Unlock a seamless tax season

Connect your back office

Simplify your back office with a single point of contact for your fund accounting and tax needs.

Get real-time reporting

Make end-of-year filings easy with your fund's activity and investors’ allocations calculated in real-time.

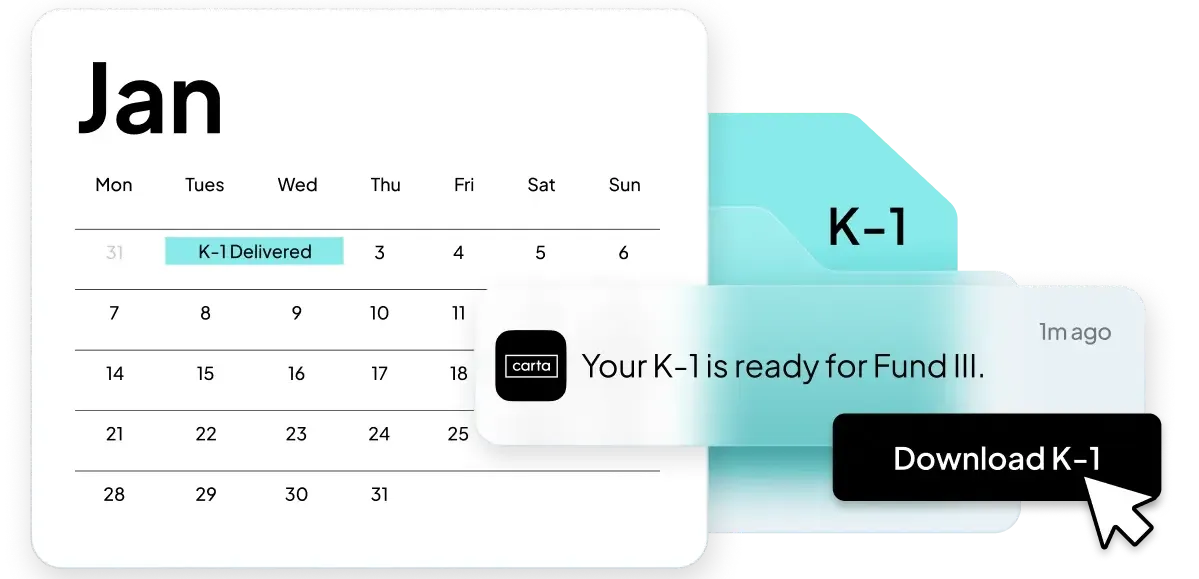

Exceed LP expectations

Impress your LPs and prepare them for tax season with a draft K-1 just days into the new calendar year.*

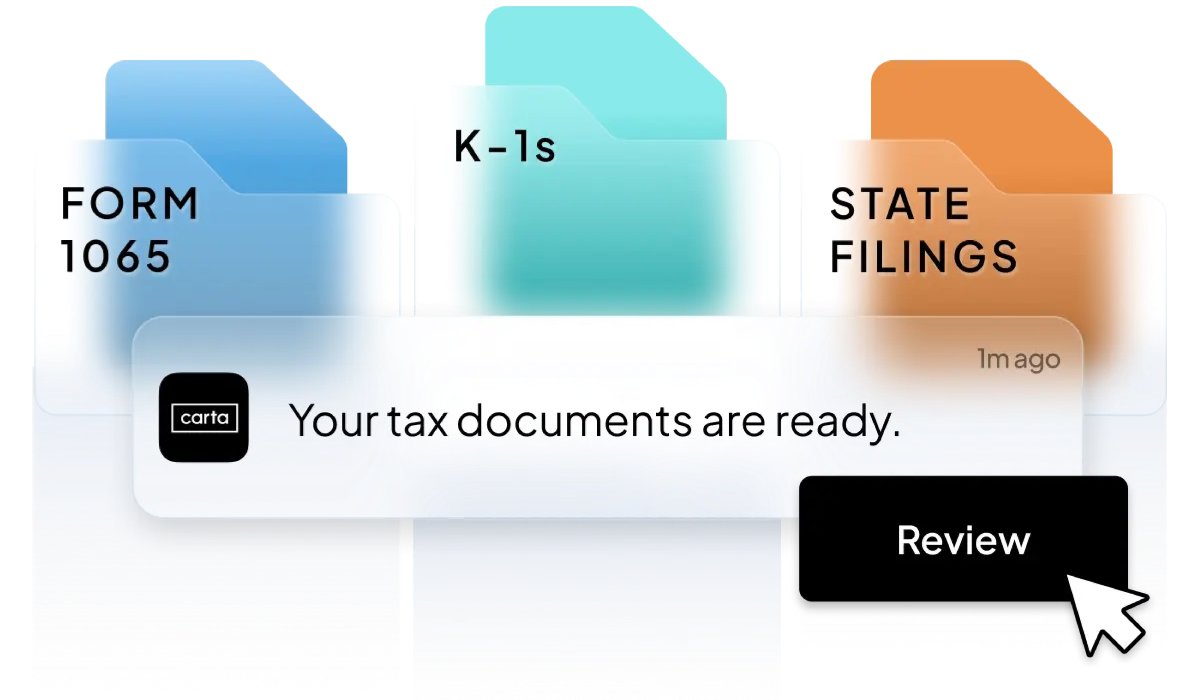

The Carta experience

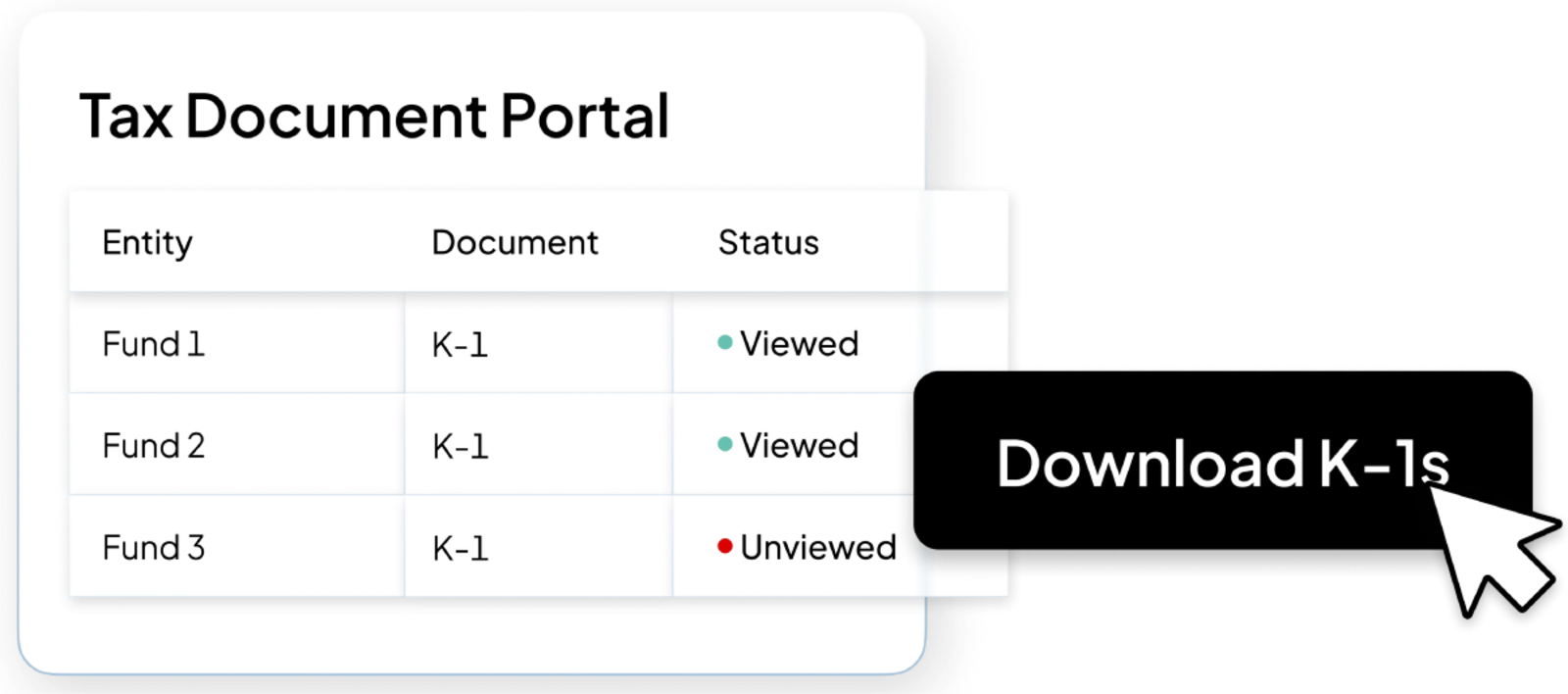

With your fund accounting and taxes managed in one place, you experience a smooth end of year, every year.

On the first day of the quarter, surprise your LPs with draft K-1s detailing their projected liability before tax season, reducing their need to file for extensions.

Whether it's taking care of your Form 1065s and K-1s or ensuring any additional state tax documents get filed—Carta Fund Tax has you covered.

Consolidate your tax and fund administration providers, eliminating much of the relay that causes K-1 delays.

* Subject to timely completion of data requirements.