What is alternative minimum tax (AMT)?

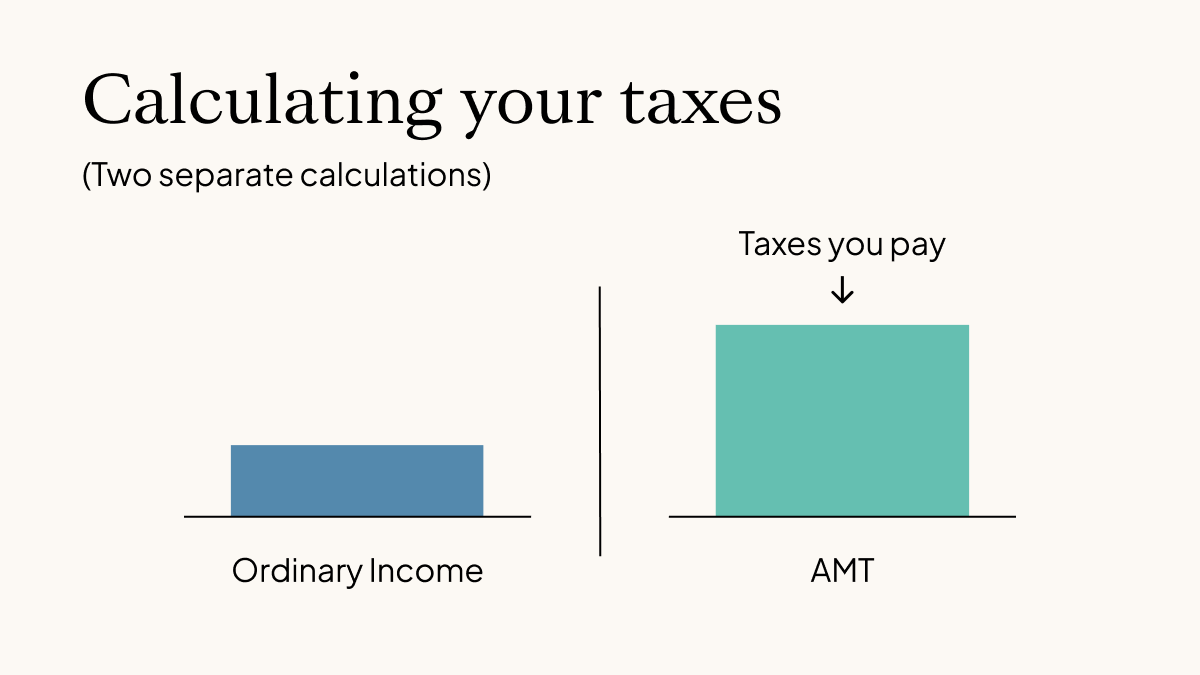

The alternative minimum tax (AMT) is a different way of calculating your tax obligation. AMT is designed to make sure everyone, especially high earners, pays an appropriate amount of income tax.

If you make more than the AMT exemption amount, you need to calculate both your ordinary income tax and AMT and pay the higher of the two. With AMT, you can’t take as many deductions or other tax breaks, which means your taxable income (when calculating AMT) will likely be higher.

You may be more prone to paying the alternative minimum tax if you:

-

Have a high income

-

Are married

-

Have more than three children

-

Live in a state with a high income tax

-

Recently exercised ISOs and didn’t sell them

What does AMT have to do with exercising stock options?

If you exercise your incentive stock options (ISO) and don’t sell them in the same year, the spread between the price you paid for the options and what they’re worth when you exercise is counted as income when you calculate AMT.

For example, if you exercise 1,000 shares at $1 each when they’re worth $5 each, you need to add $4,000 to your income when calculating AMT. You can calculate your spread using IRS Form 6251.

If you exercise your shares and sell them in the same year, the spread doesn’t count as AMT income and instead counts as regular income.

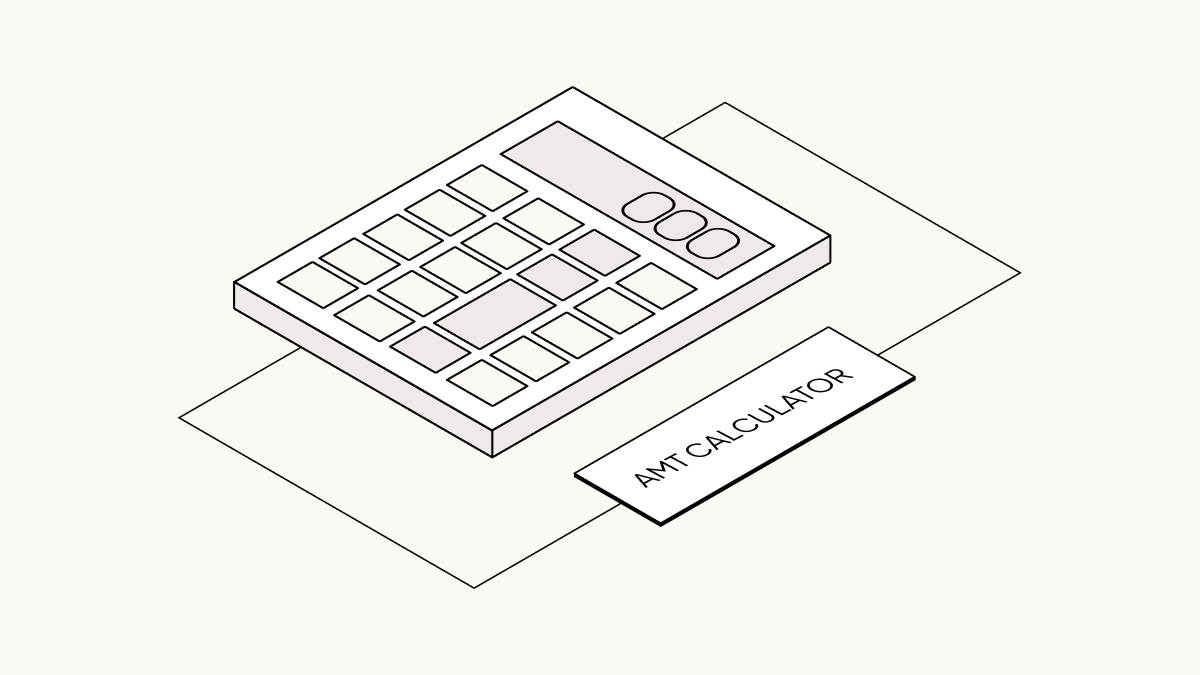

How do I calculate AMT? (Free AMT calculator)

Calculating AMT can be complicated, but you may want to get an estimate before you exercise, as it could be a significant amount of money.

To help, we’ve put together a free AMT calculator you can use to estimate your potential tax bill. To use this calculator, all you need is the following information:

-

Your income

-

Filing status

-

Current fair market value (FMV) of your shares

-

How many options you exercised/you’re thinking of exercising

Download the AMT calculator

If you want to manually calculate your AMT, you first need to figure out your alternative minimum taxable income (AMTI). This includes:

-

Your regular income

-

Some amounts you can usually subtract for regular tax purposes, such as personal exemptions and some deductions, like the deduction for state and local taxes

-

Preference items, like the spread between the price you paid to exercise your ISOs and their market value when you exercised

-

And more

Calculating your AMTI can get complicated, so we recommend using tax software and/or talking to a tax professional. If you file a paper tax return, you can calculate your AMTI using IRS Form 6251.

Similar to standard deductions under the regular tax system, you can exempt (subtract) the following amount from your AMTI:

2023 AMT exemption amounts

|

Filing status |

Exemption amount |

|

Unmarried individuals |

$81,300 |

|

Married filing jointly |

$126,500 |

Source: Tax Foundation

However, these exemptions start to phase out once your AMTI hits a certain threshold:

2023 AMT phaseout thresholds

|

Filing status |

Threshold |

|

Unmarried individuals |

$578,150 |

|

Married filing jointly |

$1,156,300 |

Source: IRS

For every $1 above these thresholds, the exemption is reduced by $0.25. When your AMT income reaches four times the exemption amount plus the phase-out threshold, you are no longer eligible for an exemption.

Once you reach your final AMTI, you can figure out how much your AMT liability is.

|

|

26% AMT tax rate |

28% AMT tax rate |

|

Married filing separately |

AMTI up to $110,350 |

AMTI above $110,350 |

|

All other filers |

AMTI up to $220,700 |

AMTI above $220,700 |

Source: Tax Foundation

If this amount is higher than what you’d have to pay doing your taxes the usual way, you have to pay AMT.

What is an AMT credit?

If you have to pay the alternative minimum tax, you may get an AMT credit, which you can use to reduce your tax obligation in future years.

How can I minimize AMT related to my equity award?

If you have questions about how exercising may impact your tax liability, talk to a tax professional—preferably before you exercise. They should be able to tell you how many ISOs you can exercise without triggering AMT and generally advise you on whether/when to exercise and sell.

If you were to sell your shares (that used to be ISOs) in the same year you exercise, you won’t have to include the spread in your AMTI. Just keep in mind that if you do this, you won’t get to take advantage of the ISOs’ favorable tax treatment, since you need to hold them for at least a year after exercising to qualify.

If your company allows early exercising (exercising before you vest), you could consider exercising your ISOs right when you’re granted them and filing an 83(b) election within 30 days. This allows you to be taxed on the day you exercise instead of having to wait until your shares vest. If you exercise your ISOs as soon as they’re granted, there usually won’t be a spread you need to add to your AMTI. However, in this circumstance, you’re paying cash now for shares that may be worth less in the future.

You may also adopt other strategies to minimize your AMT obligation, such as lowering your adjusted gross income. Your tax advisor may discuss maxing out contributions to your retirement accounts and increasing your charitable contributions.

Carta Equity Advisory helps the employees of our customer companies make informed decisions about equity ownership and taxes.