In business, owning equity in a company means you have an ownership stake. A wide range of people and entities can own equity in a company, including the company’s founders, investors, employees, advisors, and consultants.

The greatest advantage of this kind of shared ownership is that it can align equity holders with the overall prosperity of a business—if the company’s value increases, so does the financial stake held by equity owners. For employees, the ability to own equity can be an incentive to join a company, stay at the company for longer, and feel more invested in the company’s success. Many businesses, including most startups, include equity as part of their overall compensation to employees.

Equity can also provide a path to wealth for wage earners through the outsized returns that could come from long-term equity ownership, especially in early- and growth-stage private companies. In this article, we'll guide you through the basics of business equity ownership.

Equity in public markets vs. private markets

A common way to own equity in a company is to invest in a publicly traded company listed on a stock exchange. For public companies, information about the company is transparent. Anyone can invest in the stock market, and companies are legally required to make information about the company’s financial situation available to investors so they can make informed decisions. Employees who work for public companies may own stock in the company as part of their employment, as well.

Private companies—small retailers, restaurants, tech startups, or other companies whose shares aren’t publicly available—can offer equity, as well. Unlike public companies, which are open to investment from anyone, equity in private companies is generally not available unless you are an employee, an accredited investor, or a qualified purchaser, such as a venture capital firm.

Note that owning equity in a private company as an investor or employee is a different idea than “ private equity,” which refers to a specific type of investment partnership in which large investment firms buy later-stage private companies and manage them.

What is equity in business?

You may see equity called “shareholders’ equity” (public companies) or “owners’ equity” (private companies). In each case the definition is the same: Equity is the portion of ownership shareholders have in a company.

Types of equity in the private markets vary according to the legal business structure of the entity offering it. Some examples of equity for businesses are:

-

Shares of stock in a corporation

-

A membership unit in a limited liability company (LLC)

Each of these types of equity has different characteristics, is governed by different laws, and is treated differently for tax purposes.

Types of equity in a corporation

Shares of common stock and preferred stock are the two main types of equity issued by private companies. Both types offer different benefits to shareholders. In general, shares of common stock are issued to founders and employees, while shares of preferred stock are issued to investors.

Common shares

Common shares, or shares of common stock, are generally issued to a company’s early founders and its employees. When the company files its Articles of Incorporation, it specifies how many shares it is creating. The company then determines how those shares will be divided if there are co-founders; and how many shares will remain unissued and available to be issued to other early contributors to the company, such as advisors, consultants, or early employees.

As a company grows in size and receives more funding, it might issue stock option grants to purchase shares of common stock, which give employees the option to exercise (buy) common shares at a set price, once they have met certain conditions such as length of employment.

Founders can amend their Articles of Incorporation to create more shares. This usually occurs as a company grows, often in conjunction with raising money from investors. With more shares available, companies can award equity in the form of stock grants or stock options to more employees. These forms of equity compensation offer an incentive for employees to join the company.

Issuing equity to employees has some key advantages—they create a possibility of profit if the company’s share price grows over time. Like all investments, however, gains are never guaranteed, and shares can become worthless if the company fails or otherwise never reaches a liquidity event, like an IPO or a merger with another company.

The major disadvantage of common shares versus preferred shares is that they receive a lower preference if there is a liquidity event—common shareholders generally only receive a payout after preferred shareholders have received at least their initial investment back.

Employee equity

Companies can issue several different types of equity to employees depending on the company’s compensation philosophy, fundraising stage, or option pool.

|

Restricted Stock Award (RSA) |

Incentive Stock Option (ISO) |

Non-Qualified Stock Option (NSO) |

Restricted Stock Unit (RSU) | |

|

When to issue |

Before raising outside funds |

After fundraising |

After fundraising |

When your company reaches a stable valuation |

Stock options

A stock option is a type of equity compensation that allows an employee to buy a set number of company shares at a fixed price (known as the strike price, or exercise price). Stock options aren’t actual shares of stock, only the right to buy them. You’re never required to exercise a stock option.

Companies generally distribute options from an option pool, which is a reserved set of shares from which equity can be issued to service providers in the future. Those people could include advisors, consultants, and independent contractors, as well as employees.

The two types of employee stock options in the United States are incentive stock options (ISOs) and non-qualified stock options (NSOs). Both enable equity ownership and are offered to service providers depending on different factors. ISOs and NSOs mainly differ in how and when they’re taxed—ISOs could qualify for favorable tax treatment.

Incentive stock options (ISOs)

Incentive stock options are the most common type of security issued to employees in the U.S. ISOs can only be issued to employees and not to other service providers. Unlike NSOs, you usually don’t have to pay taxes when you exercise ISOs (except for the alternative minimum tax, if applicable). ISOs sometimes qualify for a lower tax rate if you meet certain requirements.

Note: under IRS rules, individuals can’t receive more than $100K worth of exercisable options as ISOs in a year.

Non-qualified stock options (NSOs)

Non-qualified stock options do not qualify for favorable tax treatment for the employee. For NSOs you pay taxes both when you exercise the option (purchase shares) and when you sell those shares.

Other types of equity awards

Other types of equity awards like restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options. Companies usually switch to restricted stock units as they grow larger to reduce share dilution and to make the awards attractive and affordable to employees.

While stock options offer you the “option” to buy shares at a fixed price, RSAs and RSUs are grants of stock subject to certain conditions. Although recipients sometimes pay nothing up front for these types of equity awards, they don’t take full ownership of the stock until their award fully vests.

Restricted stock units (RSUs)

An restricted stock unit is a promise to give you shares of a company’s stock (or the cash equivalent) on a future date—as soon as you meet certain conditions. These conditions are the “restrictions” placed on the award, and the process of meeting the conditions is called vesting.

With RSUs, you are usually only responsible for paying the applicable taxes when you receive the shares. Larger, later-stage companies more commonly issue RSUs.

→ Learn more about RSUs vs options.

Restricted stock awards (RSAs)

Restricted stock awards are equity awards that are acquired upon grant, and are usually subject to vesting conditions. If the shares do not vest, the company has the right to repurchase the unvested shares when the service provider leaves the company. Very early-stage companies issue RSAs before raising substantial funding—when the fair market value (FMV) of common stock is low—to help recipients avoid a large tax burden.

→ Learn more about RSAs vs. RSUs.

Preferred shares

Preferred shares, or preferred stock, is equity issued primarily to investors (such as VCs or angel investors) when they invest in a company’s funding round. Preferred shareholders have preferred access to company assets, which means they get paid ahead of common shareholders in a liquidity event (such as an acquisition of the company) or in the event of a bankruptcy. This preferred status is granted as an incentive for investors to take on the risk of investment.

Vesting

At most companies, employees must work for a certain period of time or meet specific milestones to earn their equity awards. This is called vesting.

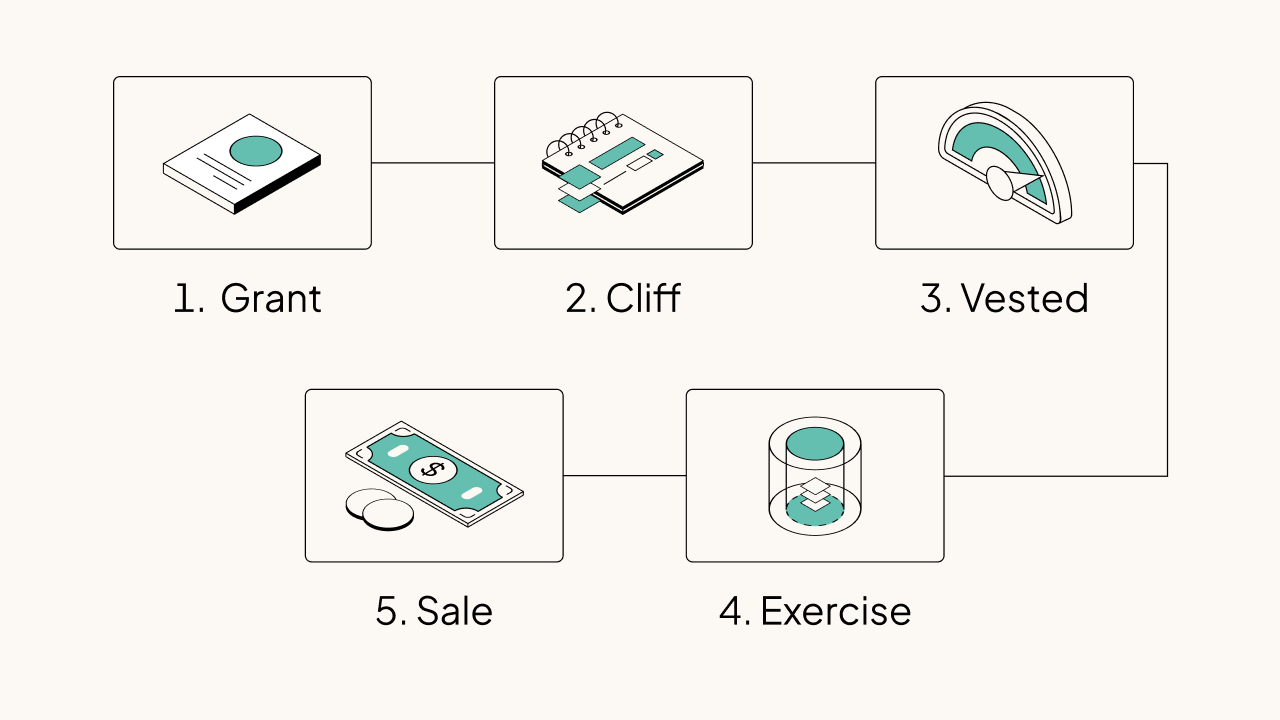

The lifecycle of an option usually looks like this:

Your option grant will outline a vesting schedule, which details when you’ll earn the right to exercise your options or when you officially own your shares (e.g. 1,000 options over four years).

Some equity plans can allow early exercising, which lets you exercise options before they are vested. This can produce tax advantages, because the recipient is purchasing the shares before the company’s FMV has increased, thus minimizing the income tax they must pay upon acquiring the shares.

The three common types of vesting schedules are time-based, milestone-based, and a hybrid of time-based and milestone-based.

Types of equity in an LLC

Limited liability companies (LLCs) use a different business structure than corporations. They are legally structured as partnerships, with different tax and employment implications. LLCs may set up an LLC equity compensation plan, to detail how the company shares ownership with employees and consultants. An LLC’s equity incentive plan is different than those that corporations use to offer equity to their employees. Corporations generally issue shares of stock, stock options or RSUs, but LLC equity can come in many forms, known as “interests.”

Profits interests

Profits interests units (PIUs) or incentive unit plans offer employees future profits from the company, either from a sale or from yearly distributions. PIUs require a threshold or hurdle valuation to establish what the business is worth on the date of grant, and the recipient is able to participate in any proceeds from the growth of the company from that point forward.

Membership interests

Membership interests—also called membership units or capital interests—are another form of equity for LLCs. Membership interests owners have the same financial privileges as other members do and may also have voting rights. This type of equity has value as soon as it’s granted.

Phantom equity

Phantom equity or synthetic equity awards recipients the right to future value, typically in the form of a cash payment when the company reaches a milestone. Phantom equity is not outright ownership (as the name “phantom” suggests) and works similarly to profit sharing. Phantom equity is typically paid out during a liquidity event such as an M&A or IPO.

Options to acquire LLC interests

“Options to acquire LLC interests” is a type of a contract LLCs use that functions similarly to a stock option grant agreement does for corporations. Options to acquire interests is the contractual agreement outlining the recipient’s right to purchase equity at a future date.

Liquidity: Turning equity into cash

Liquidity is when equity becomes a tangible asset. Without a liquidity event or the prospect of a liquidity event, equity in a business is virtually meaningless.

The biggest advantage of investing in the public market is its liquidity: Publicly traded stocks are typically easy to buy and sell on a daily basis. All types of investors can enter the public market, while only accredited investors or qualified purchasers are able to freely invest in the private market.

The following are some of the paths to liquidity for privately held companies:

Merger & acquisition (M&A)

When one company or firm purchases another, shareholders of the acquired company may receive a cash payout or new shares from the buyer making the acquisition. What happens to your equity during a merger and acquisition (M&A) transaction depends on the type of equity, tenure at the company, and the deal terms with the buyer. As in all liquidity events, preferred shareholders are generally paid out before common shareholders. In acquisitions where the price is at or below the total amount that preferred shareholders invested in the company, this can mean common shareholders receive no proceeds from the acquisition.

IPO

An initial public offering (IPO) is when a private company offers its stock on the public market for the first time, allowing it to exchange shares for capital from the public and non-accredited investors. Existing shareholders in the company, including employees, can access liquidity by selling some or all of their vested shares for cash.

Secondary market transactions

The secondary market for private stock allows stockholders of private companies to liquidate their equity before an exit event such as an M&A transaction or an IPO. Secondary market transactions do not function the same as public stock market transactions.

Private market secondaries can be:

-

A company-sponsored liquidity event, such as tender offers, block sales, or auctions.

-

Direct stock transactions, which allow investors to purchase shares directly from existing stockholders.

Tender offer

A tender offer is when multiple sellers—usually employees—can sell their shares either to an investor, a group of investors, or back to the company. Tender offers happen when a company is still private, allowing shareholders to liquidate equity without having to wait for the company to go public or get acquired. It is the most common type of secondary transaction.

Share buybacks and third-party tender offers are the two types of private company tender offers.

-

Share buyback: when a company repurchases shares from its shareholders—typically, their employees, investors, and (in some cases) former employees

-

Third-party: when a company allows investors to purchase shares from existing shareholders

How to calculate your equity’s value

Knowing how much shares are worth is essential to understanding the value of your equity. In the public markets, the share price of all companies listed on stock market exchanges is publicly available in real time, and is based on supply and demand. Private companies that offer equity calculate share prices in a different way—they use a 409A valuation (an independent appraisal of the fair market value of common stock) to calculate the FMV of each share for compliance purposes and to establish the exercise price. Most companies use financial platforms like Carta to track ownership, allowing employees to see how many shares they own and what their company’s latest FMV is.

To evaluate an equity offer from a prospective company, or to calculate the value of your existing employee equity, employees can consider:

-

The number of options or RSUs in your grant (the total number of options offered to you)

-

The cost of acquiring the shares (the strike price, or the price per share to exercise your options)

Over time, an employee or other equity holder can monitor the FMV of the company; most companies conduct 409A valuations on an annual basis, or even more frequently. If the valuation of the company rises relative to the strike price, that is a sign that the shares are growing in value. However, any actual profit would only come after several steps: The employee must exercise the shares (or fully vest their restricted stock), the company must have a liquidity event (either an IPO, M&A, or secondary transaction), and the employee must sell their shares at a current market price that is higher than the price for which they purchased their shares.

Equity holders in a company typically are not allowed to sell shares during a “lock-up” period following an IPO, usually 90 or 180 days.

The ownership economy

What if issuing equity were as easy and cheap as paying payroll? Could we make ownership as ubiquitous as salaries?

That’s the concept behind the ownership economy. Equity keeps employees invested in their work. It allows them to own a piece of the company and gives them a personal reason to help it succeed.

At Carta, we create more owners. More than 35,000 companies use our platform to map and expand equity ownership to over two million shareholders.