A strike price, also known as a grant price or exercise price, is the fixed cost that you’ll pay (per share) to exercise your share options and turn them into actual shares.

Share options give you the right to buy a certain number of private company shares at a strike price that is outlined in your option agreement. While your strike price is fixed at the time of granting, the fair market value (FMV) of your company’s shares typically changes over time. You’ll profit from this form of equity if you sell your shares (once exercised) for more than the strike price.

If you’ve ever wondered what determines a strike price and how to figure out how much your options could be worth, we’ve got you covered. Here, we’ll explain FMV and how share options can change in value over time.

How is the strike price of an option determined?

Companies typically determine the strike price of a share option based on the fair market value (FMV) of their shares.

Public companies

The FMV of a public company’s shares is obvious, because it’s the price at which the shares are currently trading on the open market. For example, if shares in Apple are selling for £160 per share on a given day, their FMV that day is £160.

Private companies

The FMV of a private company’s shares isn’t so obvious because the shares aren’t consistently trading in a public stock exchange. Instead, a private company can use a 409A valuation to determine the FMV of its equity, which helps to set the strike price of a share option.

If the company is granting equity under a UK government-approved share scheme, such as EMI or CSOP, it needs an HMRC valuation to determine the actual market value (AMV) of its ordinary shares.

FMV vs. strike price

The strike price of a share option is usually equal to or above the FMV (or AMV). If a company grants equity at a price below the market value, it risks incurring tax penalties for its employees. However, if the strike price is too high, it’s difficult for grantholders to profit from exercising their options and selling the shares, as we’ll see below.

A company therefore needs to determine a realistic and justifiable FMV of its ordinary shares. Using an independent valuations provider like Carta can help protect the company from costly audits and reduce the risk of employee tax penalties.

How share options change in value over time

At any given moment, the FMV of the company’s shares can be higher, lower or the same as the strike price of your equity award.

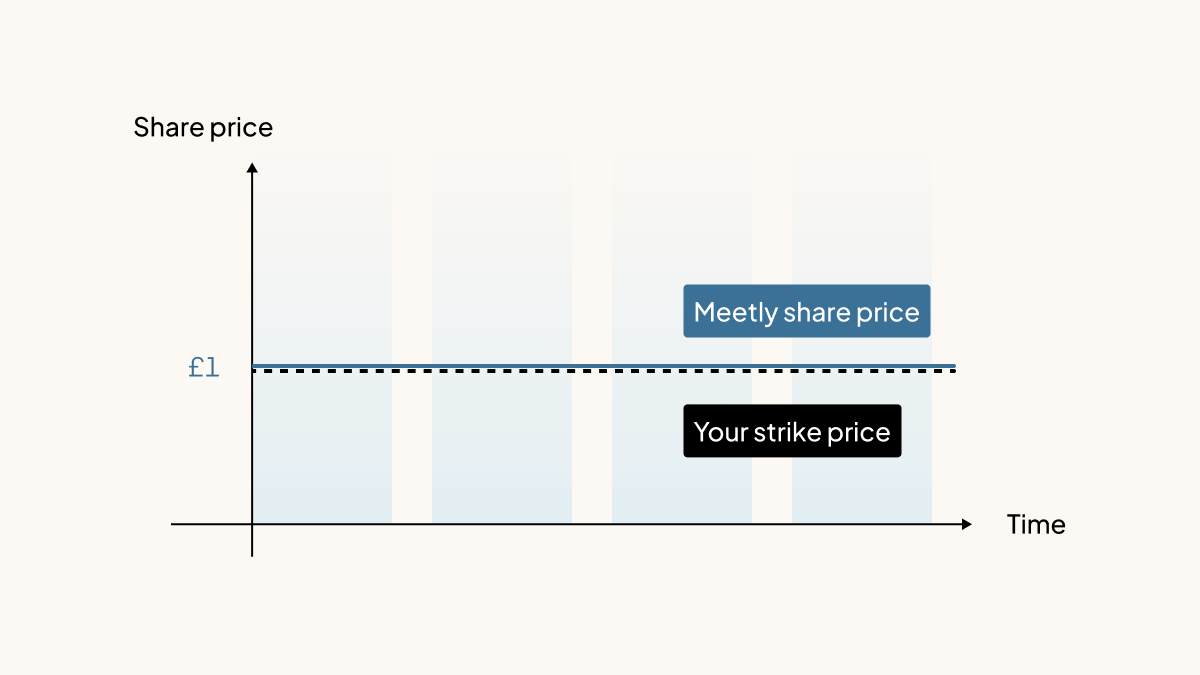

“At-the-money” share options

Imagine you’re awarded options in a fictional company called Meetly. In the graph above, the black dotted line represents the strike price of your options, which doesn’t change over time because it’s fixed on the grant date.

Meetly’s current share price (FMV or AMV), illustrated by the blue line, is equal to your strike price. If you decide to exercise your options, you would have to pay £1 to get one pound’s worth of shares in return. In this scenario, your options are considered “at the money”.

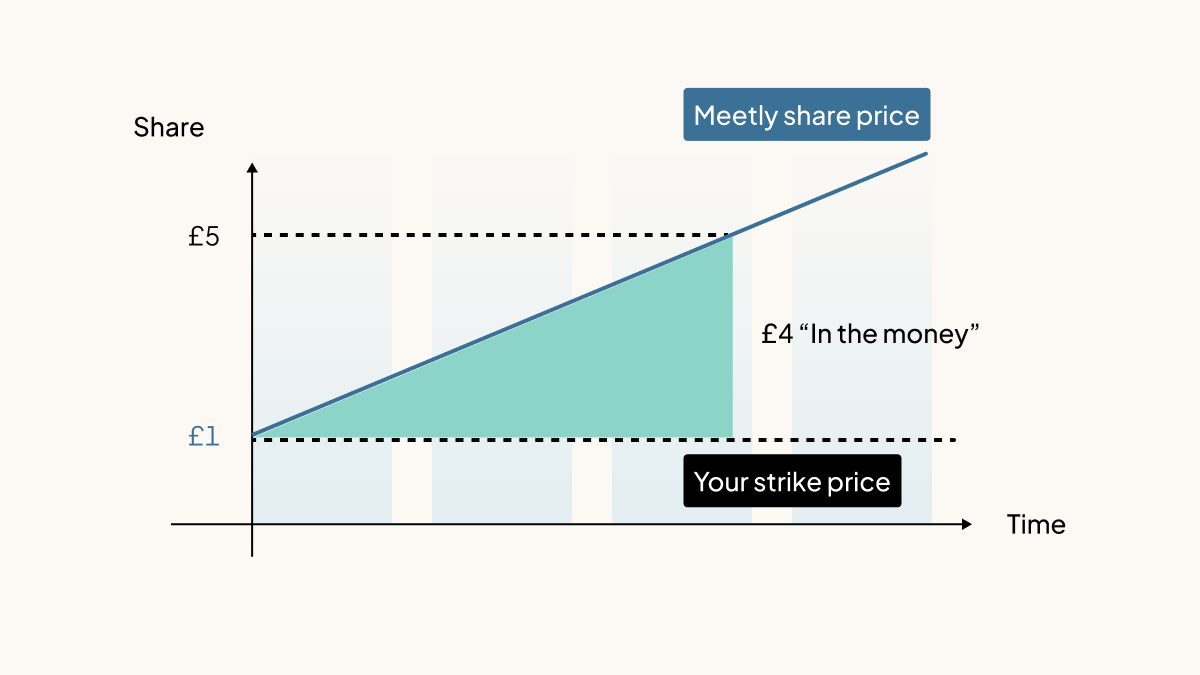

“In-the-money” share options

When the value of the company’s shares increases, the difference between the FMV and your strike price is called the “spread”. This is the underlying value of your options today. If the spread is positive, your options are considered “in the money”.

If you exercise your options at a strike price of £1 and sell your shares when Meetly’s FMV is £5, the spread is £4 (per share).

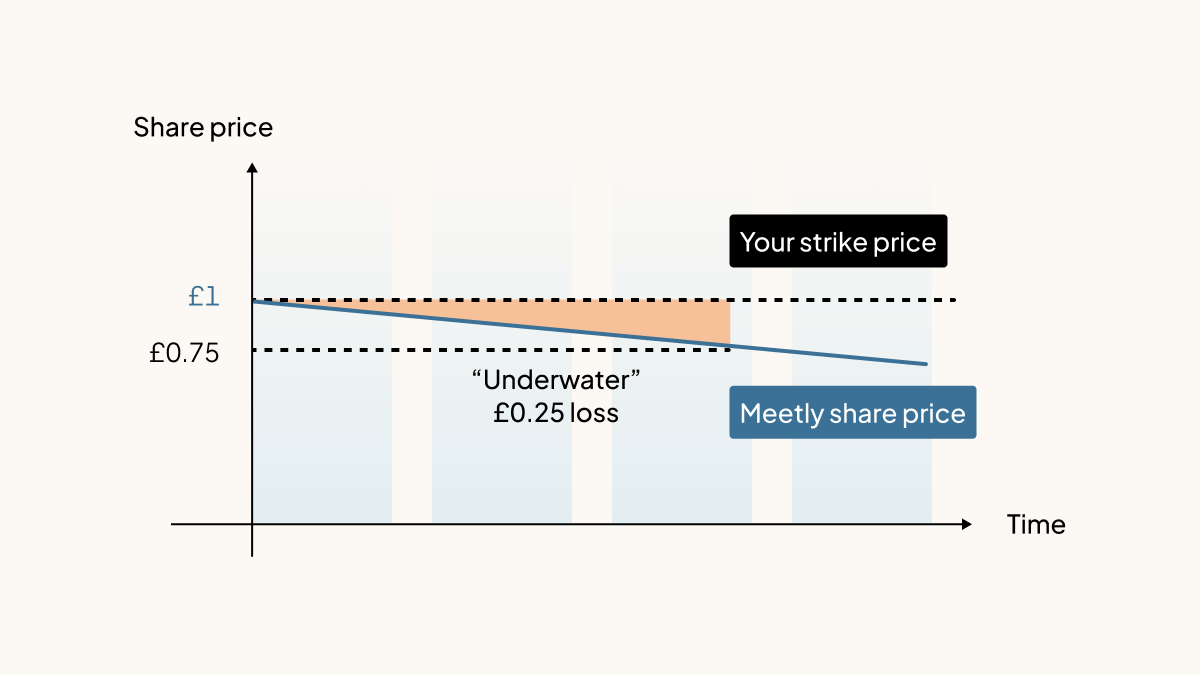

“Underwater” share options

Unfortunately, not every startup gains value all the time.

If Meetly’s FMV decreases to £0.75, your options go “underwater” because the spread is negative”. In this scenario, you would have to pay £1 to get £0.75 in return, so you’d probably decide not to exercise your options. Note that Meetly could choose to reprice the options or replace the underwater options with new ones that have a lower strike price.

Share dilution

If your company issues additional shares, which tends to happen when it raises a round of capital, your shares could be diluted. Although this means that you’ll own a smaller percentage of the business, it’s not necessarily a bad thing. Because companies aim to increase their valuation each time they raise a funding round, diluted shareholders typically own a smaller piece of a bigger pie; as such, the actual value of your shares could increase even if your equity is diluted.

Why strike prices matter

You can only exercise your options during a specific period of time, known as the “exercise window”, which is defined in your option agreement. The beginning of your exercise window is based on your vesting schedule and whether your company offers early exercise. Many share option schemes have a 90-day post-termination exercise period (PTEP), while others offer more flexibility.

Between the date your options vest and when they expire, knowing whether your options underwater, at the money or in the money will help you decide whether to exercise them. Other factors to consider include affordability (in terms of the strike price and any taxes that may be due upon exercise), your sense of the company’s future value and when you expect to be able to sell your shares. Consulting a financial planner could help you decide whether exercising your options makes sense for you.