For early-stage founders looking to raise their next round of venture capital, patience is an increasingly important virtue.

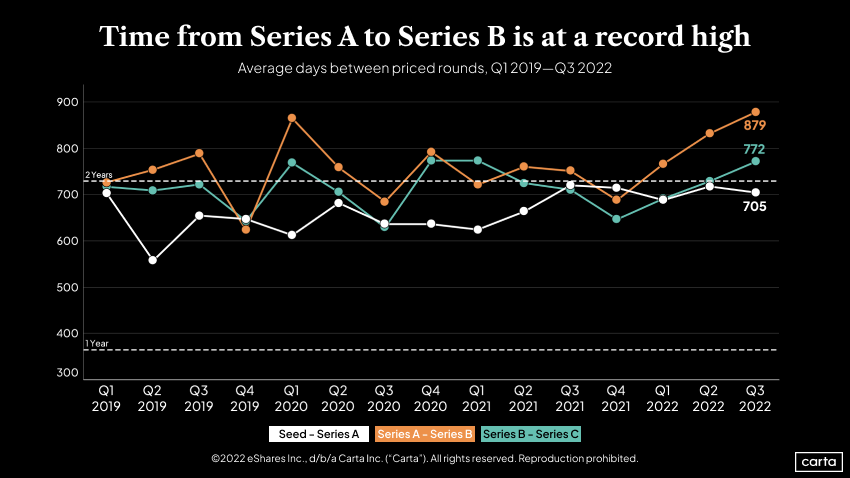

Venture investment slowed significantly in Q3 2022: Overall deal count plunged 30% compared to Q2, while deal count and deal value both declined at every funding stage. With fewer deals and dollars to go around, the startup fundraising timeline is stretching out. On average, companies that raised a Series B round in Q3 2022 waited 879 days after their Series A. That’s about two years and five months—the longest average interval for the move from Series A to Series B since the start of 2019.

Interval between Series A and Series B hits record high

The time between Series A and Series B rounds increased every quarter this year. The same is true for the average time between Series B and Series C, which reached 772 days in Q3, only two days short of the record set in Q1 2021.

Lower deal counts and longer waits between rounds are two aspects of a shift toward austerity in the venture industry that’s unfolded across 2022, one also marked by shrinking valuations and waves of layoffs. Last year was the busiest year for venture capital activity on record, with soaring tech valuations in the public markets and near-zero interest rates driving a flurry of deals. In 2022, the stock market has slumped and the Federal Reserve has increased interest rates to combat inflation.

When the economy gets rocky, startup investors get choosier. And when investors get choosier, raising a new funding round tends to chew up more time.

“I tell some founders of great companies, you’re just going to have to have two to three times the amount of conversations with investors that you did previously,” says Alex Harris, a founding partner at early-stage fintech investment firm Fiat Ventures.

What extended fundraising intervals mean for founders

During last year’s fundraising frenzy, Harris says some founders were hesitant to sell off too much of their equity or raise a supersized round as they aimed to avoid the pitfalls of excessive dilution (which can limit the degree of ownership a founder retains) and overcapitalization (which can push companies to chase rapid growth at the expense of other strategic goals). Other founders took a more aggressive approach, opting to pad their balance sheets by bringing on larger investments than they needed to fulfill their business aims.

The latter group is better prepared for the current environment, according to Harris, who says the shift in the market has shown the benefits of a full bank account. If you have more runway, raising new capital isn’t a necessity. And if you do choose to raise, a longer runway allows companies to negotiate with investors from a position of strength, rather than one of need.

“When you’re going to raise the next round and investors can see how much runway you have, you buy yourself more leverage to negotiate terms,” Harris says. “It’s now being hammered into founders to have more runway. Take more capital if you can.”

Investors are searching for certainty in this economic environment. To meet that demand, Harris advises founders to focus on the quantifiable when they’re seeking to raise new capital. Venture investing is always some combination of hard numbers and gut instinct. But when there are fewer deals to go around, hard numbers might matter more.

“You need to have great data, so you don’t just have a finger in the wind,” Harris says. “You really need to know: What value propositions are resonating? What product features? Who’s your target exactly? There can’t be that uncertainty.”

Another tool for founders seeking more runway is the bridge round, a type of unpriced funding event that companies use to bridge the gap between primary rounds. With those gaps lengthening in 2022, bridge rounds have grown more popular, particularly for late-stage companies. In Q2, bridge rounds made up 22% of all rounds for companies at Series D or later.

Learn more

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: