and then understand what makes you, you, and what you have to bring to the table.

Kara Nortman, Upfront Ventures

I think one of the harder things is if you’re coming into a firm and you are the first; the only woman, African-American, or whatever it might be, you’re role modeling off all the people who are there. Firms want additive networks. If you’re coming in and everyone else at your firm is camped out at Okta and Stripe and Datadog and all of these companies, trying to get the exact same people, you camping out there trying to do the same thing is less helpful. Every firm is different. Some firms may care more about track records coming in, and whether you’ve been an angel or not. Some firms are looking for dynamics of people who fit in, in a certain way. I think what’s really important is to come in it, fit in just enough to work in that partnership and then understand what it is about you that will make you stand out.

Tyson:In terms of track record, some firms will care about that in some form, some firms won’t. If you bifurcate the distribution of firms out there in the world, there are firms who recruit talent because they just believe in talent. Other firms are sort of newly established and they need investors who can help them raise capital. With that said, track record can never hurt that’s for sure.

Sourcing deals and attribution

Sonal: What would you say on sourcing and attribution? I would love to hear each of your thoughts on how much it matters who sourced this deal and who get credit for this deal.

Tyson:Internally, play it cool. It’s not about attribution internally. Externally, it’s all about attribution. You want to make sure that people know the deals you’ve done, where you’ve been influential, but internally, it can be very political as you claim credit for a deal. You’ve got to navigate the political structure within your firm. Externally, it’s all about promoting what you’ve done and making sure folks give you credit for the deal you’ve done.

Kara: I grew up in a very heavy attribution oriented firm at Battery Ventures. We would look at our deal sheets every week and see whose initials were under who actually brought the company yet. In my first year I sourced six investments when I was 23. I was very proud of that. There are some people who just don’t like finding companies. They like analyzing them and they like sitting on boards and they’re great at winning. I think winning investments is incredibly important. I love finding companies; the Battery Ventures Associate in me will never die. One of the hardest things about my new role is I’ve got to do all these other things. I can’t run around scanning PitchBook on my own and cold calling companies. Attribution is the conviction to lead the investment, not the relationship that brought it in. If you don’t like finding companies, you have to really make sure you love the other parts of it.

Connie:That’s why I value the conviction piece so much. I just recently signed a term sheet on a deal that I was going to turn off. As someone on my investment team made a very strong case for why I needed to reconsider. I spent more time with the founder and decided I really wanted to invest in this company. I changed my mind. And so I will give my colleague the credit for getting me to that conviction point.

My definition of attribution is, would the firm have done the deal if you were not there?

Connie Chan, Andreessen Horowitz

The importance of firm brand and VC Twitter

Sonal: Can you share your thoughts on brand building and where it is and isn’t helpful, particularly when it comes to underrepresented folks who might want to be GPs?

Connie:Brand building in venture is much more important than it was 10 or 20 years ago. I feel like all of us are feeling that way.

Those of us who are not naturally good at social media, we have to get good at it. Those of us who are naturally introverts have to get good at networking and relationship building. Brand building matters, especially when you’re trying to win a deal and people are trying to decide which partner they want to work with.

Connie Chan, Andreessen Horowitz

Not only is it based off of their interactions with you, because remember, it’s not like they’ve spent years and years with you. Most of the time they’ve only spent hours with you. When they’re trying to choose which partner they want to work with, the brand certainly helps. The brand helps people feel more confident that they have a sense of what you can bring to the table if you work with them.

Kara: I was on call with my partner Mark today, who some of you may have heard of his brand. It was so much bigger than mine. Mark was tweeting all day long Twitter when Twitter started. I was one of those people who probably typed in a name, like Twitter was search. I tweeted maybe once every six months. The short answer is I figured out Twitter. I actually got a Twitter mentor. I actually got a Gen Z mentor to mentor me on how to use Twitter. I’m now up to almost 18,000 followers, it’s a long journey to learn this stuff. As an individual, you want to represent your firm’s brand in the market. If you’re a founder in Los Angeles, that is when I want to be able to compete well. If it’s in the Bay Area, why are you, why am I there? I should ask myself that question because 25% of my investments are up there. So what is your brand that resonates? Are you better at seed? Are you better at this industry? Do you have relationships with the founders? At a minimum, Twitter is good for reminding people that you exist at a minimum. And honestly, it’s been very, very helpful.

Tyson:It has to be authentic. If you love Twitter, if you love social media and you’re good at it, all good. If you’re not good at it and you’re just trying to fake it, that comes off badly. There’s a bunch of playbooks around how you can go to your brand. Social media is definitely one of them. Twitter is incredibly influential among most of VC crowd, but, but there are other VCs who do it in a different way. It matters how you are authentic on any platform.

Navigating partnerships and politics

Sonal: I want to talk about internal politics and what it takes to navigate a partnership, especially as an underrepresented person in the room. And I’d love for each of you to kind of share your thoughts on this.

Tyson:I think I was the first black investor at GV five years ago. You can imagine my mandate would be bringing people from my network into GV and that would be additive. I’ve talked about this in different settings, but, I felt a bit like I wasn’t courageous around this topic. Imagine a partnership, you’re bringing someone who looks different either a woman or someone who’s African-American or Latino or whatever you look different, they don’t pattern match. You’re early on in your career as an investor and knowing that most VC deals don’t work out, do you want to sort of lay your career on the line to promote diversity in the ecosystem. That’s been one where I’ve struggled conceptually. I would love to believe in the future that I would bring more people of color and women because I have the credibility and the social capital to do that within my firm. Because we are African-American or women, there’s an obligation that we feel to promote or to extend this amazing set of capital to people who need it and to not do so is disappointing.

Connie:At Andreessen Horowitz, we’re very big on culture. Ben Horowitz wrote a book on culture. We operate very much like a team sport. And Jeff Jordan always talks about, we use the word. We, instead of, I, um, we do things for the team, we play to win. I never played a team sport, but I imagine that it’s a similar dynamic when, when you see your partner win something you’re excited for them, you know, and if something, if someone falls, you are there to cheer them up. We also hang out with each other, which I think is very helpful. My daughter just made a birthday card for one of my partners yesterday. I think that’s critical to work with people that you respect, that respect you, that, you know, bring their best to work every day. I think the best way to avoid politics is really being very picky on which firm that you want to become a partner.

Kara:I kind of want to be careful to navigate this because my feeling behind the scenes, talking to a number of primarily women, white women, women of color, et cetera, is that most people feel deeply misunderstood and their firms for most of their time. And I think it’s a real journey to get there. We have to acknowledge politics to build a great culture, because as soon as you have more than two people in a room, you have politics. Generally as a partner, I think rapport building is really important. Invest time in building relationships and rapport that have nothing to do with a transaction that you’re trying to get done.

Building a new firm vs joining an existing firm

Sonal: Would you advise investors listening to go on their own or should they join a partnership?

Connie:If you are young and junior and you’re deciding if you want to go down a GP track or start your own fund, when you start your own fund, that’s a very long-term commitment. Whereas if you join a fund, say as an associate and analyst, even a principal, no one’s going to fault you if you leave in two years. Before you go and start your own fund, the main thing I would ask is, do you have conviction that you love investing? Does it bring you the joy that you’re talking about? Like, can you sign up for doing this job for multiple years? And that’s a big question I would ask myself.

Tyson:To get into Andreessen or Upfront or GV, it’s a high bar. For someone who was coming to venture capital, your fate isn’t up to you. If you’re relying on these funds to hire you because they have a lot of applicants and they have a choice. I’m honestly impressed and humbled by the number of first time fund managers who are out there saying, I’m not going to play this game. I think that’s awesome. That is also a hard road. There’s no easy option here. The question is, what path do you want to take? If there were an easy option, we would all be taking it right now.

Kara:I would assume when you’re starting in a GP role at a firm, assume you have five years to figure it out.

Do a check-in with yourself around two to three years. Ask yourself, am I being invested in, am I learning, am I growing? Yes, it’s going to feel really hard. Starting your own fund is going to be really hard, too.

Kara Nortman, Upfront Ventures

What I say to our new partners, who I help bring in, is that the beginning is going to be hard. And I’m a source for you. We’re going to teach you. It’s not going to be fun all the time. This job is not fun all the time. But, at some point in time, you’re going to be more valuable or as valuable on the outside as you are inside. If you’re unhappy, give me a year’s notice, and then I’m going to look for you to be loyal. If you’re not feeling it, you really want to go start your own fund. Tell me, I’ll help you start that fund.

If you are in a fund, you are miserable, you love investing. You can’t find anyone to mentor you or help you move through it, and you are afraid of starting a fund because we’ll know the LP side, call me. There aren’t enough women making LP introductions for other women.

Sonal:The recurring theme of this whole session is about that passion, that joy you feel not being responsible, but not only making one thing your identity, but figuring out the specialization. And then bottom line is the connections, the helpfulness, the networks, and people supporting each other. That is obviously the core of this. Thank you everyone for sharing your insights.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta, Inc. (“Carta”). This communication is not to be construed as legal, financial, accounting or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.