What is a cap table?

A cap table (or capitalization table) is a document, like a spreadsheet or a table, that details who has ownership in a company. It lists all the securities of a company, including shares, convertible notes, warrants and equity ownership grants. Here’s what you need to know about cap tables.

This video gives an overview of what a cap table is as part of Carta’s free Cap Table 101 curriculum.

Why do I need a cap table?

Cap tables are important because they tell you who owns how much of your company. This can affect everything from how you price future funding rounds to the dilution of your ownership percentage; it can even determine who needs to sign off on major company decisions. Accurate cap tables also play a key role in due diligence for potential investors or venture capitalists who are considering investing in your startup.

How do I create a cap table?

There are multiple ways to create and manage a cap table. The best option for you depends on your company’s stage and ownership structure.

Use a cap table template

In the very early days of a startup, cap tables often live in a spreadsheet because ownership is usually relatively simple to track at this stage. However, if you’re creating a cap table for the first time, starting from scratch can get complicated quickly. Download Carta’s free cap table template for a good starting point – but note that Excel-based spreadsheets aren’t a viable long-term solution, as they won’t scale alongside your growing company.

Download the template

Use an equity management platform

Once you begin hiring employees and fundraising, an equity management platform is the way to go. There’s no need to manually update your cap table and then share the latest version with different stakeholders; instead, everything from funding rounds and company valuations to equity issuances will be automatically reflected in your digital cap table. Carta can also help you stay compliant with local tax authorities and within the limits of UK government-approved share schemes, such as EMI and CSOP.

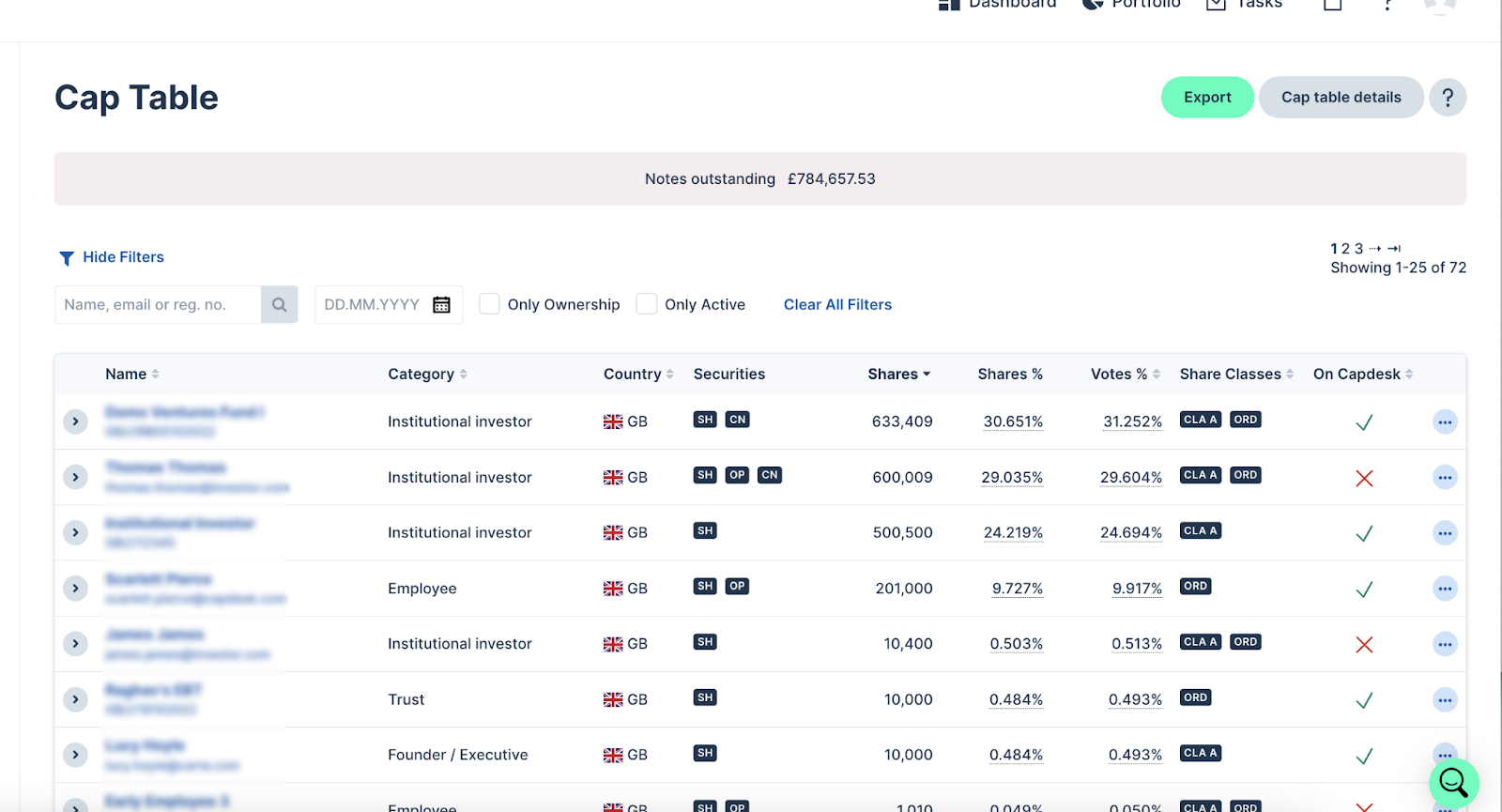

Cap table example

Cap tables usually include a list of names or groups (such as founders, investors and ordinary shareholders) on one axis, and ownership details (including what type of security, what percentage of the company and when they invested) on the other axis. A cap table also shows a company’s option pool size, ordinary shares, preferred shares and outstanding shares to give an overall picture of the fully diluted share capital. While there’s no standard format, here’s what a capitalization table could look like:

What is wrong with Excel-based cap tables?

Traditionally, the legal ownership of a private company lived on paper shares issued to founders, investors and employees. Some of the biggest venture-backed private companies still ask their lawyers to issue paper securities and model their cap tables in Excel. However, this method is antiquated and inefficient.

There’s no single source of truth

There’s usually more than one version of a manually updated Excel cap table model. Your lawyer manages one copy (for an hourly fee), while you or your CFO are responsible for another version. If an employee joins or exercises their options and you forget to send the updated cap table to your lawyer, or vice versa, there’s no longer a single source of truth. Mistakes compound and things get complicated.

They’re expensive

It can take a law firm many billable hours to issue share option grants in line with HMRC and Companies House requirements. The costs can add up quickly when it’s time for your next funding round – we’ve seen quotes of over £15,000 in legal fees to reconcile different versions of a company’s cap table.

How do I manage a cap table?

If your cap table lives in a spreadsheet, you have to be diligent about using consistent names, updating your version after every material event or equity issuance, and sending the latest version to relevant stakeholders – such as your lawyer.

The quickest and easiest way to keep your cap table up to date is to use cap table software. With Carta, your cap table updates automatically whenever you issue equity and when someone accepts their security. Learn more about our features, explore the platform or book a demo today.