Prepare your company and employees for tax filing season

Carta’s tax filing resources help you understand key tax filing dates and provide resources to guide your employees through tax season.

Carta’s tax filing resources help you understand key tax filing dates and provide resources to guide your employees through tax season.

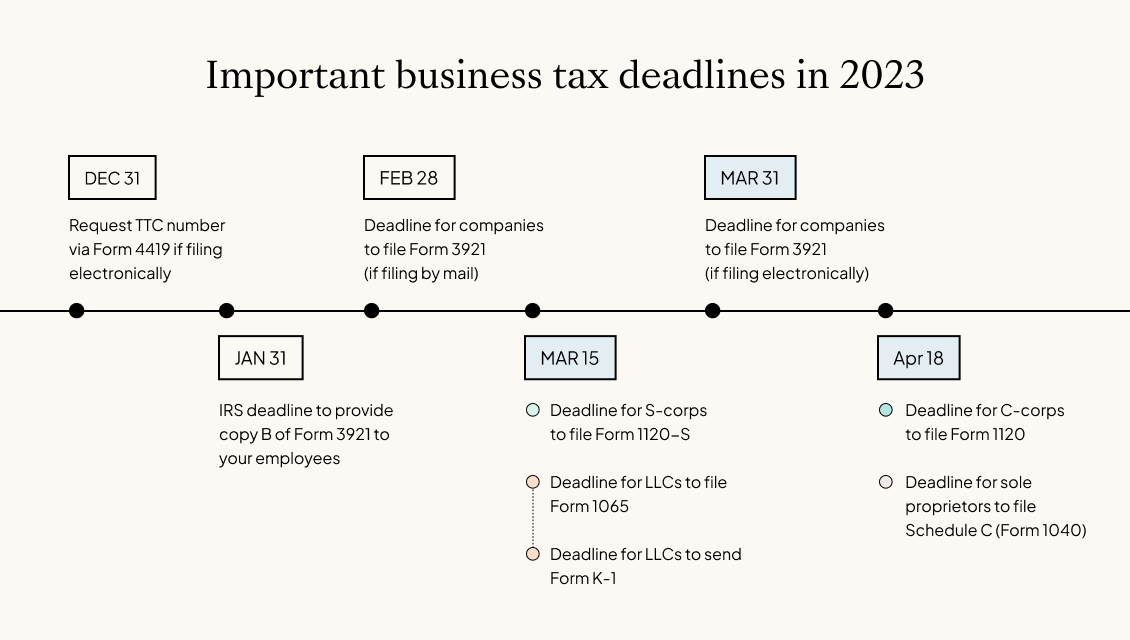

Startups and other businesses classified as corporations and LLCs should keep in mind several important dates for filing business taxes.

If your employees exercised ISO stock options in 2022, you’re legally required to file one 3921 form per ISO exercise to inform the IRS of ISO compensation.

Tax Advisory helps employees understand how their equity compensation is taxed via webinars and personalized 1:1 sessions—saving your company time and resources.

Help your employees prepare for tax season

If employees exercised and/or sold stock options this year, here’s what they need to know.

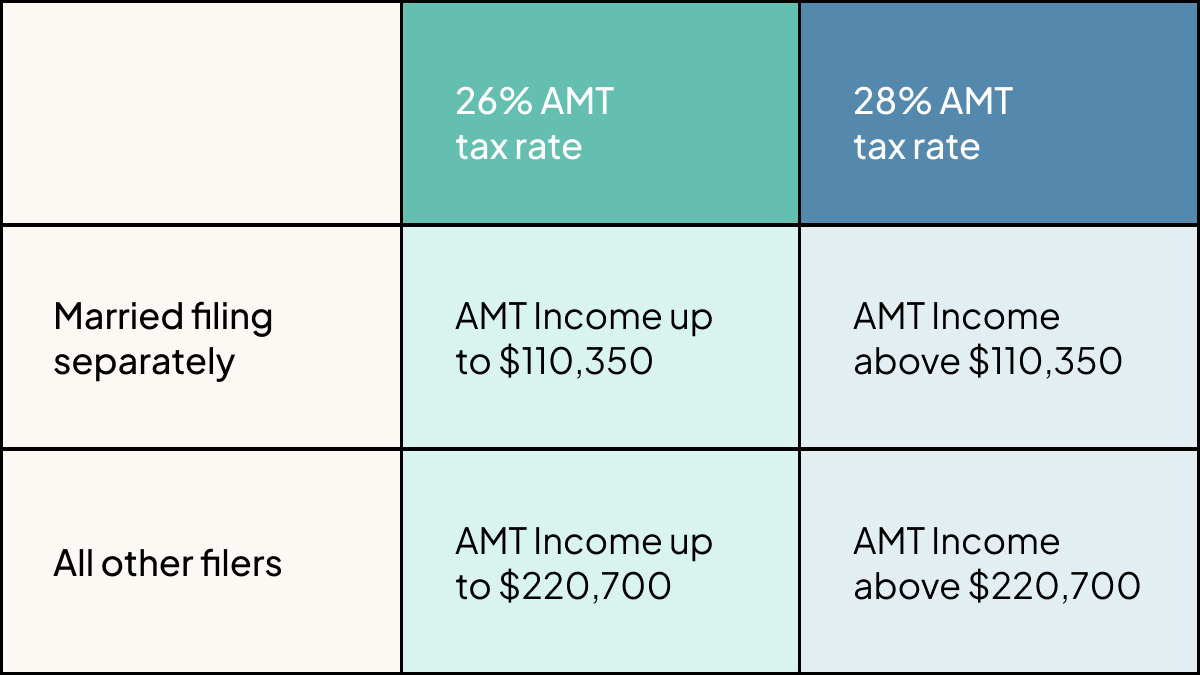

When employees exercise ISOs, they need to pay either ordinary income or the alternative minimum tax – whichever is higher.

If employees early exercised equity, they’ll need to file an 83(b) election within 30 days of exercise to receive potential tax advantages. Here’s what you need to know.

Carta Tax Advisory helps employees make informed decisions about their equity and taxes, on the same platform they already receive equity.