Firm overview

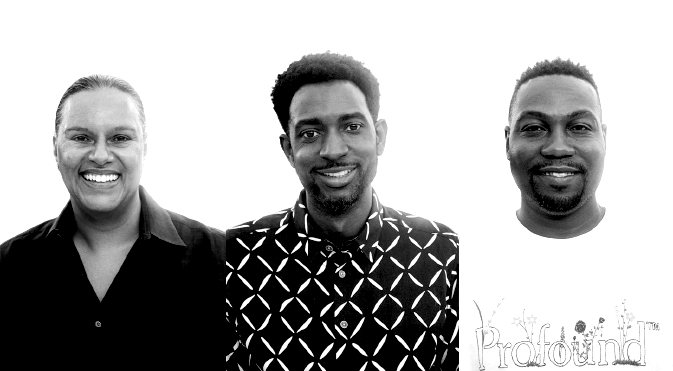

In 2020, Sean Green and James Norman put their heads together with guidance from their mentor Joanne Wilson to build a venture fund in the light of their own experiences as Black founders. From there, they reached out to their network to game plan. Through a series of conversations with their peers and other leaders in the venture space, a strategy was developed to address the largest problem in the market for top Black founders, the Series A funding gap. Putting all the pieces in place to properly accelerate the brightest minds in their community, Black Operator Ventures was built. At Black Ops, they intend to be the launching pad for the most multi-billion dollar valued tech companies led by Black founders.

In 2024, Black Ops is a $25M fund focused on leading seed rounds of the top Black founders in the US. Backed by legendary investors including Ben Horowitz, Fred Wilson and Brad Feld; legendary founders including Drew Houston, Mike Seibel and Jake Gibson; and world renowned institutions including University of Michigan, Northwestern Mutual and Bank of America, they are building a firm that will fundamentally change the venture landscape.

To learn more about Black Ops’ world view, please take a look at Transparent Collective, Harvard Business Review’s guide to investing in Black founders and their medium blog.

Firm strategy

The Black Ops vision is to leverage the team’s own founder journeys to guide the next generation of Black entrepreneurs through the company building process, from securing funding to scaling ventures. According to Crunchbase, just 1% of capital invested in U.S. startups goes to Black entrepreneurs. The Black Ops team works closely with founders to help close this historical funding disparity, with a particular focus on helping founders cross the chasm from seed to Series A. To date, they have reviewed more than 50 opportunities across the U.S., and have made investments alongside leading co-investors such as a16z and Serena Ventures.

Why we invested

The Black Ops investment thesis aligns with Carta’s mission of creating more owners in private companies. With its focus on underrepresented founders who have a unique perspective on the markets they serve, Black Ops will channel VC to entrepreneurs serving populations and geographies that are too often overlooked. The firm’s mission to send more Black entrepreneurs through the seed-to-Series A pipeline is also backed by a strong network: In addition to the team’s decades of combined experience as investors and operators, James is also a partner of Transparent Collective, which helps Black, Latinx, and female founders gain access to resources and network connections in venture capital. We’re excited to partner with Black Ops as they find and accelerate the next generation of Black-led companies.