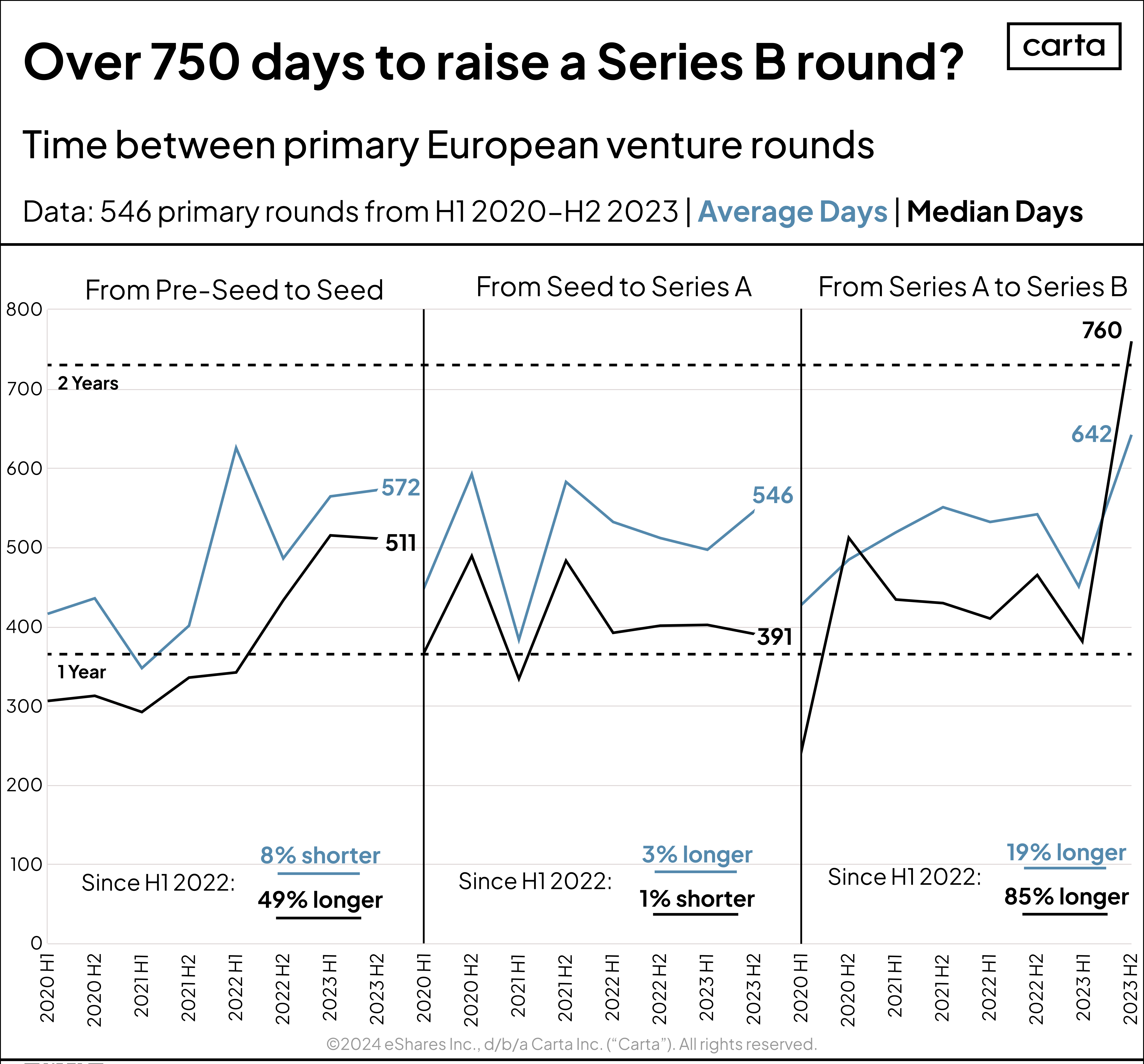

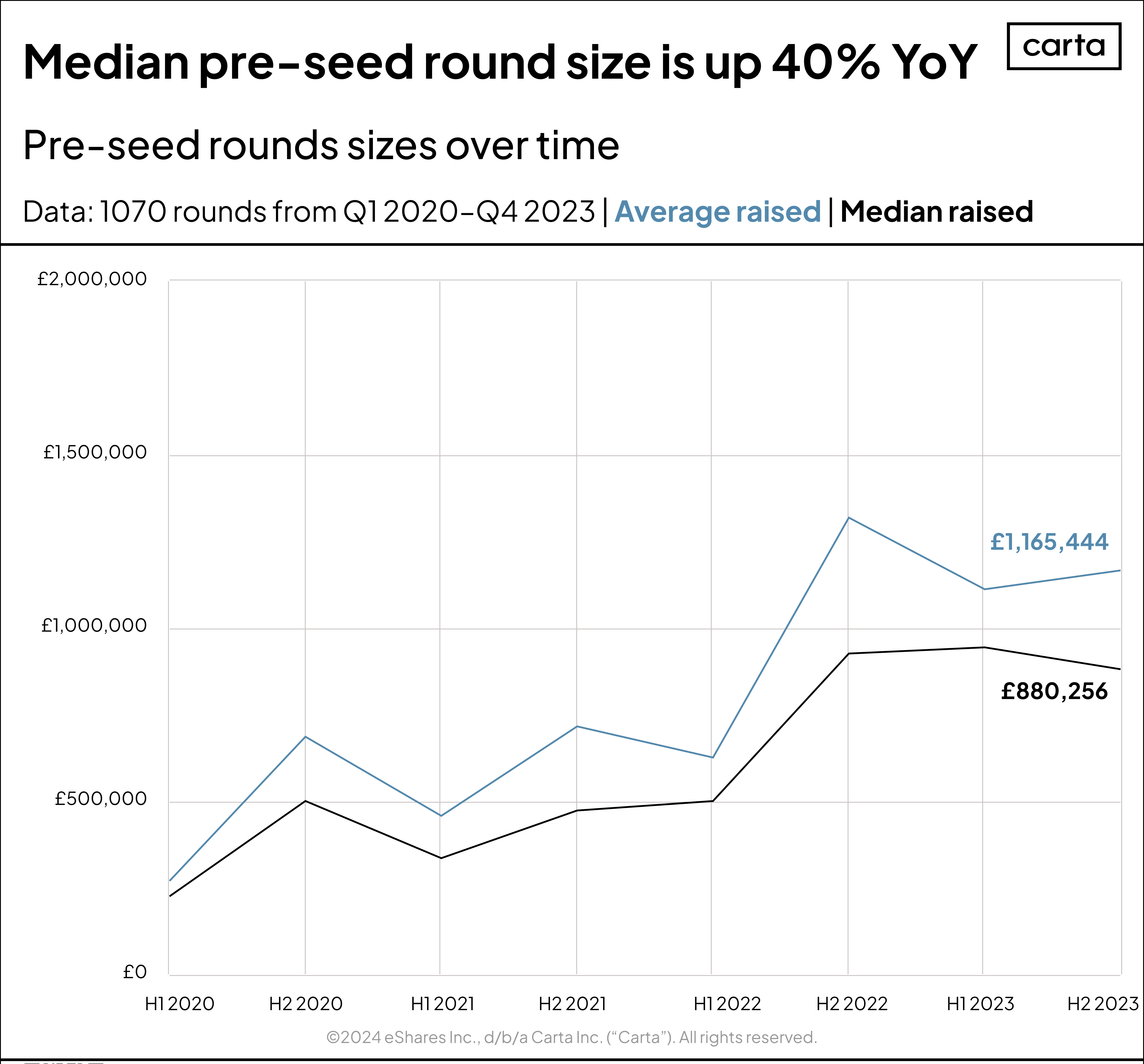

The median and average round sizes for pre-seed companies have grown steadily since 2020, with a particular surge in 2023 (up 40% vs. 2022). This sudden increase may be as a result of the 30% contraction in the number of pre-seed opportunities which led to a seller’s market.