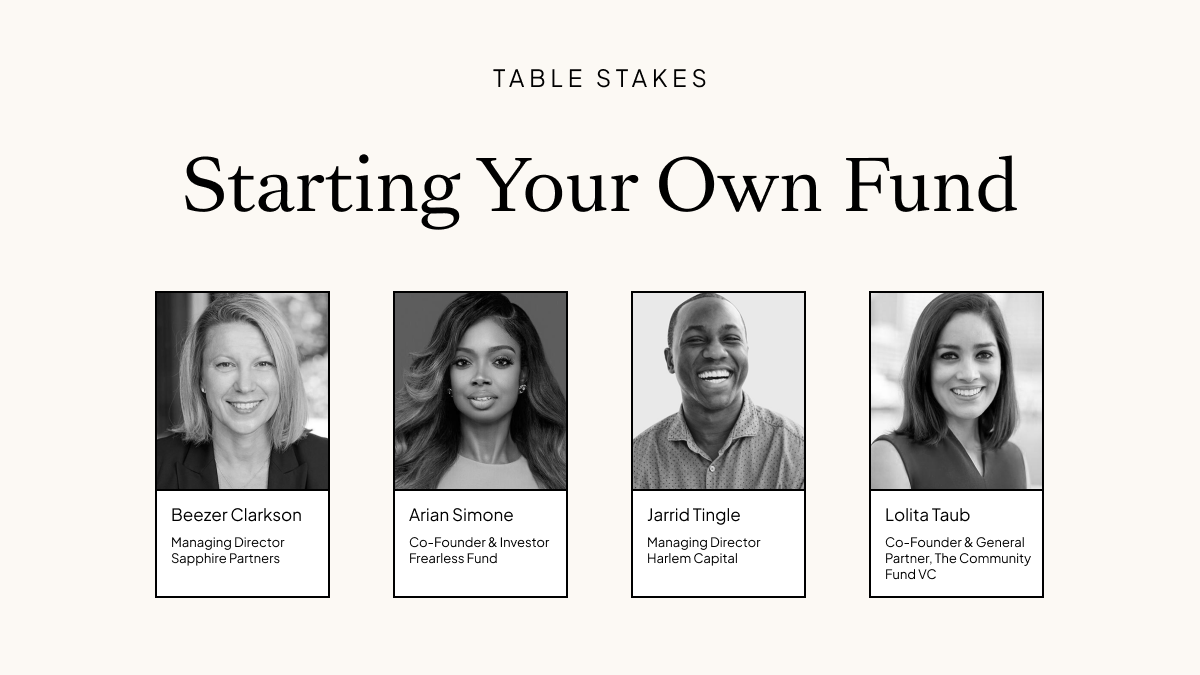

Raising your first venture capital fund is challenging. We invited Elizabeth “Beezer” Clarkson Managing Director of Sapphire Partners, and founder of the #OpenLP initiative to interview Jarrid Tingle, Managing Partner of Harlem Capital Partners, Ariane Simone co-founder and general partner of the Fearless Fund, and Lolita Taub co-founder and general partner at the Community Fund about their perspectives as first-time fund managers.

Table Stakes 2020: Starting your own fund

Starting your own fund

Beezer:We’re here to talk about starting your own fund. I’m with Sapphire Partners and Sapphire Partners is an LP. And for those in the audience that haven’t heard that term so much, LPs are the folks who invest in venture funds, think of it as the money behind the money. At Sapphire Partner, we invest in Series A funds and some seed funds, predominantly in the U.S. and a little bit in Europe and Israel.

We’re going to be talking about fundraising and how opaque the world. We started an initiative called #OpenLP about four years ago with some other LPs, because we felt that it was just too darn hard to know what was going on in LP land. There were some LPs out there talking about it, but not a whole bunch. We wanted to encourage more LPs and encourage more GP voices. We believe that information is its own kind of superpower.

Ariane:My name is Ariane Simone. I’m one of the general partners and co-founders at the Fearless Fund. We are based in Atlanta, Georgia. We invest in women of color businesses at the pre-seed, seed, and series A stages.

Jarrid:I’m Jarrid with Harlem Capital we’re a seed-stage fund focused on investing in minorities and women. We have a $40 million fund we’re deploying out of right now. We’re generalists. We invest all across the country. We are based in New York. We’ve done 21 deals already out of the fund and we’re moving at a good clip.

Lolita:My name is Lolita Taub and I’m co-founder and general partner at the community fund. We’re a $5 million fund investing in early stage, so pre-seed/seed companies that are community-driven. The way we define community-driven is companies where customers identify as members, members support each other, have a space to add value to each other, and start that marketing/sales flywheel. We’re sector agnostic, and super excited to talk to anyone who’s building something with community in it. I’m out of San Diego, although technically the fund is out of New York.

Pathways to venture capital

Beezer:So let’s start at the beginning. Each of you had a really interesting and unique path into venture. What was that moment when you decided to do a venture fund and what inspired you to take that step?

Jarrid:I was in private equity before I was in venture. It was great because I got hands-on experience for what it’s like to invest large sums of money. I was in a very unique position because there’s very few diverse GPs in private equity. Even though I thought I could have a path working way up the ladder in private equity, when it actually came down to having AUM and running a firm that was not on my plate at all until I was working at ICV. We like to say you can’t be what you don’t see. So working with people that look like me, literally opened my eyes and gave me the confidence and conviction I needed to start my own thing. Because it was a smaller firm, I was able to see all things about building platforms — tax, legal, fundraising, we got a lot of exposure at a pretty young age. We used that to build Harlem Capital.

Harlem Capital we started four months into our private equity experience. My co-founder Henri was an associate there as well. We’re like, hey, we would love to invest together to start investing in startups. We didn’t really have a strategy. We were pretty opportunistic. Eventually our strategy found us, we started sourcing deals. We started getting attention and we found that most of our deal flow was coming from early stage startups. We had great minorities and women in our network who were having great companies, but were having a hard time raising funding. After we pulled back the layers of the onion, we realized that this is probably in large part because there’s not diverse representation on the GP side and there may be opportunity to really own this market, help grow the ecosystem and go from there.

So we did six angel deals, over two and a half years, a pretty long period of time. By the time I got to business school, we decided to go out and try to raise a fund instead of getting an internship. It all worked out. It wasn’t easy, but we did find some great advocates and supporters early enough that it really changed the game and allowed us to hit the market in a really strong way.

Lolita:So my path kind of came out of nowhere. I started my career going on 15 years in tech. I started in corporate at IBM and then went on to Cisco. There’s a long story in there about meeting a tribal chief, him becoming my mentor and me going into the startup land. But that’s for another day. I go into Silicon Valley. I start working for the first startup. I didn’t even quite understand the difference between SMB or startups, but I’m in Silicon Valley at a female-founded company. I was hired to lead sales and I’m starting to have meetings with investors. And I was like, what is this venture capital concept? I had no idea. I’m first generation. First of all, my parents came to the US illiterate. Their dream was that I finished high school.

So I was coming from, what is this venture capital thing? It never existed in my life six years ago. So I dive in and I start to see the discrepancy in diverse founders; founders from underestimated backgrounds and also how hard it was for us to raise capital for our startup. AsI started having these interactions with venture capitalists. I was like, wait, so there are these people that invest in companies that are going to produce outsized returns, and why is it that most of them are white cis-gendered guys? There’s a lot of opportunity that’s being left on the table. I realized that there’s this huge gap and something needs to change. And so from that point on, I was determined that I wanted to become a check writer because there’s so much opportunity out there.

I went back to school, did my MBA and turned to venture capital so I could become a check writer. I worked for backstage capital and again, really focused on serving the underestimated founder community. What I really learned was like, great, I’m a check writer, but I should become a GP. It’s been a tough journey because I don’t come from wealth. I don’t have a trust fund. It was very difficult for me to start this fund with no connections or anything like that. I’ve just been hustling along and this summer I was on Twitter and I met my co-founder now. Jesse Middleton from Flybridge said, hey, look, we’re thinking of doing a fund. We started talking about this concept of being able to invest in underestimated founders within community and allowing for more check writers from underestimated backgrounds to come in and be check writers. In having these conversations with Jesse on Twitter, by the way, the power of Twitter is real. We eventually decided to launch this $5 million fund. We’ve been investing for now two months as a team. We’re looking at probably ending the year with eight investments.

Ariane:I am truly a visionary, truly a dreamer. I act on my dreams. I’m born and raised Detroit, Michigan knew nothing about venture capital. Growing up. I attended Florida A&M University for college. I’m a product of their five-year MBA program. While I was in college, I set out to open up my own mall-based retail store, which was about 2,500 square feet. I went around with the deck and I was pretty much selling people on this vision of me opening the store. I raised about a couple hundred thousand, but I remember what the experience was like, how I hated it, and I sat on the floor of the grand opening. I said, one day I’m going to be the business investor that I was looking for. I am living in the manifestation of that promise that I made to myself at 21 that was some years ago. I made that promise to myself and I just never forgot it.

After college, I closed the store, I moved to Los Angeles, California. I was working for Nelly’s Apple Bottoms for like 30 days. I ended up getting fired from there, like everybody else, because the company got sold. And I went from living out of my apartment to my car without a place to stay for about seven months. I ended up building a PR marketing company from the ground up and servicing Sony Pictures, Universal, and Walt Disney. After a while of being settled in that career for about 14 years, I started encountering people in the venture capital space. That triggered me, I said, Arian remember the promise that you made to yourself at 21?

So I started meeting people, started making connections, got securities attorneys, started learning the different industry disparities, as far as race were concerned. Black women received 0.00006 percent of venture funds. And it’s not just a lack of diverse investments. It’s a lack of diverse investors. I found out that it was 80 percent white male in the industry of investors. So I said, I’ve got to get on the other side of this table and cut a check in order to experience change in this space. It’s going to take billions of dollars to move the needle on these statistics.

I encourage anybody out there of any race to definitely invest in people of color. Right now, as far as black women are concerned, cause I’m a black woman, we are the most founded entrepreneurial demographic and the least funded. You will not find a talent pool this ripe and untapped that is ready for investment that is worth betting on. I say it’s more so the non-traditional path, I’ve been blessed with great mentorship and guidance. We set out to be a $5 million concept fund which quickly turned in this year to be a $20 million fund due to all of the attention from the civil unrest in today’s society of people having an interest in black equity. Here we are investing in women of color. That’s my journey to it. I’m a woman with a dream and people decided to believe in our vision.

Differentiation and competitive advantage

Beezer:Let’s get into the nuts and bolts of this because if we want to inspire other people to write checks, let’s help them figure out how to do it. How do you differentiate yourself? How do you think about it in the market and competing for the dollars you want to get into your companies?

Ariane:In our cases there’s not even enough in the space to even call it competition. We need so many more people investing in people of color to where just taking on that mission is unique in itself. That’s just the reality of it. I know at our fund, we’re the first woman of color fund that’s built by us for us. And the words of our Madam vice president elect. We may be the first, but we don’t plan on being the last. That’s how we set out to do this.

Jarrid:So investors care about three things when you’re raising a fund: it’s the team, it’s the strategy and it’s the track record. You have to know where you sit. If you come from another firm you’re spinning out of, you may have a track record. A lot of people don’t, particularly diverse new GPs. And I think over half of diversity GPs actually start their own funds. It is very tough to work your way up to GP level at other firms. They have low head count, they don’t have turn over that much. So you really do have to find out what your advantage is and go from there.

We did not have a track record in the conventional sense. We had our angel portfolio. So we talked about that. That’s all we had and we just painted the vision for what we’re going to do in the future. Most people were betting on us as a team and our strategy. We are not just a diverse run firm, we are planning to invest in diverse founders. There is a fantastic pipeline of black women, black, Latin X women of any race founders, but some people with capital don’t necessarily believe it cause they haven’t seen their day to day. We were very thoughtful about how we just constructed it.

You have to know raising money, whether it’s for a fund or for a firm, why you? Why should someone back you with their capital, their hard earned post-tax dollars? Why should they believe that you could generate a return for them? We came to the conclusion that we’re the best people solving an important problem at the right time.

It’s very important to know what your strengths are. There are many different ways to be successful in raising money in this market. Family offices and funds of funds are helpful for most firms. They were not very helpful for us. We figured we were in New York, we had private equity connections, they have capital, we can talk their language. We just tripled down on that. You have to figure out like if you’re getting friction, just adapt, find out where you can be most successful.

One quote that we got from a top private equity investor was advice is cheap, get the money. You will get advice from every direction you are raising funds. You have to have conviction in your strategy, whether or not someone backs you. You have to know you’re going to be successful. You can’t waffle and eventually will work out if you continue to, to block and tackle, stay organized and execute.

Lolita:For us, this is the community-driven approach and having clear, defined examples from our analysis. We’ve actually created a team of folks that have complimentary backgrounds, skill sets, expertise. They’re either operators, investors, or founders themselves. We want to very intentionally look at and leverage their community. So we’re a community driven fund and we chose community-driven leaders with these different hats seats, different lenses, access to different communities, access to different expertise. When you think about sourcing, you have a great team that has reach in all types of areas where you can have this differentiated deal flow.

Getting the first check for your fund

Beezer:Let’s go into fundraising. We want to break it down. Let’s talk about how you got your first check and then in the fundraising process, I think it would be really great if people understood how long it takes.

Arian:The very first check didn’t happen in a traditional format, which is just the story of my life. I was posting different venture capital stats on social media and Marsai Martin. She plays on Blackish,she is the youngest girl on the show. She’s also the youngest producer in Hollywood right now. Her parents saw me posting these stats and they call me and say what are you up to? I hadn’t told anybody what I was working on. And they’re like, well, we feel you’re getting ready to do something. And I’m like, well, I actually am, I’m starting a fund, investing women of color businesses, we have our advisory board, we have our paperwork, but I haven’t discussed this with anybody. And they said, Oh, we just called to be your first investor. And I was just like, okay, I’m off to the races. I sent over docs. They said, where do we wire? And it was like that. Now that’s just the story of that check. That’s not how this process kept going. It was just like, wow. Off to the races. It was all I needed to just go forward full steam.

We started off kind of like friends and family asking different people in our community, which in the African-American community, this can be a very big educational gap. Even speaking to people who are multimillion dollar revenue, generating people. They’re like, what are you talking about again? And I’m like, Oh gosh, now I got an education piece and I’m trying to pitch at the same time. So it’s like, I have to educate that I have to pitch. And then it was just, it was a lot. It was definitely a lot. During that time we would see hundreds of meetings and you’re like, okay, is anybody gonna cut a check?

Jarrid:It took us 18 months. This is what not to do, a blast email, to like hundreds of people, they were BCC, but that does not work. You’re not going to separate people from their money with any blast communication. It should be personal. It should be intricate and you can use templates, but like you really do have to connect with people one-on-one. There’s no other way to do it. Even at the institutional level, remember these are people making these decisions. So keep that in mind at all times, we went out to friends, family, professors in school. We had some good conversations, a lot of difficult feedback and everyone was telling us not to do it. We were under 30 or black. We’re investing in people of color, no VC experience like any knock you could have on us. We had, and fortunately we made it, we made it work, but like, that was tough.

We found is that people that have taken risks in their careers, the people that actually have started companies have been successful are probably better candidates to go to. Hopefully they have more liquidity, but they’re also is better. If you go to people even who have a fair amount of net worth, but have been in a structured organization, it’ll probably be tough for them to understand the risk appetite you have as a entrepreneurial fund manager. People that have been checking the boxes are going to have a much harder time taking risk and betting on you. So I would try to steer away from that.

Even with family offices, the first-generation is a much easier path to go to you. Once they are led by the second, third generation, they’re more about wealth preservation than risk seeking. What actually changed the course of our fundraise was meeting basically a husband and wife. The wife runs a family office. The husband is a very successful private equity and they made a seven figure check to us, but what was more impactful? They said, you can use our name when you’re fundraising. We’re like, Oh, okay, that’s different. And so we started asking investors that were notable. Can we put you in our deck? And so we had literally pictures, titles, and it was our deck was now mission team, notable investors, which completely changed the conversation. People don’t want to be out there on an Island when they’re making a check. They want to know that other smart people are investing.

Building your brand

Beezer:I’d also want to talk a little bit about brand and we’re down to the last few minutes and you’ve been so powerful. You’ve all been very powerful at making your brands known, which is candidly unusual in the fund world. It’s usually much harder and GPs don’t actually always think about it until later on.

Lolita: One thing to remember as we raise as GPs, is that it’s very similar to founders raising from us. We are the future. So they should be lucky that we’re in their room and that we’re bringing them and letting them invest in us. So just a reminder there, because I think there needs to be a little bit of like, hey guys, it’s not a thank you for letting me be here. It’s like, I’m going to make you money. So write that check for us. From a Flybridge perspective, they are the sole LP for the community fund. And the reason I do want to shout this out is because I think it’s a really interesting way for traditional funds that have been around for a while. Flybridge has been around for almost 20 years, but they need to have others that have a reach that they don’t so that they continue to invest in the best companies that will have those optimal returns for their LPs.

Part of the reason why I ended up doing the Community Fund was because of my broad reach, because of my brand. In fact, that’s how I met Jesse on Twitter. At the end of the day, people buy from people they like and know. It’s no different in venture capital. So founders are going to take money from people they like and know and have access to.

As I have been serving the underestimated founder investor community, as I’ve been preaching my values that I want to see more dollars going into underestimated founders, I’ve been consistent with my words and my actions on social media and off. Brand building builds a relationship and a trust that is so difficult to create if you don’t put yourself out there. If you didn’t come from money and you had that social capital gap, which so many of us do where we are starting from scratch. Building brand and building in public is so important. Just putting out there like, hey, here’s what I stand for. Here’s what I’m investing in. Here’s how to leverage me. In fact. So one thing that I’ve done is try to be as concise as possible on my Twitter handle. Like I’m about investing in community driven companies and serving the underestimated founder investor family.

Tell your story, build in public. People are so hungry for that. I did a poll about what was important to founders. Was it the capital? Was it the brand, the name of the fund? What was it? The top by far was human empathy from investor. So people care about the people who are writing checks more and more so from the founders side. Keep that in mind, as you’re building your brand and expressing your values and what you’re about and what you bring to the table on both the LP founder side.

Countering the worst advice you received

Beezer:What is the worst advice that you got, and you do not want other people to suffer from?

Ariane:When people told us that we wouldn’t get institutional investors, I didn’t receive that. I knew we needed bigger checks in order to cross the finish lines that we were looking to to cross. People trying to teach to preach to you their route and their traditions and how things got done. Don’t let allow anybody to project their fears onto you because it doesn’t have to be your reality.

Lolita:So where’s the worst advice I’ve ever heard. Don’t build in public. Please build in public. It’s important to humanize the process. It’s tough, it’s messy. And this industry is littered with bias. So let’s just put our best foot forward. There’s a community of progressive folks who will support you.

Jarrid:Worst advice was someone told me to go back and get more experience. It was not the right advice for us. We knew we had a unique opportunity. We knew we had a competitive advantage. So you have to believe in yourself. There’s always going to be risk. But if we hadn’t, we would have always wondered what if. So knowing your heart, if you have a unique opportunity set; you want to start soon. You have to have the data to back it up. If you do have a dream, make sure you do go ahead and focus, get the data points, know what else is going on in the market, know how to be successful, know your math, know the research and absolutely you can go ahead and do it. It may require some more mentorship. It may require some more advisors, but there is absolutely a way to get it done.

Beezer:It’s amazing listening to your stories and what you’re doing in the world and the change. And I always learn every time I talk to all of you. Thank you for being so candid and transparent and looking at all the comments the audience was blown away from what I can tell.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta, Inc. (“Carta”). This communication is not to be construed as legal, financial, accounting or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.