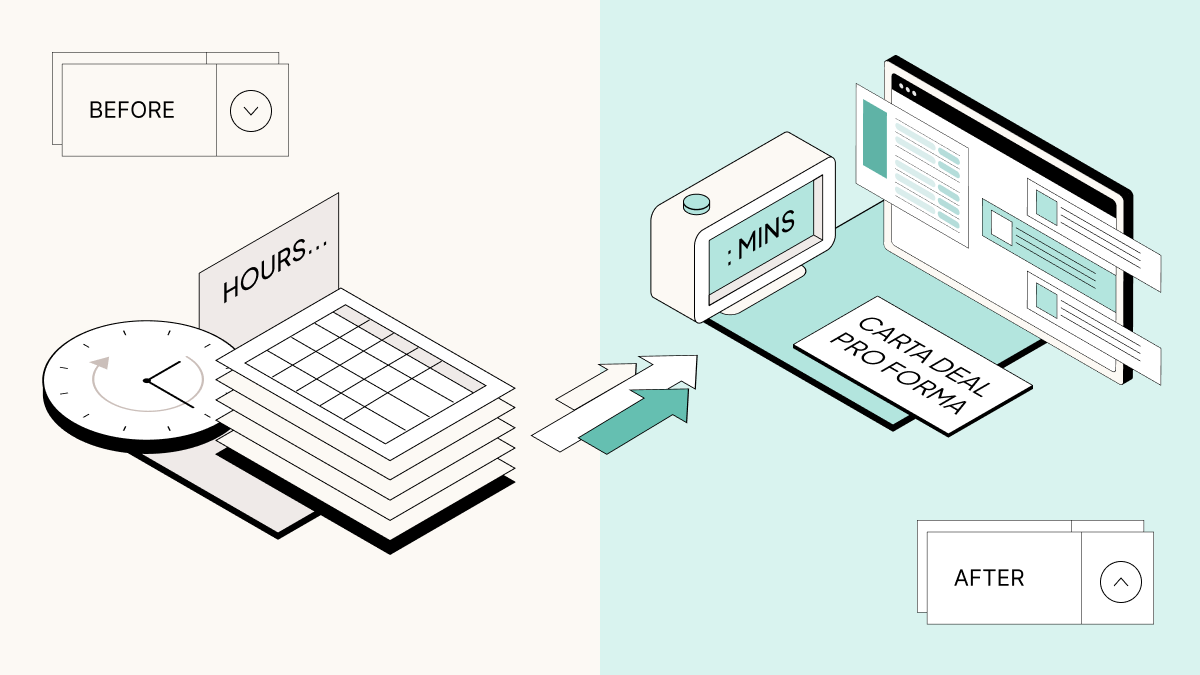

Today we released Carta Deal Pro Forma, making it possible to generate an accurate cap table projection for deals in minutes, not hours. It’s the first tool of its kind available to lawyers supporting startup founders on Carta.

“Carta’s new pro forma tool gives founders and finance executives a way to quickly model the effect of a financing round,” said Jake Routhier, corporate innovation attorney, Orrick, Herrington & Sutcliffe LLP. “It can help them better approach negotiations with prospective investors.”

Prior to Carta’s Deal Pro Forma tool, the process of modeling—especially for the conversion of multiple tranches of notes or SAFEs—could take lawyers hours of work and cost founders thousands of dollars in legal fees. Today, it can be completed on Carta within minutes.

The tool uses existing cap table data to instantly fill in necessary fields, and then automates the computation for a precise, minimal-effort, deal-ready pro forma.

“Most startup founders need to raise capital through the sale of shares—also known as equity financing,” said Charly Kevers, chief financial officer at Carta. “But creating a deal pro forma, the first step in an equity financing, has been too tedious for too long. We’re excited about being able to solve this pain point, and follow through on our promise of building infrastructure for innovators.”

With this new tool, users can easily make incremental changes through various inputs (investment amount, pre-money valuation, etc.). Ultimately, this flexibility means founders can be more efficient and versatile in their modeling for investors, and understand implications for their ownership by running multiple scenarios with ease.

“With over 30,000 customers on Carta, we often hear about the challenges of company-building—pro forma modeling was one of them,” said Vrushali Paunikar, chief product officer at Carta. “So we set out to build a tool that was easy, efficient, and exportable. Today, Deal Pro Formas built on Carta serve as a reliable source of truth for all parties involved pre- and post-financing.”

“Carta’s Deal Pro Forma was built with top law firms across the venture ecosystem—including Perkins Coie; Orrick, Herrington & Sutcliffe LLP, and over 100 individual attorneys,” said Natasha Arora, director of business development at Carta. “With the introduction of Deal Pro Forma, Carta is able to support equity planning not just as a record-keeper, but as a key facilitator of transactions.”

To learn more and get started with Carta’s Deal Pro Forma tool, read our support article:

Testimonials

“There are countless ways to model a financing round. A lot of nuance goes into the calculations that founders don’t always know to watch out for. Carta’s pro forma tool walks founders through that nuance in an easy, step-by-step process. It presents the final model in a way that investors and counsel would expect.” — Montana Ware, Managing Associate, Orrick, Herrington & Sutcliffe LLP

“This is a game-changer for us. Carta has a well-earned reputation for making cap table management more efficient for startups, and this tool will make a key step in the fundraising process more efficient, too.”—Michael Glaser, emerging companies & venture capital lawyer.