Below, we’ll cover everything you need to know about incentive stock options (ISO), including how they differ from other types of equity compensation, how they work, and how they’re taxed.

What are incentive stock options (ISO)?

Incentive stock options (ISO) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option–they are not actual shares of stock; you must exercise your options to become a shareholder. Incentive stock options are differentiated from other types of equity compensation by how they are taxed. Unlike non-qualified stock options (NSO), you usually don’t have to pay taxes when you exercise ISOs. Plus, you may be able to pay a lower tax rate if you meet certain requirements (more on that later).

Startups and other types of companies in the U.S. include ISOs as part of a total compensation package. Stock options like ISOs can motivate employees to stay longer until the options vest. Once your incentive stock options fully vest, you can purchase them (exercise your options) at a pre-set strike price.

The value of stock options changes over time. If your company is successful, you could make money on the increased value. However, you’re never required to exercise ISOs.

Incentive stock options vs. non-qualified stock options

Non-qualified stock options (NSO) are another type of stock options U.S. companies may offer to employees. With NSOs, you pay taxes both when you exercise and sell your options. This usually means you pay more taxes with NSOs than with ISOs.

ISOs vs. NSOs

|

|

ISO |

NSO |

|

Exercise |

May be subject to alternative minimum tax (details below) |

May be subject to ordinary income tax |

|

Sell |

Ordinary income or capital gains |

Capital gains |

ISOs vs. equity awards

Instead of stock options, some startups use alternative equity compensation, such as restricted stock awards (RSA) or restricted stock units (RSU), depending on the company’s stage. RSAs are typically used for very early stage companies, while RSUs are common for more mature ones. Both RSAs and RSUs are grants of stock, not options of stock, so you typically don’t need to exercise them.

→ Learn more about the differences between RSUs and stock options

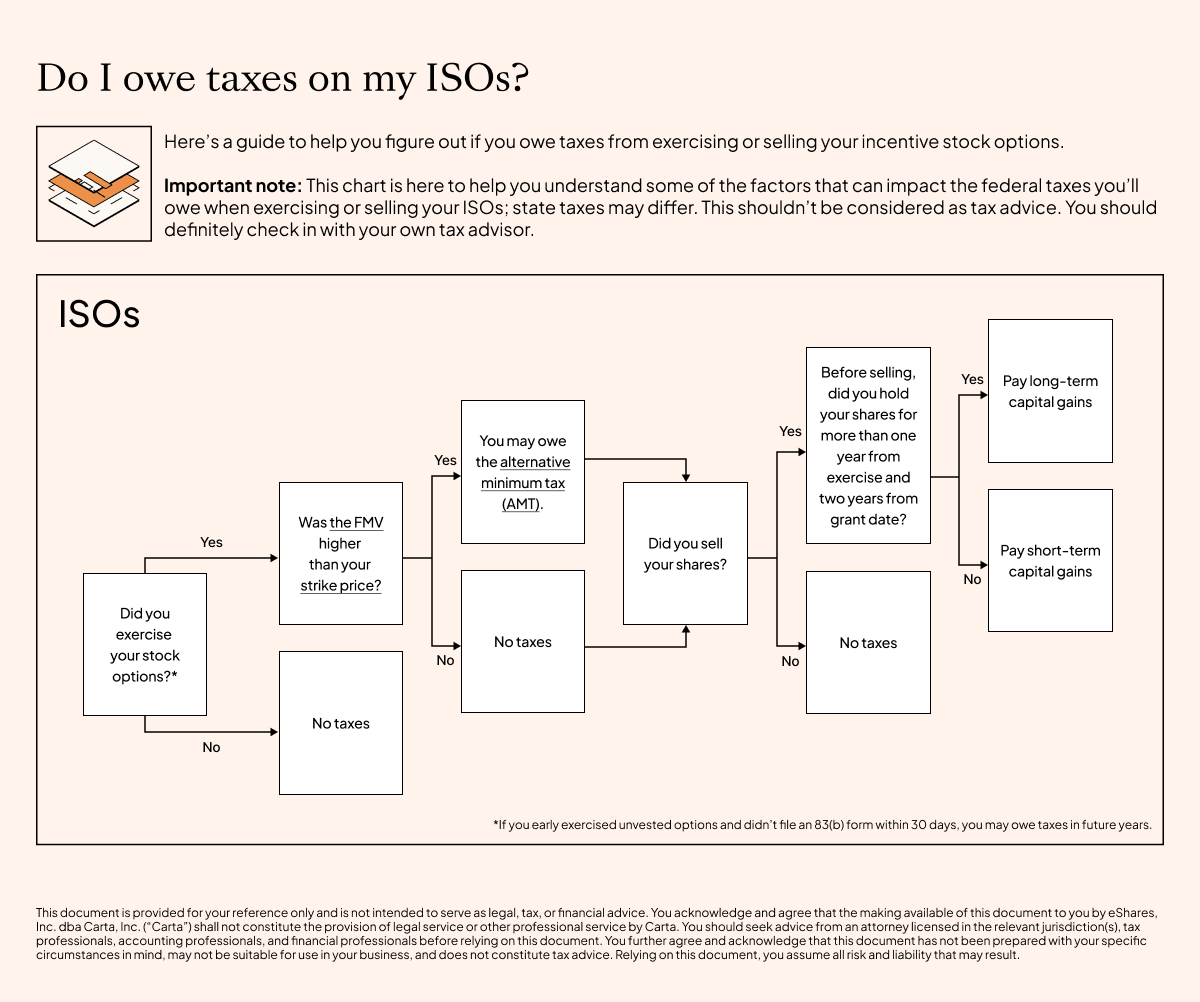

How are incentive stock options taxed?

There are two types of taxes to consider with equity compensation: ordinary income tax and capital gains tax. The capital gains tax rate has historically been lower than the ordinary income tax rate.

When you exercise ISOs, you don’t have to sell the resulting shares right away. If you do sell right away (for example, to cover the cost of exercise), the shares you sell won’t qualify for the ISO tax advantage. Instead, they’ll be taxed like NSOs and you’ll pay ordinary income tax on the spread between your strike price and the fair market value (FMV) at the time of sale.

If you exercise ISOs and hold your stock for at least one year, your stock should be eligible for the tax incentive when you sell. To receive the incentive, you must hold (keep) ISOs for at least one year after exercise and two years after the grant date.

-

If you hold your stock for at least a year after purchase, you will pay the lower capital gains tax rate on the increase in value. However, you may be subject to the alternative minimum tax (AMT) when you exercise. Talk to your tax advisor to see if AMT might impact you. Typically, it only affects high-income earners.

-

If you sell your stock right away, you will not experience any capital gain and therefore will pay ordinary income tax rates on the portion that you exercise and sell.

→Learn more about how stock options are taxed.

When can I exercise ISOs?

Usually, you can’t buy all of your shares right away and have to work for the company over time to be able to purchase your shares. This is called vesting. You can exercise your ISOs as soon as your options have vested, but it’s not required.

In some cases, you might be able to exercise your ISOs before they vest. You can check your option grant or ask your company to see if they allow early exercising. Note that this may result in a taxable event, so also consult with your tax advisor.

→ Learn more about exercising stock options.

When do incentive stock options expire?

Theoretically, ISOs expire 10 years from the date you’re granted them. However, your company might enforce a post-termination exercise (PTE) period that gives you a shorter amount of time to exercise options after you leave the company. If you don’t exercise them before that period ends or before they expire, you’ll lose the opportunity to purchase them.

Even if your company gives you a long time to exercise ISOs after you leave, if you don’t exercise them within three months of leaving, they’ll lose their ISO tax treatment and will be taxed like NSOs.

When can I sell my ISOs?

You have to exercise ISOs and purchase shares before you can sell your shares. If you choose to exercise your ISOs, you usually have two options: pay for the total in cash or do a “same-day sale”—in other words, sell a portion of your shares to cover the cost of exercise.

Selling to cover exercise costs is called a “cashless” exercise. It’s less risky because you haven’t invested your own money. However, selling shares right after exercising prevents you from taking advantage of ISOs’ favorable tax structure. Not all companies allow cashless exercises, so check to see if yours does before exercising and check with your tax advisor in general.