What is a capital call?

When venture capitalists are ready to invest in a private company, they usually have to make a capital call first. A capital call means asking investors in their fund to send the money they’ve promised to contribute.

A capital call involves more than just a wire transfer. There are legal obligations to consider, as well as best practices that will help general partners (GPs) maintain good relationships with investors.

Here’s everything you should know as you prepare to start calling investment capital into your fund.

Capital calls and VC fund structure

A VC firm is managed by a GP. While some of the money VCs manage is their own, most of it comes from external investors, known as limited partners (LP).

When VCs raise a fund, what they’re really doing is collecting capital commitments from LPs. But LPs don’t just hand over the money as soon as they commit to a fund: Their commitment—also called a “subscription”—is a legally binding promise that they’ll send the money they pledged when the VC asks for it.

When LPs subscribe to a VC fund, they commit to a specific sum. The GP of the fund lists this amount, along with any other rules and agreements, in the LP’s subscription documents. This set of agreements between the LP and the GP includes the limited partnership agreement (LPA) and any side letters that modify the agreement. The LPA also outlines terms of the management fees the LP owes to the GP, and determines when and how the GP will distribute returns on the fund’s investments.

There’s a simple reason LPs don’t just write a big check for the entire subscription amount when they commit and then wait for the returns: Venture funds typically have a 10-year lifespan. Often, a fund’s initial investment period—the time it takes to deploy the investment capital—lasts for several years. During this time, LPs prefer to maintain control over their committed capital until the VC needs it to make an investment in a portfolio company—that way, they can continue earning returns on their capital by putting it to work in short-term investments.

How capital calls work

As the GP of a fund, when you decide to invest in a portfolio company, you might have enough cash on your balance sheet to do the deal. More often than not, though, you’ll need to call additional capital from the fund’s LP investors. The amount you’ll call depends on the size of the investment you want to make.

In practice, making a capital call means asking one or more of your LPs to transfer funds to the fund’s bank account. Rarely will a GP ask for all the committed money at once, as without a deal to deploy the funds to, this could damage fund performance metrics. Instead, most GPs opt to make a pro rata capital call. This means that they’ll ask all of the fund’s LPs to send the same percentage of their committed capital, regardless of the amount they pledged, in order to have enough cash in total to be able to make the investment.

Legal obligations for the GP

The limited partnership agreement typically allows GPs to call capital from LPs in order to make new deals during the deployment period (or investment period). While the deployment period is usually about five years, many funds deploy their capital (meaning call commitments from LPs and use the funds) between 18 to 36 months. During the deployment period, the limited partnership agreement may place limits on how much money can be committed for any one particular deal. Concentration limits can be based on the relative amount invested in a particular company, geographic limits on where companies operate, industry limits, or other factors.

The limited partnership agreement also typically limits what a GP can call capital for after the deployment period ends. Usually, capital can only be called for things like follow-on investments, to pay expenses or fees, or to fulfill other obligations agreed to during the deployment period.

Legal obligations for the LP

When a GP initiates a capital call, the LP typically has between 10 to 14 days to wire the funds for the investment. The request is legally enforceable according to the details of the LPA, but LPs rarely default because it would cause both reputational damage and have severe financial ramifications.

Example of a capital call

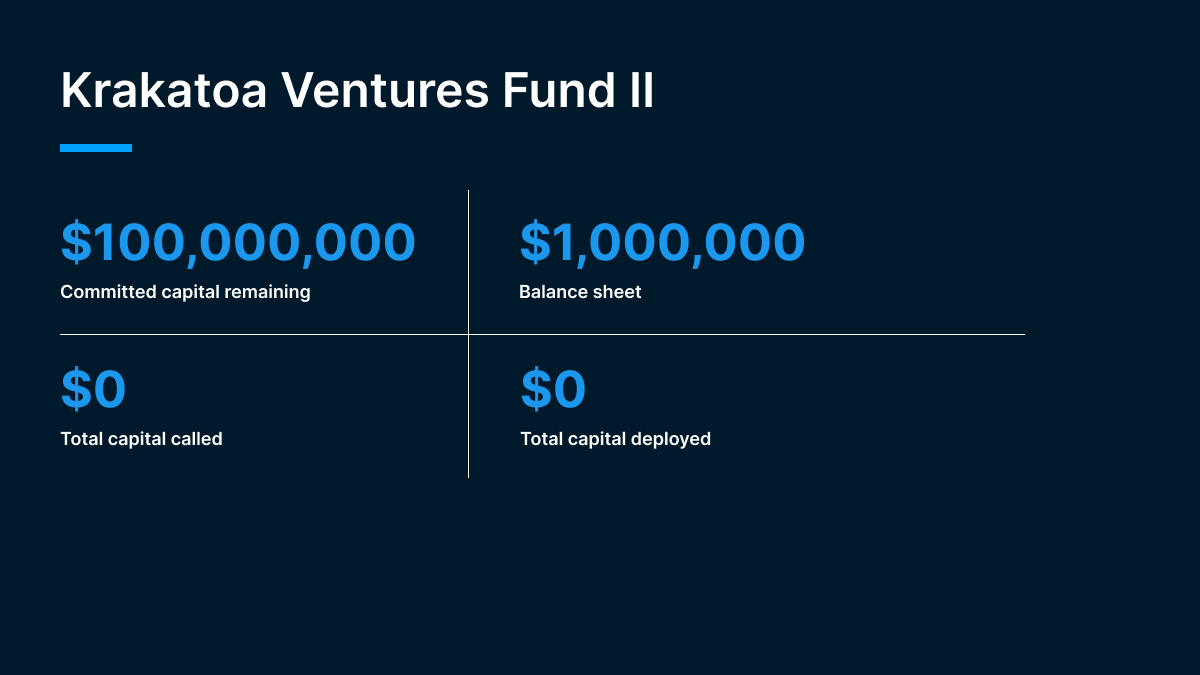

Imagine you’re the GP of Krakatoa Ventures Fund II, a $100M fund specializing in early- to mid-stage biotech companies. You’ve just reached a deal to make a $5M Series B investment in a startup called Genealogy Life Sciences, but you only have about $1M on your balance sheet. To do the deal, you’ll need to call capital from your investors.

You have 85 LPs in your fund, and their contributions range from $100,000 to $10M. You could call $5M from the anchor investor, the venture capital arm of a large biotech corporation. Doing so, however, might irritate an institutional investor you worked hard to recruit: They might rightly suspect that you’d only called capital from them and let the other investors continue earning short-term gains.

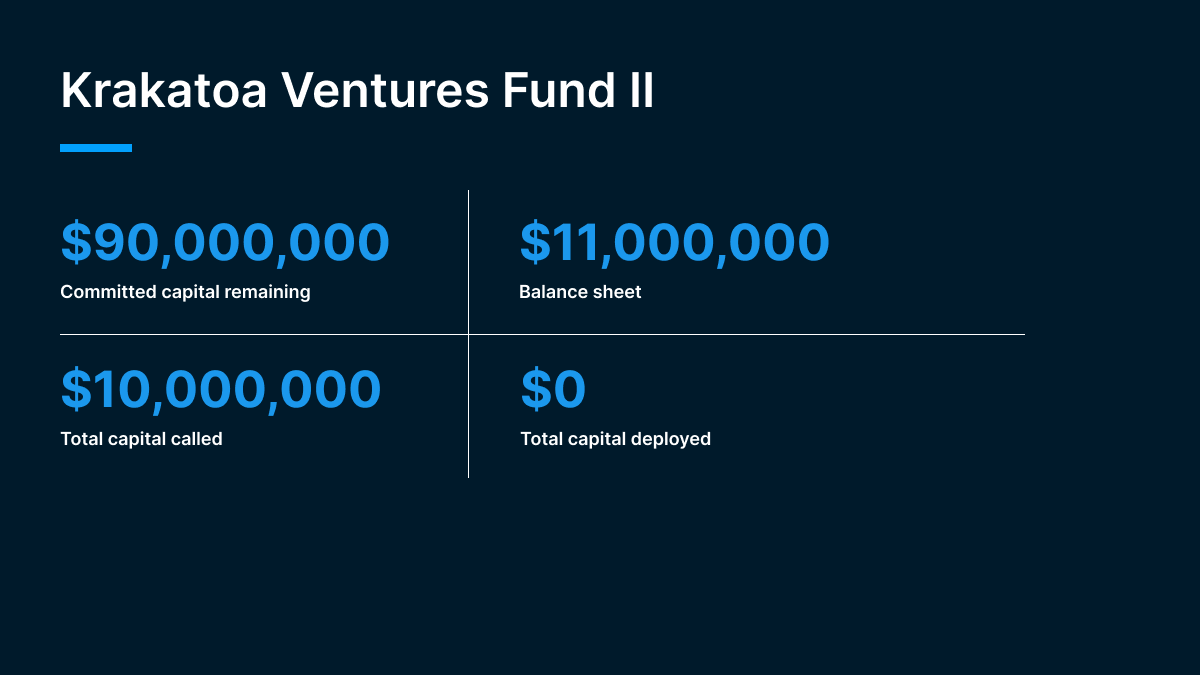

Instead, you decide to initiate a pro rata capital call, which means you’ll request the same percentage of committed capital from each LP in your fund. A 5% capital call would give you enough money to purchase the negotiated stakes in Genealogy Life Sciences, but you’re also in discussions for a smaller Series A deal. To make things easier for your LPs, you decide to make a 10% pro rata capital call.

The Librarians of America Pension Fund, which had pledged $1 million to your fund, is the first LP to respond: They wire you $100,000 to fulfill the capital call. The other LPs in the fund have a legal obligation to send their pro rata amount, as well—in this case, 10% of their respective commitments to the fund.

Now you have enough cash on your balance sheet to do the deal:

After closing the $5M deal with Genealogy Life Sciences, you’ll still have $90M in committed capital to call at a later date, plus $6M in the bank.

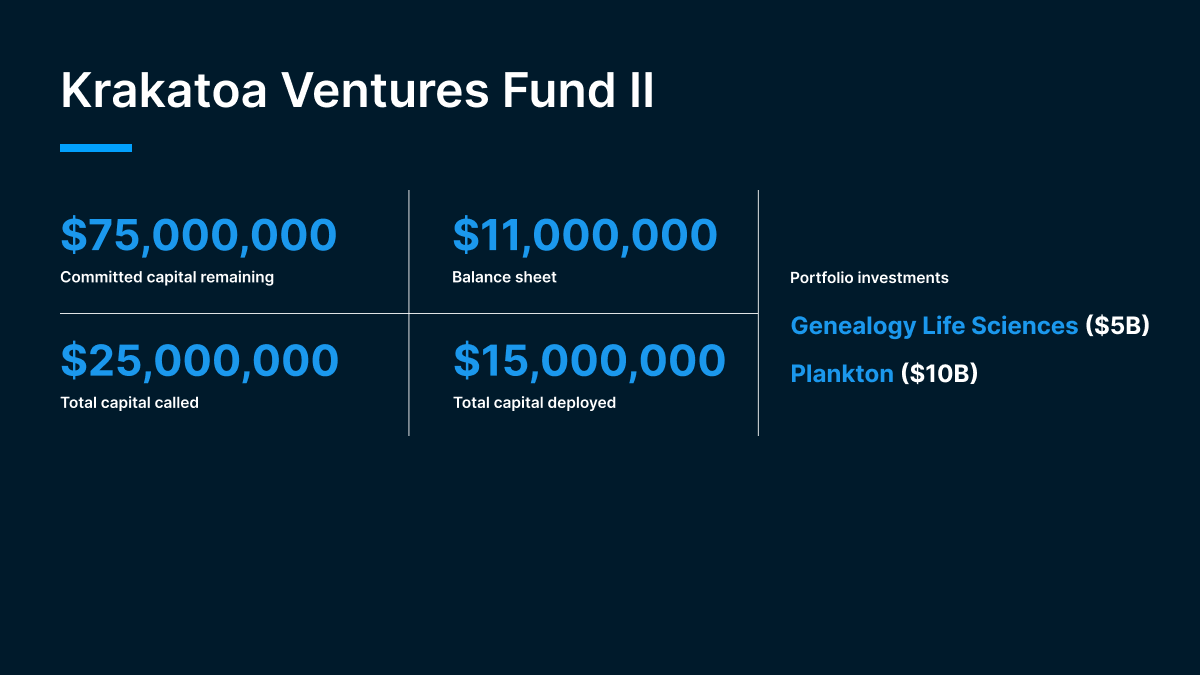

Two months later, you’re about to close another deal. This time it’s a $10M investment in the Series B round of a bioinformatics company called Plankton. You’re down to $6M on the balance sheet. Your fund doesn’t have the cash on hand to lock in the deal, so it’s time to make another capital call. Since you also have that Series A deal in the works, you decide to call 15% pro rata from your LPs. The Librarians of America Pension Fund sends another $150,000, and the rest of your LPs follow suit by sending 15% of their total commitment. Your balance rises to $21M, and you wire $10M to Plankton to close the deal, bringing your balance sheet to $11M.

After two capital calls, you still have 75% of your $100M fund available for subsequent investments. Your fund also has ownership in two promising biotech companies, and has enough cash on hand to make your planned Series A investment.

How to strategize your capital calls

It’s important to know how much money to call and when to call it.

Timing a capital call

If you call capital before a deal is finalized and the agreement falls apart, the money will sit in your fund’s account and drag down two important metrics: the fund’s internal rate of return (IRR) and total value to paid-in (TVPI). These metrics are used to measure a fund’s performance. IRR calculates the annual rate an investment grows. TVPI is a formula that estimates the total value of an investment portfolio, including realized and unrealized investments.

If you call capital from an LP without enough time to spare, the LP may not be able to wire the money by the time you need it to close the deal. This can cause a deal to collapse. A seasoned manager will often give their LPs informal notice when they enter into discussions to invest in a company, ensuring that the subsequent capital call doesn’t come as a surprise. Usually, LPs need 10 to 14 days to liquify assets.

Capital call lines

Over the past decade, VC and private equity firms have increasingly used capital call lines of credit to make sure they’ll have the necessary capital on hand to complete a deal. A capital call line of credit is a short-term loan from a third party that you can use to invest in a company while waiting for LPs to transfer funds.

Capital call lines have benefits for both LPs and GPs. The LP saves money on management fees, since the GP holds their capital for a shorter period of time. And the GP can legally boost IRR metrics for the same reason.

What happens when an LP defaults?

LPs rarely fail to complete the capital call. But it can happen. What happens after an LP defaults depends on the LPA. A GP may:

-

Impose a penalty of a few percentage points on the capital called for each day the money is late—effectively charging steep interest for the late payment.

-

Use their own funds for the investment, sell the defaulting LP’s entire stake in the fund or defaulted stake to other investors in the fund, or sell the stake to a third party, with terms dictated by the GP.

-

Hold LPs accountable for liabilities incurred due to the default, potentially putting them on the hook if their payment falls through.

The penalties for missing a capital call are usually harsh. It’s important to have the consequences outlined in an LPA to prepare for a worst-case scenario.

How Carta can help

Carta’s capital calls request tool is designed to make capital calls fast and easy.

Pro rata capital calls

For pro rata capital calls, you can simply enter the total dollar amount or pro rata percentage you’d like to call. The tool will automatically calculate the amounts to be called from each investor.

Subsequent close capital calls

Sometimes LPs subscribe to a fund or increase their commitments after the first capital call. In such cases, you’ll need to initiate a capital call that will bring these LPs up to a level pro rata contribution with the other investors in the fund.

When you select a subsequent close capital call, Carta will list out new investors and those with changed commitments since the last capital call. Next to each, you’ll see an optional text box for your additional notes. After inputting the capital call details for each investor, you’ll have the opportunity to conduct a final review before initiating the call.

Carta has partnered with Coastal Community Bank to offer capital call lines of credit to VC investors using a transparent offer with standardized fees and pricing terms.

To learn more about Carta’s fund administration services, including our capital calls tools, contact a fund administration associate.