AMT calculator

Using the following information, Carta’s free AMT Calculator helps you estimate your potential tax bill:

If you exercised any incentive stock options (ISOs) and did not sell them in the same year, you’ll need to calculate the alternative minimum tax (AMT) when it’s time to do your taxes. The spread between the price you paid for the options and what they’re worth when you exercise is counted as income when you calculate AMT.

Using the following information, Carta’s free AMT Calculator helps you estimate your potential tax bill:

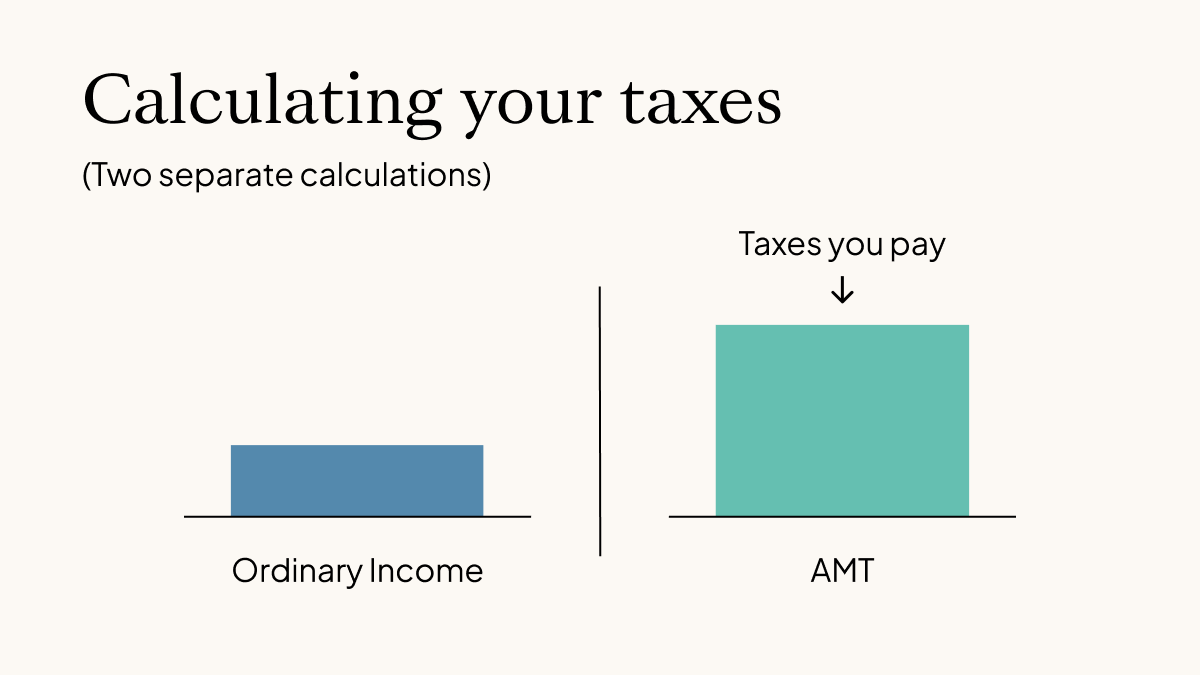

After you have your AMT calculation, compare it to your ordinary income tax calculation. Whichever yields the higher amount is what you’ll owe to the IRS.

Calculating AMT can be complicated and the taxes you owe might be prohibitively expensive. Estimating your AMT before you exercise and using a tax professional who specializes in equity can help you make more informed decisions.