TechCrunch+ dug into the late-stage funding market yesterday using recent data from Carta to explore how the largest startup rounds are changing. Catching up those who missed the piece: We are seeing late-stage startup rounds shrink rapidly, even if valuations for the startups closest to going public are proving stickier than we perhaps expected.

Today we’re flipping the script and looking at the earliest startup stage, using the same dataset as before. Why seed? Because if you want to understand the startup market, tracking how investors are placing wagers on the youngest companies is the only to way grok what comes later; today’s seed companies are tomorrow’s recalcitrant unicorns clinging to paper valuations taller than Olympus Mons, after all!

Seed is holding up better than late-stage investing in some important ways, pushing back against the narrative that we’re in some sort of startup recession. Indeed, times appear to be pretty good for brand-new startups hunting for capital.

Carta’s data, sourced from the startups it helps manage equity ownership, is a good source for understanding incremental changes in the venture game. Because it sources information directly from startups that have recently raised, it can provide a useful lens for what is happening very recently, meaning that we aren’t dealing with data-lag issues that often crop up in venture reporting. (Venture rounds are often publicly reported far after they are closed, making some aggregate datasets inherently out of date.)

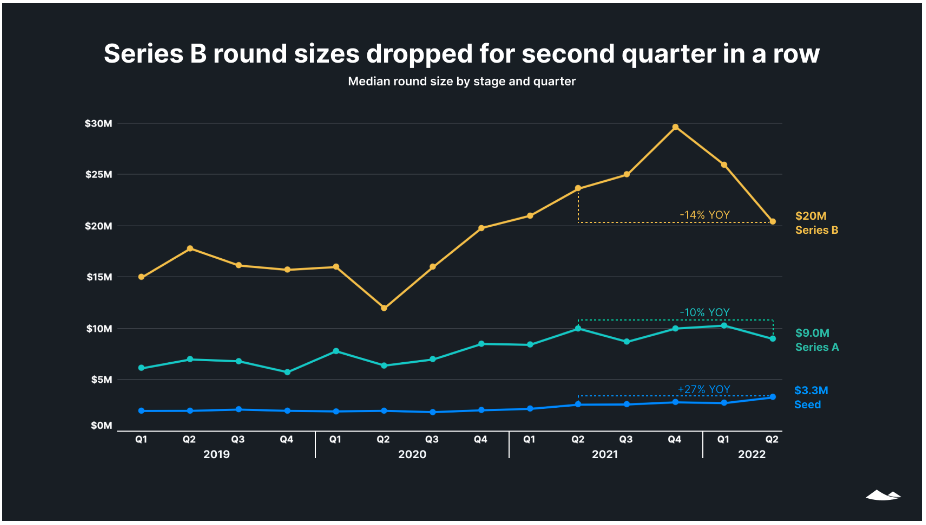

The following chart, which contrasts sharply with what we looked at yesterday, shows median Series B rounds falling from recent highs, while Series A rounds are posting similar year-over-year declines, if less dramatic reductions in median size compared to recent peaks.

Then there’s seed:

Image Credits: Carta

Seed is misbehaving when contrasted with what we’re seeing in other startup stages, at least from a median-round size perspective. As Carta notes in the digest of its Q2 2022 data, “the median seed valuation reached $3.3M — up 20% [compared to the sequentially preceding quarter] and 27% [from the year-ago data point].”

But money in is only one part of the equation. To truly say that seed is healthy, we’ll want to know at what prices investors are writing checks. Carta’s data shows a rosier picture there than you might expect. When compared to year-ago results, the median Series B valuation seen by the company was up 9%, while valuations were up 18% for Series As and 31% for seed. When we compare to recent highs, things are a bit more nuanced — and negative for Series A and B rounds — but regardless, seed deals are getting both larger and more expensive.

In fact, Carta notes that the median seed valuation has only “dipped in three quarters, and never by more than 4%” since 2019. More simply, seed is not only healthy today in contrast to a more conservative late-stage market and a frozen public-offering landscape — it is continuing a run for the ages, one in which private-market investors have been committing more capital at higher prices to the youngest startups in the market.

Naturally, this could create some indigestion when high-priced seed deals run into, say, less winsome Series A and B pricing, but for founders now, things are hardly poor, provided that they are at the earliest stages of building a new tech upstart. That’s good!

While the overall startup and venture capital markets have slowed in recent quarters from all-time records set in 2021, it’s worth keeping in mind that demand for startup shares remains elevated compared to historical norms. Investors are still willing to pay prices — from seed deals through the later stages — that even a half-decade ago would have been deemed ridiculous.

It’s still a founder’s market. Especially for seed.