What is a fund of funds (FoF)?

A fund of funds (FoF) is an investment vehicle that uses its capital to purchase stakes in other investment vehicles that are managed by other fund managers. A fund of funds earns a return for its investors by receiving a slice of the profits generated by each of the funds in which it invests.

Types of funds of funds

A fund of funds can invest in many types of funds, including exchange-traded funds (ETF), mutual funds, index funds, or hedge funds.

Target-date fund

A target-date fund is a popular type of mutual fund that builds its strategy around a particular end date, typically the time when investors in the fund expect to retire. Over time, the fund rebalances its asset allocation across different asset classes to reduce risk as the target date draws closer. A target-date fund that invests in other funds, instead of directly in stocks, bonds, or other assets, is a fund of funds.

VC fund of funds

In the startup ecosystem, a fund of funds typically invests in venture capital funds managed by venture firms that make direct investments in private companies. This is known as a VC fund of funds.

Fund of funds vs. venture capital fund

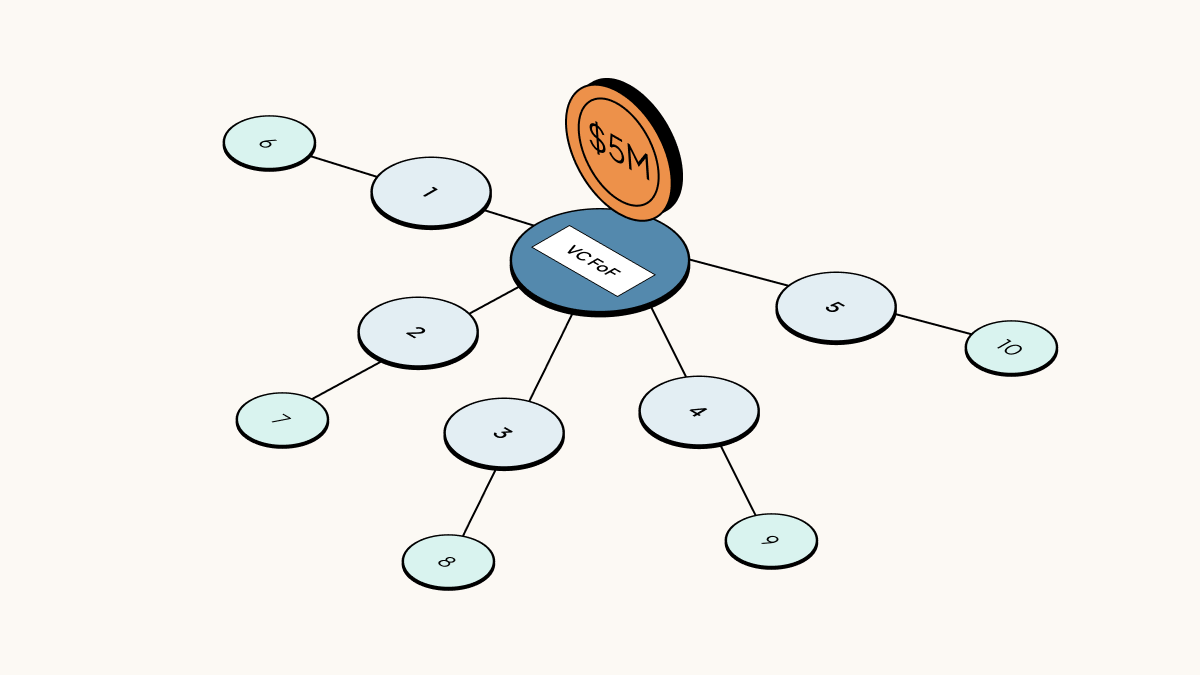

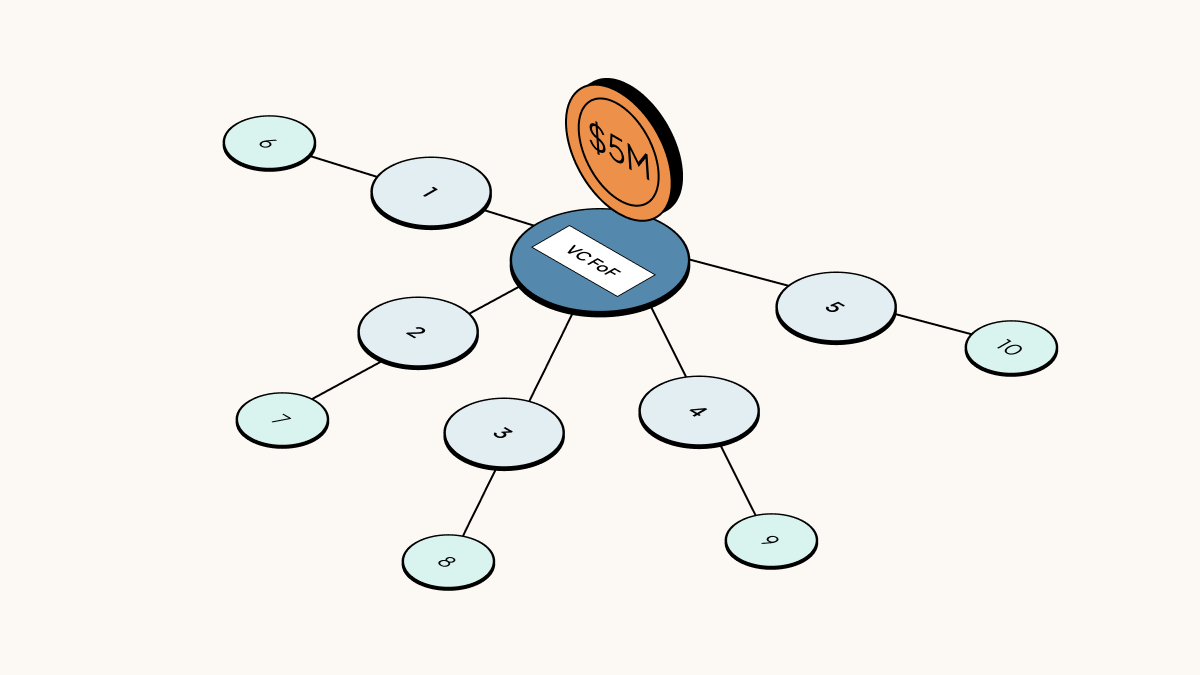

Compared to a direct venture capital fund, a VC fund of funds usually indirectly owns much smaller stakes in a much longer list of companies. If any one company does very well or very poorly, the impact on a VC fund of funds is thus reduced.

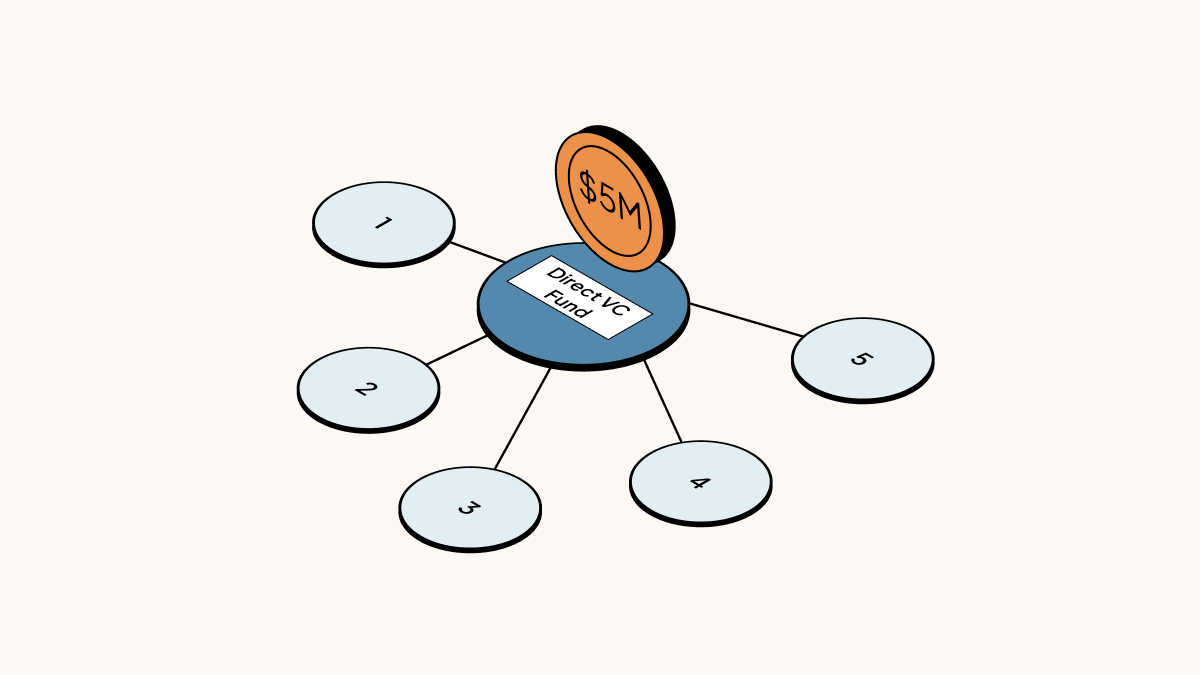

For example, if a hypothetical LP invests $5 million in a direct VC fund and the fund spreads that capital evenly over five investments, the LP will essentially have a $1 million stake in five different startups.

If that same LP invests $5 million in a VC fund of funds and that fund also spreads the capital evenly over five investments, the LP will essentially have a $1 million stake in five different funds. Each of those funds will still divide that capital further to make individual investments in startups. Spread across these different funds, that same initial $5 million investment might be able to acquire smaller stakes in many more companies.

This means a fund of funds is usually seen as a diversification play, offering investors exposure to a broader band of the marketplace than a direct fund. In general, investors expect a fund of funds to offer better downside protection but less upside potential than a fund that makes direct investments.

Access to top funds

For many limited partners (LP), gaining access to a large venture fund managed by a firm with a strong past performance can be difficult. Some firms deal exclusively with large LPs who are institutional investors, and others feature a high minimum investment that might be out of reach. Investing in a FoF that invests in the original fund can be one solution, allowing the investor to functionally pool their capital with other investors in the fund of funds in order to write a larger check.

A VC fund of funds can be particularly attractive to investors with limited capital who are looking to build a diversified portfolio. Instead of investing those finite dollars in a few individual startup deals or one or two venture funds, a fund of funds gives investors exposure to a larger number of startups.

Funds of funds and the secondary market

Funds of funds are often active in the secondary market, serving as a source of liquidity for other limited partners who made direct investments in venture capital or private equity funds. If an LP is looking for liquidity from an investment in a fund that won’t be fully realized for several years, it might sell its stake in that fund to a fund of funds. As such, funds of funds can play an important role in increasing liquidity in the private markets.

Structure of a VC fund of funds

A VC fund of funds is typically structured as a limited partnership, the same as a direct VC fund. The fund manager (portfolio manager) is the general partner, who bears ultimate dealmaking responsibility, and investors in the fund of funds are limited partners.

Fund of fund fees

The nature of the FoF strategy means that investors in a fund of funds are exposed to a double layer of fees. The fund of funds manager will typically charge their own management fee and receive their own carried interest; the managers in each of the other funds in which the fund of funds invest will also charge their own fees and receive their own carried interest, some of which is passed down to the LPs in the fund of funds.

For this reason, some VC funds of funds charge lower fees than the 2% management fee and 20% carry that is most common among direct VC funds.