Most startups grant equity compensation to new hires as part of their overall compensation package to incentivize them to join and stay at a company. But what about rewarding and incentivizing employees who have been at your company for a few years? Recruiting and training new employees is costly, so it’s important to have strategies—like equity refresh grants— in place to retain your top performers.

What is an equity refresh grant?

Since equity is such a powerful tool for employee retention, it makes sense to grant equity throughout an employee’s time with your company, not just when they’re hired. An equity refresh is a stock grant issued to employees who have already received a new-hire grant (equity that’s granted to an employee when they first join a company).

While refresh grants are always aimed at employee retention, there are three main types of refresh grants.

1. Time-based, retention, or tenure grants

These grants are given to employees when they reach a set tenure milestone or are completing vesting of their new-hire grant. These are aimed at retaining employees beyond the cliff of their new hire grant and are generally issued when the initial grant has vested at least halfway.

Issuing refresh grants at a predetermined cadence makes it easier to forecast how these grants will impact your equity pool, which can minimize dilution. It can also help with retention since employees know that they could receive more equity if they stay for a set period of time.

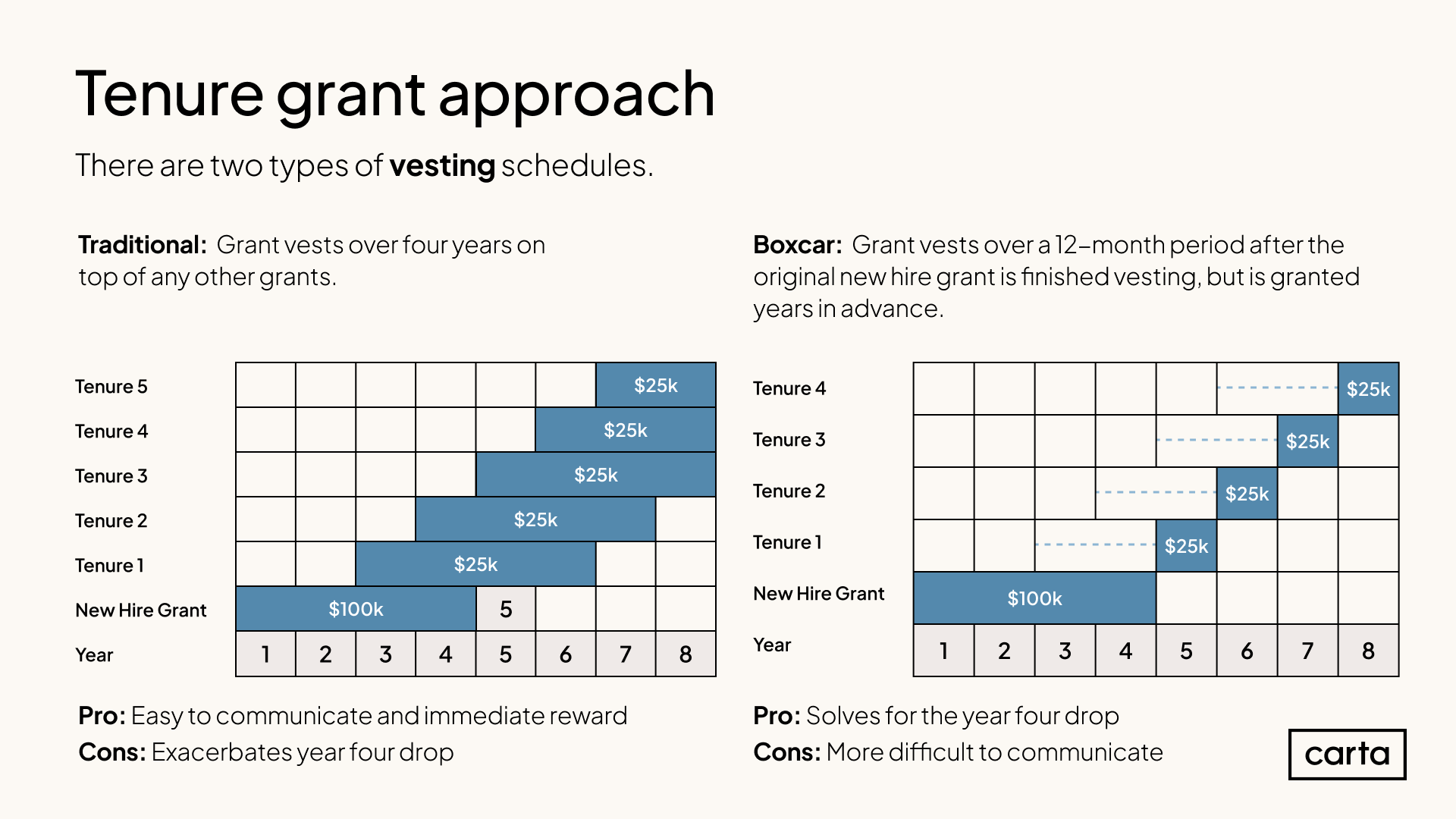

There are two main ways to structure a time-based refresh grant:

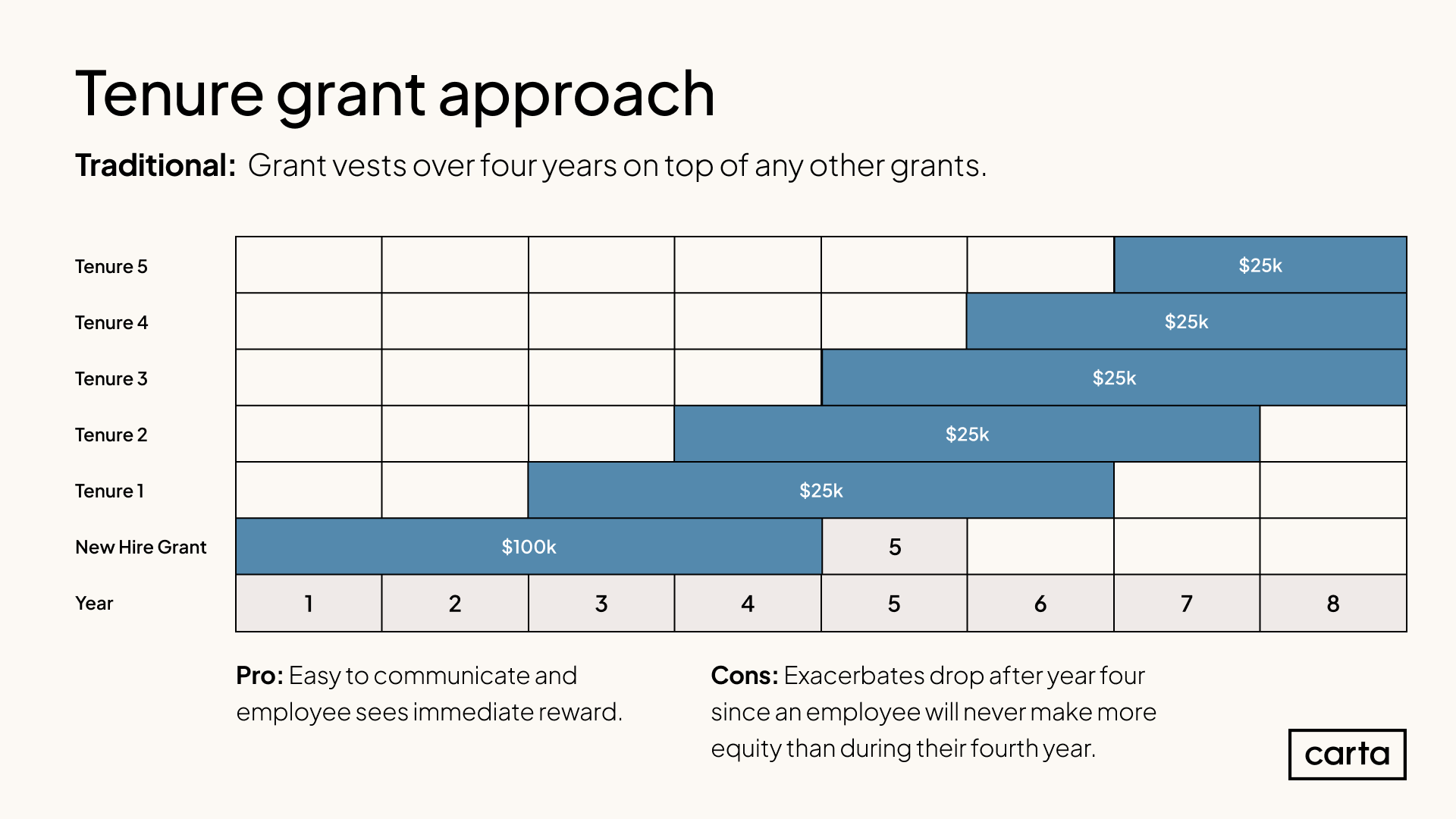

Traditional annual refresh grant

Some startups treat equity refreshes like yearly salary raises and give a standard increase to all employees to stay competitive against the market. These grants start vesting immediately and vest over either one or four years on top of any other grants. As a business, this is easier to budget equity for but it can exacerbate the drop-off after year four because employees will never earn more equity than they do during their fourth year.

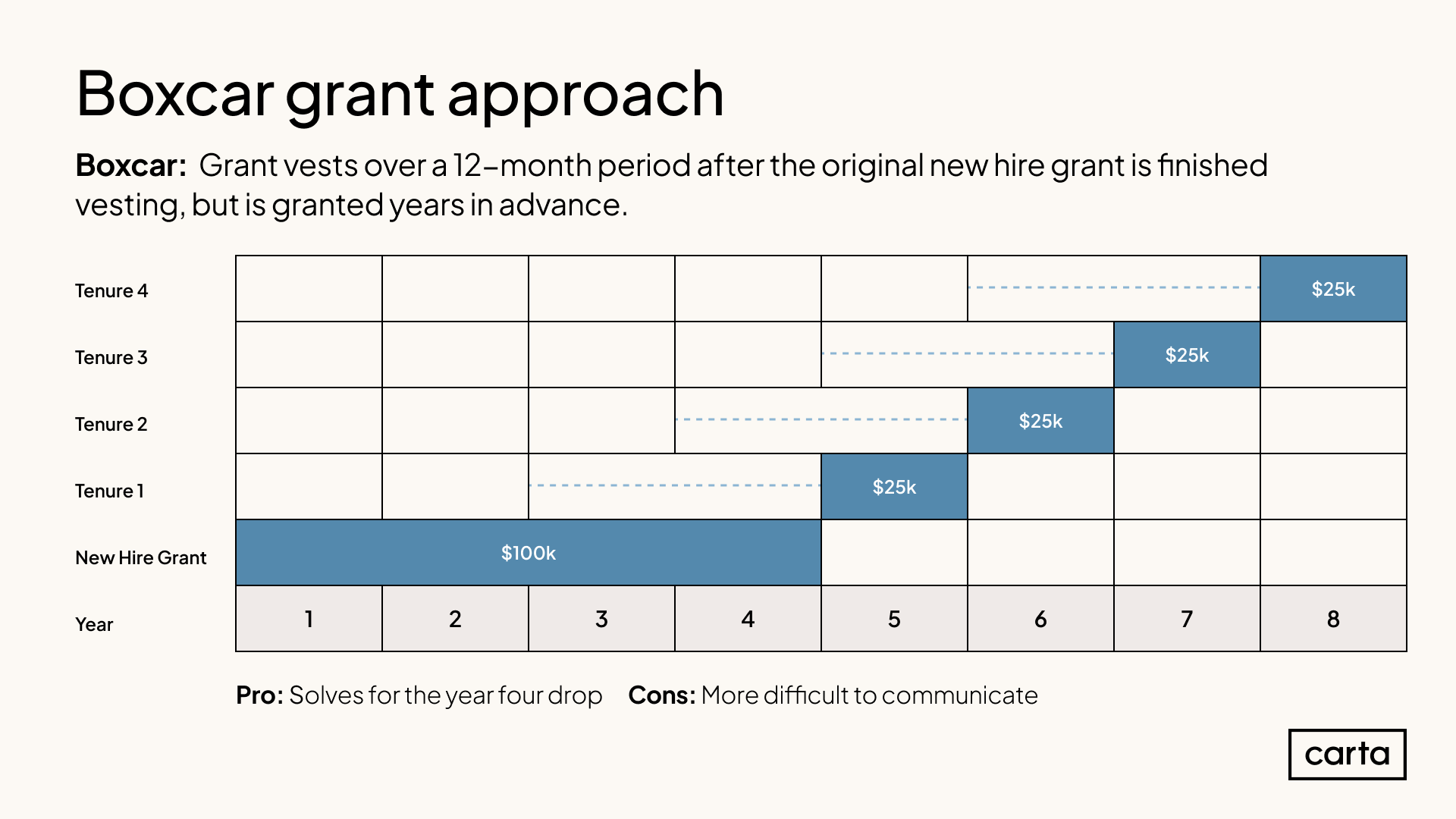

Boxcar grant

You grant equity to an employee at year two or three, but the new grant only starts vesting once the new hire grant is fully vested (after year four). These grants vest over one year vs. a traditional grant that vests over four years. This method avoids overlapping vesting periods while ensuring employees can take advantage of a lower stock option strike price and potentially pay less in taxes if your company valuation continues to rise.

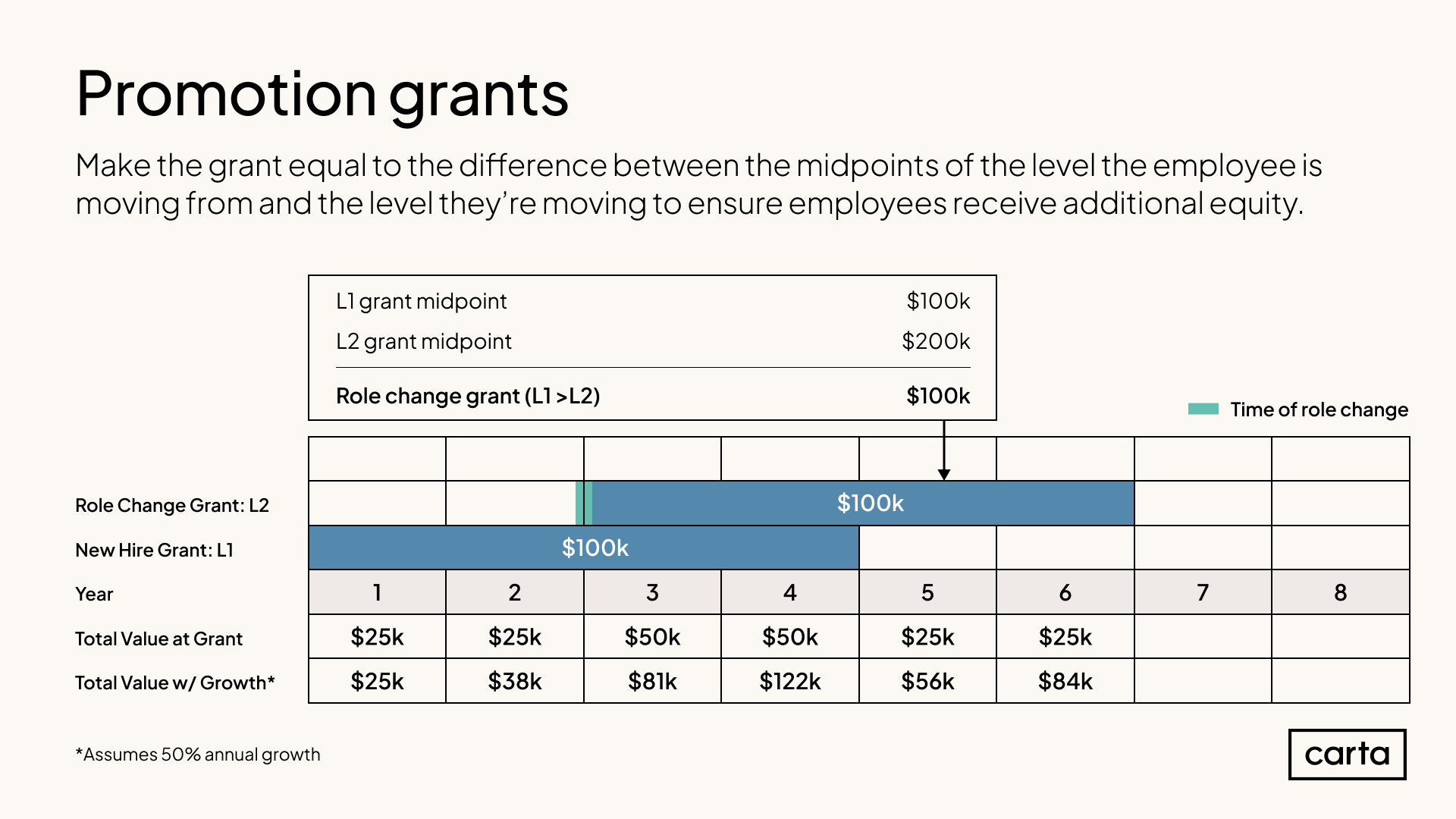

2. Promotion grants

These are granted at the time of a promotion to reflect the new role or level’s compensation. To determine the amount to issue for these grants, you’ll need real-time, accurate compensation data for what a new hire in that role would receive. Then you would match the difference.

If your company's valuation (and therefore a tenured employee's initial equity grant’s value) has increased, then a tenured employee’s equity could be worth more than what a new hire would receive if they got the same grant today as a new hire. In this case, it can be tempting not to offer additional shares to a tenured employee getting a promotion, since their equity is already worth more than what a new hire in that same position would be making. But, this can feel unfair to tenured employees who feel they should get more equity as a part of their promotion.

To address this, you can make promotion grants equal to the difference between the midpoints of the level the employee is moving from and the level they’re moving to, so no matter how much the initial grant’s value has grown, they’ll still get some additional equity. This ensures early employees don’t feel shortchanged.

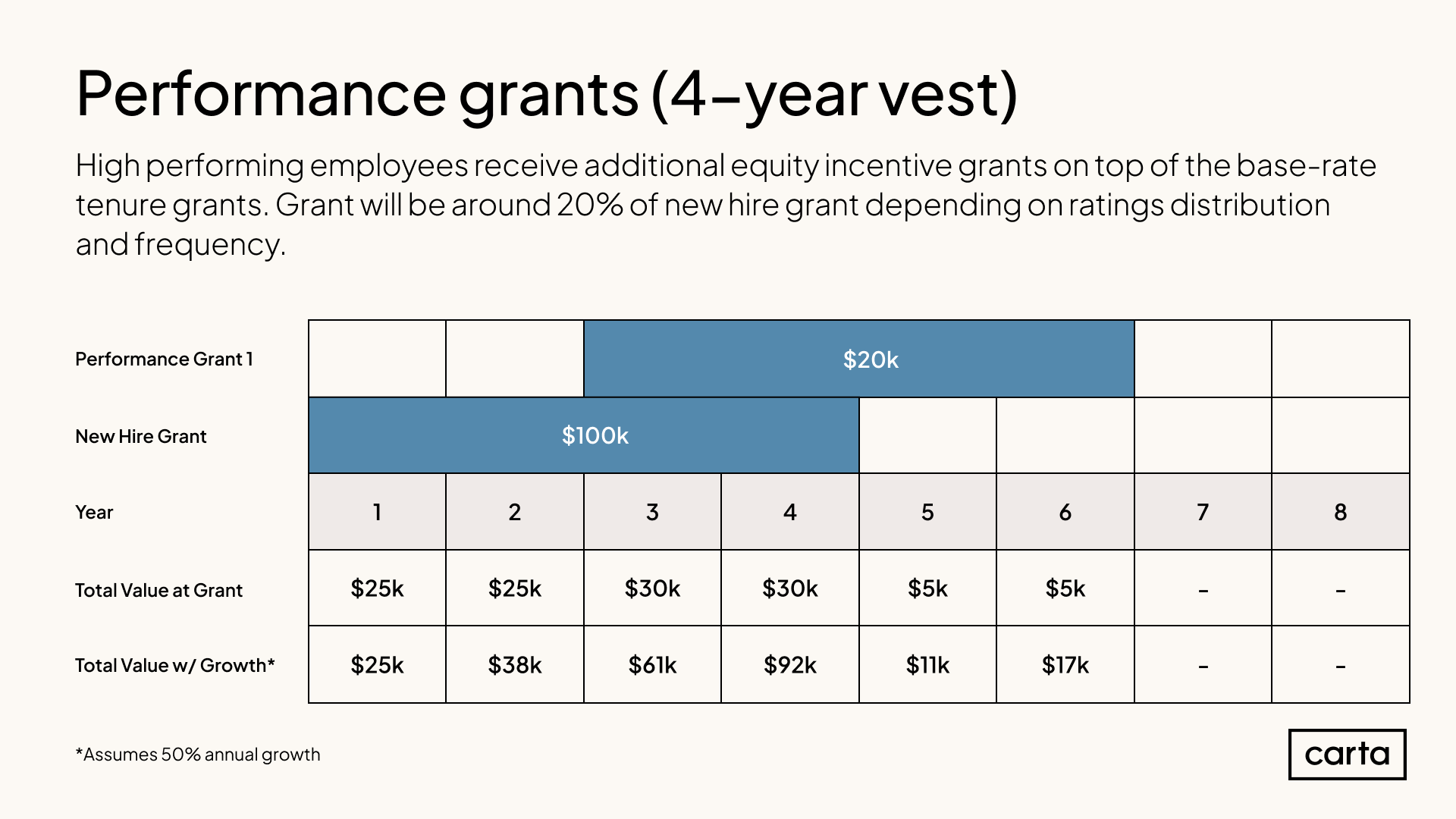

3. Performance grants

These are granted to reward top performers or when employees hit certain predetermined metrics. The vesting schedule may vary (vesting over one or four years), but they generally start vesting immediately to reward employees. These are typically awarded once a year during a company’s standard review cycle.

You can read more about how Carta approaches equity refresh grants here.

What is the typical size of an equity refresh grant?

Generally, our data shows that refresh grants are about 30% of what a new hire would be granted if that person were hired today for that same role or level. The size of grant may vary depending on the type of grant, when it’s issued, and a person’s role. But, since refresh grants are usually being issued on top of other existing holdings, they’re smaller than a new hire grant would be.

When are companies issuing refresh grants?

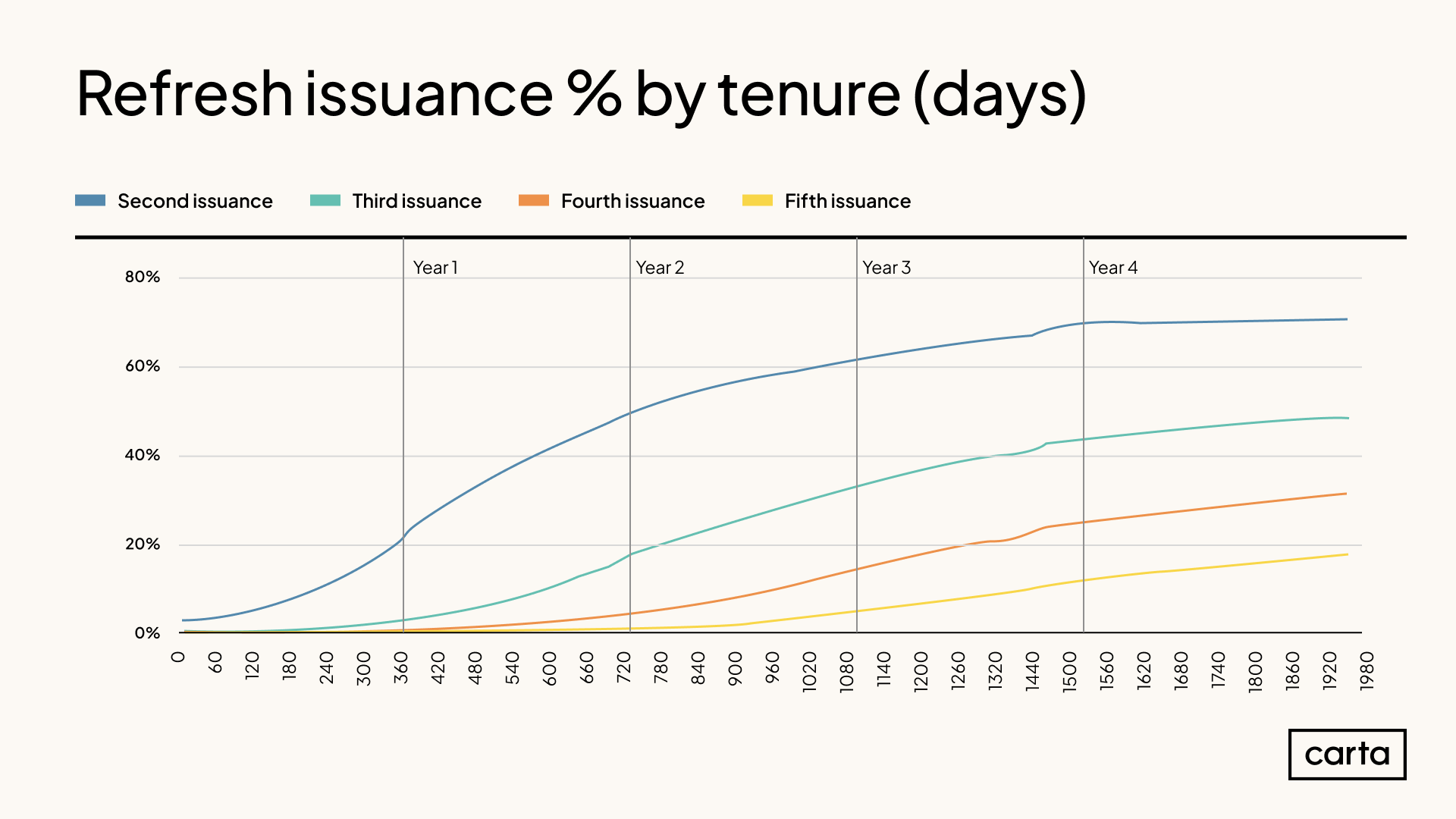

According to Carta data, between 2022-2024, about 20% of employees received a refresh grant at year one. By year two, over 50% of employees received at least one additional grant beyond their new hire grant.

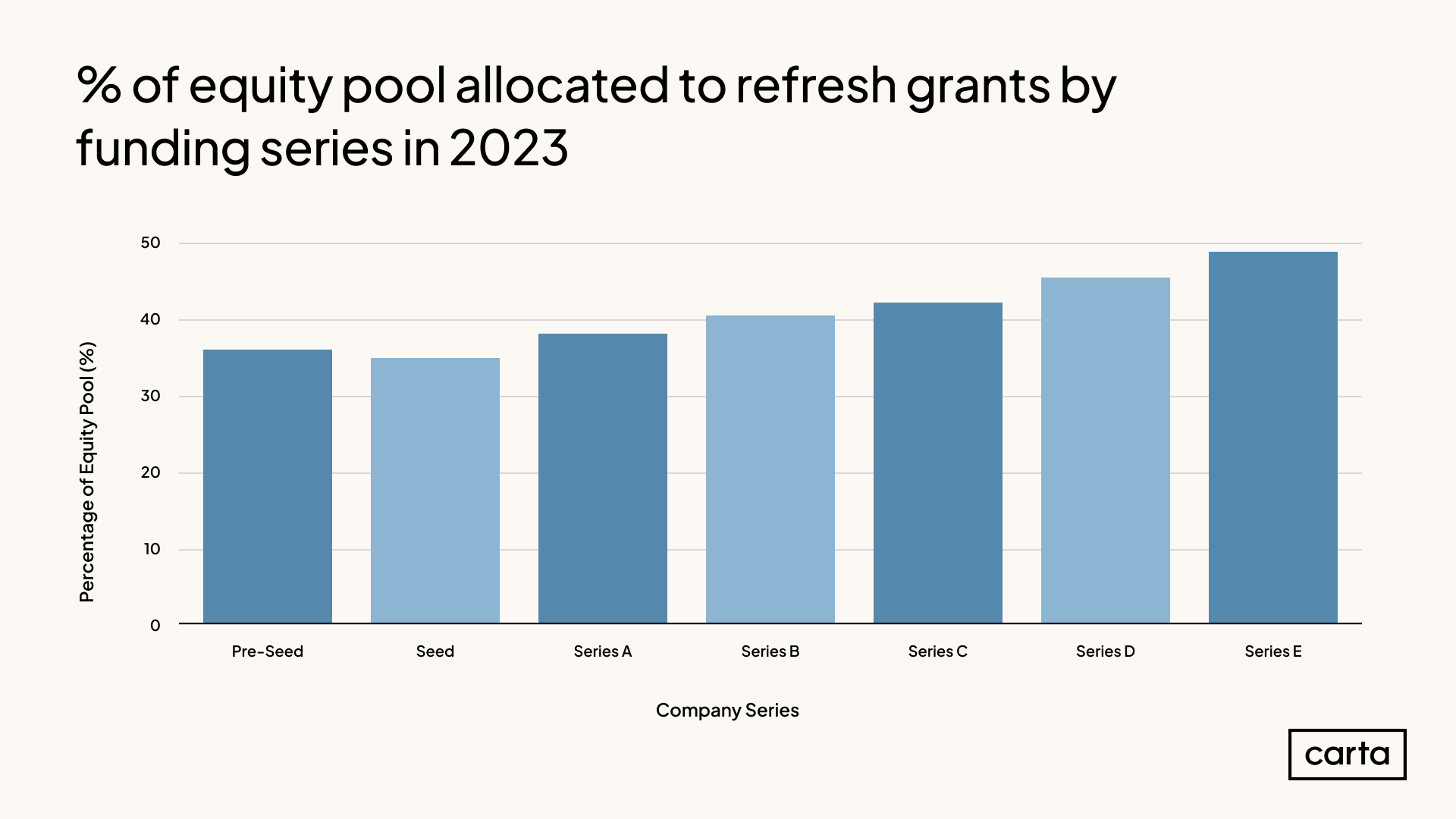

Companies of all sizes are granting refresh grants. Between 2022-2024, pre-seed to Series A companies allocated approximately 35-37% of their equity pool to refresh grants and Series B-E companies granted between 40-50% of their equity pools to refresh grants.

Best practices for equity refresh grants

The main goal of a refresh grant is to retain top talent and reward employees’ contributions, ensuring continued alignment between their interests and the long-term growth and success of your company.

But, the criteria for who receives a refresh grant—and when—varies widely from company to company. Whether or not you offer equity refresh grants, and to who, should be based on your compensation philosophy. And the amount you grant should always be based on relevant and accurate equity compensation data.

While there’s no one-size-fits-all way to structure your equity refresh program, there are some general best practices to follow.

Plan proactively

When it comes to implementing an equity refresh program, proactive compensation planning is essential. This process starts with establishing a solid compensation philosophy, which becomes the backbone of your decision-making process and ensures that your approach to refreshes is consistent, fair, and transparent.

Key elements of proactive planning include:

-

Forecasting: Regularly assess the impact of refresh grants on your equity pool and potential dilution. Use data from your cap table for accurate forecasting over 12, 24, or 36 months for your employees.

-

Board involvement: Keep your board informed and involved. Present them with detailed forecasts for all types of grants to gain their approval and support.

-

Adapting to changes: Be ready to adjust your plans based on company growth, returns to your equity plan pool, market conditions, and employee feedback.

Use relevant, accurate compensation data

To understand how much equity you should be granting, it’s important to have up-to-date and accurate equity compensation data. This ensures your refresh grants are fair, competitive, and in tune with market trends.

When using data, you’ll want to ensure:

-

The data is updated regularly: What was relevant a year ago could be very outdated today. To ensure you’re compensating fairly and competitively, make sure the data you’re basing your decisions on is updated quarterly.

-

You’re evaluating an employee’s total equity packages: A holistic view of an employee’s total equity package, including existing holdings, is essential. This will help in determining the appropriate size of the refresh grant, ensuring it reflects an employee's contributions and standing within the company.

Communicate with employees

Making sure employees understand the value of their equity is crucial for a refresh program’s success. Create an internal communications strategy alongside your performance cycles to make sure employees understand the value of their shares, how it can grow over time, and how they can earn more (tenure, performance, or promotion).

Companies that effectively communicate the value of their equity tend to have higher retention rates.

-

Educate: Explain the wealth-building potential of equity and how refresh grants work.

-

Be transparent: Be clear about your decision-making process. Make sure employees understand when refresh grants are issued and who will receive refreshes. Maintain open lines of communication, especially when there are changes in the program or individual grants.

→ How to create an equity education program for employees

How Carta Total Compensation can help

Carta Total Compensation will proactively flag when employees are completing vesting of their new hire grant soon, so you can accurately forecast equity pool allocations and dilution.

You can use the Equity Refresh Report to see the full list of employees who will complete vesting in the upcoming months and years and each person’s:

-

Total number of shares vested

-

Total unvested shares

-

Estimated shares for a refresh grant

Carta’s estimation of how much a refresh grant could be is calculated by new hire benchmarks and adjusted proportionally for use as refresh grants. Estimated grants follow your existing compensation philosophy, which includes your peer group, compensation bands, and market target positions from your compensation plan.