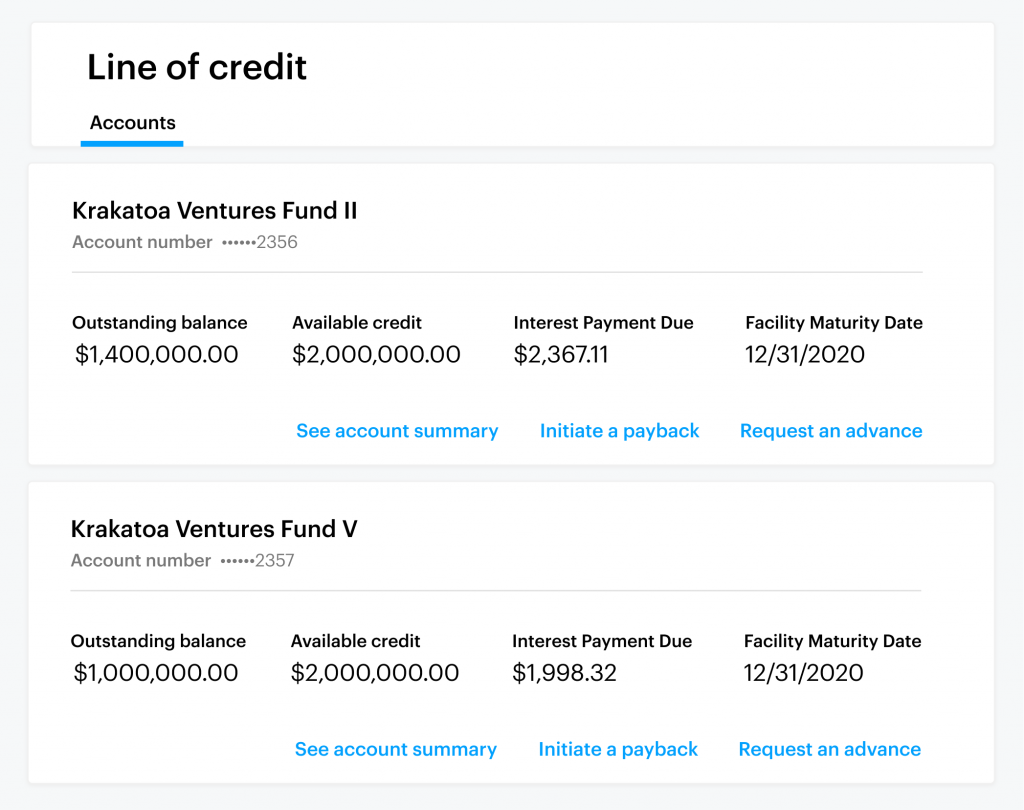

The venture capital industry prides itself on funding innovative companies, but capital call lines of credit—the loans that finance many VC investments—haven’t changed for decades. Carta is already in the business of helping you run your fund, now we’re offering capital call lines, too — and we’re doing things a little differently.

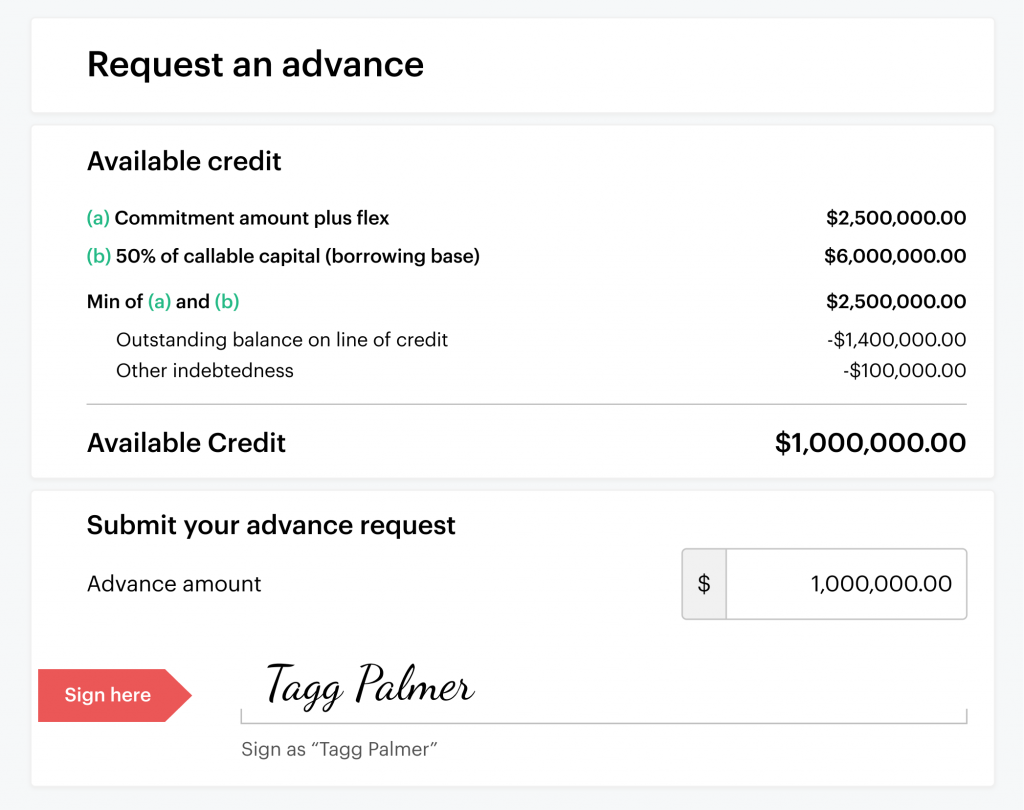

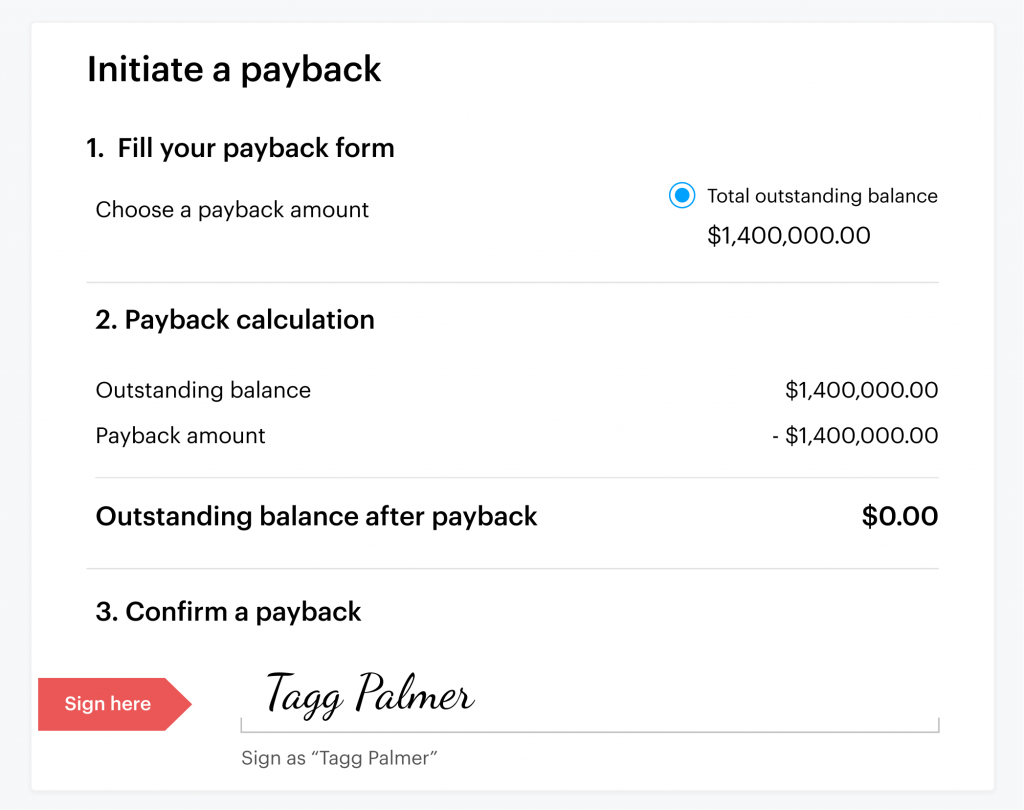

Traditional capital call lines have lots of fees; complex bespoke term sheets and legal agreements; and negotiations that tend to favor those who rub shoulders with private bankers. There’s a lot of negotiating and little transparency into how most banks ultimately decide what price and terms you get.

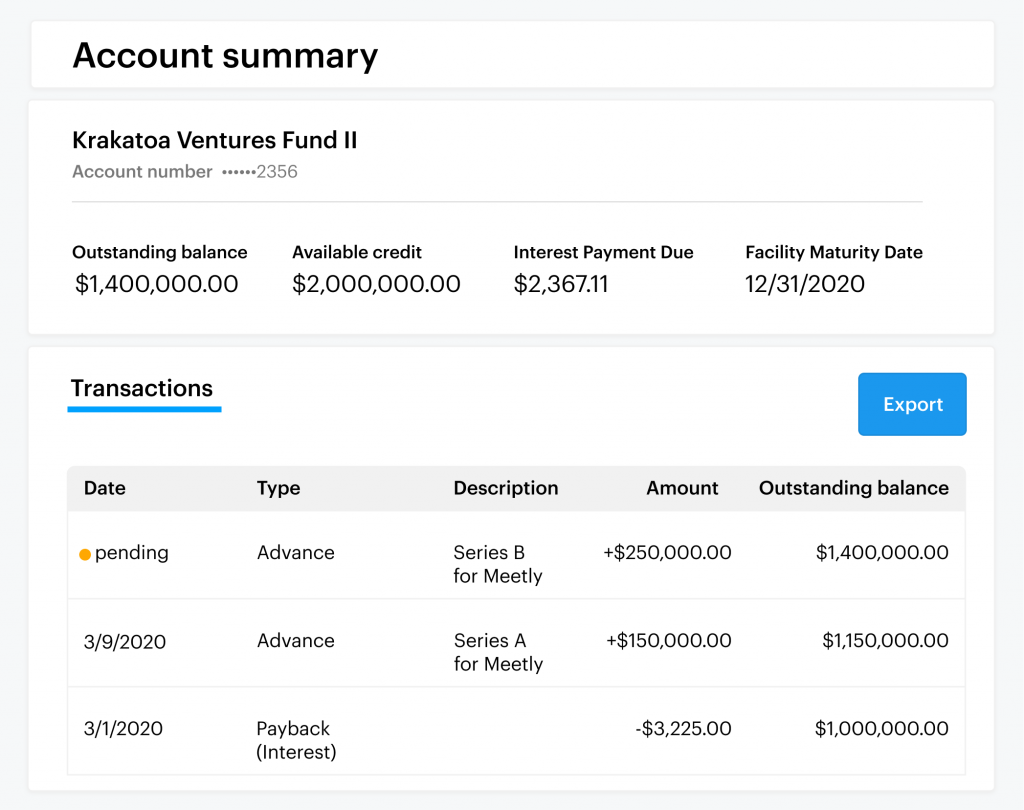

With Carta, everyone gets our best offer, which includes fair and transparent terms. See if you’re eligible.