Late-stage rounds seem to be hitting the gym this year.

A new report from Carta — a dataset that TechCrunch got a preview of earlier in August — indicates that late-stage rounds are seeing their heft rapidly shrink as 2022 continues.

The cap table management company sits atop a regular inflow of startup information from which it extracts hard data about venture capital activity. While we lean on a host of data sources here at TechCrunch, Carta data has the benefit of all coming from bare metal, if you will.

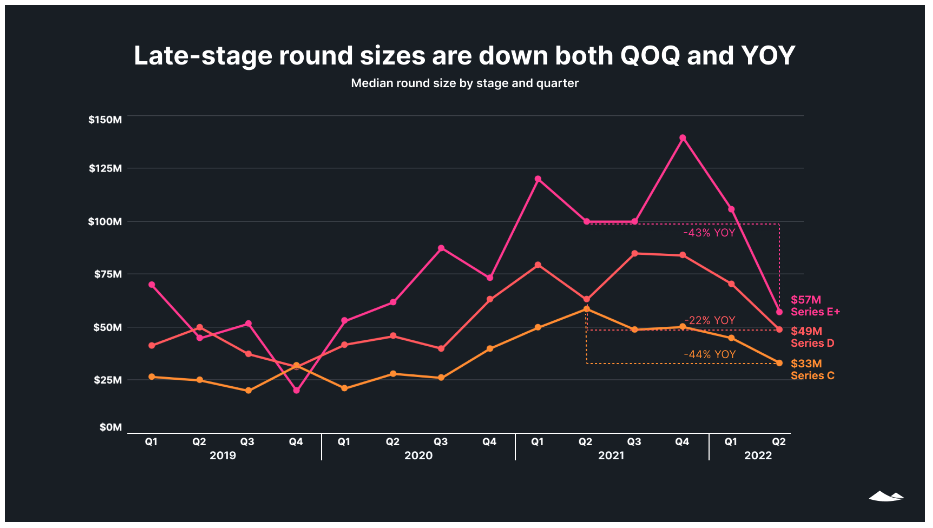

Parsing a chart shared by the company’s analysis team, the median Q2 2022 Series E is now smaller than median Series D rounds back in 2021, while Series D rounds are now smaller than peak 2021-era Series C rounds, measured in median terms.

More simply, every late-stage round has been knocked down a series, meaning that growth-stage startups are now looking at smaller rounds, period:

Image Credits: Carta. Shared with permission.

Notably, Series C rounds in Q2 2022, sporting a median size of $33 million, are now just above the peak median value for Series B rounds in 2021, a figure that landed at around $30 million, according to the same dataset.

So what?

There’s a twist in the data that surprised us: While median round sizes have shrunk rapidly in every part of the late-stage startup market, the same cannot be said for all late-stage valuations. This means that rounds are getting smaller, yes, but also that they are not converting to a consistently similar-sized stake in companies raising Series C and later funding rounds, measured in ownership terms. (Smaller rounds at flat valuations yield lower ownership for investors on a per-round basis.)

Carta reports that Series E valuations, for example, rebounded off Q1 2022 declines, rising to a median of $1.65 billion in the second quarter. That’s their second-highest mark ever by our read of the data. So if your startup is at the very cusp of going public, you may not be able to raise as much as before, but valuation concerns could be a little bit overblown at that point in your startup’s maturity cycle. And you might hold onto a bit more of your company in percentage terms overall.

Things are more cautious at the Series D and C stages, with Series D median valuations falling 5% year over year and Series C valuations sporting a stiffer 21% decline; both datapoints are also off more sharply when contrasted to peak-2021 valuations, which came in Q3 for Series D rounds and Q4 2021 for Series C investments.

The above data is a mishmash of sorts, with the information not pointing cleanly in one direction. But considered in aggregate, rounds are getting smaller, and mostly we are seeing valuations come down. That tracks with what we’ve heard from founders and investors alike, even if the data doesn’t — yet — indicate that things are in full-blown meltdown mode, at least among the startups that use Carta to manage their equity.

The flip side is the seed stage, which is seeing rising median round sizes and valuations that only keep going up. Why is that the case while late-stage funding gets dinged? Perhaps all those huge funds that once stuck to the later stages of startup deal-making showed up at the table for earlier deals leading to more fighting among investors for early-stage allocation, higher prices and larger rounds.