Run your fund on Carta

As your fund grows, so do your needs. Carta’s suite of reliable products and expert services support you at every stage.

Rely on expert support

Carta’s dedicated fund accountants have the deep industry experience to manage your back office, answer your questions, and provide strategic guidance.

Elevate the LP experience

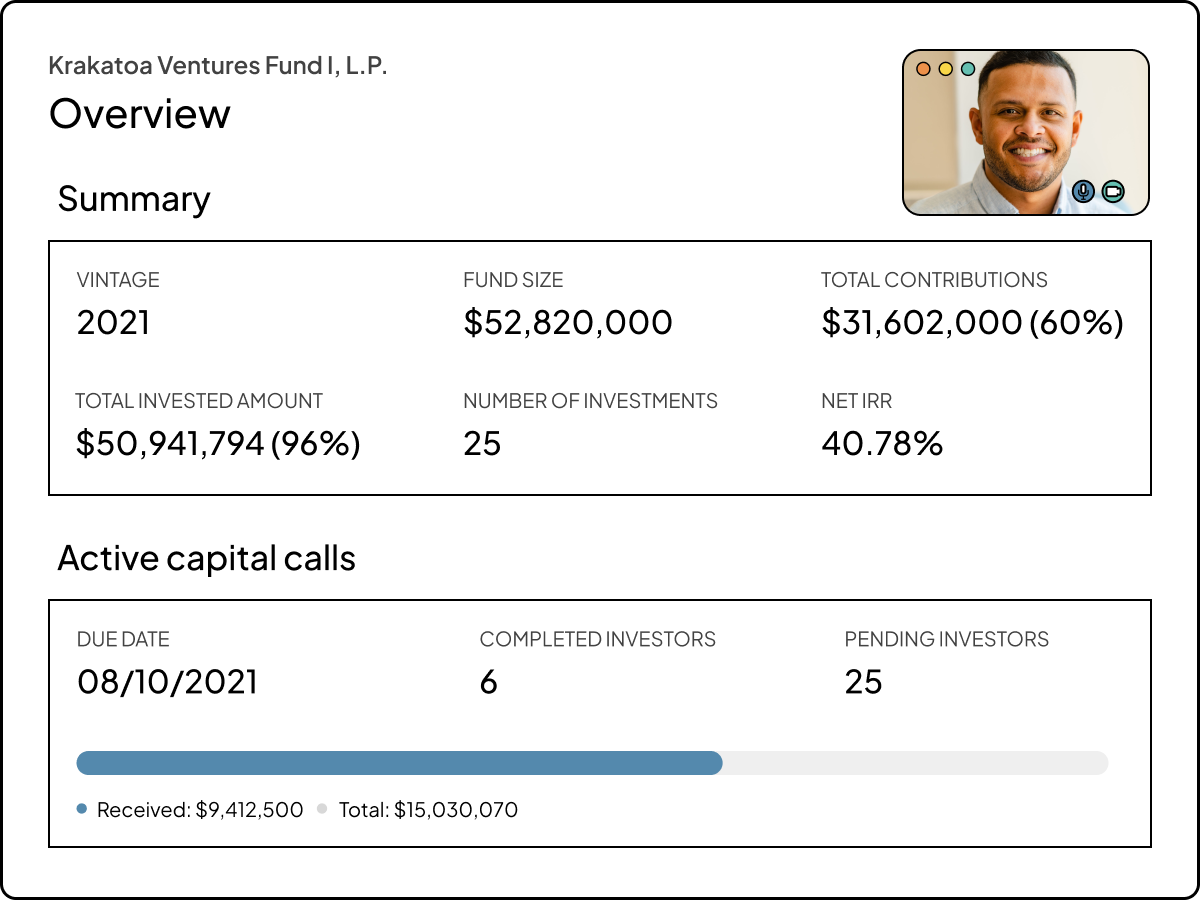

Provide your LPs with a single login for frictionless communication, access to secure data rooms, and up-to-date performance metrics.

Spend more time investing

Save time with automation, up-to-date portfolio insights, and workflows that improve efficiency, eliminate data discrepancies, and help you maximize returns.

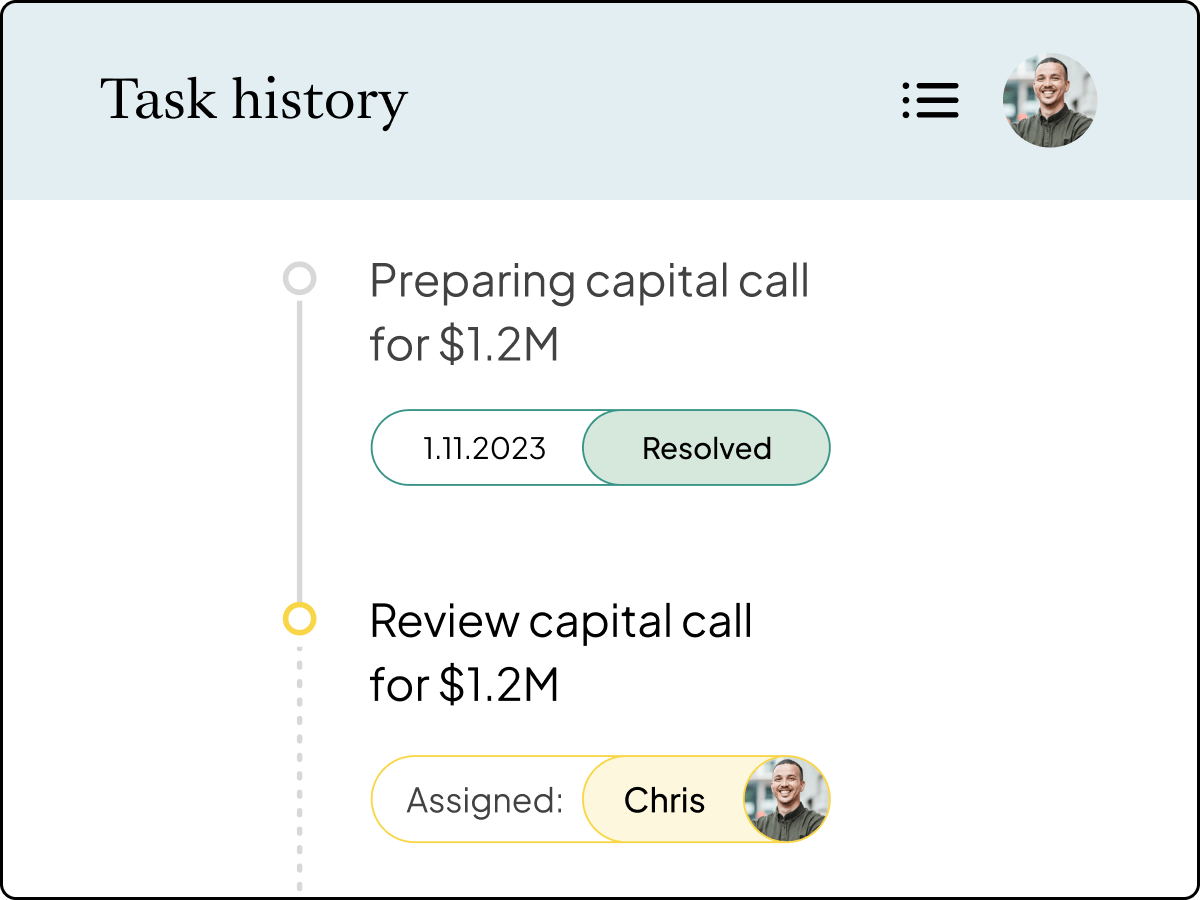

Enjoy full transparency with real-time status updates on your fund’s tasks and instant visibility into your fund’s operations, wherever you are.

Carta’s software and venture services team take care of your fund administration needs, so you can spend more time funding the future.

From thesis to launch, Carta guides you through every step of starting your fund.

Form, close, and administer your special purpose vehicle with support from Carta’s experienced team of fund administrators.

Trusted by nearly 7,000 funds and SPVs representing nearly $130B in assets under administration

Carta offers a product-first approach paired with phenomenal service to give us freedom to help more founders. They're patient, they're approachable, and they're high-integrity.

The process of starting a venture capital fund or SPV is unclear, expensive, and complex. We’ve built resources to help managers build their funds.