Audit-ready valuations, fast

Valuations from professionals who have delivered more 409As than anyone in the industry.

Trusted with over 15,000 valuations per year

Receive tailored valuations

Our experts ensure the nuances of your business are accounted for and leverage Carta’s proprietary software to deliver fast, accurate 409As.

Enter audits with confidence

Carta is trusted with over 15,000 valuations per year. Expert professional services and robust software ensure your valuation stands up in IRS, audit, and SEC reviews.

Get in-house support

Our dedicated support team is here for you throughout the entire valuation process, from providing accurate reports to offering detailed guidance to mitigate audit risk.

Valuations can add up. Carta gives you accurate valuations whenever you need them, built right into your plan.

The Carta Valuations team brings decades of hands-on knowledge, with experience working at top-tier finance and accounting firms. We serve clients across a wide variety of industries, from Healthcare and Life Sciences to Web3.

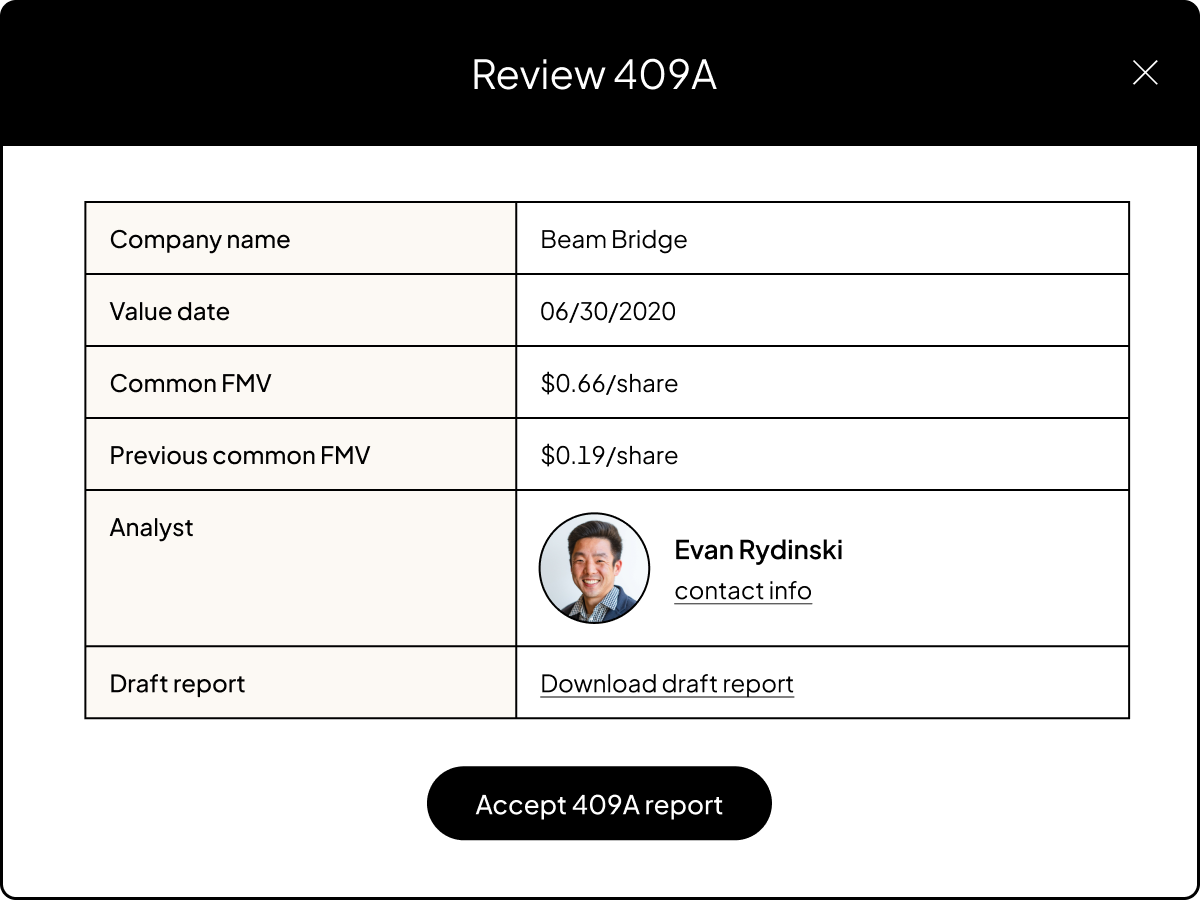

Transparency makes auditor conversations easier, ensures turnaround times are clear, and gives you a deeper understanding of why your business is valued the way it is. We visually break down every step, so you can quickly identify where you are in the valuation process and what to expect next.

Download our sample report to see what a complete 409A should look like.