Not all companies in the United States offer equity compensation, but many do—especially startups and private companies. Regardless of whether equity awards make up a large or small portion of your employees’ compensation packages, it’s important to understand how it works so you can make the most of it.

In this article, we’ll explain what equity compensation is, how it works, and the different types of equity compensation startup leaders can offer to their teams.

What is equity compensation?

Equity compensation is a non-cash part of overall compensation and benefits, offering employees and other service providers an ownership stake in the company they’re working for. Equity-based compensation could include stock options or restricted stock units and may be given to advisors, investors, or other contributors in addition to employees.

Company stock can appreciate as your business grows. By offering equity, you can align recipients’ interests with the business’s success. This type of compensation can also help attract and retain talent when cash flow might be tight in your startup’s early days.

How does equity compensation work?

A paycheck is pretty self explanatory, but equity compensation plans can be more complex.

1. Equity grant

A grant is a document that you give to your employees or other service providers as part of their compensation. It will have important information like:

-

the grant date

-

how many stock options / the number of shares being granted

-

the fair market value (FMV) of the shares / the exercise price

-

the vesting schedule or other vesting requirements

Recipients will need all of this information to make informed decisions about their equity—like whether to exercise their options or sell shares— and for tax treatment information.

2. Vesting

Vesting is the process of earning equity over a period of time or via predetermined benchmarks like hitting performance metrics. The most common vesting schedule is a grant that vests over four years with a one-year cliff. That means the recipient wouldn’t earn any of their equity unless they stay at the company for a year; to receive all shares, they’d have to stay for all four years.

Vesting periods like this can help ensure employee retention for a certain amount of time.

3. Exercising

Granting stock options grants the right to buy shares at a previously agreed-upon price, known as the exercise or strike price. A stock option grant does not automatically issue any equity. Recipients of stock options must exercise their options (aka buy the shares) to actually own shares in a company.

In most cases, option holders can only exercise their options after vesting conditions are met. But, some companies allow early exercising, which allows stockholders to buy options before they vest.

Exercising stock options early can have beneficial tax consequences and starts the clock for preferential long-term capital gains tax treatment and potentially qualified small business stock treatment (QSBS).

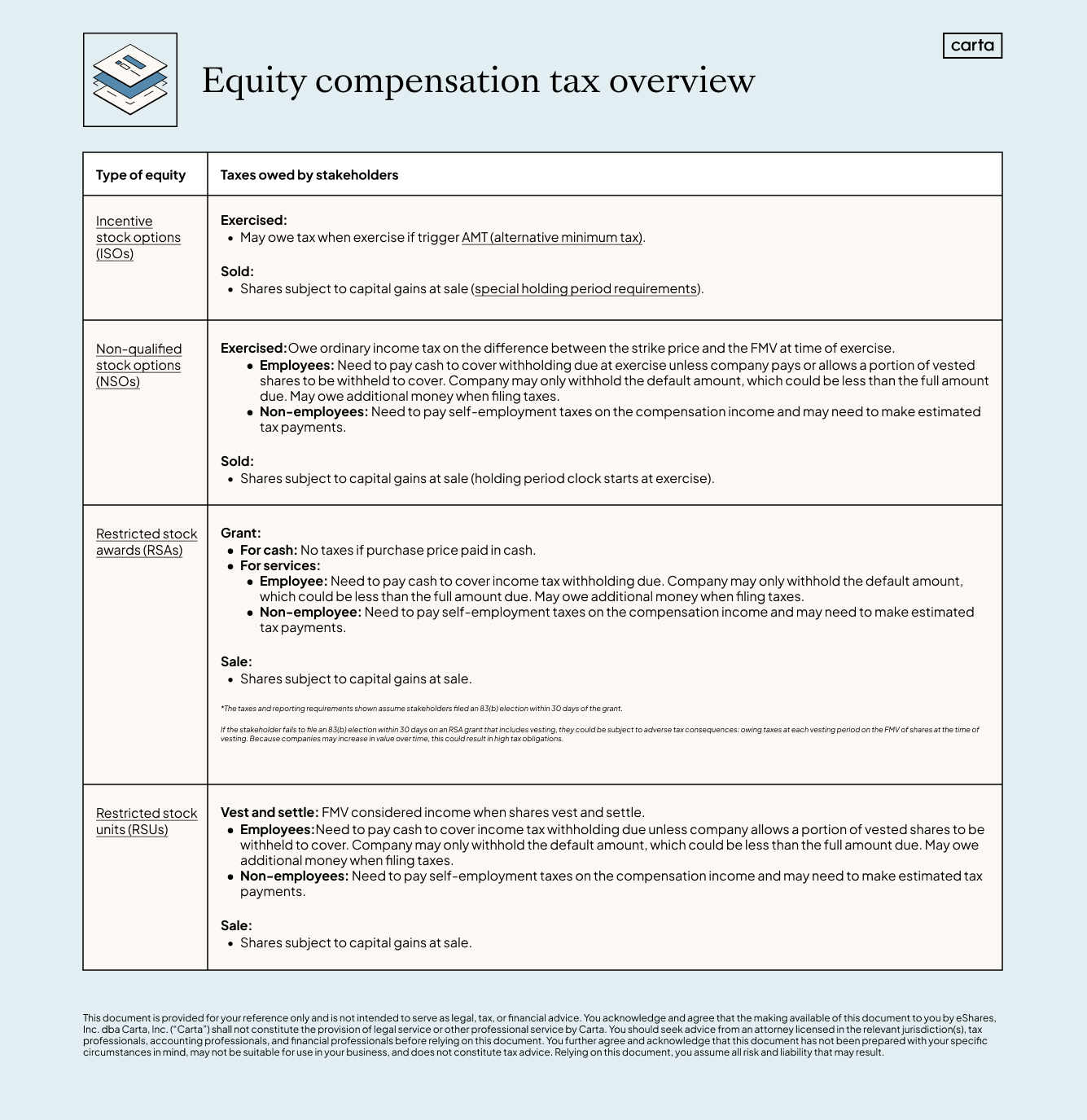

4. Taxes on equity compensation

Tax implications for employee equity vary widely based on equity type ( ISOs vs. NSOs for options, for example). Companies who use Carta for cap table management can take advantage of easy access to expert tax advice for their employees.

Carta’s Equity Tax Advisors can help answer common tax questions, including:

-

Do I owe income taxes or the alternative minimum tax (AMT)?

-

When does my holding period start for capital gains?

-

What types of tax benefits will I receive?

-

Does my equity meet the requirements for QSBS tax advantages?

-

How can I prepare for federal gift and estate taxes?

-

What are the differences between RSUs vs. RSAs?

Different types of equity compensation

1. Stock options: ISOs and NSOs

There are two types of stock options: ISOs (incentive stock options) and NSOs (non-qualified stock options).

ISOs

Incentive stock options are only available to employees and offer potential tax benefits (like not having to pay taxes when exercised unless the AMT is triggered).

→ Learn more about ISOs and how they’re taxed

NSOs

Non-qualified stock options can be issued to employees or non-employees, including consultants or contractors. NSO holders will owe income taxes when they exercise their options.

→ Learn more about NSOs and how they’re taxed

2. Restricted stock units (RSUs) and restricted stock awards (RSAs)

Unlike with stock options, which must be exercised first, with RSAs and RSUs, you’re the legal owner of the shares when they’re issued to you. The question of when you receive those shares depends on if you have RSUs or RSAs.

With RSAs, you own the shares when you accept your grant and meet any purchase price requirements, but they’re still subject to vesting conditions. If you file an 83(b) election within 30 days of receiving your grant, you can start the holding clock on all your shares on your grant date vs. waiting for the vest date.

With RSUs, you get the right to acquire shares of common stock if certain conditions are met—often a vesting schedule and/or a liquidity event for the company. You generally don’t have to pay anything to acquire these shares, besides taxes. But, the FMV of your vested RSUs will be treated as compensation.

3. Equity incentive plans for LLCs

Equity compensation for limited liability companies (LLC) is different from what corporations can offer. The biggest differences between equity compensation options for these types of entities include taxation, voting rights, and employee status.

Phantom equity

Similar to a bonus, phantom equity or phantom stock gives holders a cash payout when the company is acquired or goes public, or a share of annual profits when the company reaches a milestone, such as revenue or profit goals. Phantom stock unit payouts are taxable to the LLC member at ordinary income tax rates, which is generally higher than long-term capital gains rates.

Profits Interest Units (PIUs)

Profits interest units are the most common type of equity offered by LLCs. PIUs offer members a share in the future profits and growth of the company, rather than immediate equity. PIU recipients are owners on the date of the grant. This form of equity compensation is particularly effective in aligning member interests with the long-term success of the LLC.

→ Learn more about LLC taxation

4. Employee stock purchase plans (ESPPs)

ESPPs enable employees at public companies to buy company shares often at a discount, through post-tax payroll deductions over a specific offering period.

Build a sustainable equity compensation strategy with Carta Total Compensation

Carta Total Compensation has the largest set of private company equity data and uses machine learning technology to ensure compensation benchmarks reflect market changes. Easily sort salary and equity benchmarks by peer group, industry, role, location, and more so you can make fair and competitive compensation packages that help you win and retain top talent. You can learn more about Carta Total Compensation here.