So, you’ve got an option grant and you want to exercise it. But what comes next? In this article, we’ll cover the fundamentals of exercising your options, from what the process involves to how Carta makes it happen.

What does it mean to exercise my options?

The process of turning a vested option grant into shares is called exercising. An option grant gives you the right to buy shares at a specific price; in purchasing the shares, you are exercising that right. In simple terms, you’re swapping your share option grant for actual company shares. This article refers to share options throughout, but the same process applies for warrants.Please note that share grants, virtual shares and RSUs are not eligible for exercise.

When am I able to exercise my options?

If you hold vested options with a company using Carta, the company may invite you to exercise them through the platform. The company does this by opening an exercise window: a fixed period of time in which you can exercise your options. You cannot exercise your options before a window begins or after it ends.The most common reasons for a company to open an exercise window are:

-

The company goes through a so-called exit event, such as an IPO or an acquisition.

-

You are an employee and you leave the company – many companies require leavers to exercise their options.

-

There are tax benefits related to exercising at a specific point in time.

Do I have to exercise all my vested options?

No. You can decide how many of your vested options you would like to exercise during an open exercise window.

What does it cost to exercise my options?

The cost of exercising depends on the terms of your grant, and how many options you choose to exercise. The exercise price – also known as the strike price – is outlined in your equity grant agreement. It is listed as the price per share. Your company administrator will tell you how much to pay, and how to pay it. The exercise process is not complete until you have signed the exercise notice and your company has received the payment.

Am I guaranteed to make money by exercising my options?

If you exercise your options as part of an exit event, such as an IPO, and you’ve committed to selling the new shares at a higher price than the exercise price, you’re guaranteed to make money in the transaction – individual tax circumstances notwithstanding.If you’re exercising your options early (i.e. before an exit event is confirmed) you are taking on a risk that may not pay off. Not all companies increase in value over time. If the company valuation hits zero, or the company shuts down, your shares won’t be worth anything and you won’t be able to recover those losses.

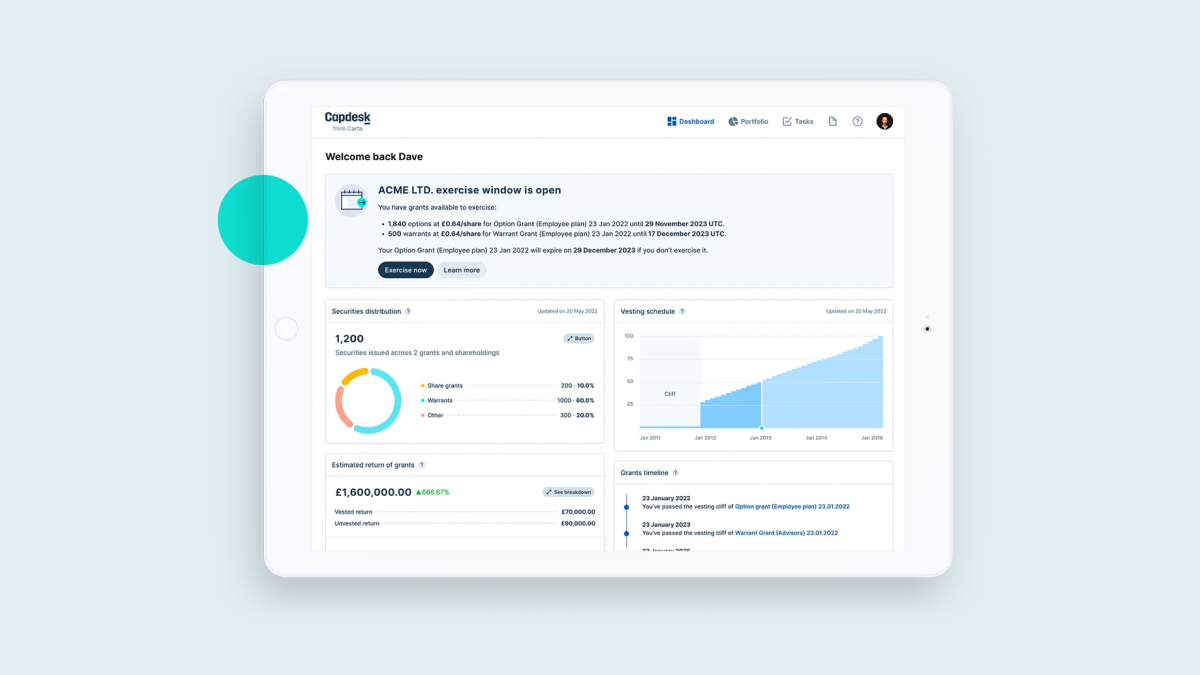

How do I know if I have an open exercise window?

When you log into your account, the dashboard will indicate whether you have an exercise window open.

I have an open exercise window on Carta, what now?

Read our Help Centre article How to exercise your vested equity for technical support on exercising your options through Carta.

I want to exercise my options but I don’t have an open exercise window. What can I do?

Contact your company directly to raise the request. The company administrator – probably somebody in the legal or finance departments – will be able to share information on the company’s plans to allow optionholders to exercise their vested options.