So you want to understand how stock options are taxed, but you’re not sure where to begin. In this article, we’ll break down the different types of stock options and how tax treatment works for each. We’ll also cover holding periods, ordinary income tax vs. capital gains tax, and alternative minimum tax.

Ready? Let’s go.

Equity basics

A stock option is a type of equity compensation that allows employees and other service providers to buy shares in the company. Stock options aren’t actual shares of stock—they’re the right to buy a set number of shares at a fixed price, usually called a strike price, or exercise price. Your purchase price stays the same over time, so if the value of the stock goes up, you could make money on the difference. You may also have to pay taxes on that difference.

→ Learn more about how stock vesting works

Types of employee stock options

Two types of employee stock options are available in the United States: incentive stock options (ISO) and non-qualified stock options (NSO). They both function the same way: They allow you to be a partial owner in your company. ISOs and NSOs mainly differ in how and when they’re taxed—ISOs could qualify for favorable tax treatment.

Instead of stock options, some companies offer alternative types of equity awards, such as restricted stock awards (RSA) or restricted stock units (RSU). These aren’t the same as stock options and are treated differently by the IRS for tax purposes.

→ Learn more about how RSAs and RSUs are taxed

How are stock options taxed?

Stock options are typically taxed at two points in time: first when they are exercised (purchased) and again when they’re sold. You can unlock certain tax advantages by learning the differences between ISOs and NSOs.

|

|

ISO |

NSO |

|

Exercise |

May be subject to alternative minimum tax (details below) |

May be subject to ordinary income tax |

|

Sell |

Ordinary income or capital gains |

Capital gains |

When you exercise

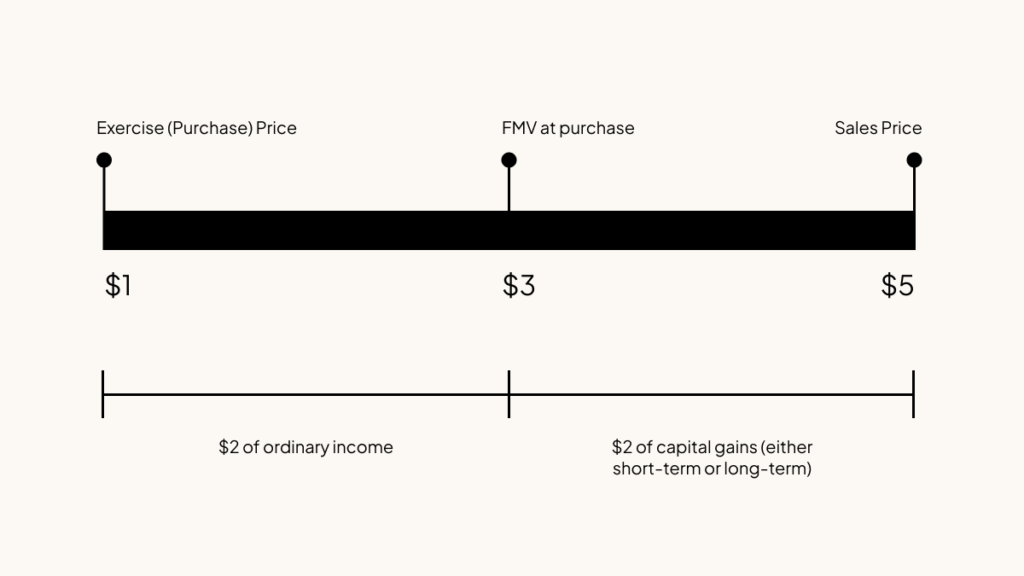

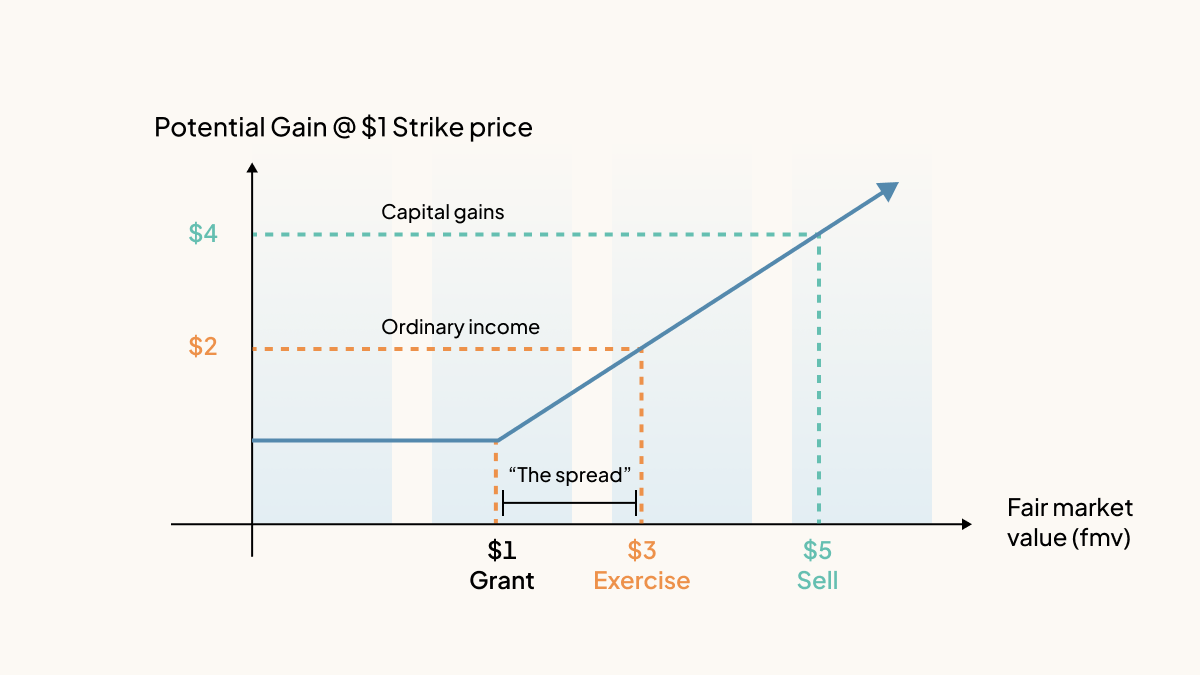

When you exercise your stock options, your potential tax liability is determined by the difference between your strike price (fixed purchase price) and the current fair market value (FMV) of those stock options. This difference is often referred to as the “spread.”

For NSOs, the spread is taxable as ordinary income and your company will usually withhold taxes (including federal, payroll and any applicable state taxes) on the spread when you exercise.

For example, if you exercise 100 vested NSOs at a grant price of $1 and the current value is $3, you’ll pay ordinary income tax on the $200 gain at exercise.

For ISOs, instead of the spread being includable in ordinary income tax, it is included as income in something called the alternative minimum tax (AMT) calculation, which could trigger additional taxes owed when you file your tax return.

When you sell

When you sell your company stock, you are taxed on any increase in value you realized on your investment. This gain can be taxed as either ordinary income or capital gains depending on the type of option and your holding period.

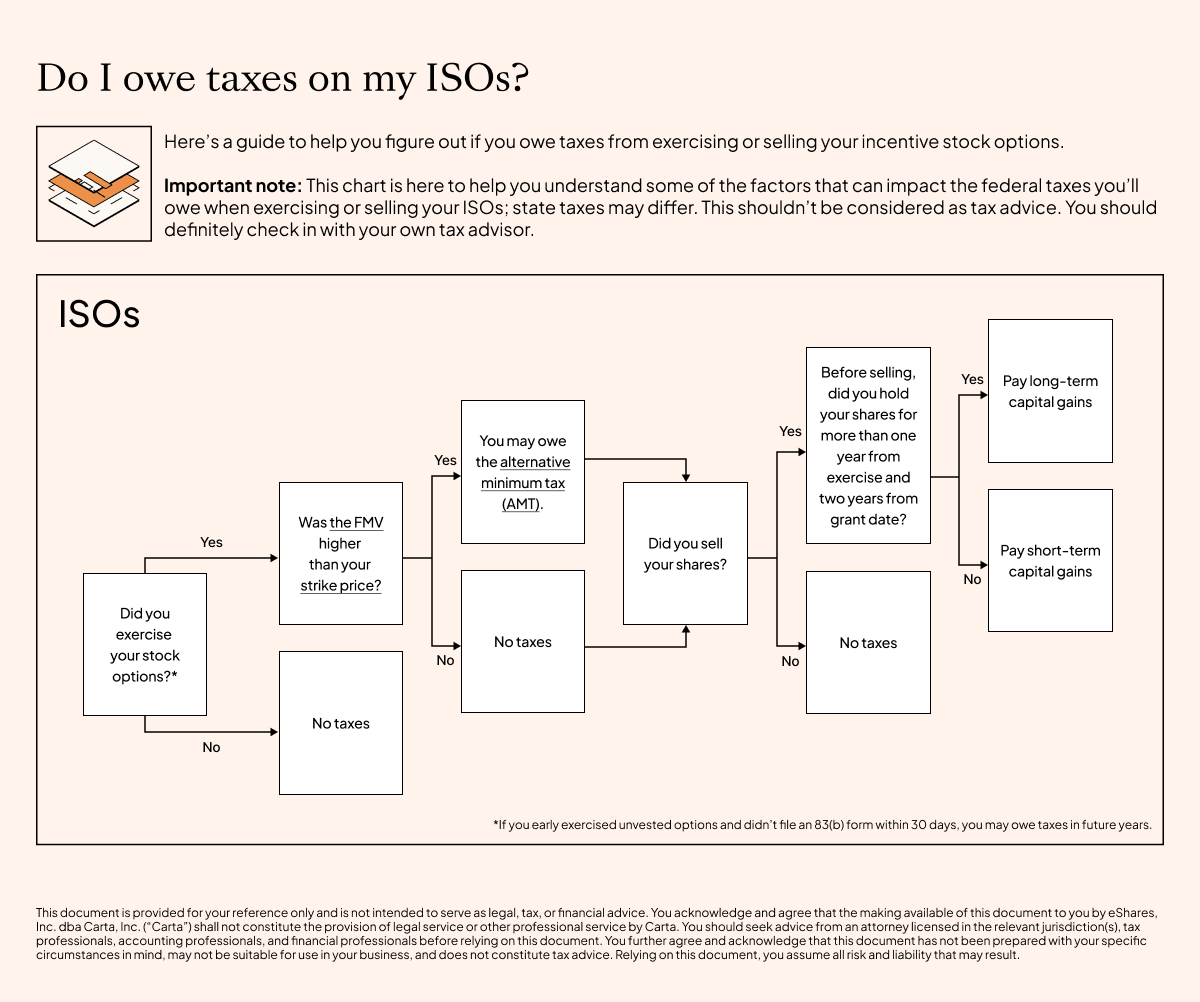

Taxes for incentive stock options (ISO)

Incentive stock options (ISO) are a type of stock option that can qualify for special tax treatment. Unlike with NSOs, you only sometimes have to pay taxes when you exercise ISOs.

ISO taxation at exercise: Alternative minimum tax (AMT)

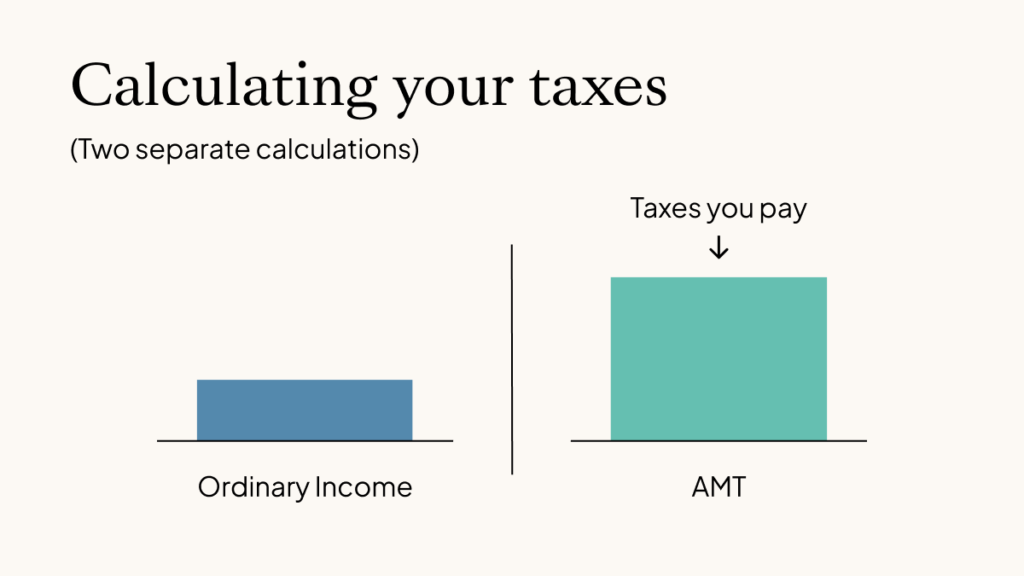

Depending on when you exercise your options and the spread at exercise (the difference between the FMV and your purchase price), the AMT may impact your taxes owed.

The AMT calculation is a completely separate calculation from your regular tax. Whichever yields a bigger tax obligation—your ordinary tax or the AMT—is the amount you’ll pay. It is meant to help prevent creative tax write-offs that historically allowed people to avoid—or significantly lower—their taxes.

→ Download our free AMT calculator

When you exercise an ISO, the spread is included in your AMT tax calculation. Your company does not withhold AMT on your behalf, so you’re solely responsible.

For example, if you exercise 1,000 shares at $1 each when they’re worth $5 each, you need to add $4,000 to your income when calculating AMT. Your regular tax calculation would not change.

AMT applies only if you bought ISOs and did not sell them in the same tax year. We recommend setting aside money any year when you’ve exercised incentive stock options to pay any year-end AMT obligations if this applies to you.

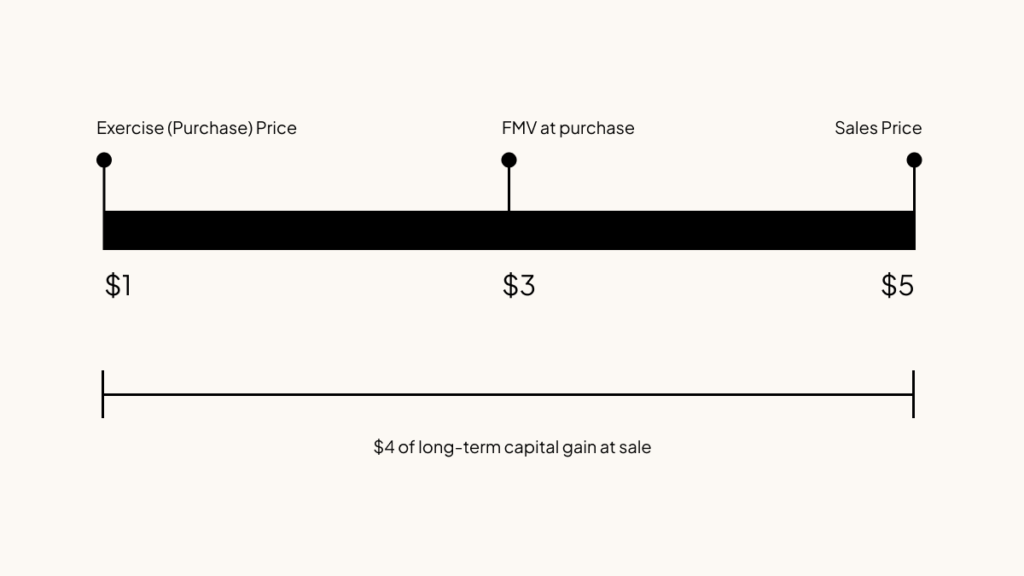

ISO taxation at sale: Qualifying and disqualifying dispositions

Qualifying dispositions for ISOs

You can take advantage of tax savings for ISOs by meeting certain holding requirements and having a qualified disposition. This will entitle you to the lower long-term capital gains rate on your full taxable gain. To qualify, you must hold the shares for both:

-

Two years from the date your ISOs were granted, and

-

One year after exercising your ISOs.

If both conditions are met, the difference between your sale price and the price you paid for the ISOs will be subject to preferential long-term capital gains tax.

Disqualifying dispositions for ISOs

If you do not meet the qualifications listed above for a qualifying disposition, the sale of your ISOs may be subject to less favorable tax treatment.

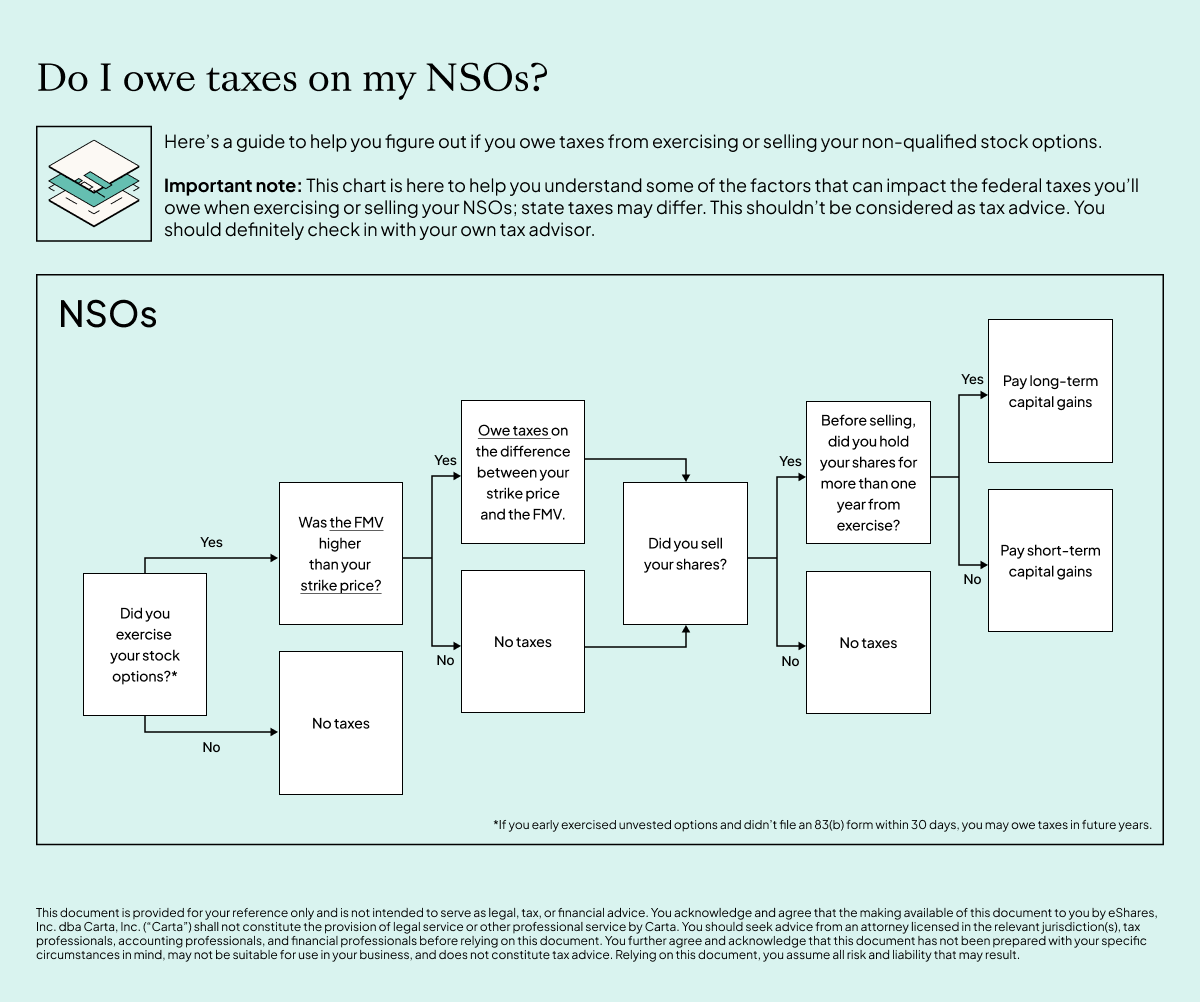

Taxes for non-qualified stock options (NSOs)

NSO taxes: explained

|

Action |

Tax implication |

|

You exercise your NSOs |

You’ll likely pay ordinary income tax on the difference between your strike price and the current market price of the stock |

|

You exercise and sell your NSOs in one transaction |

You’ll likely pay ordinary income tax on the difference between your strike price and the current market price of the stock |

|

You sell your NSOs within a year of exercising |

You’ll likely pay short-term capital gains taxes on the profit you made selling your options |

|

You sell your NSOs after holding them for at least a year |

You’ll likely pay long-term capital gains taxes on the profit you made selling your options |

NSO taxation at exercise

With non-qualified stock options (NSO), you could trigger taxes both when you exercise and when you sell your options. This usually means you pay more taxes with NSOs than with ISOs.

When you exercise an NSO, any spread between the FMV on the date you exercise and the price you are paying for the stock is considered ordinary income to you. Your company will usually withhold ordinary income tax (including federal, payroll and any applicable state taxes). Typically, because there is no cash involved in the transaction, you will need to pay your employer to cover the cost of the withholdings at purchase.

NSO taxation at sale

When you sell NSOs, any appreciation on the stock will be taxed as capital gains. The taxable capital gain for NSOs is calculated by subtracting the FMV of the stock on the day you purchased your shares from the sale price.

Capital gains tax vs. ordinary income tax

There are two types of taxes you need to keep in mind when dealing with your options: ordinary income tax and capital gains tax.

Capital gains tax for stock options

You’ll likely pay capital gains tax on a portion of the profit when you sell stock you have previously exercised. For tax purposes there are two types of capital gains:

-

Short-term capital gains – if you have held the stock for one year or less from the date of exercise

-

Long-term capital gains – if you have held the stock more than one year from the date of exercise

Short-term capital gains are not tax preferential and are taxed at ordinary income rates. However, long-term capital gains are taxed at lower rates. The 2022 tax rate for long-term capital gains is between zero and 20%. Therefore, holding your shares long enough to qualify for long-term rates is favorable for tax purposes if you are selling at a gain.

Ordinary income tax for stock options

If a portion of your taxable gain is subject to ordinary income tax (as described above), you will be taxed at the same rate as the rest of your ordinary income based on your taxable income and filing status.

The ordinary income tax rate is currently almost double the long-term capital gains tax rate, so optimizing your exercise strategy to maximize the benefits of long-term capital gains tax treatment will most likely result in lower tax liabilities.

How to plan for stock option taxes

When you exercise your stock options, gains are not guaranteed. All investment decisions, including whether or not to exercise, carry risk. Reach out to a professional tax advisor or legal advisor to understand your options. If your company uses Carta's equity management software, you may have access to Carta Equity Advisory for free.