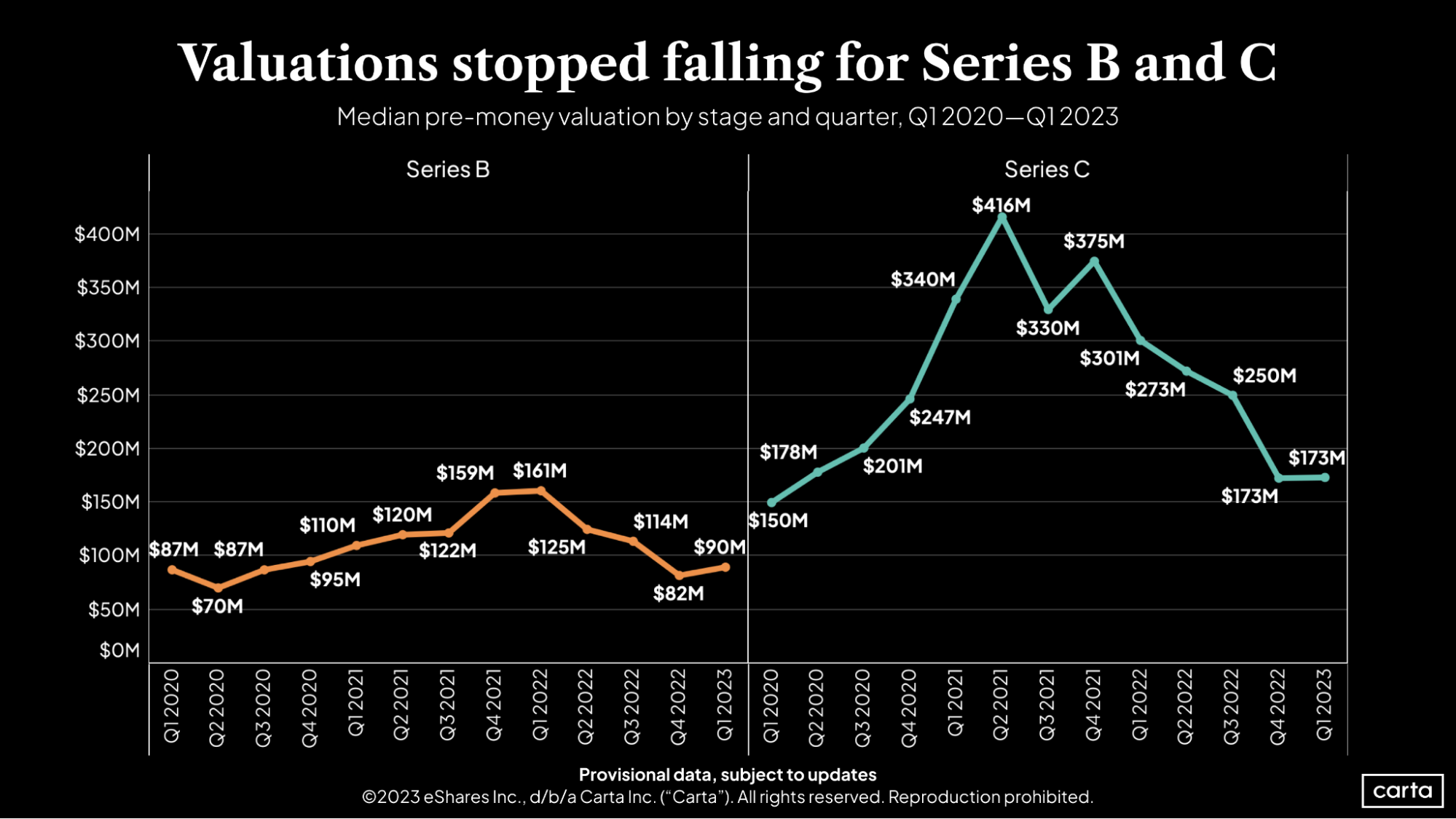

For the first time in a year, Series B valuations are again trending up.

The median valuation for a Series B round was nearly 10% bigger in Q1 2023 than it was in Q4 2022, jumping from $82 million to $90 million, according to the first cut of Carta’s Q1 valuations and fundraising data. This is the first quarterly increase since Q1 2022, and the largest quarterly leap since Q4 2021.

It’s part of a broader positive trend in valuations across the middle and early stages that occurred in Q1. The median Series C valuation held steady at $173 million, ending a streak of four straight quarterly declines. And the median Series A valuation rose from $37 million to $40 million.

The biggest quarter-over-quarter increase, though, came at Series B, offering a boost to these companies looking to make the transition from true startup into a more established business. Still, last quarter’s median Series B valuation is lower than in all eight quarters from 2021 and 2022. Q1’s median of $90 million is down 44% year over year.

That’s closely in line with the median Series C, which is down 43% year over year. But on a longer timeline, Series C valuations have fallen off further from their lofty pandemic peak. Last quarter’s median Series C was down 58% from its recent high of $416 million in Q2 2021.

Learn more

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: