Calculating the internal rate of return (IRR) is a way for VCs and investors to track the performance of private companies before other profitability metrics are available. The easiest way to determine IRR is with a spreadsheet-based internal rate of return calculator.

What is internal rate of return (IRR)?

The internal rate of return (IRR) shows the annualized percent return an investor’s portfolio company or fund has earned (or expects to earn).

Gross IRR vs. net IRR

There are two ways to measure IRR:

-

Deal IRR (also known as gross IRR): Measures the return from a fund’s portfolio. This is a common way to determine how successful the general partners’ (GPs’) investments are to date.

-

Net IRR: Measures the return from limited partners (LP) minus any management fees or carried interest. This is used to measure the value of the investment.

How to calculate IRR

Using a spreadsheet-based IRR calculator or dedicated fund administrator like Carta is the best way to quickly calculate IRR.

Download the IRR calculator

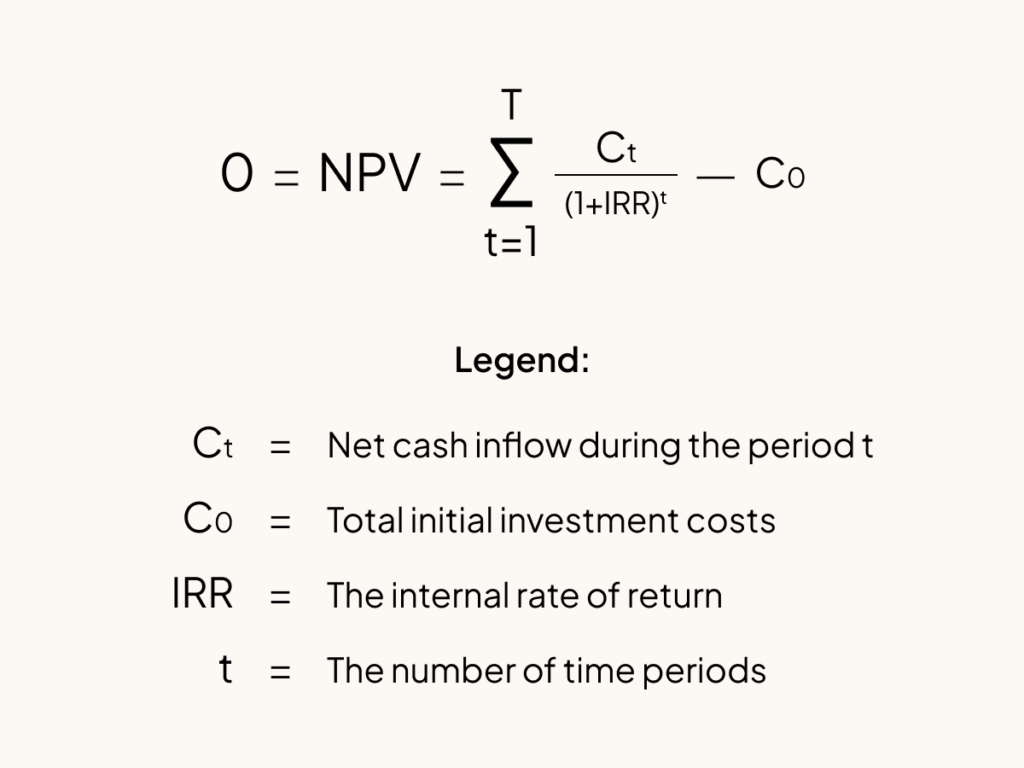

Internal rate of return formula

The formula to calculate IRR looks like this:

You can calculate IRR by setting NPV to zero and solving for the discount rate. However, doing complex calculations manually leaves more room for error.

Why is IRR important?

Benchmarking is comparing your IRR to the industry comparables to see your relative performance against your peers. This helps funds measure the effectiveness of their deals and their performance against other funds.

Unlike other forms of performance measurement, like return on investment (ROI) and net present value (NPV), IRR allows you to make apples-to-apples comparisons across asset classes and public market indexes—no matter the time frame.

IRR is also an important metric that LPs look at when you’re raising money for your fund—if you consistently show excellent returns on your investments, it may be easier to attract investors.

What is a good IRR?

What’s considered a “good” IRR can vary based on the type of investment you’re making. In general, many early-stage investors target a 30% net IRR, while many later-stage investors target a net IRR of around 20% (both, over an average period of eight years). However, some investors aim higher.

Get help calculating your IRR

While an IRR calculator is more efficient than calculating your IRR manually, it still leaves room for errors. Some of the most common mistakes people make include entering the dates and amounts wrong.

Go beyond our IRR calculator and automate the process with Carta’s fund administration service. We sync our general ledger daily and calculate everything for you so you can access your real-time IRR.

Learn more about Carta for Venture Capital, or talk to an expert about Carta fund admin today.