Equity Advisory

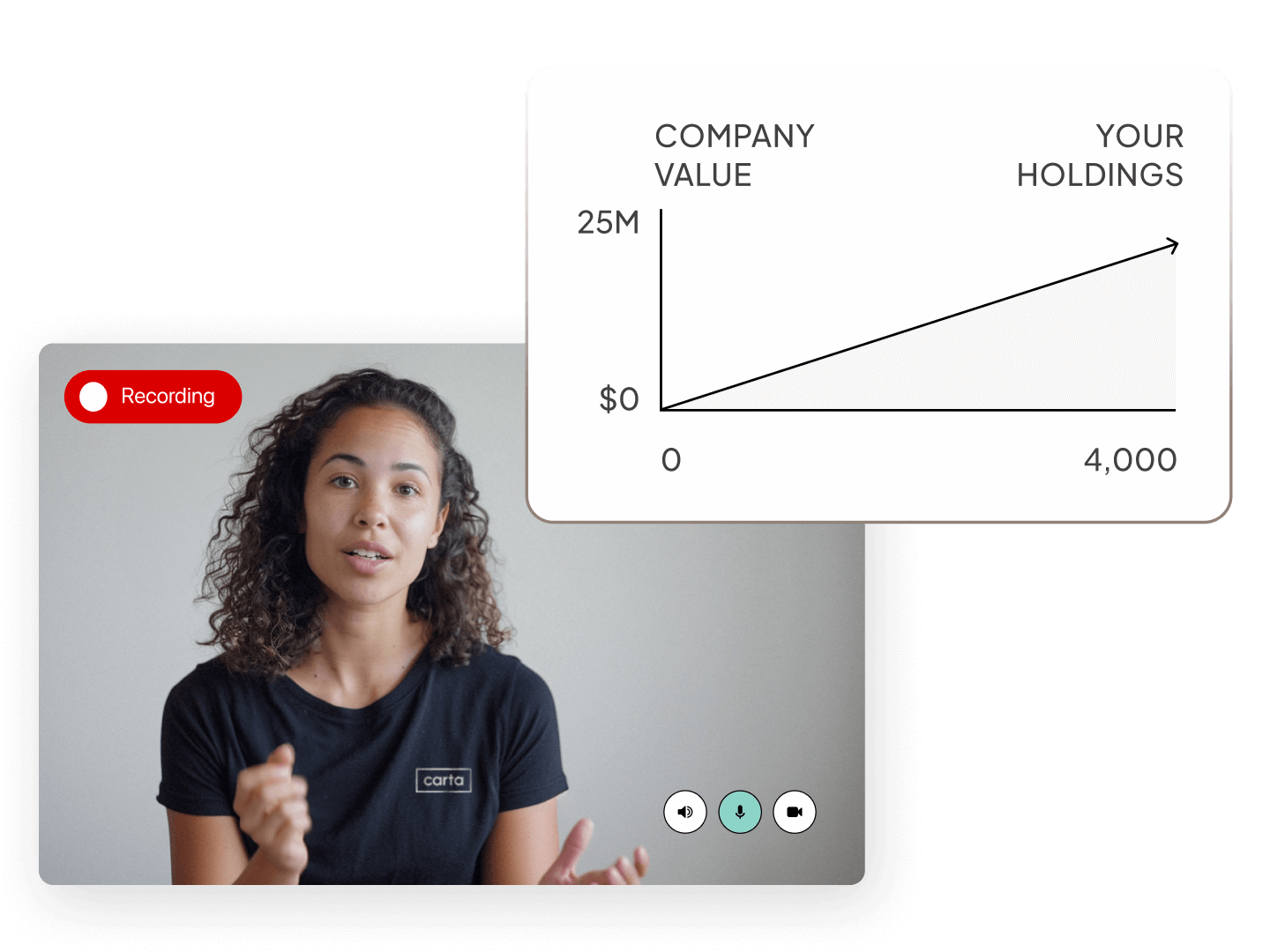

Empower your team with equity tax education

Leverage real, actionable tax strategies from real experts to help your team make informed decisions on their equity compensation.

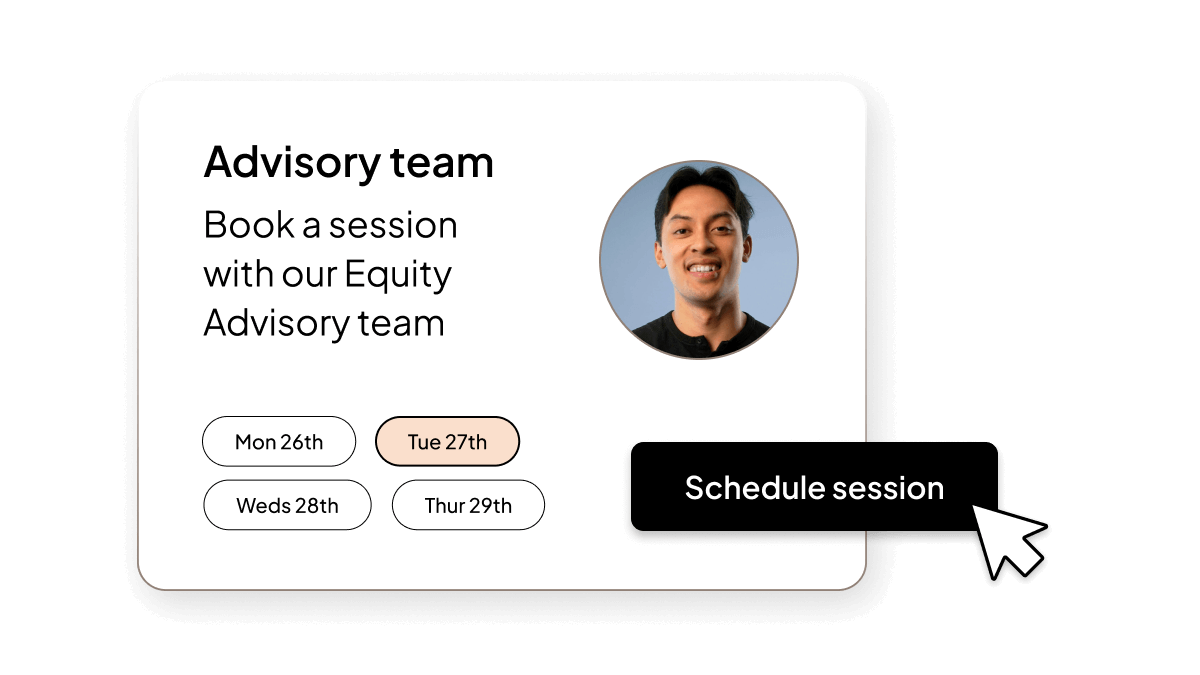

- Unlimited 1:1 equity education sessions

- Review all equity grants

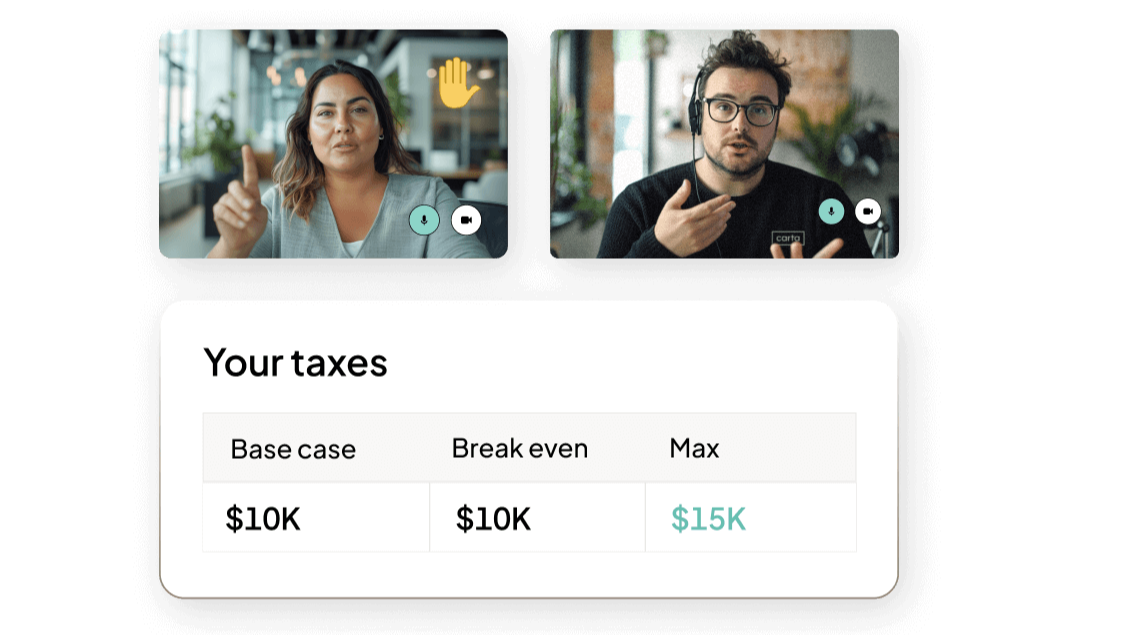

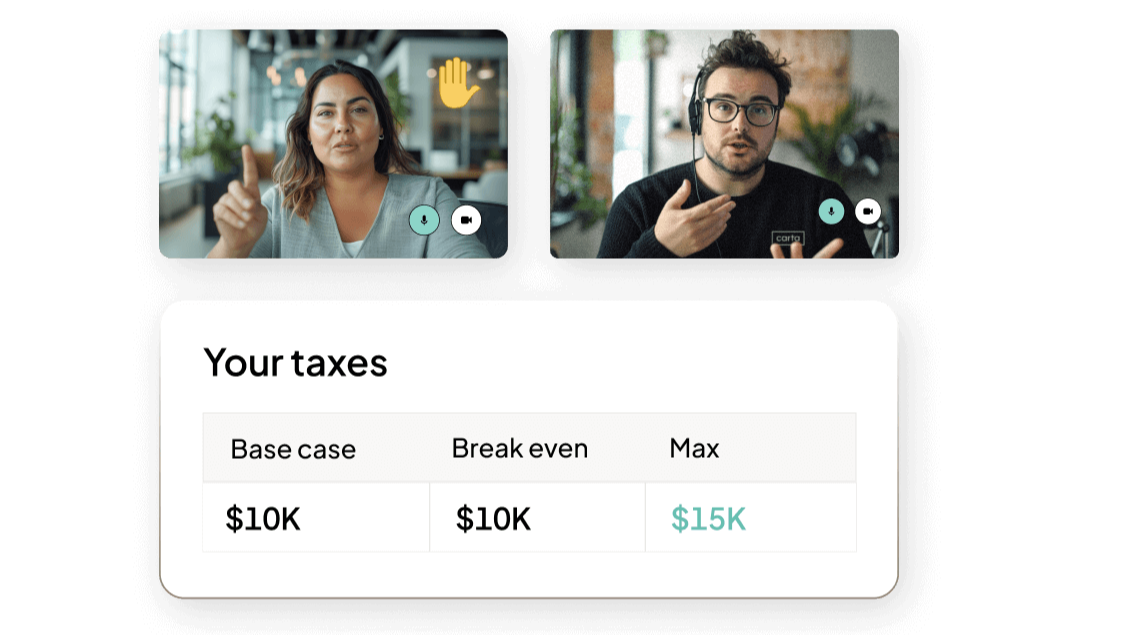

- Understand the cost of exercising options

- Get insights on tax breaks and credits

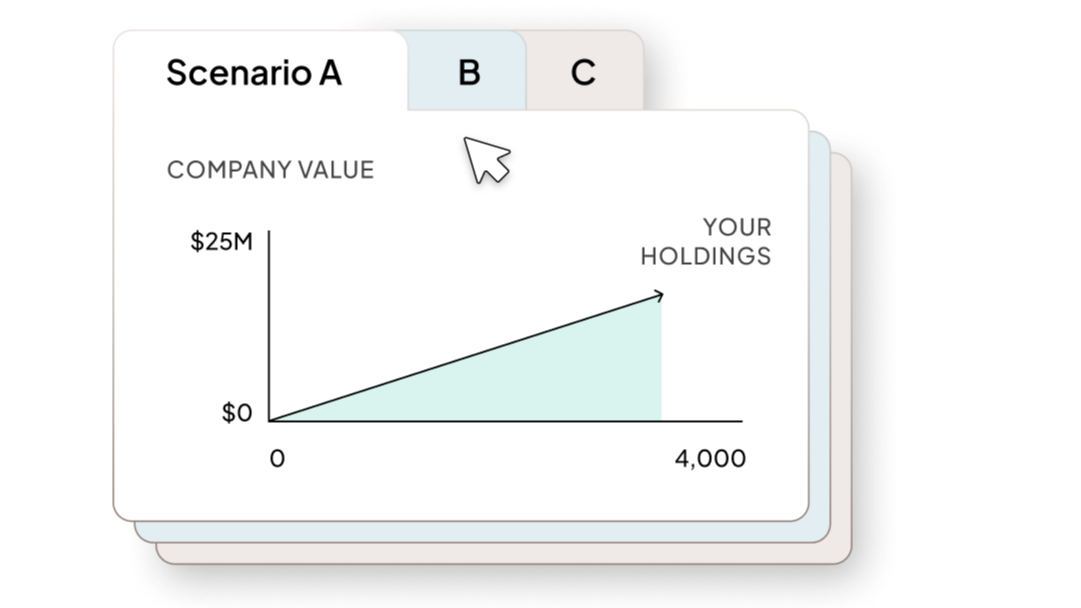

- Model tax scenarios for exercising or selling

- Design equity plans that optimize tax benefits

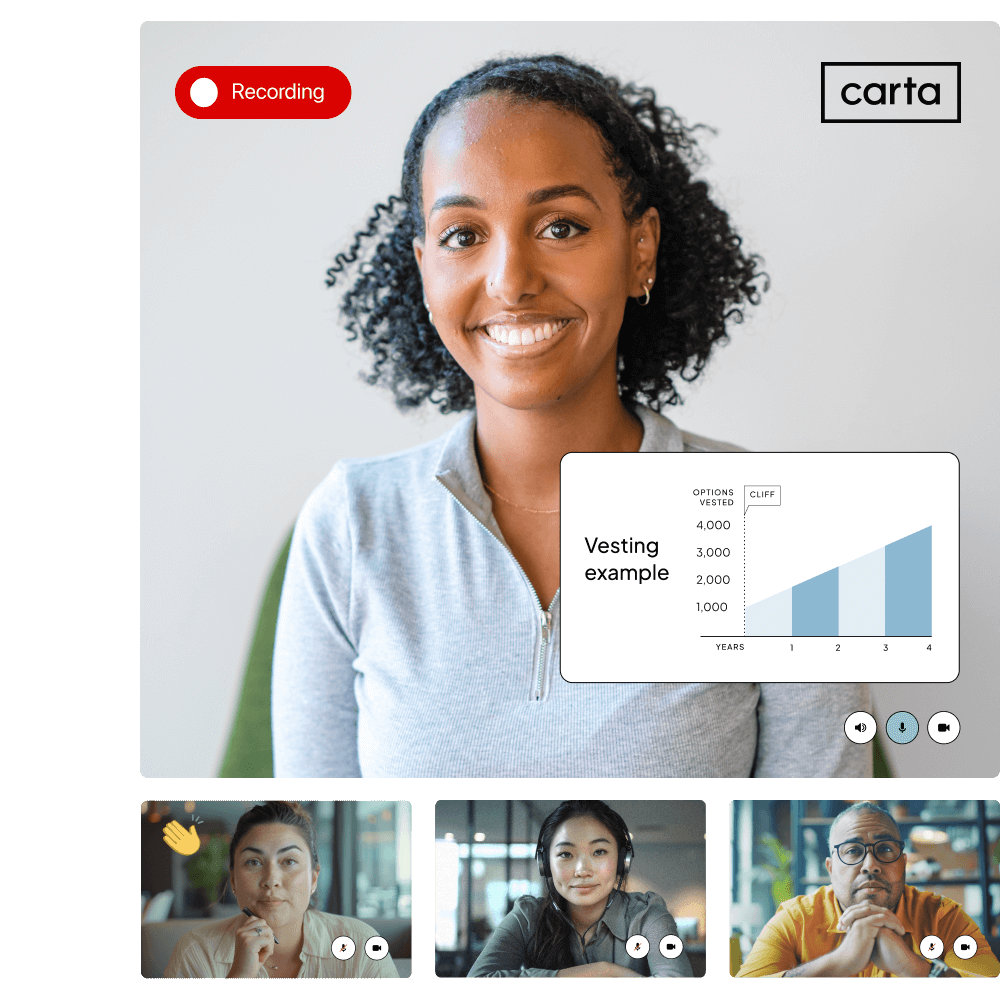

- Tailored company-wide webinars

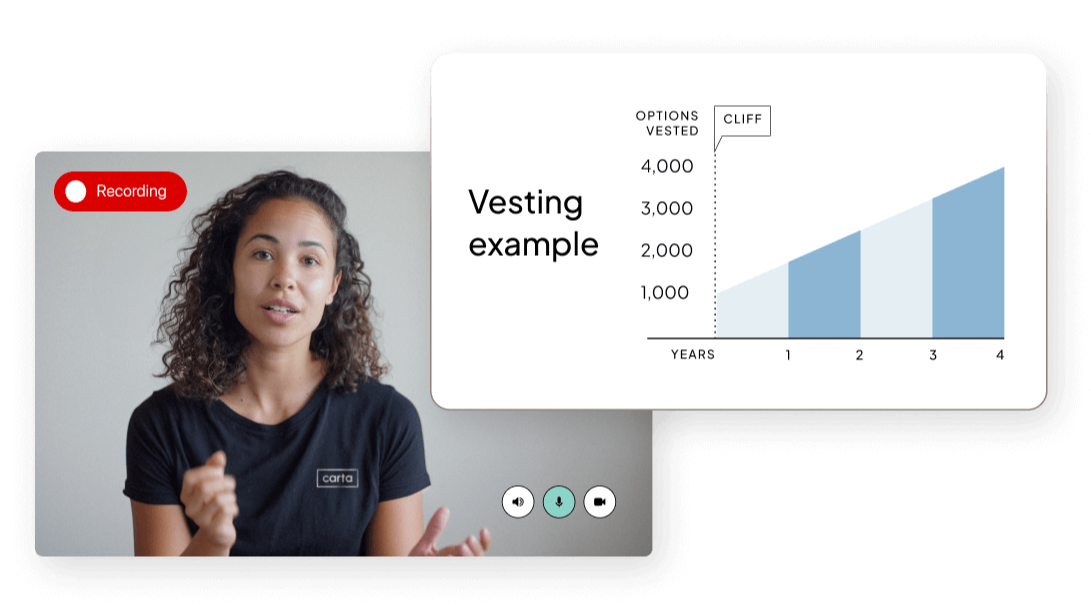

- Access videos covering equity and tax basics

- Reduce operational burden from your HR, finance, and legal team

Meet your advisors

Available for unlimited 1:1 sessions, hosting company-wide webinars, and featured in our on-demand education.

Employee support, backed by decades of experience

Trusted by over 40,000 companies

Related resources

FAQs

Do I need to be a Carta customer to access Equity Advisory?

Yes. Equity Advisory is a subscription service that Carta offers cap table customers to educate their employees on equity basics and the tax implications of holding equity in a private company. Learn more about pricing and plans here .

What’s the difference between a tax advisor and a financial advisor?

A tax advisor helps with taxes, while a financial advisor helps manage or invest your money. A financial advisor can’t give tax advice, and a tax advisor can’t give financial advice—unless you’re working with someone who is credentialed as both. Learn more here .

Who is eligible for Equity Advisory?

Once you’ve signed up, your employees will automatically be able to book time with an Equity Tax Advisor—right from their existing Carta account.

How does Equity Advisory work with my cap table?

Equity Advisory is directly integrated with your cap table. The Equity Tax Advisors go into every session understanding each employee’s exact grant, strike price, and vesting status—along with accurate information about your company’s cap table and latest 409A valuation.

What other tax related services does Carta offer?

Optimize your equity tax benefit with QSBS. Carta's valuations team will determine QSBS eligibility, provide attestation letters, and develop personalized tax strategies for you and your employees. Learn more here .