Trusted by top VC firms

Carta combines superior service and robust technology to help you manage your fund. Our products help you scale, and your dedicated team of Carta fund administrators partner with you to address your individual needs.

Carta’s solution combines your back office with fund admin, ASC 820 valuations and more to help your fund scale.

With over 70 fund accountants, we’re well equipped to give you the personal attention your fund deserves.

Carta has a dedicated product, engineering, and design team committed to providing a native, all-in-one platform.

Carta vs. Aduro

Full-service fund administration

Carta fund administration combines exceptional service and real-time technology. We’ll maintain your general ledger, produce your accounting statements, provide you with analytics and reporting, and help you manage cash effectively. Aduro doesn’t provide real-time metrics, reporting, or IRR on desktop or mobile like we do.

Make your next audit easier

Aduro doesn’t offer ASC 820 valuations for your fund. Carta’s team of analysts have performed thousands of valuations. Our team leverages best-in-class technology for increased accuracy and fast delivery. If you prefer to run your own valuation, we also offer a self-service ASC 820 tool that will guide you step by step.

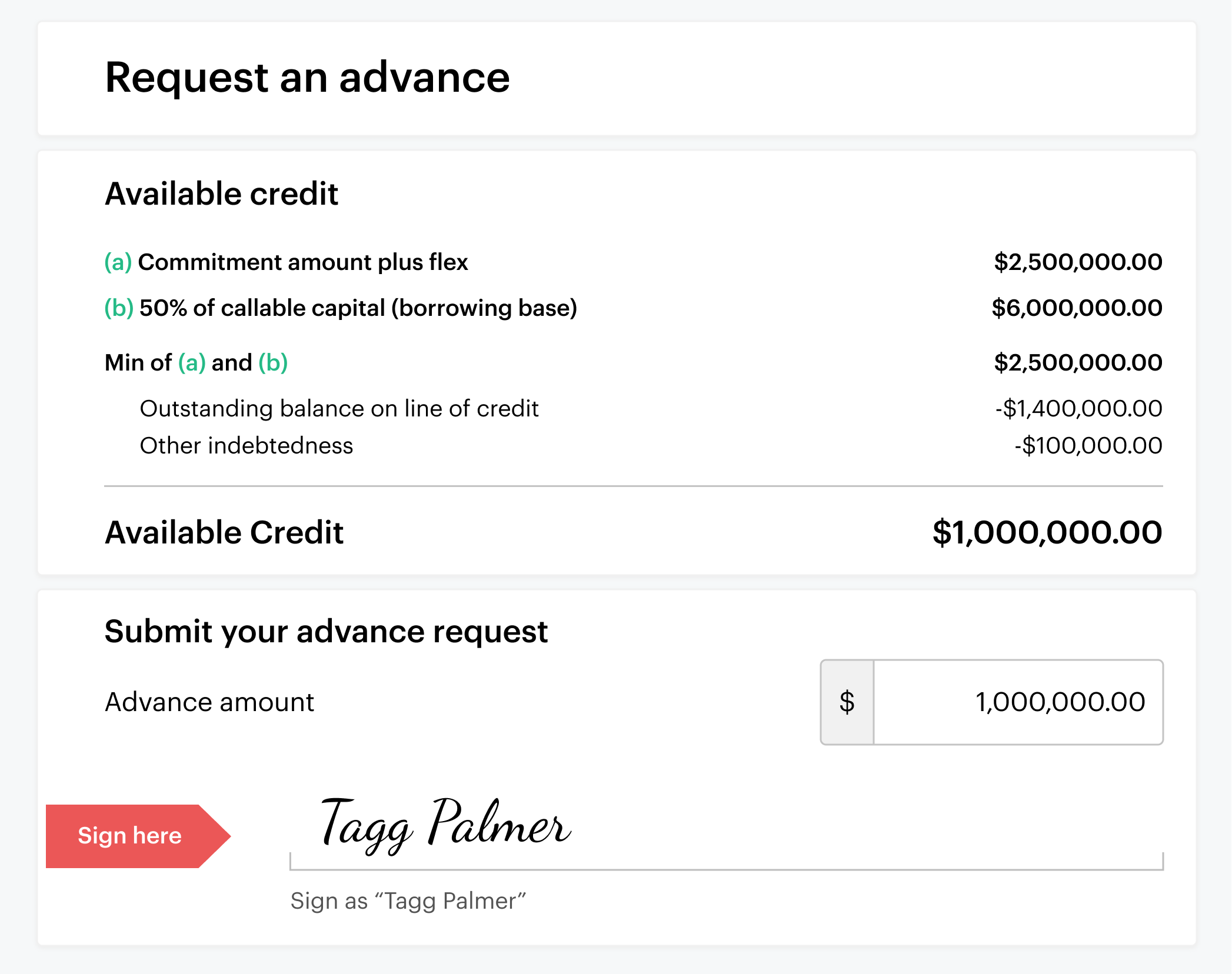

Capital on-demand

With a line of credit, your firm can call capital at a regular cadence and help your LPs plan for liquidity more effectively. Carta has partnered with Coastal Community Bank, member FDIC, to offer these loans. On Aduro, you won’t be able to manage a capital call line of credit on the same platform.

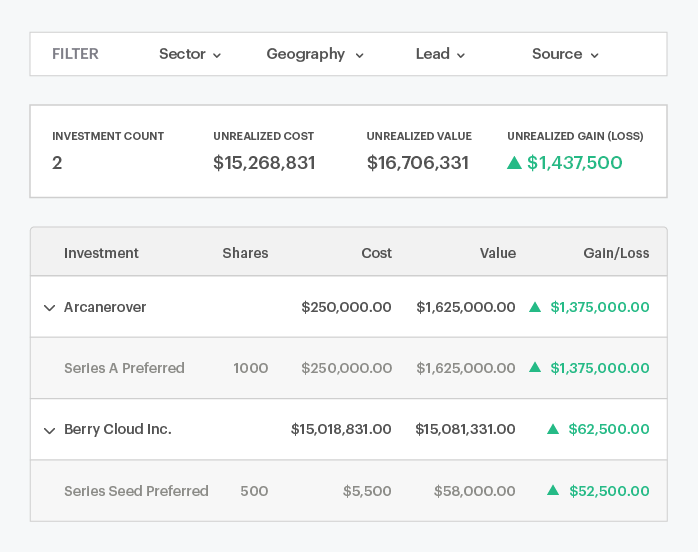

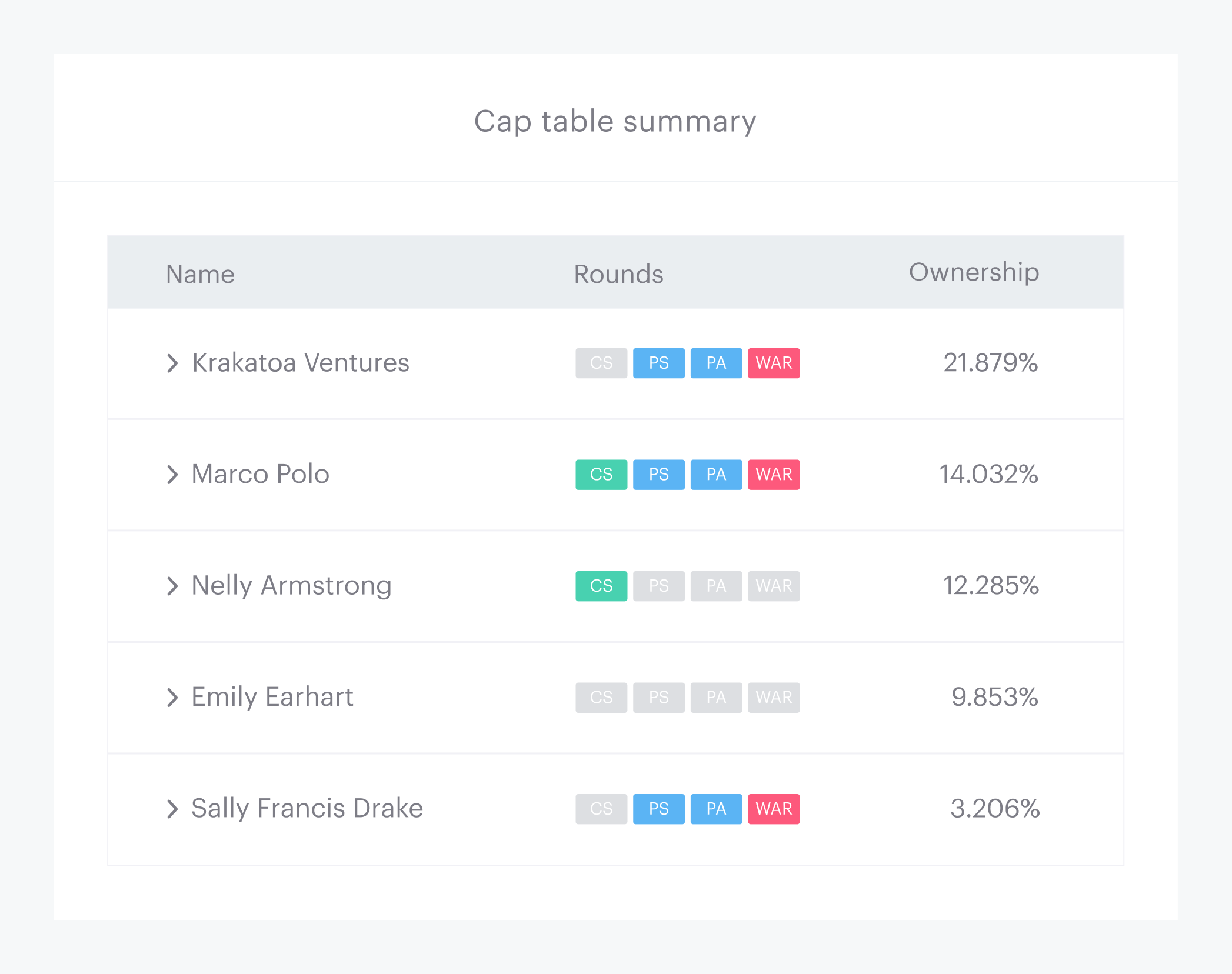

Real time portfolio company data

Carta’s technology allows for better visibility into your portfolio than Aduro’s. When a portfolio company issues a security on Carta, you can request access to their cap table and see details like cash raised, last preferred valuation, and your ownership percentage. You can then use Carta’s waterfall and round modeling tools to model exits, something Aduro doesn’t offer.