EXPENSE ACCOUNTING

Get audit-ready financial reports

Leverage easy-to-generate expense and disclosure reports to help you stay compliant.

Accurate and seamless, at every stage

Frictionless financial reporting

Leverage tailored solutions built to help your company stay compliant at every milestone.

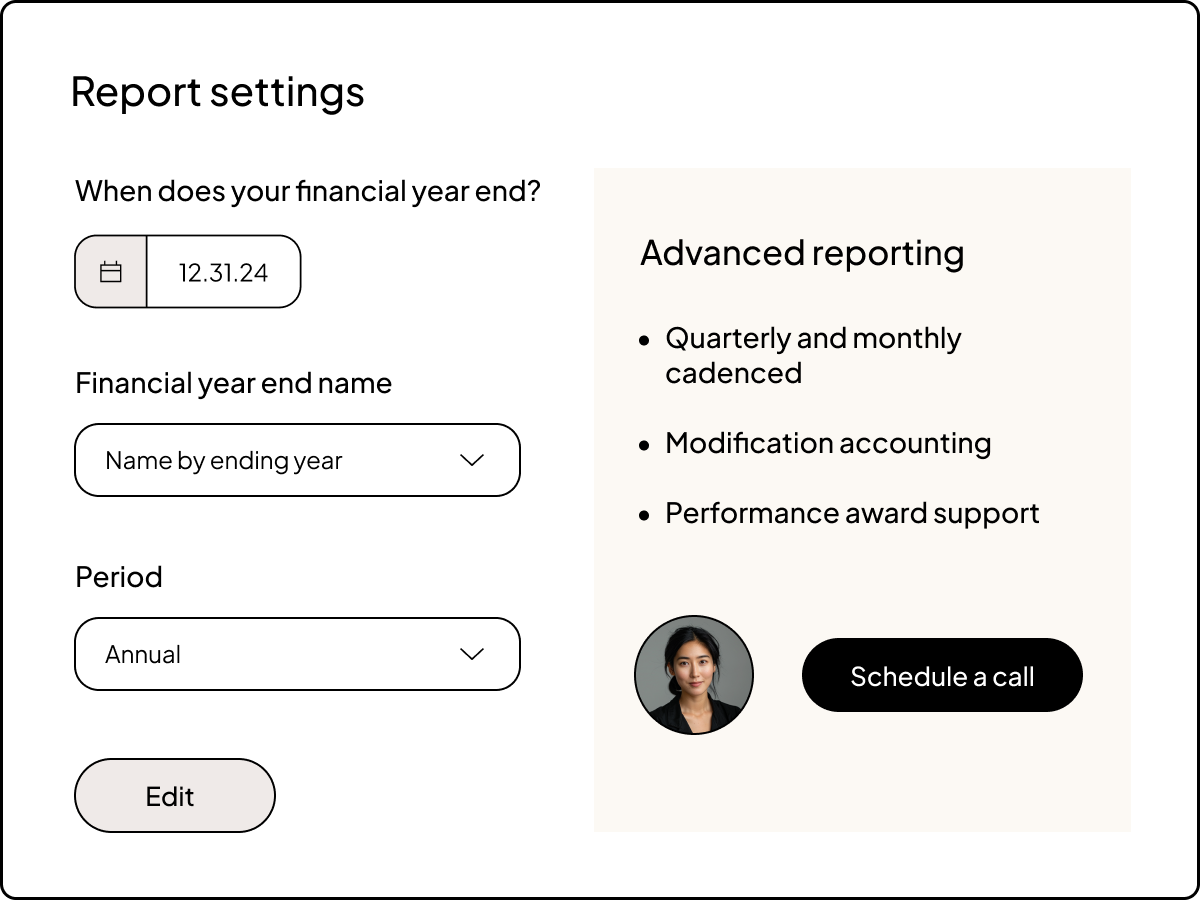

Create fully customizable reports that accurately reflect the unique needs of your business and capture every scenario, including stock splits and grant re-pricing.

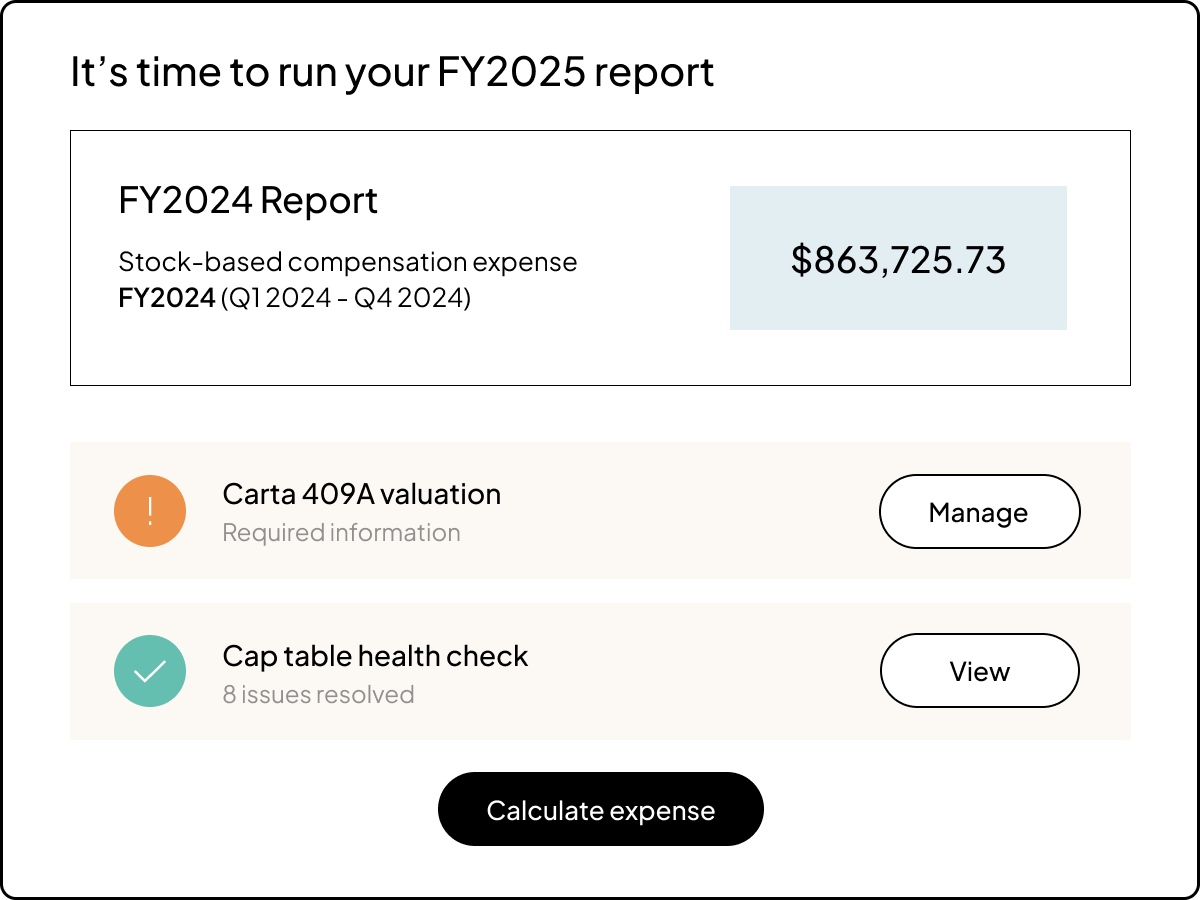

Reduce operational burden with automated reporting. In a few clicks, use your last financial statement to generate accurate, up-to-date reports fully integrated with your cap table.

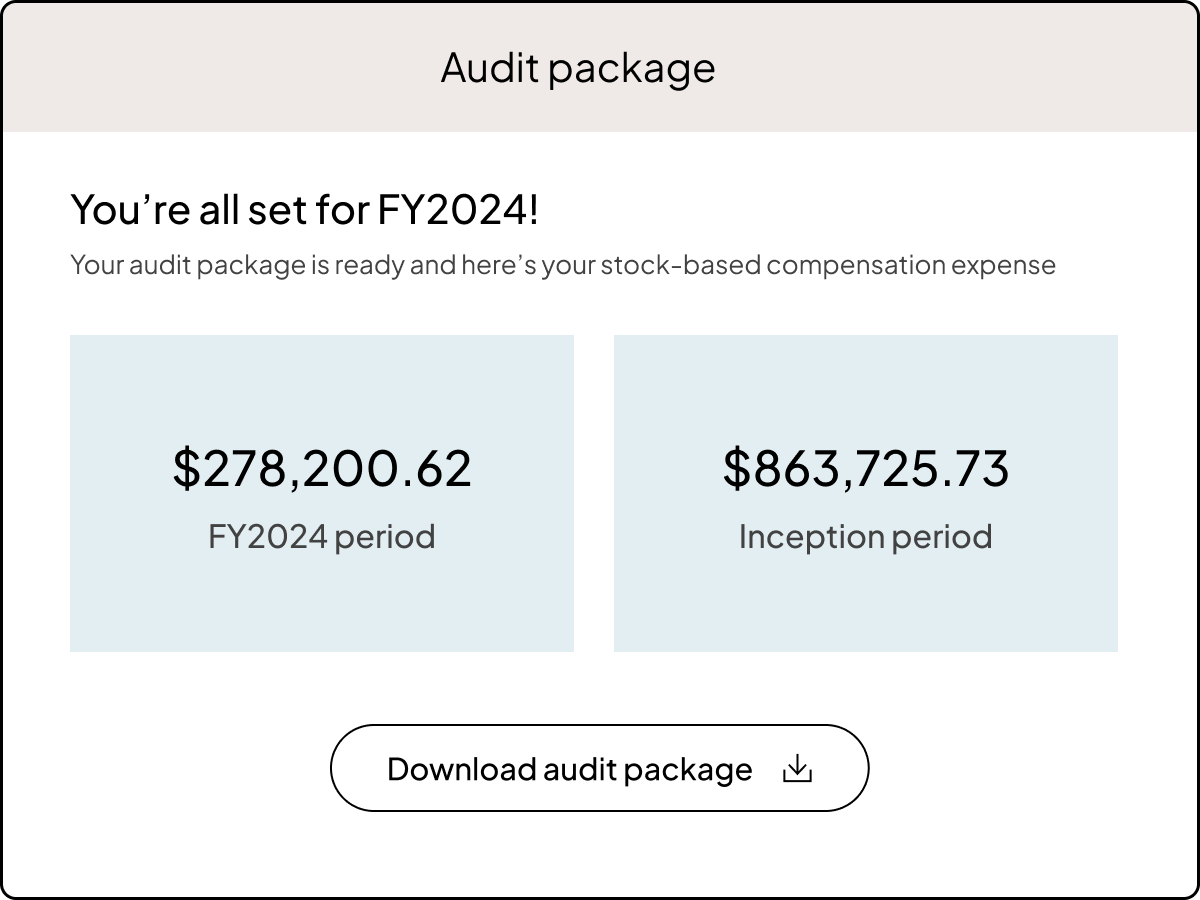

When it’s time for an audit, you’ll have access to a packet that includes your stock-based compensation expense and minimum disclosure reports, plus an audit guide.

On average, customers have saved 1-2 weeks with automated financial reporting

Related resources

FAQs

When do I need financial reporting?

Companies that have raised at least $10M in funding OR have at least 500 stakeholders on their cap table are required to disclose their stock based compensation expenses on their income statements.

Do I need to be on Carta to access financial reporting?

Yes, you need to be onboarded onto Carta to access this product. Learn more about pricing and plans here .

Which accounting standards do you support?

Carta supports both GAAP and IFRS accounting standards. You’ll receive the accounting standard that matches your country of incorporation, with advanced tools that can support you as you grow and face different accounting standards.

When should I report my stock-based compensation expenses?

Companies are required to report on their stock-based compensation expenses annually. However, many investors may ask that companies report expenses quarterly.

What is a financial audit and why do I need one?

A financial audit is a third-party evaluation of your company’s financial statements to confirm that your reported values are complete and accurate. Depending on your company’s goals, you may want an audit to appeal to investors, satisfy insurance requirements, or get a loan. Learn more here .

Get audit-ready financial reports

DISCLOSURE: This communication is on behalf of eShares Inc., dba Carta, Inc. (“Carta”). This communication is not to be construed as legal, financial, accounting, or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Features and pricing subject to change. Carta does not assume any liability for reliance on the information provided herein.

©2024 Carta. All rights reserved.