Raising and forming your fund

When you’re starting a venture capital fund, you are more likely to succeed with institutional investor support. If you’ve already worked with institutional investors at your current or previous job, you may be able to tap back into your networks and start having conversations. However, if you don’t have a strong track record for working with institutional investors, how do you show investors you will manage their capital effectively?

Similar to how companies sell products to customers and founders sell companies to fund managers, you have to sell institutional investors on the concept of your fund. And that’s where a pitch deck comes in handy. Before you craft a compelling pitch, though, you have to make sure you’re pitching to the right people.

Identifying prospective limited partners

There are a multitude of different types of LPs, but you can differentiate most of them by their check sizes and individual investment approaches. Most LPs fall into one of two categories when it comes to investing: they’re either driven by process or discretion.

Process-driven LPs have clear investment policies that dictate the percentage of their total assets they allocate to certain asset classes. Fund of funds, multi-family offices, endowments and foundations, sovereign wealth funds, and pension funds tend to fall in this category. These LPs tend to write large checks and manage a broad portfolio of equities, fixed income, and alternative assets. When they invest in venture capital firms, they usually look for firms that are capable of raising multiple successive funds.

Discretion-driven LPs, on the other hand, have a more flexible approach. They may or may not have an investment policy governing their asset allocation to alternative assets. Single family offices, corporate and strategic investors tend to fall into this group. Some write large checks across many funds, while others are just starting to explore investing in the venture capital asset class. High net worth individuals generally fall into this category; many of them are entering the venture capital asset class for the first time as solo LPs. New LPs, like new GPs, are both at the beginning of their investment journeys and often require additional education about the venture asset class.

To figure out which LPs to target, it’s important to do your research. For example, you may find that a pension fund has a dedicated emerging manager program to invest smaller checks into emerging venture funds and might be the right fit for your fund. Look into an LP’s previous investments and investment policy to understand if there is alignment with your fund size, investment thesis, and portfolio construction strategy.

Finding your anchors

When you’re forming your fund, you may need to identify both anchor investors, who will make a meaningful allocation to your fund, and consultants, who can help you to identify prospective limited partners. After all, fundraising is a momentum game—and many institutions like to piggyback off of one another.

Start by looking for your anchors, the LPs who make the largest investments to your fund. Generally, if you get a well-regarded institutional lead on your side, other companies and investors will want to jump on the bandwagon. However, because LPs generally don’t want to comprise more than 10% to 15% of a fund, you need to get the support of a few different institutional LPs to gain momentum and create enough buzz around your fund.

That’s why it’s a good idea to have upwards of 5,000 names on your contact list at any given time. Taking advantage of all your resources helps you find the LPs who are most likely to support your fund and galvanize other investors.

Creating a pitch deck

A pitch deck gives prospective LPs insight into your fund. With eight to ten informative slides, they’ll learn what makes your fund unique, how they’ll benefit from investing with you, and what your individual qualifications are. To create a strong pitch deck, you can include the following as a start:

- Fund summary: What is your unique value proposition? What gap in the market are you trying to address?

- Investment thesis: What is your strategy and how will it give you an edge over the competition?

- Fund details: What is your fund size, sector focus, stage focus, and geographical focus?

- Deal sourcing: What is your deal flow like?

- Portfolio construction strategy: How many companies will you invest in and how do you plan to allocate capital?

- Performance: What is your track record for investing?

- Case studies: Do you have examples of success to share?

Accommodating LP preferences and building a data room

Keeping your LPs happy comes down to accommodating their preferences. Most LPs want to see a financial commitment from GPs, whether it’s an upfront cash investment or a fee offset. They also prefer to have easy access to your fund information. To keep them in the loop, it’s helpful to build a data room that includes some of the following components:

- Pitch deck

- Track record

- Audited returns

- ILPA Due Diligence Questionnaire (DDQ)

- Previous investment memos

You may even want to build separate data rooms for different types of LPs—from institutional investors and family offices to endowment funds. Ultimately, it’s important to make yourself available to current and prospective LPs for questions and conversations.

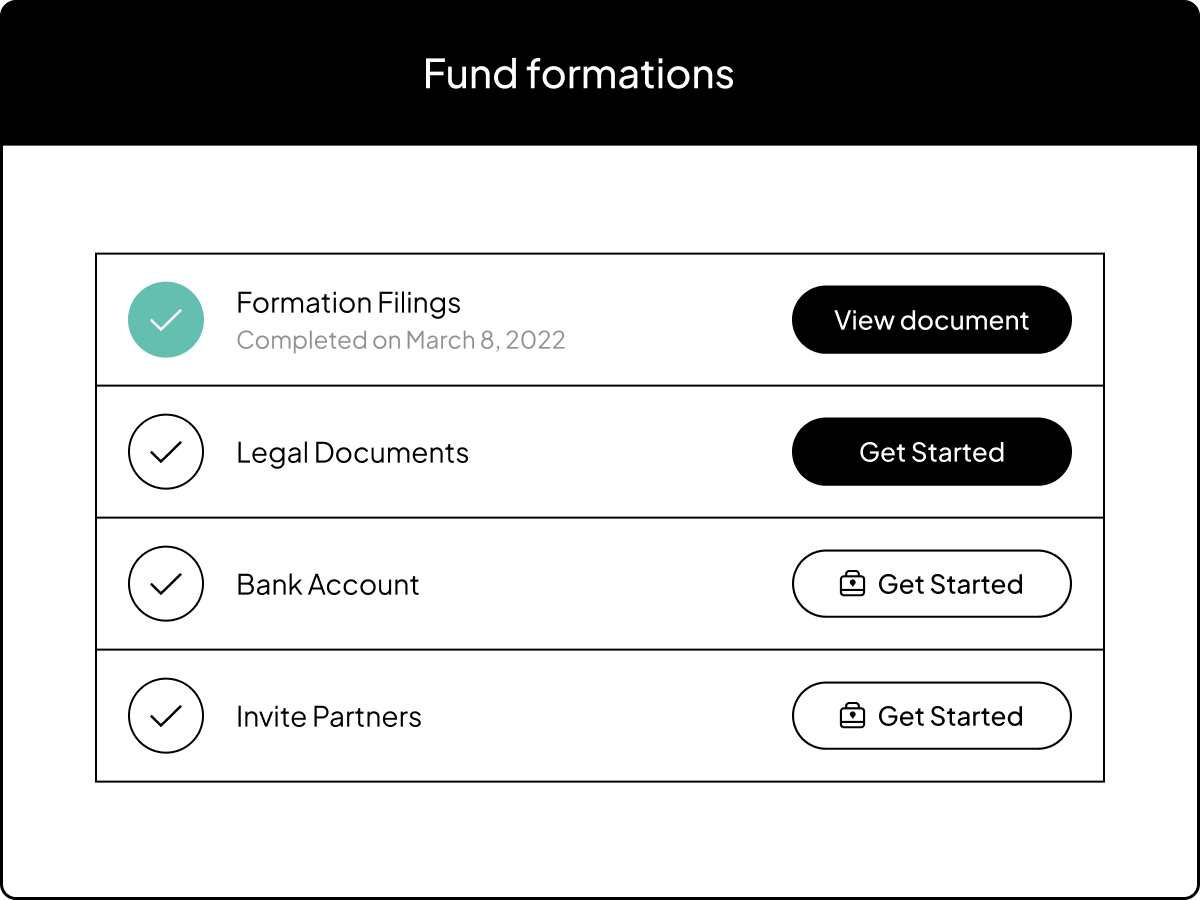

Legal considerations for fund formation

It’s crucial to be prepared on the legal front when forming your fund. In addition to considering the logistics around fund management—like how you’ll allocate profits and losses—you also need to make sure your LPs know what they’re signing up for when they invest in your fund.

To get your ducks in a row, take the time to hire a qualified fund attorney who can help you to navigate the legal process of fund formation. In addition to forming the fund entities, you’ll need to draw up contracts that discuss the following:

- How you’ll handle capital contributions

- How you’ll calculate and distribute profits and losses

- The tax implications of your fund

- Your fund management policies

- What happens in the event of fund dissolution

- Your financial management policies

- Your compensation and fee structure

- LP rights and considerations

DISCLOSURES: This communication is on behalf of eShares Inc., d/b/a Carta, Inc. (“Carta”). This communication is not to be construed as legal, financial, accounting or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.

This communication contains links to articles or other information that may be contained on third-party websites. The inclusion of any hyperlink is not and does not imply any endorsement, approval, investigation, or verification by Carta, and Carta does not endorse or accept responsibility for the content, or the use, of such third-party websites. Carta assumes no liability for any inaccuracies, errors or omissions in or from any data or other information provided on such third-party websites.

All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.