Restricted stock awards (RSA) are grants of stock that companies can use to compensate their employees. RSAs are an alternative to restricted stock units (RSU)—another type of restricted stock equity award—and stock options (such as ISOs and NSOs).

What is a restricted stock award (RSA)?

Restricted stock awards are a type of equity compensation that grants employees and other service providers company stock with certain restrictions. You’re the legal owner of RSA shares from the date the grant is issued and you satisfy any purchase price requirements, but typically, the shares will still be subject to vesting conditions.

RSAs are considered “restricted” stock, because the shares cannot be freely transferred or traded, which allows the company to stay in compliance with securities laws.

By comparison, stock options offer employees the “option” to buy a set number of shares at a fixed strike price. Although the employee sometimes pays nothing up front for the stock options, they don’t take full ownership of it until they meet certain conditions. You don’t own the incentive stock options (ISO) or non-qualified stock options (NSO) until you exercise your option to buy them.

Why companies grant restricted stock awards

RSAs are generally issued by very early-stage companies when the fair market value (FMV) of common stock is very low—this way, employees don’t need to pay a lot to have ownership in the company, and they won’t get hit with a significant tax burden if they receive the shares as compensation instead of purchasing them outright.

RSAs also have some advantages over certain types of options. Unlike options, RSAs don’t have to be exercised, and you start the long-term capital gains holding period when you acquire them. In addition, they don’t have to satisfy the additional ISO holding periods. RSAs help startups compete for talent against larger companies that can pay higher salaries by allowing the companies to offer equity with high upside potential.

RSAs vs. RSUs

The two types of restricted stock equity awards—RSAs and RSUs—have differences when it comes to purchase cost, vesting periods, tax treatment, and terms upon termination.

→ Learn more about the differences between RSAs and RSUs

RSA vesting

Timing is key with RSAs: When you acquire the shares and when you sell them are important factors in determining the full value and tax implications of these equity compensation awards.

The most common vesting conditions placed on RSAs are time-based and involve a vesting schedule, which means you earn full rights to the shares over time. Time-based restrictions incentivize employees to stay with the company. Other vesting schedules may be based on certain milestones or achievements related to the performance of the individual or the company.

Because you acquire RSA shares when they are granted to you, RSA vesting only impacts whether the company can repurchase your shares if you leave or are terminated, and does not affect your tax obligations. Most companies have time-based vesting schedules in place to prevent individuals from joining a company, receiving their RSA award, and leaving immediately with the ownership of their full equity grant without having “earned” it. Vesting also aligns personal outcomes with company outcomes throughout the organization. While time-based vesting is the standard for RSAs, milestone-based vesting can also be used, but is more rare.

Termination and RSAs

When you leave a company, what happens to your RSAs depends whether the RSAs are vested or unvested.

You’ll keep all of your vested RSA shares when you leave, but any unvested shares are subject to a company repurchase. That means your company has the right (but not the obligation) to buy the shares back, usually at the lesser of the price you paid for them or the current FMV.

RSA tax

There are two types of taxes to consider with equity compensation: ordinary income tax and capital gains tax. The long-term capital gains tax rate is currently lower than the ordinary income tax rate. If an employee holds stock for more than a year between acquisition and sale, any increase in value is taxed as long-term capital gains.

When you’re granted RSAs by a company, you have to pay a certain price per share to acquire them. If the cash purchase price you paid equals the FMV, you do not owe ordinary income taxes on the RSAs at the time of the grant.

Section 83(b) election

If your RSA includes vesting, then you will need to file an 83(b) election with the IRS.

Without an 83(b) election, you would owe ordinary income tax at each vesting event (e.g., at the cliff and every month thereafter for a standard four-year monthly vesting schedule with a one-year cliff). The taxes would be calculated on the difference between the FMV at the time of vesting and the initial purchase price. As the company’s value grows over time, this could lead to significant tax burdens in the future.

Sending an 83(b) election to the IRS means that you can choose to pay all of your ordinary income tax up front on an RSA, at a time when the FMV equals the strike price (so there is no taxable difference). RSA recipients should file an 83(b) election within 30 days of the grant date.

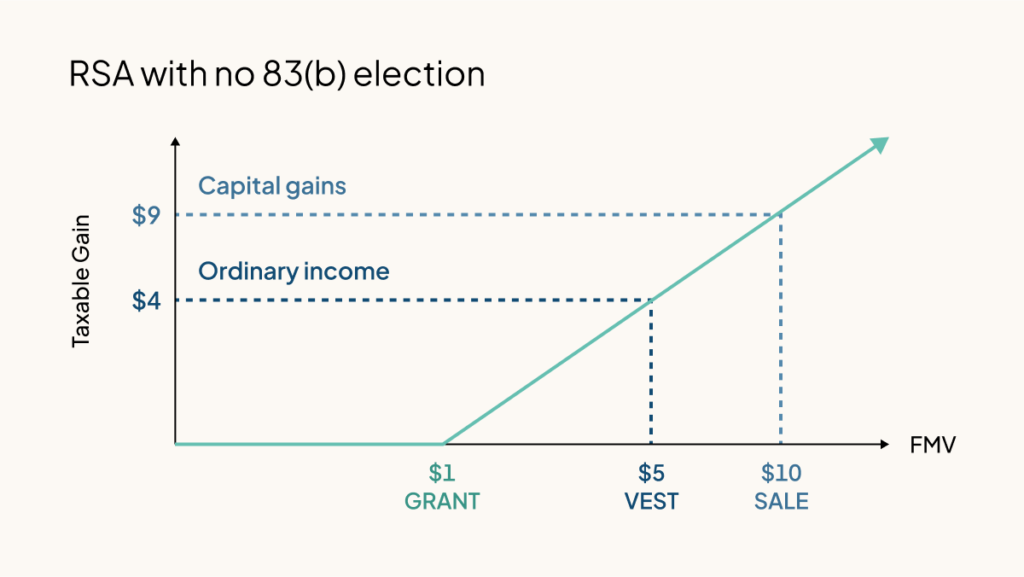

RSA with no 83(b) election

As the FMV increases over time, you’ll owe taxes on the difference between the FMV and the purchase price if you did not file an 83(b) election within the first 30 days of receiving your shares (more on that below).

The graph above shows a RSA’s taxable events over time, assuming a single vesting event. On the x-axis is the FMV of the shares. The y-axis (taxable gain) is the current FMV (at the time of the event) minus the FMV on the grant date ($1). As you can see, when shares are initially purchased at a cost equal to their FMV, the taxable amount at that time is zero.

Without an 83(b) election, for each vesting event after the grant date, the vested shares are subject to ordinary income tax on the increase in value from the purchase price. When the vested shares are then sold, any gain between tax basis set by the previous taxable event (vesting) and the proceeds from the sale is subject to capital gains tax. (Whether it’s at the short-term or long-term capital gains rate depends on whether you hold the shares for more than a year.)

The FMV of the stock could just as well decline after vesting, and the shares could end up being almost worthless. In the example above, the FMV has increased to $5 at the vest date, yielding taxable income of $4 per share.

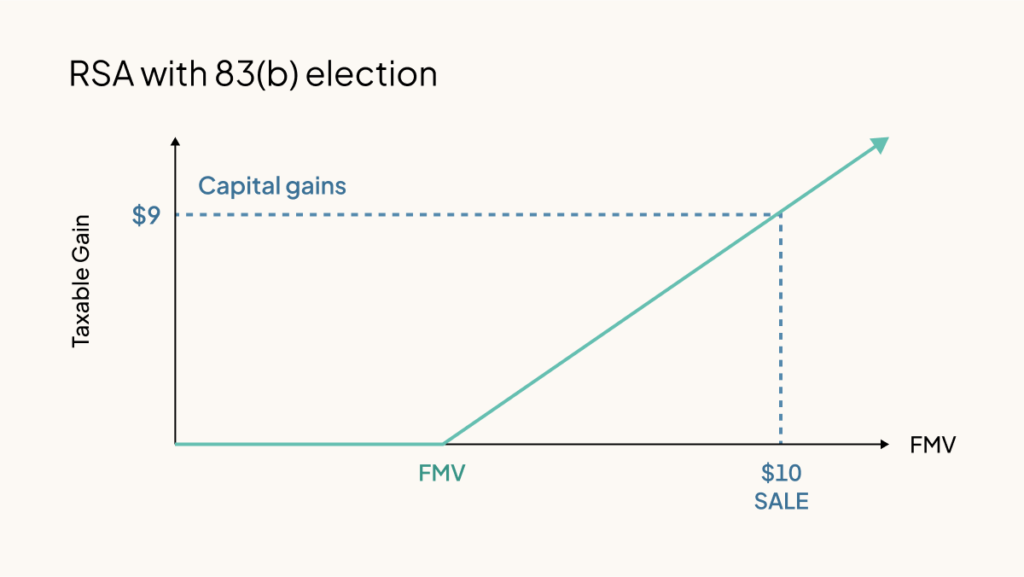

RSA with an 83(b) election

As shown in the example below, the taxable income is usually zero when you pay in cash and make an 83(b) election. This is because the FMV of the shares should be equal to what you paid for them.

Here, the taxable income is zero at grant because the FMV is the same as what was paid in cash: $1. By filing an 83(b) election, you choose to recognize ordinary income tax up front. Since the taxable amount above is $0, no tax is owed. (Note that if you had received the shares for services instead of cash, then you would owe income tax on the value of the shares at grant.)

Even as the RSA shares vest, no federal income tax is owed. Instead, you’d pay capital gains taxes on the full $9 gain when you sell the shares.

This is favorable for two reasons:

1) The long-term capital gains tax is currently a lower rate than the ordinary income tax.

2) Eliminates the risk of paying hefty additional taxes on illiquid shares that cannot be sold to offset the tax burden.