Compared to recent history, it was a quiet year for venture capital in 2023. Startups on Carta closed 5,409 new deals over the course of the year, the lowest annual total since 2018.

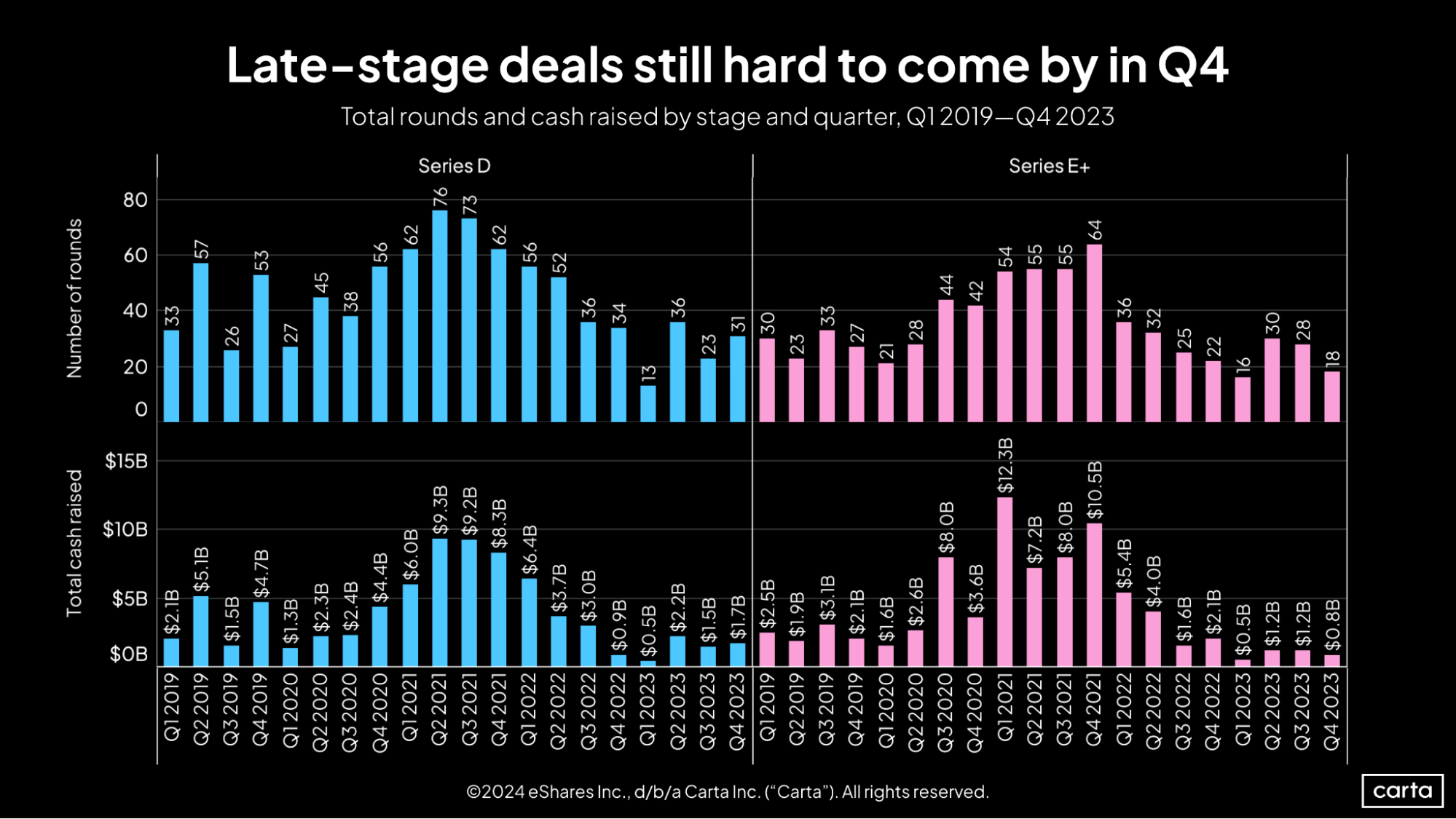

The volume ebbed particularly low at the latest stages of the startup lifecycle. At Series D, startups raised 58% less capital in 2023 than they did in 2022, and deal count declined by 53%. At Series E and beyond, cash raised fell by 72% year-over-year, while deal count dropped by 20%.

Last year’s figures were a far cry from the late-stage market’s peak in 2021. They’re also still lagging behind the pre-pandemic funding market of 2019.

Investors pull back

Jon Keidan is the founder and managing partner at Torch Capital, where he’s invested in consumer tech companies such as Acorns, Rho, and Sweetgreen. The data aligns with what he saw throughout 2023: For late-stage startups seeking new capital, the bar has been raised.

“Capital is still there for new ideas, but much more scarce for growth-stage companies,” Keidan says. “If you are going to raise, you have to be very clear on exactly what you’re spending and how far that gets you. You have to make sure that burn is wildly reduced if you’re not getting all the way to profitability. There is just a lot more scrutiny, which is probably healthy in the long run. But it is painful.”

Higher expectations from investors were one reason late-stage deal count has declined. Keidan says that a reduction in the number of investors looking to actively deploy capital was another.

“A lot of the growth investors were really pencils down for new deals,” Keidan says.

The venture boom in 2021 was aided by an increase in nontraditional venture investors such as hedge funds, sovereign wealth funds, and corporate VC arms, who were drawn by tech startups’ recent history of producing exponential returns. Between 2019 and 2021, the combined deal value of venture deals involving nontraditional investors spiked by 157%, according to data from PitchBook.

Now, many of those investors have retreated to their usual domains. Between 2021 and 2023, deal value involving nontraditional investors fell by 58%, retreating nearly all the way to 2019 levels.

A late-stage bright spot

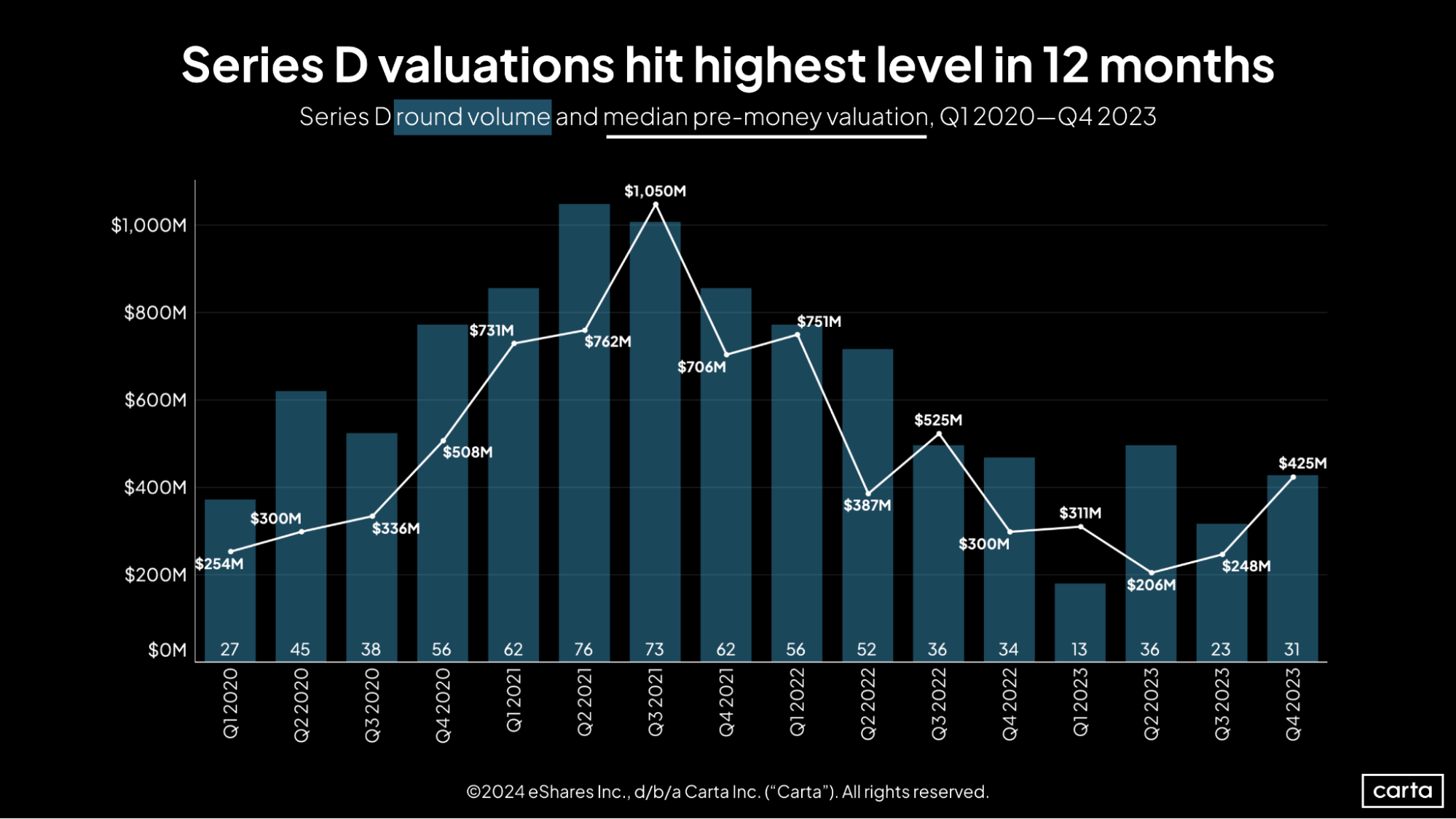

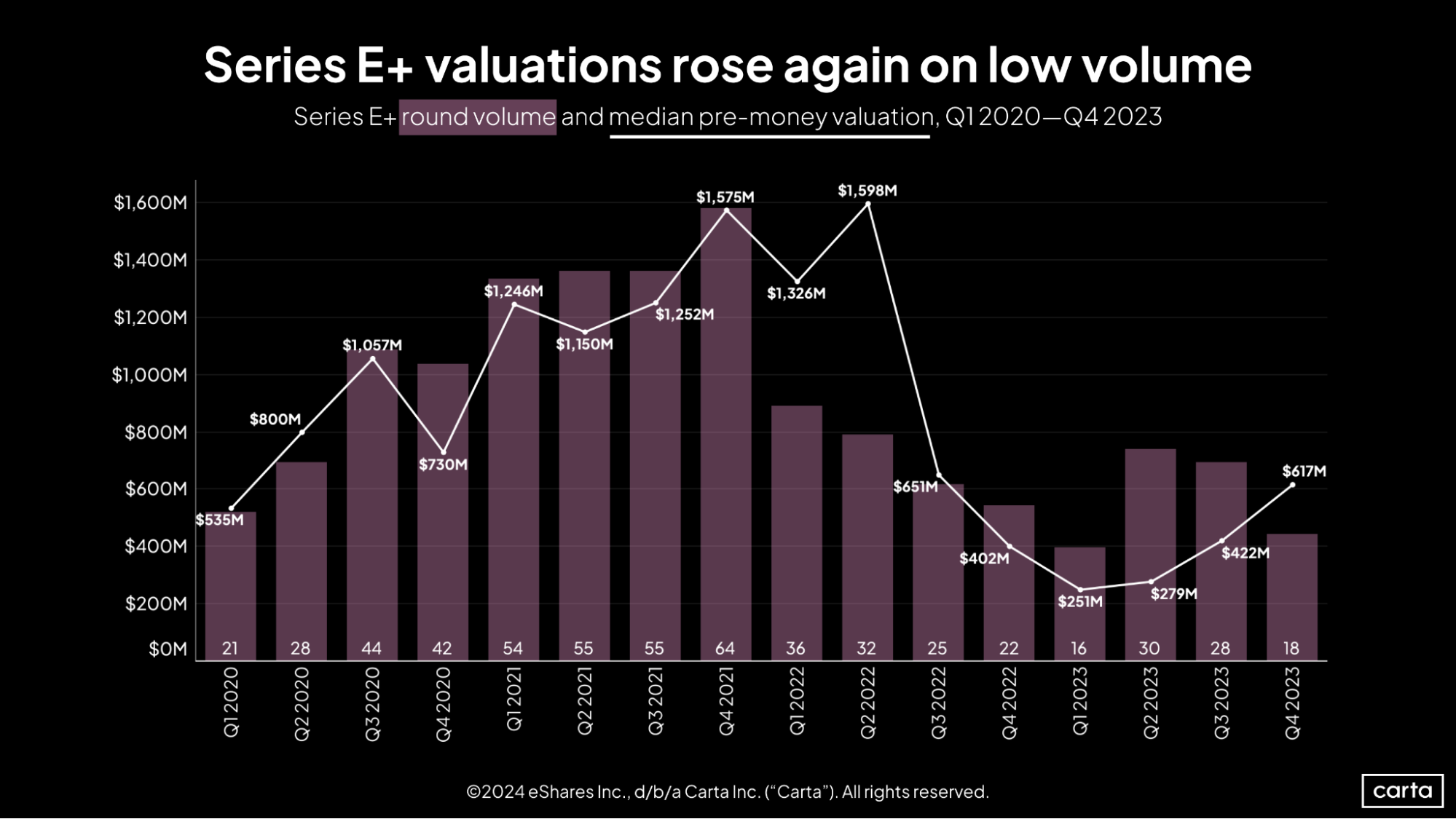

Late-stage deal counts and dollars raised have shown little upward momentum in the past several quarters. Recent trends in valuations, however, look a little more promising.

At Series D, the median valuation jumped to $425 million in Q4, a 71% increase compared to the prior quarter. It’s the highest median Series D valuation since Q3 2022. The median round size at Series D, meanwhile, ticked up 29% from Q3.

And at Series E+, the median valuation rose by 46% in Q4, reaching $617 million. The median valuation at these latest stages has now increased in three straight quarters.

‘Surviving, not thriving’

Given the low deal counts from Q4, however, it’s clear that most late-stage startups didn’t see a direct benefit from this late-stage valuation bump. With the market for new investments so tepid, many founders and investors turned their attention to other aspects of building a business. For Keidan and his companies, that meant frequent conversations—sometimes weekly, sometimes daily—about managing runway and adjusting to a new economic environment.

“The idea of portfolio support took on a whole new meaning,” Keidan says. “I think you got to see who is a true venture investor that knows how to help companies build and navigate even in turbulent times, and who isn’t.”

Many of these same ideas are still top of mind for Keidan in the early stages of 2024. With late-stage investments so scant, companies will aim to find ways to make do with what capital they have.

“I think it’s about surviving, not thriving, not hockey-stick growth,” Keidan says. “It’s about surviving the next year, because those that are left will have a really big advantage coming up.”

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter:

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. ("Carta"). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein. ©2024 eShares Inc., d/b/a Carta Inc. ("Carta"). All rights reserved. Reproduction prohibited.