Traditionally, sensitive tax documents like Schedules K-1 are sent manually via email and regular mail. Besides numerous security vulnerabilities, these methods are also extremely time-consuming and prone to error.

Carta has the solution. We have developed a fully-integrated, secure and encrypted portal that makes it quick and easy to manage investors, documents, and communications trusted by leading investment firms.

Here’s how it works:

Secure, frictionless, and controlled file delivery: Using customized access permissions, documents can be easily uploaded in bulk, parsed (using Carta’s DocumentDivider), and distributed.

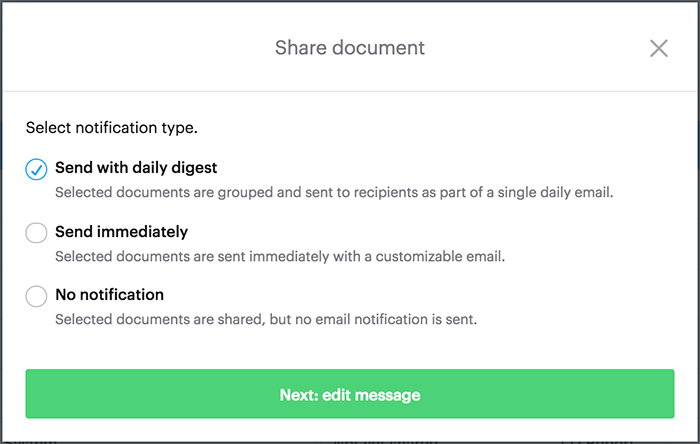

Configurable notifications to investors: Choose the way you would like to notify your investors and include a personalized message.

Searchable repository for historical documents: The Carta document page is not just for K-1s. Instead, it is part of a robust investor portal where you can share quarterly updates, historical legal documents, and structured data about the fund’s underlying portfolio.

Reduce administrative burden: Investors manage and service their own accounts. Carta is quickly becoming the platform of choice for private market investors; tens of thousands of investment firms have Carta accounts.

Talk to an expert to learn more.