Firm overview

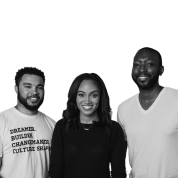

Collab Capital is an early-stage venture capital fund based in Atlanta and focused on funding the next generation of Black entrepreneurs. The fund was started by three prominent Black entrepreneursJewel Burks, Justin Dawkins, and Barry Givens who saw a need in the market in their prior lives as founders and entrepreneurs. Jewel was the CEO and founder of Partpic, a startup that made it easier to find industrial parts; she sold it to Amazon in 2016 before becoming Google’s head of startups. Barry founded and developed Monsieur, an automated bartender startup, before licensing his IP and transitioning to Techstars as the managing director for their social impact accelerator. Justin is a 20-year software development veteran and co-founder of Goodie Nation; he brings experience building an entrepreneur development program focused on social good.

Firm strategy

Jewel, Justin, and Barry founded Collab Capital with the goal of providing scalable capital to Black entrepreneurs. After experiencing the difficulties of raising capital at the early stage as founders themselves, they started a fund to provide resources to founders who didn’t have access to traditional sources of capital. In fact, their firm offers something very few entrepreneurs can access: a new type of investment instrument, called a SPACE (shared profit and collaborative endorsement agreement).

A SPACE is an agreement that gives founders flexibility and optionality for a successful business beyond the binary metrics used by traditional VC. For portfolio companies that don’t reach venture scale, they implement profit sharing once the company reaches predetermined revenue targets—which allows Collab’s LPs earlier access to venture returns without the need for a sale, or IPO. Upon making an investment, Collab Capital uses their network of growth partners to accelerate investment traction, working with founders to help hire teams in local communities. Ultimately, the fund focuses on strong teams looking to build sustainable and profitable businesses and founders who are willing to invest back into their communities.

Why we invested

It’s rare to find a first-time fund with this level of GP experience, social mission, and capital innovation. When we first met with Jewel, Barry, and Justin, it was obvious that they weren’t only building a venture capital fund focused on Black entrepreneurs; they were designing a venture fund purposefully built to tackle the problems these entrepreneurs face. Their experience, thoughtfulness, innovation with SPACE vehicles, and focus on a demographic that still does not receive the time and attention it deserves all resonated with us. Jewel, Barry, and Justin eat, sleep, and breathe their mission, and we’re excited to see how they continue to bring disruption and innovation to the venture industry.