For many, exercising is a serious financial decision that begins with a lot of uncertainty. When should I exercise? How do I exercise? What are my shares worth? Do I have to pay taxes—and how much?

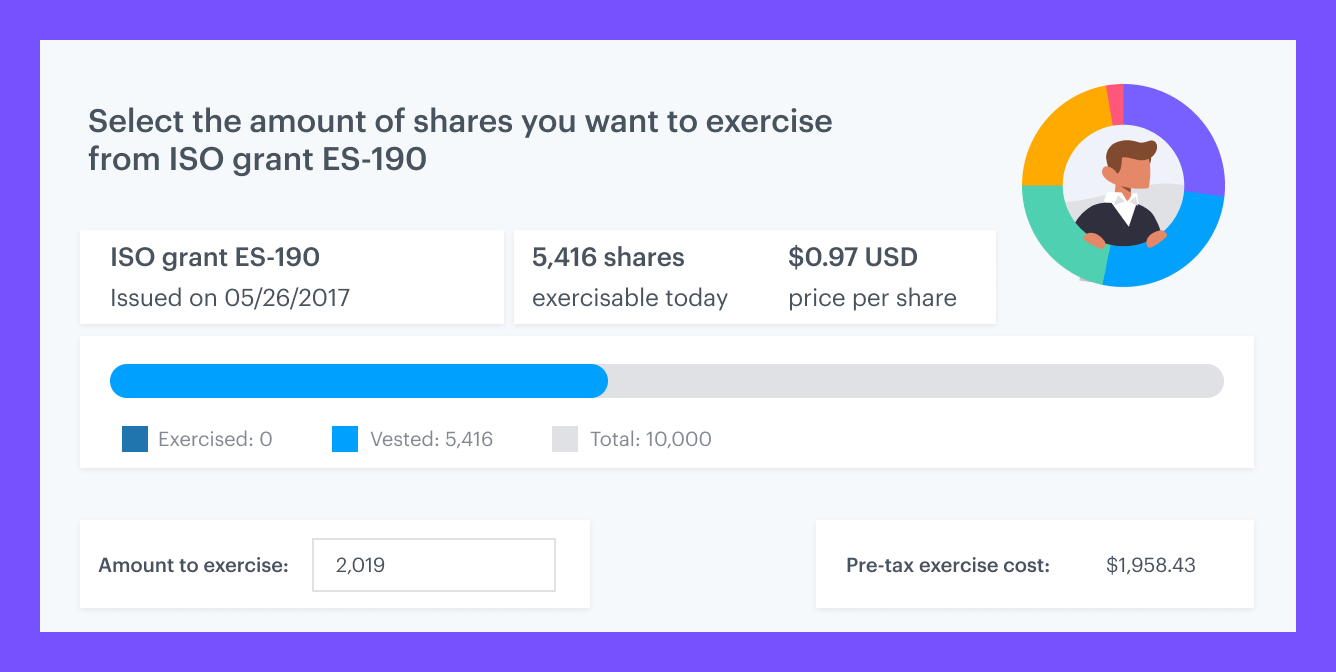

We updated our in-product exercising experience to help employees feel more confident throughout the process and reduce the finance and HR team’s burden of managing (and answering questions about) option exercises.

New and improved exercise flow

When employees exercise, the company’s cap table needs to be updated. This can get overwhelming as you scale. But with Carta, your cap table updates automatically when employees exercise. The transaction and taxes associated can be handled completely through the platform—without employees having to hand you a single check.

Now, we’ve made the employee workflow even easier. When your employees want to exercise, we guide them through a step-by-step process that includes:

-

Educational content to help employees understand equity compensation and answer all the questions that come up along the way, like what’s the difference between ISOs and NSOs and what it means to early exercise

-

Estimated tax breakdowns to help them understand their obligations at the time of exercise and the end of the fiscal year

-

Exercise summary to show all the details of the transaction, including exercise price, number of shares, total cost, and taxes

-

Profile and payment information management to streamline the exercising experience without friction

-

Autofilled 83(b) election form for employees who early exercise to use when filing their election with the IRS

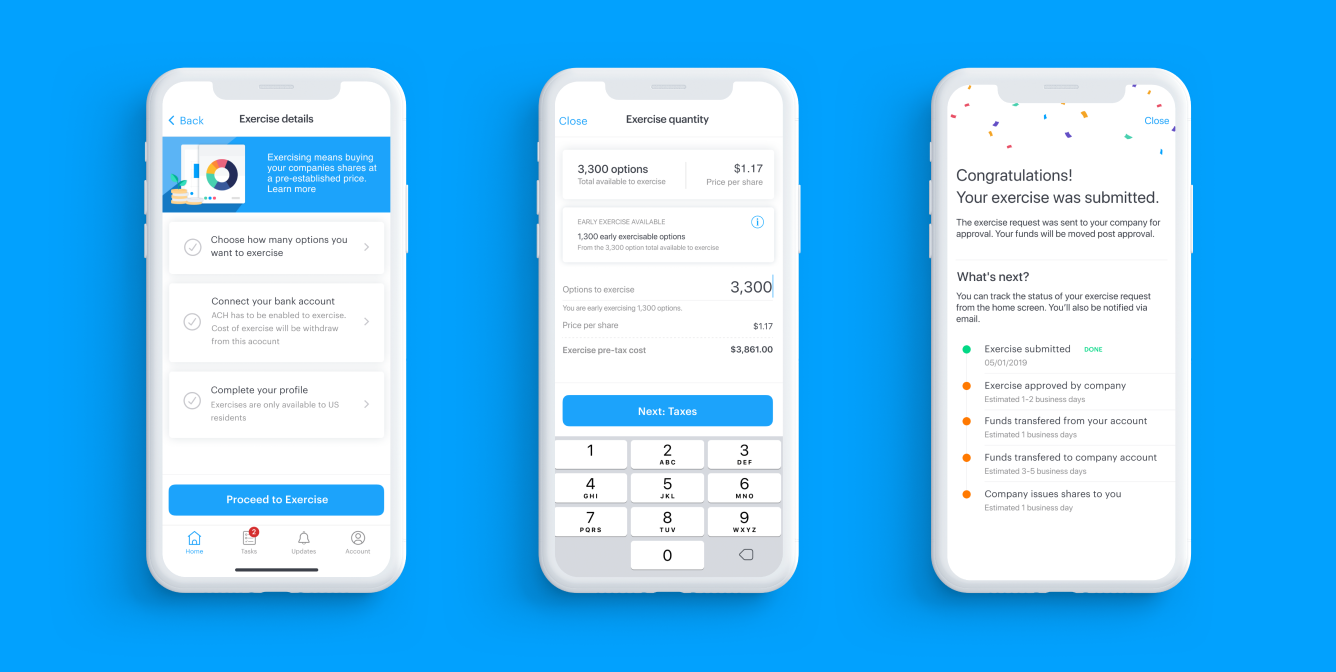

Exercising on iOS and Android

We also added new exercising flows on mobile so employees can exercise their options on iOS and Android when and where they want with the same confidence they have on desktop. Users can also complete their personal profile and connect their bank account all from the app.

Keep your employees informed

Equity, options, and exercising can be confusing. We’re committed to helping your employees understand what they own. Send these resources to your employees to get ahead of their questions:

At Carta, we are dedicated to having the best shareholder experience. Let us know if you or your employees have feedback on how we can continue to improve this flow.