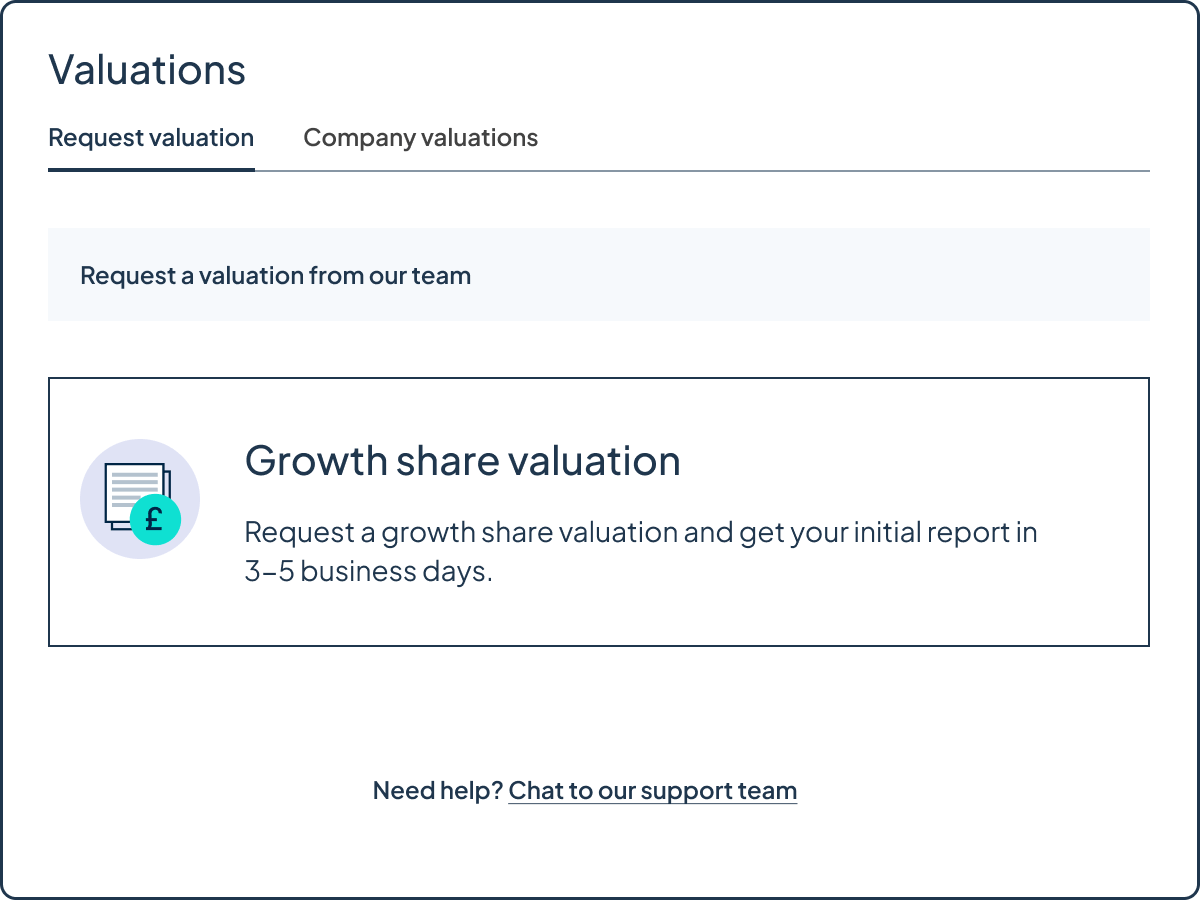

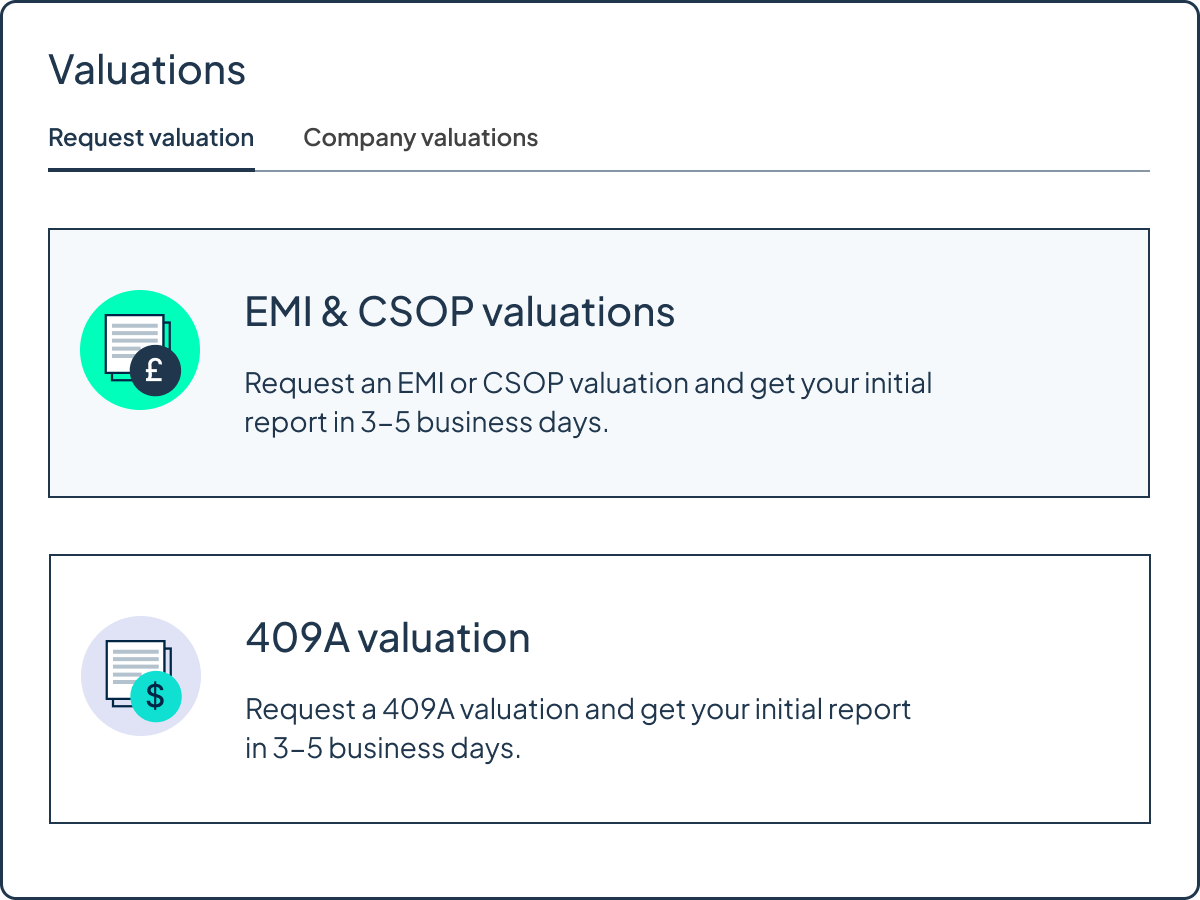

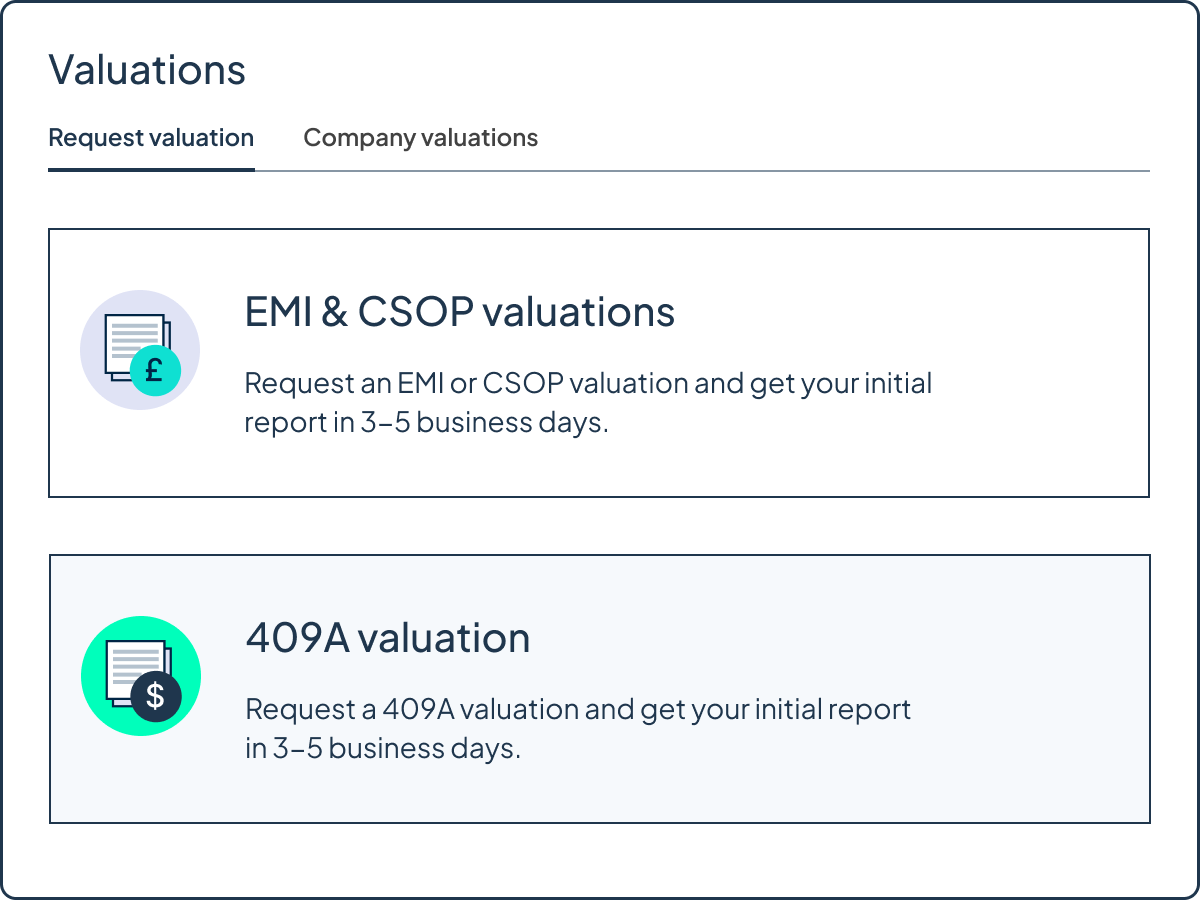

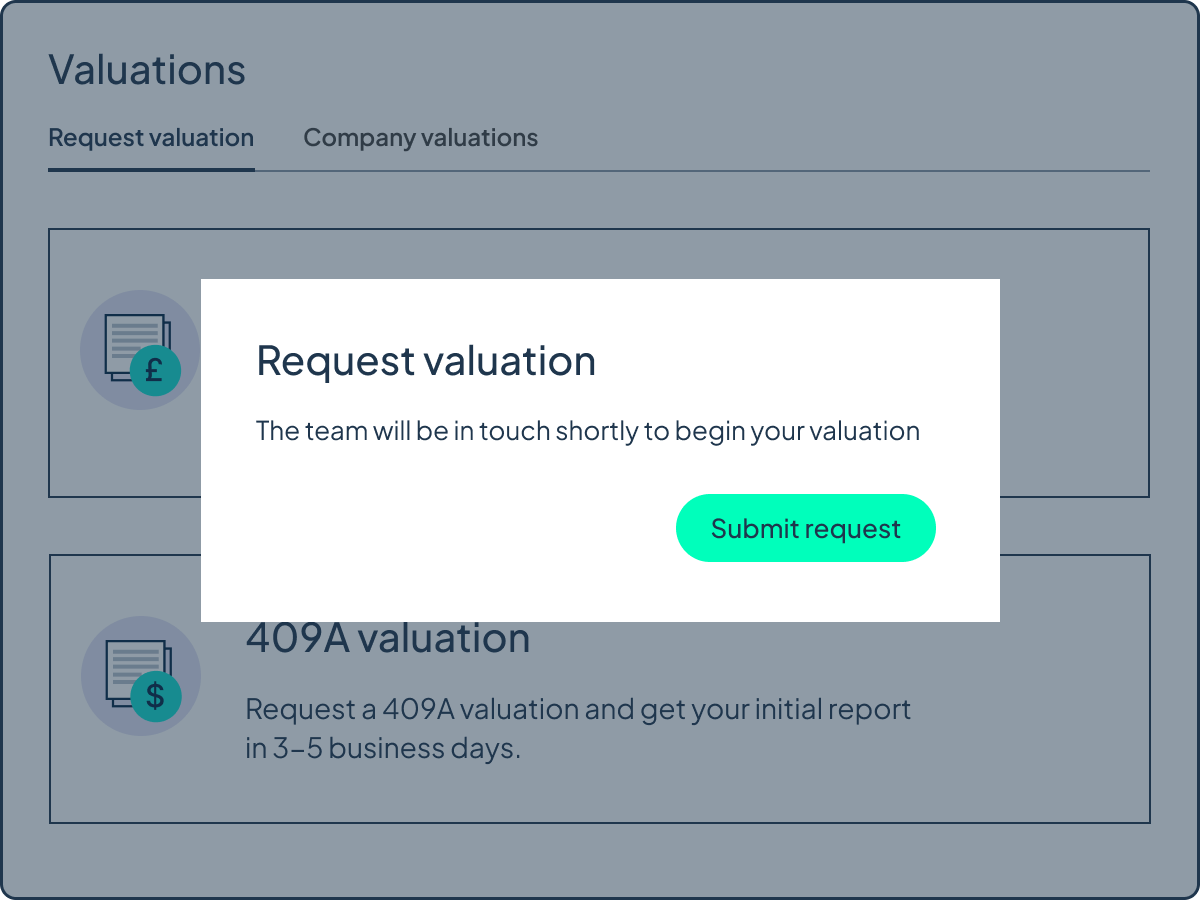

Fast, accurate valuations

Get EMI, CSOP, 409A and growth share valuations from Carta, whenever you need them.

In-house expertise

Your valuations are performed by our own experts, never outsourced to a partner or third party.

HMRC and IRS support

Let us do the boring stuff for you. We’ll even liaise with UK or US tax authorities on your behalf.

The leading provider

You’re in good hands. Carta is the world’s leading provider of 409A valuations, creating thousands each month.

Solutions for the UK and the US

EMI and CSOP Valuations

409A Valuations

Why Carta?

Valuations can add up. Our subscription model covers multiple valuations per year for a fixed fee.

If you’re working against the clock, waiting weeks for a valuation report won’t do. Our in-house team can perform a valuation and deliver your initial report in 3-5 days.

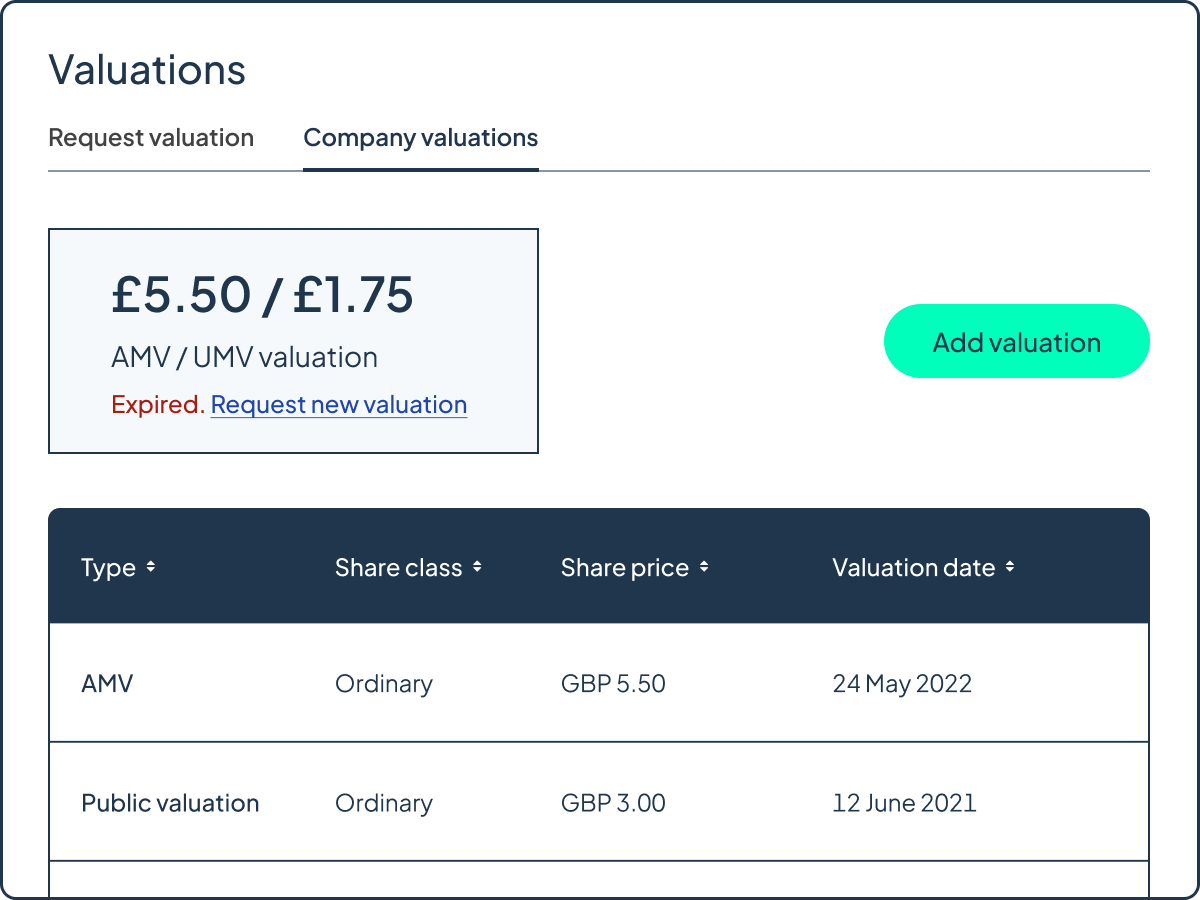

Valuations expire periodically, preventing you from issuing options to your employees. Update your company valuation regularly and keep your equity plan moving.