Compare providers

Carta vs. Captable.io

Start with your cap table on Carta, and easily add features as you scale. You won’t have to switch platforms as your company grows.

Carta provides the best experience for equity administrators, lawyers, employees, and investors.

Carta scales with you from incorporation to IPO. As Carta builds the future of equity, Carta continues to invest in new products for clients.

With Carta, receive a dedicated representative at sign up. Once setup, you’ll have access to our extensive and professional services team.

Hey early-stage founders, there’s a free plan to help companies with less than 25 stakeholders and less than $1M raised in funds issue equity, fundraise, and find support along the way.

Want help deciding? Call us at: 1-833-403-5468

Carta vs. Captable.io

Advanced cap table management

With Carta, when you issue or exercise securities, your cap table updates automatically. On Captable.io, you can only record transactions after they happen, which leaves room for human error and wastes time.

Built-in compliance features

Carta has an in-house 409A valuations team and built-in features like Form 3921, stock-based expense accounting, and Rule 701 management to help you stay compliant. Captable.io 409A valuations are outsourced and not included in their plans.

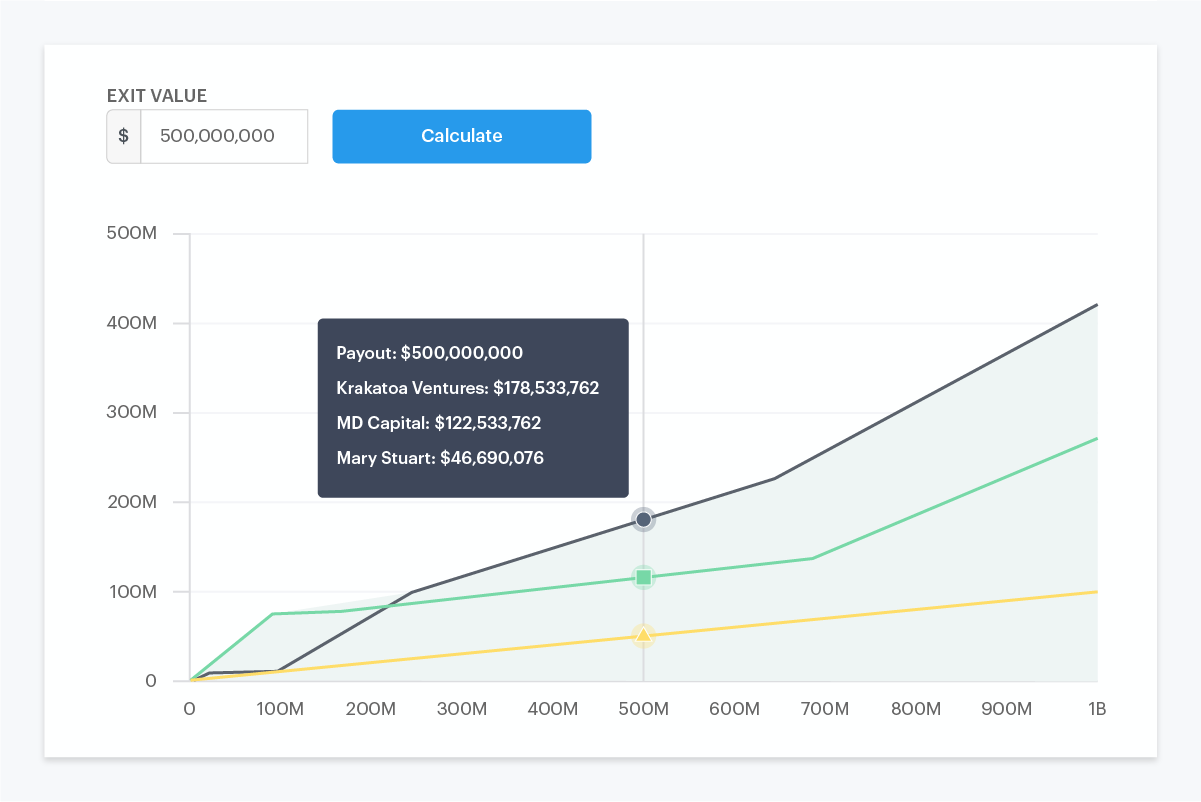

Model your next round before you sign

With Carta, you can model future financings or exits in-product. Our easy-to-use tools include sensitivity and breakpoint analysis, payout and dilution modeling, and pro forma cap tables. Unlike Carta, Captable.io has extremely limited modeling capabilities, which makes it harder to plan your next round.

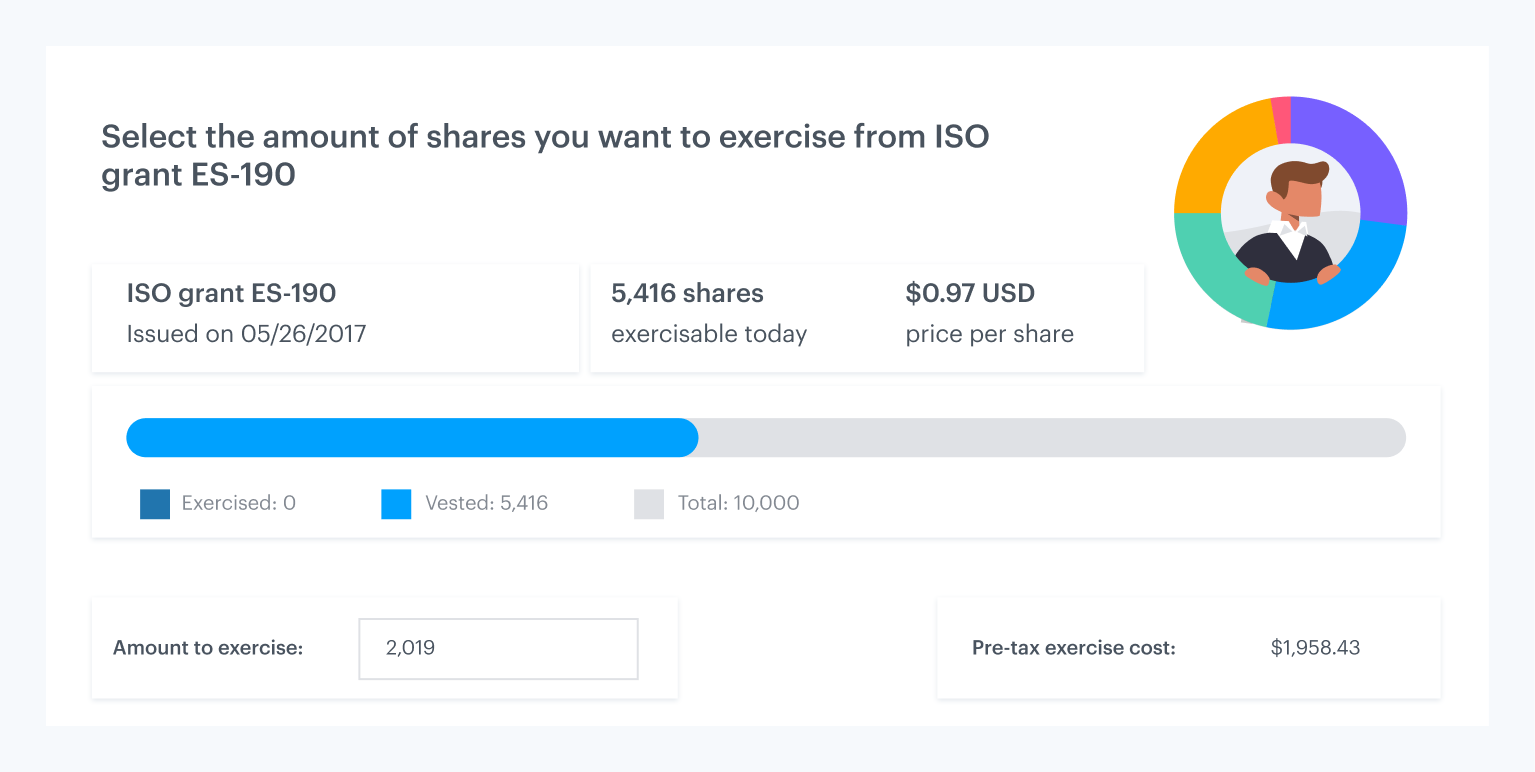

Employees can exercise options in-app

Employees love Carta—they can accept securities, exercise options, and view vesting progress from the web or our iOS app. Unlike Captable.io, we have a fully integrated exercise flow that updates your cap table and shareholders’ portfolios automatically.

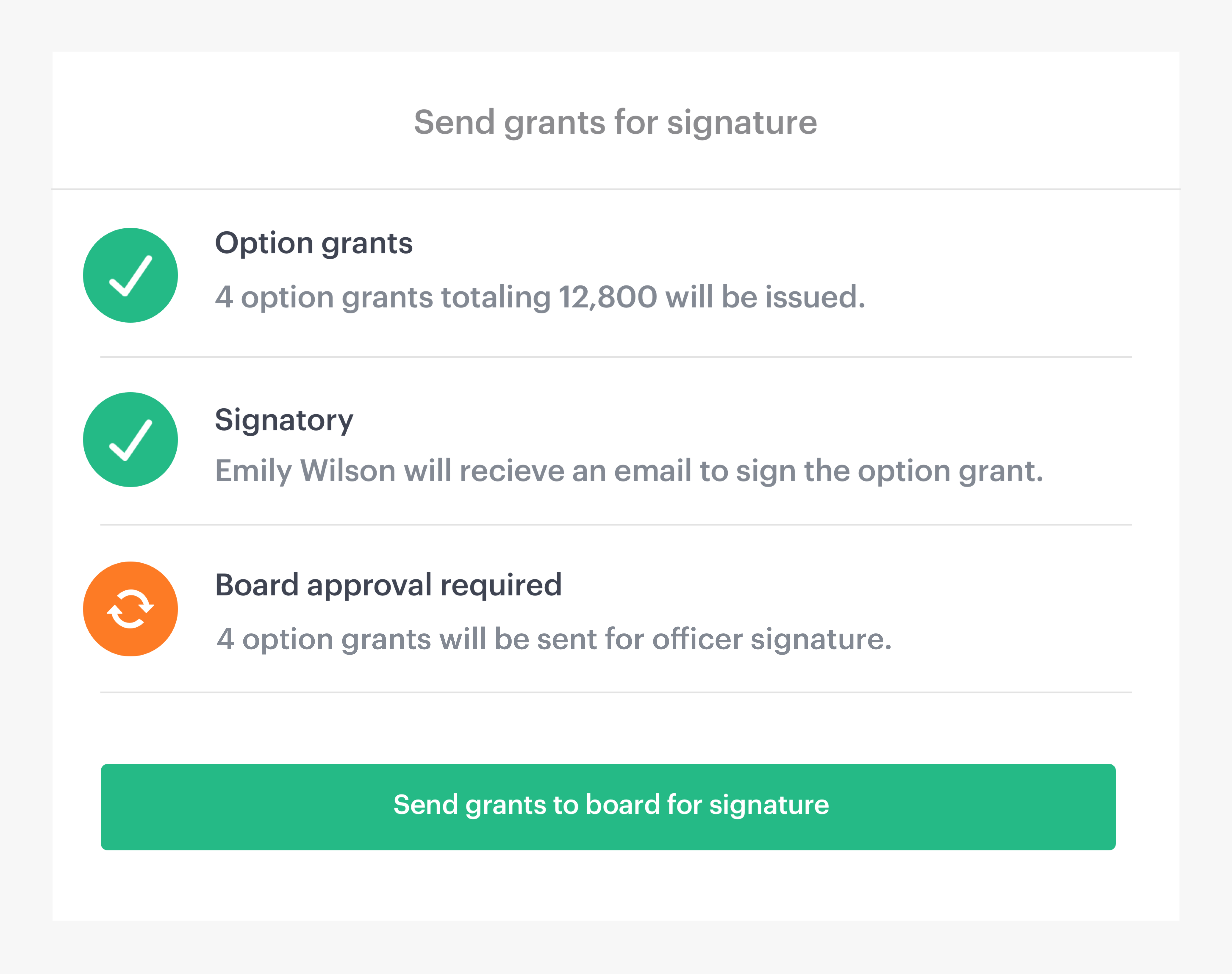

Faster option grant approvals

On Carta, board consent workflows are included in every plan. Seamlessly get board approvals when you issue options and get a new 409A valuation. On Captable.io, you can’t holistically manage and track approvals on a single platform.

From the blog

Carta makes it easier to keep your cap table up to date and stay compliant throughout your company’s lifecycle.