What is a compensation plan?

A compensation plan (also known as a comp plan) is a set of guidelines for employees’ salaries, bonuses, and equity. It gives current and prospective employees a clear view of their compensation package—which gives your company an advantage as you’re hiring.

A great compensation plan not only sets the value of what you’re paying (compensation bands), but also defines roles and levels and outlines how performance will be evaluated. Ideally, it’s part of a total rewards plan, which documents your comp plan plus the benefits you offer.

Foundation of a compensation plan

A compensation plan is built on four pillars: compensation philosophy, job architecture, performance management, and incentives.

-

Compensation philosophy: your company’s overall position about employee compensation. Your compensation philosophy should align with your business strategy to hire, retain, and reward top talent.

-

Job architecture: how you define roles and leveling. Also called job leveling or job structure, this refers to the hierarchy of jobs within your company.

-

Performance management: guidelines for performance evaluations. This helps managers track employees’ work so they can receive ongoing feedback and advance their careers.

-

Incentives: how you pay employees for their performance. Incentives like bonuses, and equity compensation, encourage employee performance and stimulate productivity.

Creating or updating any compensation program starts with a clear philosophy. Knowing what your company values makes it easier to make decisions that match those values. Knowing why you’re making those decisions will make sure the entire planning process goes smoothly. Once you have that down, we’ll explore items two through four below.

Why your company needs a compensation plan

An official compensation plan cultivates pay equity and transparency, maintains strong company culture, and helps retain top talent.

Pay equity is simply compensating employees equally for performing the same or similar role according to factors like experience and job performance. Without a compensation plan, pay equity can be difficult to track and manage, especially for early-stage companies.

A fair work environment increases employee performance and reduces turnover, according to a Gartner survey. By implementing a compensation program early, founders and CEOs can attract the best employees and reduce turnover.

Compensation vs. total compensation

Compensation, also referred to as “direct compensation,” is strictly salary, bonus, and equity. “Total rewards” encompasses compensation plus benefits. (You may hear total rewards described as “total compensation,” but since benefits are not strictly compensation, that’s less accurate.)

|

Compensation |

Total rewards |

|

Salary |

Salary |

|

Bonus |

Bonus |

|

Equity |

Equity |

|

Benefits |

Total rewards plan advantages

A total rewards plan (compensation plus other employee benefits) ensures your company remains competitive. Take a look at some of the top advantages to total rewards plans and examples below.

|

Advantage |

Example |

|

Helps eliminate bias to accomplish DEI (diversity, equity, and inclusion) initiatives |

Creating affinity groups for employees around shared backgrounds or interests to increase feelings of belonging in the workplace |

|

Supports strategic goals |

Implementing bonuses to support a goal to increase customer base by 20% |

|

Shows integrity and transparency from leadership |

Weekly office hours with executives where any employee can ask questions and feel heard by leadership |

|

Helps retain and attract top talent |

Annual cost-of-living salary increases to keep up with rising inflation in addition to performance-based compensation increases |

|

Motivates employees and creates company loyalty |

Hosting team offsites where employees can connect outside of work and team-build |

|

Improves company culture |

Encouraging feedback and employee recognition to help people grow their careers within the company |

Types of compensation

The possibilities are endless when structuring your company’s compensation plan. Here are some considerations to keep in mind for direct compensation (salary, bonus, and equity).

Salary

Salary is the main pillar of compensation and is often the foundation of a company’s total rewards. When determining salaries for your company, consider geography and structure.

Localized vs. national salaries

Salaries can be standard regardless of location or can be based on an employee’s specific region. For example, you may choose to pay employees in San Francisco, California, more than employees in Raleigh, North Carolina, based on the cost of labor to stay competitive in local markets.

Salary structures: Traditional vs. broadband

A traditional salary structure is common at larger companies. This structure has smaller differences between the minimum and maximum pay bands, placing more emphasis on promotions.

Here’s an example of a traditional salary structure:

|

Level 1 |

Level 2 |

Level 3 |

Level 4 |

Level 5 | |

|

Salary |

$45K–57K |

$57K–$69K |

$69K–$81K |

$81K–$93K |

$93K–$105K |

Broadband salary structure bands are much wider and are more common at smaller companies with fewer employees because it allows for more flexibility.

Here’s an example of a broadband salary structure:

|

Level 1 |

Level 2 |

Level 3 | |

|

Salary |

$45K–$65K |

$65K–$85K |

$85K–$105K |

Bonus

A bonus is additional compensation given to employees. When you’re determining your plan for bonuses, consider eligibility, targets, and payouts:

-

Who is eligible? Often, companies distinguish between the bonus structure for employees in sales vs. other departments.

-

What are the targets employees need to hit to get bonuses? Targets can be flat dollar amounts or percentages and can vary by job level. You can also create ranges for bonus payouts.

-

What should the payout structure be? A compensation plan can include minimum and maximum payouts, outline the frequency of bonus payments, and include a methodology for payout metrics.

Equity

Equity is the final piece of direct compensation. Equity compensation incentivizes employees to stick around by giving them an ownership stake in the company. As the company grows, an employee’s equity grows, too. A compensation plan should outline the types of stock, grant timing, and vesting schedules.

Types of stock

Common types of equity for earlier-stage companies include incentive stock options (ISOs) or non-qualified stock options (NSOs).

ISOs have more favorable tax treatment for the employee than NSOs. Restricted stock units (RSUs) are a popular equity vehicle offering for more mature companies because employees don’t need to pay to exercise in order to own shares outright (which might be prohibitive considering usually steep 409A valuations for late-stage companies). Seed-stage companies that have not yet raised outside capital commonly issue restricted stock awards (RSAs), which an employee owns outright the day they are issued.

|

RSA |

ISO |

NSO |

RSU | |

|

When to issue |

Before raising outside funds |

After fundraising |

After fundraising |

When your company reaches a stable valuation |

Your company might move from issuing employee stock options to RSUs as it grows to better align between the company and equity strategy (e.g. to limit share dilution or if there’s a plan to IPO soon). That’s why it’s so important to revisit your compensation plan every year or anytime your company’s goals shift.

Vesting schedule

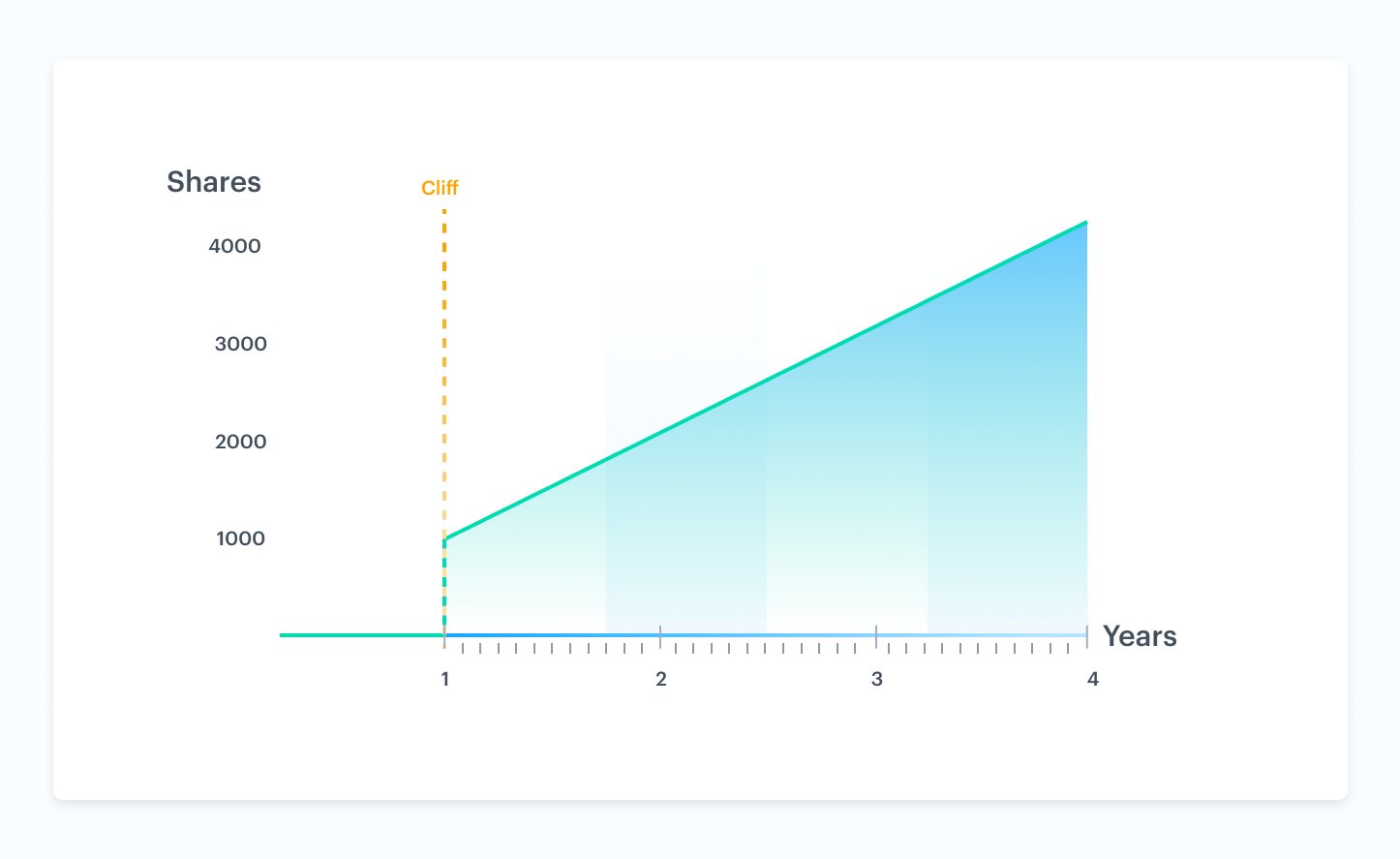

A vesting schedule is another consideration for equity. Vesting is the process of earning either options or stock over time and can encourage your employees to stay longer at the company to earn their rewards. There are three common types of vesting schedules: time-based, milestone-based, and a hybrid of time-based and milestone-based.

A typical vesting schedule for a new hire grant is four years with a one-year cliff. Here’s an example:

Less common than time-based vesting, milestone vesting is when options or shares are distributed after the company reaches a business goal (e.g. the company hits a certain valuation). Hybrid vesting is a combination of the two.

Refresh grants

Most companies that offer equity as part of compensation also need to consider whether they’ll have a grant refresh program—an additional grant given to employees who have previously received grants. Here are some questions to answer when adding grants to a compensation plan:

-

How will you structure refresh grants? The structure of your refresh grants can help account for the reduction in employee’s unvested value over time. Most private companies use a traditional vesting schedule, which often leads to employee turnover after their initial grants vest.

-

Will refresh grants be timed based on an employee’s start date or will there be a “focal” date? The latter choice means several employees receive new grants at the same time, which helps maintain equity among employees’ compensation.

-

Will you have a grant refresh program? This can help with employee retention, along with salary increases.

Types of benefits (indirect compensation)

Retaining employees generally comes down to more than just compensation. It often takes benefits, development opportunities, and company culture, all of which fit nicely into a holistic total rewards approach. Those benefits can include a wide range of perks, depending on your company’s philosophy and overall mission. For example, a rideshare company might offer fully paid commuter benefits for its employees, while a medical imaging company might offer more wellness and well-being benefits than other employers.

Some examples of benefits are:

-

Medical insurance

-

Dental and vision coverage

-

Retirement benefits

-

Wellness benefits (such as gym reimbursement)

-

Educational incentives or continuous learning stipends

-

Well-being benefits (coaching, meditation, therapy)

-

Volunteer opportunities

-

Flexible spending accounts (FSA)

-

Flexible work opportunities (hybrid work)

-

Paid time off (PTO)

-

Disability insurance (DI)

-

Company equipment (such as a laptop)

-

Paid holidays

-

Reimbursement for childcare expenses

-

Relocation stipends or housing options

-

Reimbursement for work-from-home costs

-

Commuter benefits

Each company is different and some leaders choose to prioritize direct compensation over benefits. It can be difficult for employees to see the dollar value of additional benefits like paid meals or continuing education opportunities. Compensation management software, such as Carta Total Comp, aggregates the value of compensation plus benefits to determine the total rewards.

How to create a compensation plan

The steps to creating a compensation plan vary from company to company. These are some of the steps you can start with when creating yours:

-

Determine your compensation philosophy

-

Outline job architecture by defining roles and levels

-

Create guidelines for performance evaluations

-

Define direct compensation (salary, bonus, and equity)

-

Add in benefits

-

Implement a pay equity process

-

Conduct post-hoc reviews

Compensation plan example

Now that you know the structure of a compensation plan, let’s put it into action. Using Carta Total Comp, you can create your company’s total rewards system. Our software accounts for all of the aspects mentioned above, including salary targets based on geography and cost of living, salary bands, bonuses structures, and equity grant schedules, as well as benefits.

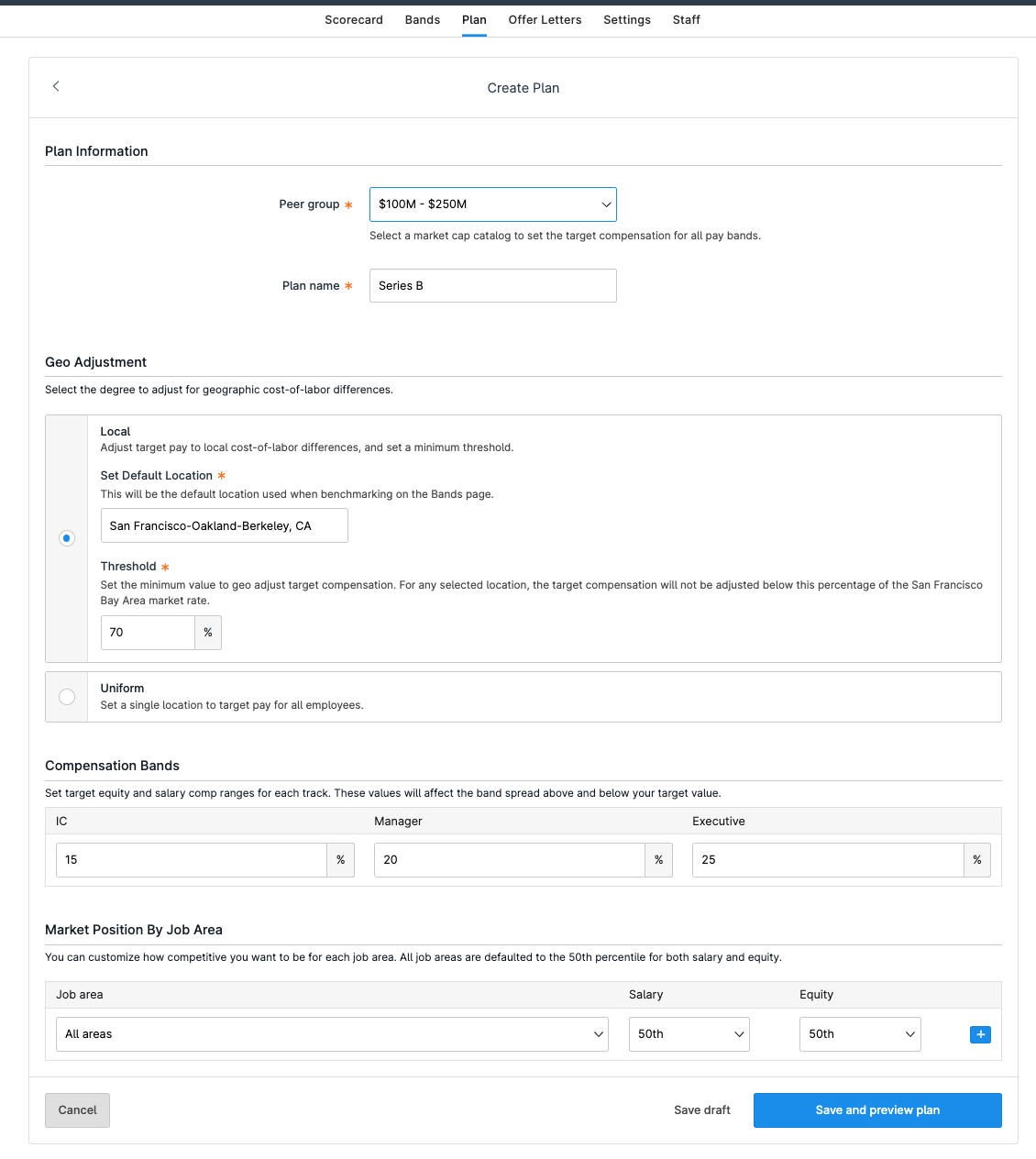

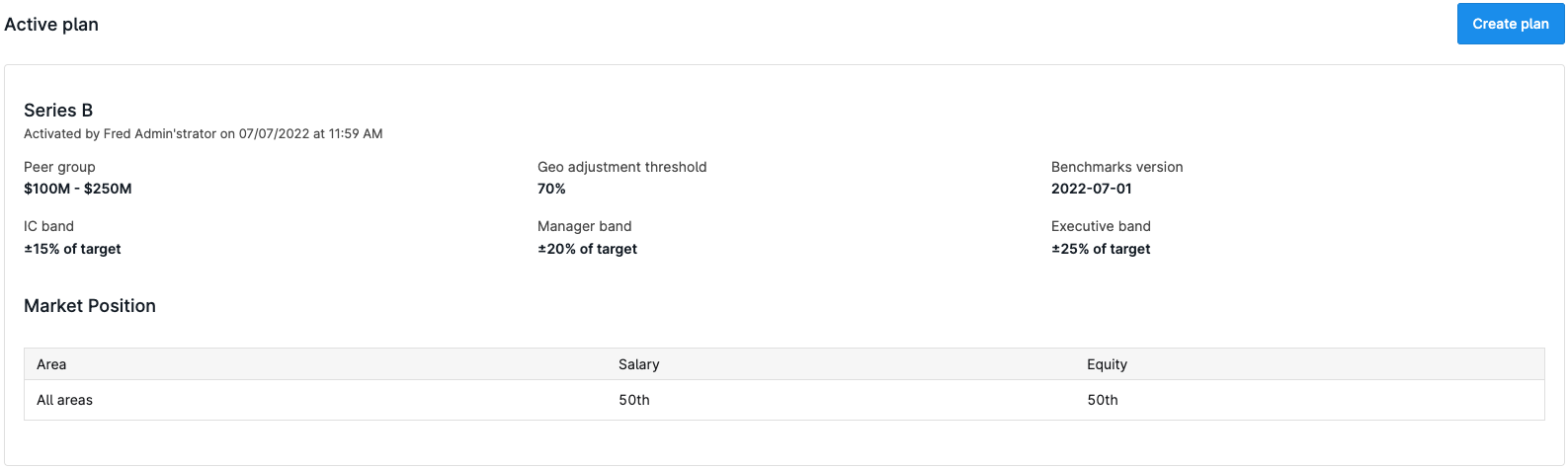

Here’s an example of a compensation plan for a (hypothetical) $150 million Series D company that used Carta Total Comp to create its compensation plan:

Meetly’s HR manager set the peer group used to benchmark compensation for all pay bands (the total amount allocated for compensation) to between $100 million and $250 million and set the geographical location to the local San Francisco-Oakland-Berkeley, CA, area. They were also able to set compensation band widths for individual contributors (ICs), managers, and executives.

Above you can see a customized compensation plan for Meetly. It also shows how the company targets compensation versus the overall market for the roles, using Carta’s benchmarks.

By inputting some basic information, you can create a total rewards compensation plan that accounts for salary, bonus, equity, and benefits. Carta Total Comp uses data from over 120,000 employees across the entire Carta’s customer base to make compensation recommendations that can help your company attract and retain talent. Schedule a demo to see how Carta Total Comp can work for your company.