What is a cap table?

A cap table (or capitalization table) is a document, like a spreadsheet or a table, that details who has ownership in a company. It lists all the securities or number of shares of a company including stock, convertible notes, warrants, and equity ownership grants. Here’s what you need to know about cap tables.

This video gives an overview to what a cap table is as part of Carta’s free Cap Table 101 curriculum.

Why do I need a cap table?

Cap tables are important because they tell you who owns how much of your company. This can affect everything from how you price future fundraising rounds to dilution of your ownership percentage to who needs to sign off on major company decisions. Accurate cap tables also play a major role in due diligence for potential investors or venture capitalists who are considering investing in your startup.

How do I make a cap table?

There are multiple ways to create and manage a cap table. The best option for you depends on your company’s stage and ownership structure.

Use a cap table template

In the very early stages of a startup, cap tables often live in a spreadsheet since ownership is usually relatively simple and easy to track early on. But if you’re creating a cap table for the first time, starting from scratch can get complicated quickly. Download Carta’s free cap table template for a good starting point—just know it’s not a good long-term solution, as Excel-based spreadsheets won’t scale with you as you grow.

Download the template

Use free cap table software

Starting with cap table software early in your company’s life cycle can save you time and money as your business scales. With Carta’s Launch plan, startups with up to 25 stakeholders that have raised up to $1M can get free cap table management through their lawyers. Talk to your lawyer to get started.

Use an equity management platform

Once you begin hiring employees and raising new rounds of financing, an equity management platform is the way to go. Instead of you having to remember to update your cap table and send the latest version to stakeholders or new investors, it’ll automatically stay updated as you get new 409A valuations, issue employee stock options, offer liquidity, and more. Platforms like Carta can also help you stay compliant with regulations like Internal Revenue Code Section 409A, Rule 701, Rule 144, and the $100K ISO limit.

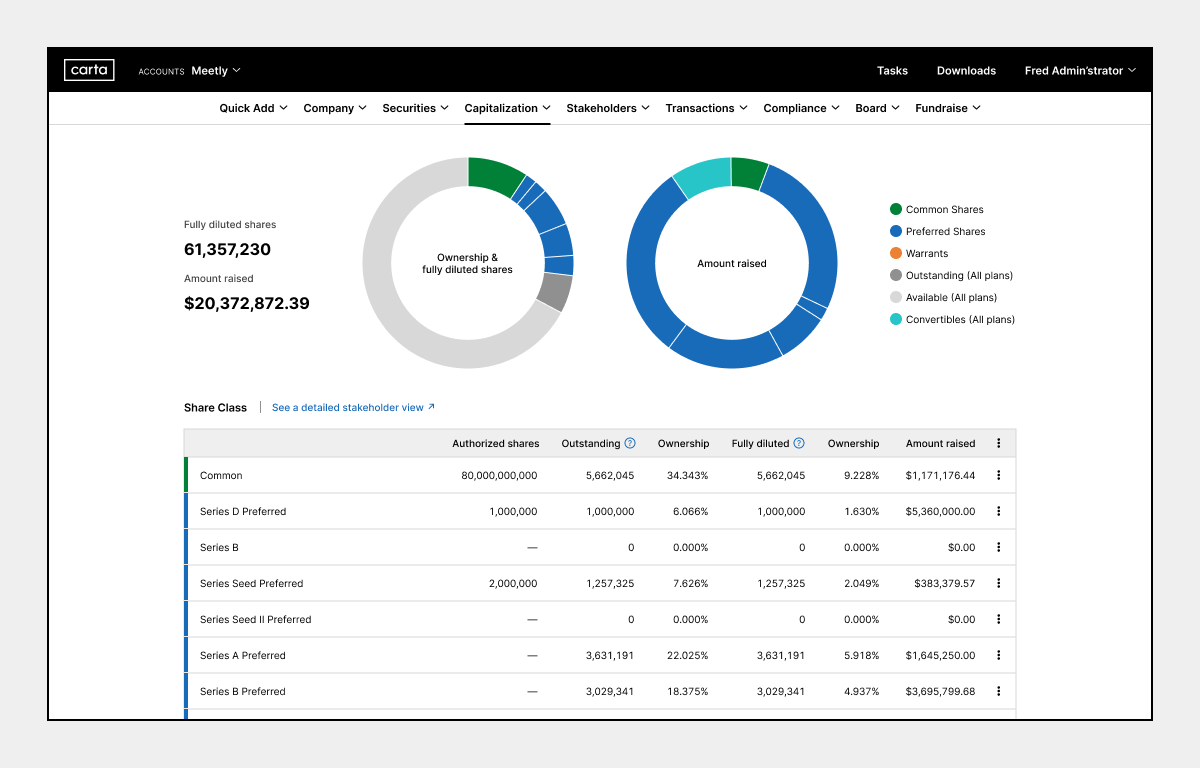

Cap table example

Cap tables usually include a list of names or groups (founders, investors, common stockholders, etc.) on one axis and details around what they own (what type of securities, how many they own, when they invested, what percentage of the company they own, etc.) on the other axis. A cap table also shows the company’s option pool size, common shares, preferred shares, outstanding shares, and SAFEs to show a full picture of the overall company ownership. While there’s no standard format, here’s what a capitalization table could look like:

What’s wrong with Excel-based cap tables?

Traditionally, the legal ownership of a private company “lived” on paper shares issued to founders, investors, and employees. Some of the biggest venture-backed private companies still have their lawyers issue paper securities and model their cap tables in Excel. However, this method is antiquated and inefficient.

There’s no single source of truth

There’s usually more than one version of a manually updated Excel cap table model. Your attorney manages one copy (for an hourly fee) and you or your CFO manage another version. If an employee joins or exercises stock options and you forget to send the updated cap table to the lawyer or vice versa, suddenly there isn’t a single source of truth. Mistakes compound and things get complicated.

They’re expensive

It can take your law firm many billable hours to issue stock option grants taking into consideration all IRS and SEC equity rules. These can add up quickly when it’s time for your next funding round from potential investors. We’ve seen quotes of over $20,000 in legal fees to reconcile different versions of a company’s cap table. Carta Launch is available through law firms and gives companies with up to 25 stakeholders that have raised up to $1M access to cap table management for free.

How to manage a cap table

If your cap table lives in a spreadsheet, you have to be diligent about using consistent names, updating your version whenever something happens, and sending the updated version to relevant stakeholders, like your lawyer.

The easiest way to keep your cap table updated is to use cap table software. With transactional platforms like Carta, your cap table updates automatically whenever you issue a security issuance or when someone accepts their security. Learn more about our features, take a video tour, or request a demo today.