When an employer gives you equity as part of your compensation package, they’re offering you partial ownership of the company. However, your stock usually has to vest first, meaning that you typically need to work for the company for a period of time if you want to become an owner.

What is vesting?

Vesting is the process of earning an asset, like stock options or employer-matched contributions to your 401(k), over time. Companies often use vesting to encourage you to stay longer at the company. Unless your company allows early exercising, you can only exercise stock options that have vested.

Vesting ISOs and NSOs

When you’re granted stock options, like incentive stock options (ISO) or non-qualified stock options (NSO), you aren’t getting actual shares of stock—yet. Instead, you’re getting the right to exercise the stock options, meaning the right to buy a set number of shares at a fixed price later on.

Vesting RSUs

If your company gives you restricted stock units (RSU), it’s giving you actual shares of stock, which you’ll be able to sell in the future. You may have to stay at the company for a certain amount of time, and sometimes you or the company must also hit a stated milestone (like an initial public offering (IPO), for example) for RSUs to vest. But unlike stock options, you don’t need to purchase them to own them—you just need to wait for them to vest.

This video explains how vesting works for stocks and options.

What is a vesting schedule?

A vesting schedule shows when you’ll earn your options or shares. It is typically detailed in your option grant (e.g. 1,000 options over four years).

There are three common types of vesting schedules: time-based, milestone-based, and a hybrid of time-based and milestone-based.

Time-based vesting and one-year cliffs

Time-based stock vesting is when you earn options or shares over a specified period of time.

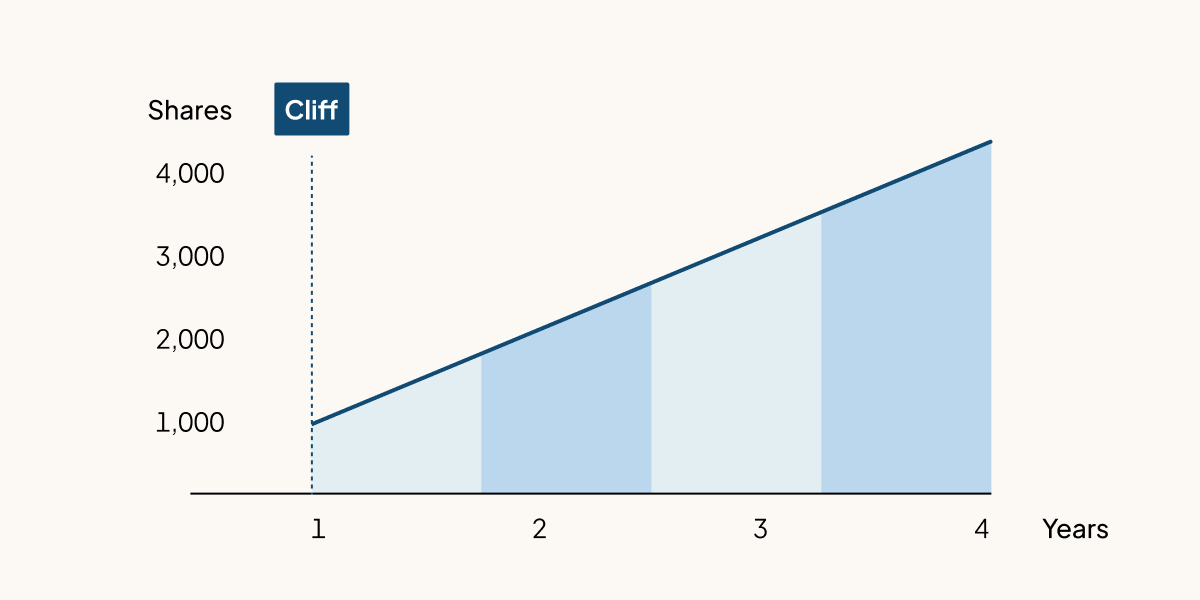

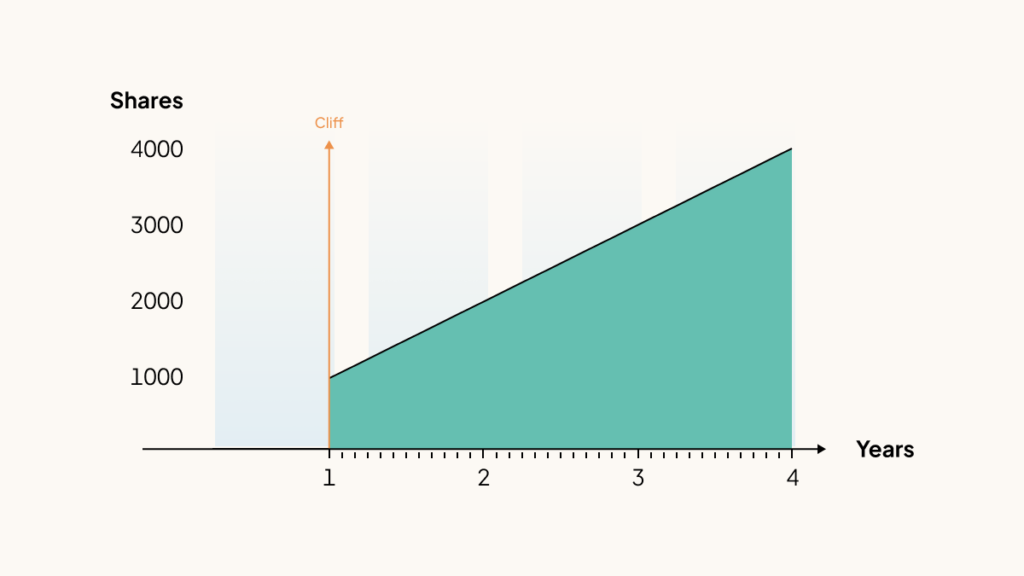

Most time-based vesting schedules have a vesting cliff. Cliff vesting is when the first portion of your option grant vests on a specific date and the remaining options gradually vest each month or quarter afterward.

Many companies offer option grants with a one-year cliff to motivate employees to stay for at least a year. If you leave before the one-year mark, any unvested options are put back into the employee option pool.

Under a standard four-year time-based vesting schedule with a one-year cliff, 1/4 of your shares vest after one year. After the cliff, 1/36 of the remaining granted shares (or 1/48 of the original grant) vest each month until the four-year vesting period is over. After four years, you are fully vested.

Keep in mind that each option grant has its own vesting schedule—vesting isn’t necessarily based on your overall tenure at the company. For example, if you received one grant with a four-year vesting schedule in 2020 and a second grant with a four-year vesting schedule from the same company in 2022, you wouldn’t fully vest all of the options from both grants until 2026.

Milestone-based vesting

Milestone vesting is when you earn your options or shares after a specific milestone. Other than IPO, milestones could be completing a project, reaching a business goal, or hitting a certain valuation. Milestone-based vesting isn’t as common as time-based vesting.

Hybrid vesting

Hybrid vesting is a combination of time-based and milestone vesting. This model requires you to simultaneously work at the company for a certain amount of time and hit one or more milestones to receive your options or shares.

Vesting schedule example

Meetly, Inc. (a hypothetical company) hired Blake on January 1, 2020. As part of the compensation package, Meetly gave Blake an option grant with the following details:

-

Grant date: 1/1/2020

-

Options granted:192

-

Vesting schedule: Time-based; monthly for four years with a one-year cliff

One year after Blake’s hire date, on January 1, 2021, she reached the vesting cliff and 1/4 of the shares (48 shares) vested. At that time, Blake could have exercised those 48 shares (though she wasn’t obligated to).

|

Date |

Options vested |

Cumulative |

|

1/1/2021 |

48 |

48 (192/4 = 48) |

|

2/1/2021 |

4 |

52 |

|

3/1/2021 |

4 |

56 |

|

4/1/2021 |

4 |

60 |

|

5/1/2021 |

4 |

64 |

|

6/1/2021 |

4 |

68 |

|

7/1/2021 |

4 |

71 |

|

8/1/2021 |

4 |

76 |

|

9/1/2021 |

4 |

80 |

Over the next three years, an additional four shares vest every month. By January 1, 2024, Blake’s options will be completely vested, and she can exercise all 192 of the shares in the option grant if she chooses.

|

Date |

Options vested |

Cumulative |

|

1/1/2021 |

48 |

48 (192/4 = 48) |

|

1/1/2022 |

48 |

96 |

|

1/1/2023 |

48 |

144 |

|

1/1/2024 |

48 |

192 |

If Blake leaves the company before January 1, 2024, she will surrender all unvested shares, which will be returned to the company’s option pool.

Understanding your options

Have you recently received equity but aren’t sure where to start? Use this guide to stock options to learn about strike prices, option pools, and other equity concepts that affect startup founders and employees.

Get expert 1:1 support on your equity and taxes with Equity Advisory—an additional offering exclusively for Carta customers. Click below to learn more.