Note: Since this was published in 2015, some of our ideas have evolved, our revenue and burn rate have both increased, and our orientation has changed. But, as you’ll read later in the post, we still hope that people stay at Carta for a decade or more.

All Carta employees (new and old) take a full-day course called Carta 101. It is an introduction to our company, our values, and our execution strategy. The class size is kept small (8–10 people) so everyone can participate in the group discussions. I give this class on Fridays once a month.

I’ve also included excerpts from my lecture notes with a few slides pulled out from my deck in this post. I hope it is helpful to ceos and employees of growth stage companies working on scaling culture.

Prerequisites

The prerequisite for this course is to read The Lean Startup and How to Win Friends & Influence People. Hopefully you have all read both books. You should have received copies on your first day, and we have many copies in the Carta library.

The term “MVP” (Minimum Viable Product) is used every day at Carta. It is the atomic unit of every idea, discussion, experiment, feature, and product. You will hear questions like, “What is the MVP feature for this law firm?” or, “What is the MVP pricing for our enterprise customers?” You will come to know and understand this concept well.

You will also apply Dale Carnegie’s rules to your customers, coworkers, vendors, and team on a daily basis. It is our People Bible. If you are unsure how to handle a people situation, read Dale Carnegie’s chapter on it. There is no better or more practical book on managing people. It is the oil that keeps our professional relationships running smoothly.

Carta is run like a Professional Sports Team

Most companies find role models in other companies (e.g. Facebook, Google, GE). They aspire to be like “Company X”. I propose an alternative model for Carta. We don’t model ourselves after companies. We model ourselves after professional sports teams. My question for you is, “What is the difference between a company and professional sports team?” [Lead 20 minute discussion]

Show up on time everyday

(Note: this aspect is no longer mandatory at Carta) There are many similarities between Carta and a professional sports team. For starters, our entire company meets everyday at 8:30am to begin the day together. Everyone — engineering, sales, services, office management. Nobody is exempt. In sports, even the goalie, who may have a completely different practice schedule from the rest of the team, still meets at the same time to warm up.

Teams meet to solve problems, brainstorm ideas, share work, or just catch up. On Tuesdays and Thursdays, the whole company meets for an hour-long Show & Tell. This is an opportunity for everyone to share, debate, and participate in the bleeding edge of Carta’s progress and decision making.

Most people think it’s crazy that we make everyone be in the office at 8:30am every morning. We think it is crazy not to. The New England Patriots would never tell players, “Show up for practice when it is convenient.” If you want to be the best in the world at what you do, start every day together.

We are Software People

Now we will watch, what I consider, the most underrated presentation in tech — Jeff Lawson’s We are Software People. Jeff is the amazing CEO of Twilio and he captures in 20 minutes what it means to be the kind of person solving the problems that we are solving.

At Carta, we are all Software People. Every day we deliver “an amazing customer experience at scale” and “suck more of the world into our software.” You don’t have to be an engineer to do this. You just have to believe that your job is to translate real-world problems into software problems.

Nobody at Carta does the same thing everyday. Everyone is working to put themselves out of a job. This is our “creative destruction” that drives us to evolve, grow, and adapt.

Create Leverage, Not Efficiency

Many people confuse leverage and efficiency. They are different. Efficiency is fixing a desired output and minimizing the effort to achieve it. We are not an efficiency company.

We are a leverage company. For a fixed amount of effort, how can you maximize your impact? This question is your guiding light. In everything you do, figure out how to multiply the impact you have by 10x.

Never confuse efficiency and leverage. Efficiency is what lazy people aspire to. Leverage is what we do.

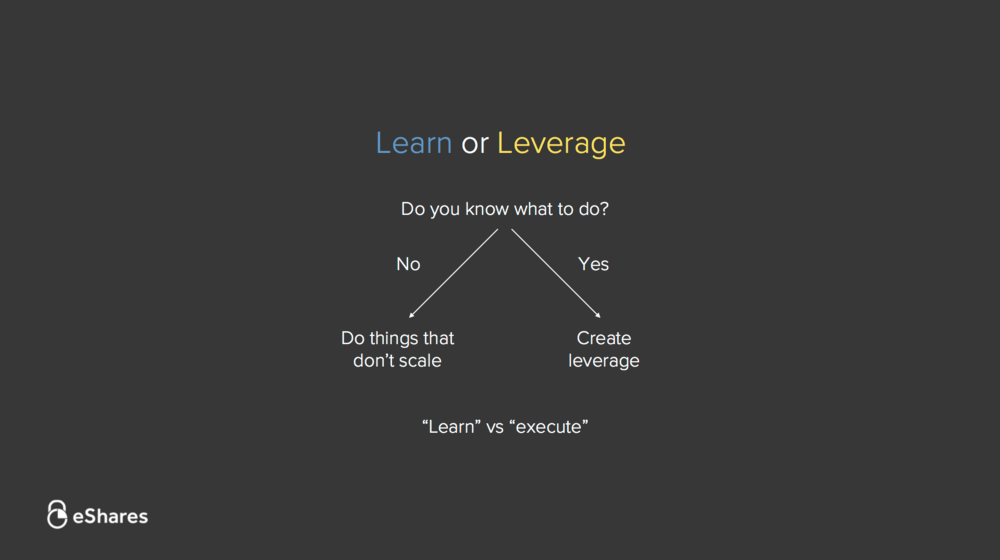

Learn vs Execute

There are two types of work that you will do on a daily basis. The first is learning. In any role there will always be an initial learning phase before you get brought up to speed. At a certain point your learning will plateau, and this is when the second type of work kicks in: executing. This is the act of applying that knowledge to get the job done and create leverage. Eventually, you will create enough leverage to automate the job or grow out of it, and this is when you start the cycle over. Learn. Execute.

Competition Is for Losers

If you are thinking about going to business school, don’t. If you already have, please try to forget most of what you learned. Everything you need to know about business is covered in the next 45 minute video.

Peter Thiel’s Competition Is for Losers is our playbook. My job as CEO is simple. I do what Peter says. And this is what he says:

1. Avoid competition

We don’t subscribe to the view that “competition means we are doing something valuable.” In fact, we believe the opposite. We avoid things competitors and investors want to do. We LOVE doing the stuff nobody else wants to do. Messy cap tables, gritty 409A valuations, legal paperwork— when we see other people getting excited about a space or problem, that is a signal to us to stay away.

2. Start in small markets

We struggled raising money because investors retorted, “your market is too small”. That is by design. We create monopolies in small markets and grow concentrically into new ones. I love Peter’s description of defining Facebook’s first market as 20,000 Harvard students and their “auspicious” start capturing 60% of the market in 10 days.

3. Durability over growth

My favorite word in Peter’s presentation is “durable.” That is how I describe us. We never worry about growth rate. Instead, we worry whether our business, product, and culture will exist 30 years from now. It seems ridiculous for a VC backed company to say we don’t worry about growth rate, but it is true. We are confident that if we build something durable, defensible, and important, our company will be valuable in the long run. We don’t care about being the fastest growing financial infrastructure company. We care about being the last one.

1-on-1s

You will do a 1-on-1 walk with your manager every 2–3 weeks, with your manager’s manager every 4–6 weeks, and with me every 4–6 months.

We have been doing this since we were three employees. Managers at Carta are required to take a class on how to do 1–on-1s. For managers, the instructions are simple: listen. For you, just talk about whatever you want. It doesn’t have to be work related. It is your opportunity to share what’s on your mind.

Our competitive advantage is the strength of our team (remember the sports analogy?). Think of our team as a network of nodes, connected by edges. 1–on-1s are how we strengthen those edges. It is the most important activity you will do here.

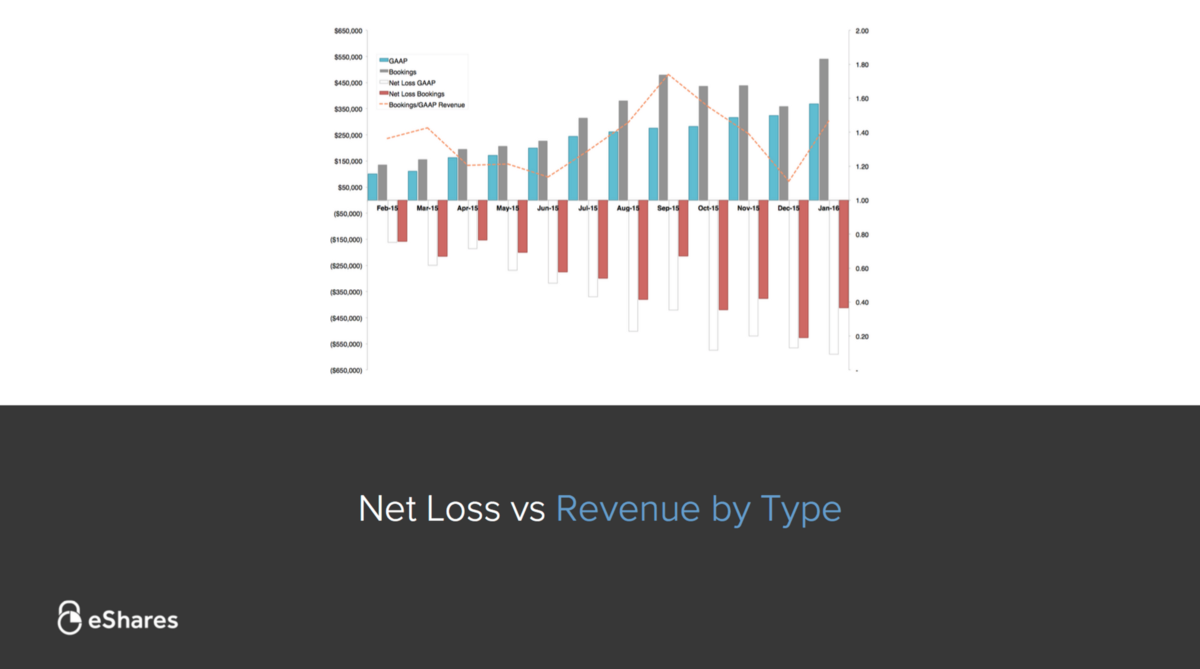

Financials

Every month I send an investor update with our performance, including our income statement and balance sheet. I forward this email to the company so you will see the same information.

There are three important things to understand about our financials:

-

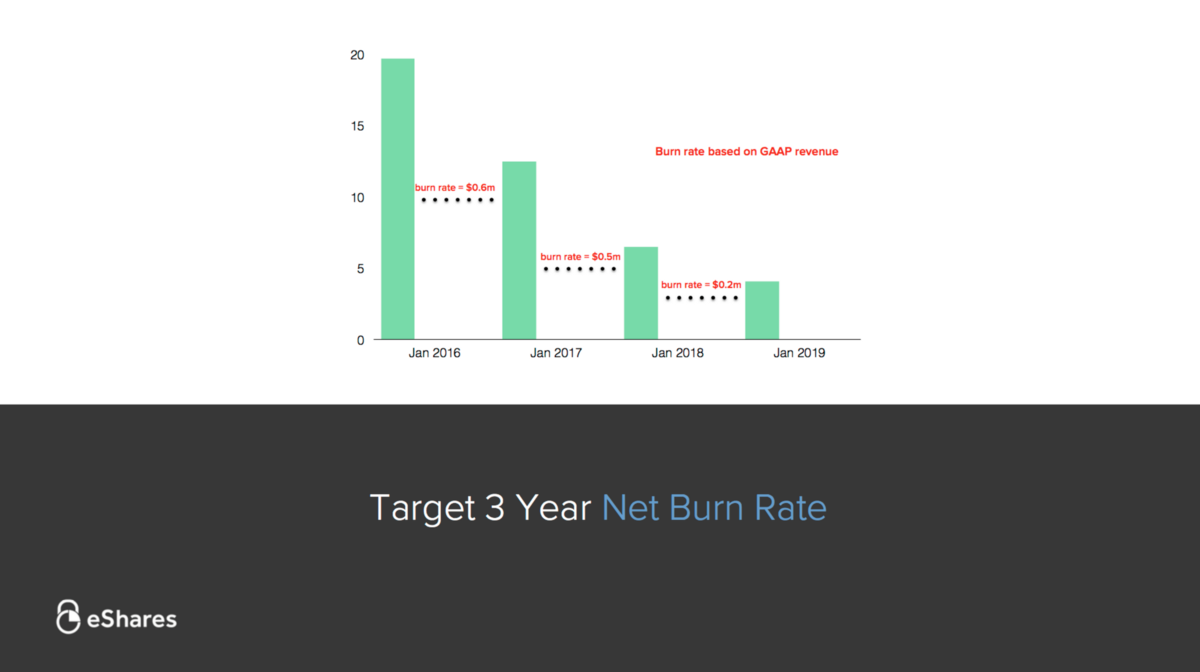

We target a $600k/month burn rate. If we burn more than $600k/month we are taking too much risk. If we burn less we are not taking enough. (This was our burn rate as of 2015)

-

Because we have a target burn rate, if we want to invest in projects, we have to earn it. We allow ourselves a certain amount of equity capital each month, but anything beyond that we need to pay for with revenue:

-

We currently have ~$20M in the bank. At target, we will spend $7.2M in 2016. In 2017 we will reduce our target burn to spend $6M. In 2018 we will reduce our burn rate further to spend $2.4M. By 2019 we will be profitable:

Our burn rate is our throttle. Though we have raised significant money, we slowly apply the gas. Many companies raise large amounts of money to deploy in 12–18 months. It is their Blitzkrieg strategy. We will deploy the full force of our balance sheet patiently over a sustained period. It is our Siege strategy.

Compensation

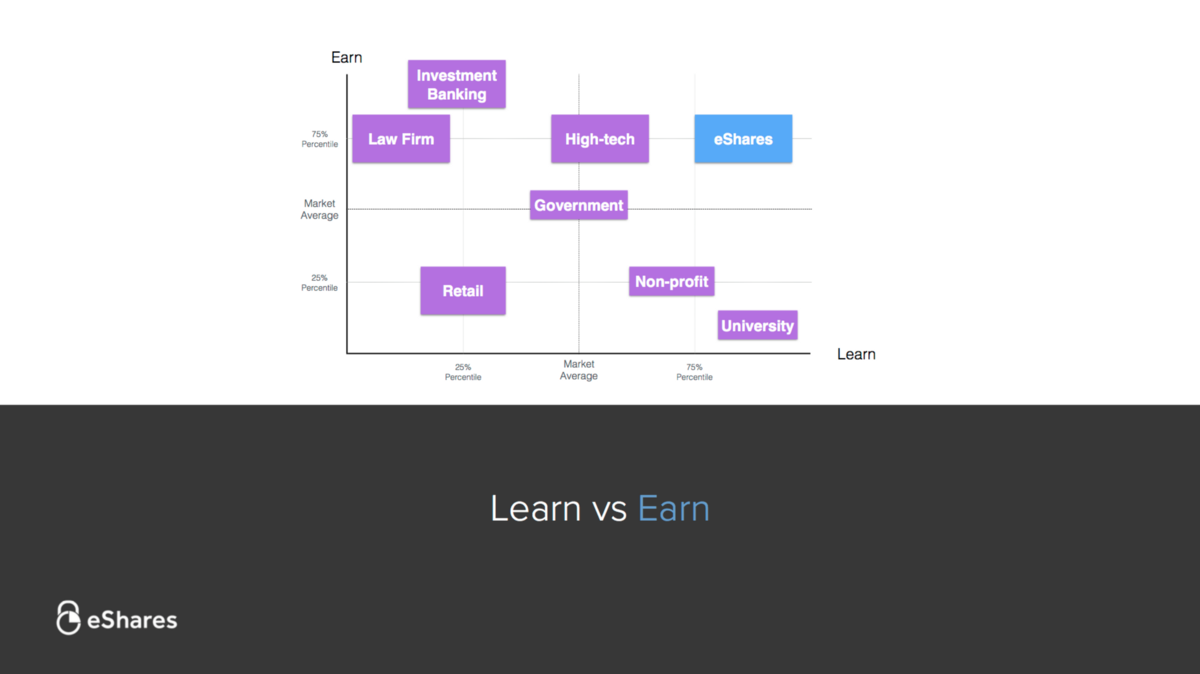

Our compensation framework draws from Netflix and Mark Suster’s excellent Learn vs. Earn. But we have modified them to work for us. The basic principles are this:

-

Compensation (salary + equity) is determined by the market for your skill set, and your skill level. That means there is no automatic annual raise of 2.4%. There is no subjective increase based on whether your manager likes you better than the others. Your compensation is exclusively determined by your marketability.

-

Increase compensation by increasing marketability. Lobbying, staying late, taking credit, buying beers — these have nothing to do with your compensation. If you want to increase your compensation, become better at what you do. It is very simple. Remember our professional sports team model? It is the same here. Increase your contract value by being a player that scores more goals. The rest is noise.

-

You will be marked-to-market at your 9-month anniversary and every 12-months thereafter. If the market for your skill has increased in value, or your individual skill has increased, your compensation will increase.

-

We target being in the 75th percentile for your compensation. That means if you were to interview elsewhere, we would expect 1 in 4 companies to offer you a higher salary than us. Why don’t we just pay top-of-market?

-

We earn our people. The best people are recruited, not bought. The companies who pay top-of-market will always win the salary-optimizing people. The best people optimize to learn (remember Learn vs Earn?). Winning and retaining those people means creating an environment where people are willing to trade short-term compensation for long-term career capital. Many companies think paying the most gets them the best people. They are wrong. Companies that teach the most get the best people. Our compensation structure is our checksum to ensure that we offer the best learning environment.

Place your dots

Everyone has seen Steve Jobs’ Stanford commencement address. I’ve seen it dozens of times and I still tear up. But the message is timeless.

One of my favorite lessons from his speech is “connecting the dots.” Almost on a daily basis, I draw on some skill or experience I learned years ago. My first job out of college was flying around the country doing software demos. I got really good at doing demos, but didn’t think I would ever use this skill again.

Almost 15 years later I was running up and down Sandhill Road doing demos of Carta. Learn and get better at what you do, and have faith that it will be useful later on.

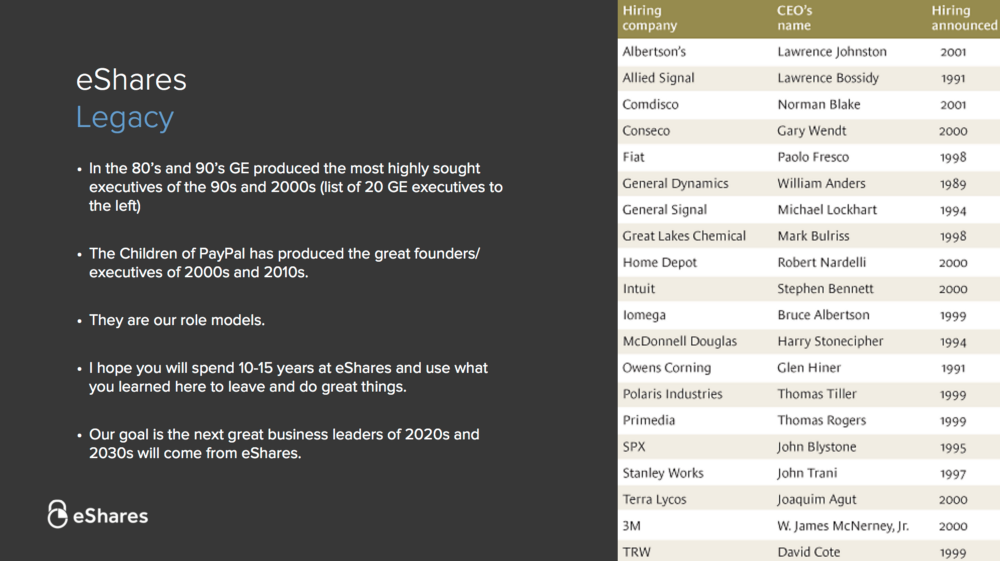

The Carta legacy

In the 90s and 2000s, GE produced the most highly sought after business leaders. After spending the majority of their careers at GE, dozens of executives would eventually leave to become ceos of Fortune 1000 companies. PayPal created a similar legacy in the 2000s and 2010s. The second generation of PayPal executives created Yelp, SpaceX, Tesla, LinkedIn, and Yammer.

I know how strange it sounds for me to say this, but I hope you will stay at Carta for a decade or more. I hope Carta will be a significant, if not majority, part of your career. My fantasy is not that Carta will be a great company. My fantasy is that when you eventually decide to leave Carta, you will go on to do even better things. The greatest thing Paypal gave us was not online payments. It was Peter, Elon, Reid, Jeremy, Max, and many others. The greatest thing Carta will produce is you.

Jason Calacanis once asked Peter Thiel why Paypal produced so many great founders. What was it about Paypal? I loved Peter’s answer — Most people’s experiences with startups fall into one of two categories. Many work for startups that fail and learn that startups are impossible so they never try. Others work for startups like Google or Facebook and learn that startups are easy so they quit when it gets hard. Paypal was “just hard enough”. Early Paypal employees learned that startups are really hard, but it is still possible to succeed.

Doing Carta is hard. You will learn that soon. My hope is it will be just hard enough. I’m excited to see what you will accomplish here. Welcome to Carta.

Thanks to James Seely