From just a handful of investor networks on the continent in the late 90s to a market that today sees more than 2,000 angel groups and 450,000 investors, the space is hotter than never.

The secret recipe is simple: top deal-flow and speed of execution.

Traditionally, angel investors would promote deals in their network and each investor would reach out directly to the startup to complete their investments. This has the advantage to be the easiest way to operate an angel group but can be very slow. Syndication can supercharge your execution speed and unlock new opportunities.

What is angels syndication?

A syndicate is a group of angels coming together to invest jointly in a startup, creating a special purpose vehicle (SPV) for each investment.

Unlock new opportunities

When you invest small tickets in early-stage startups you must make a lot of investments to balance the risk. From Series A onward, startups have in general a high-ticket minimum which rules out the angel investors from advantageous and less risky opportunities. By forming a syndicate and joining forces, you may be able to invest with as little as $10,000, access larger deals and compete for the best deals with VCs.

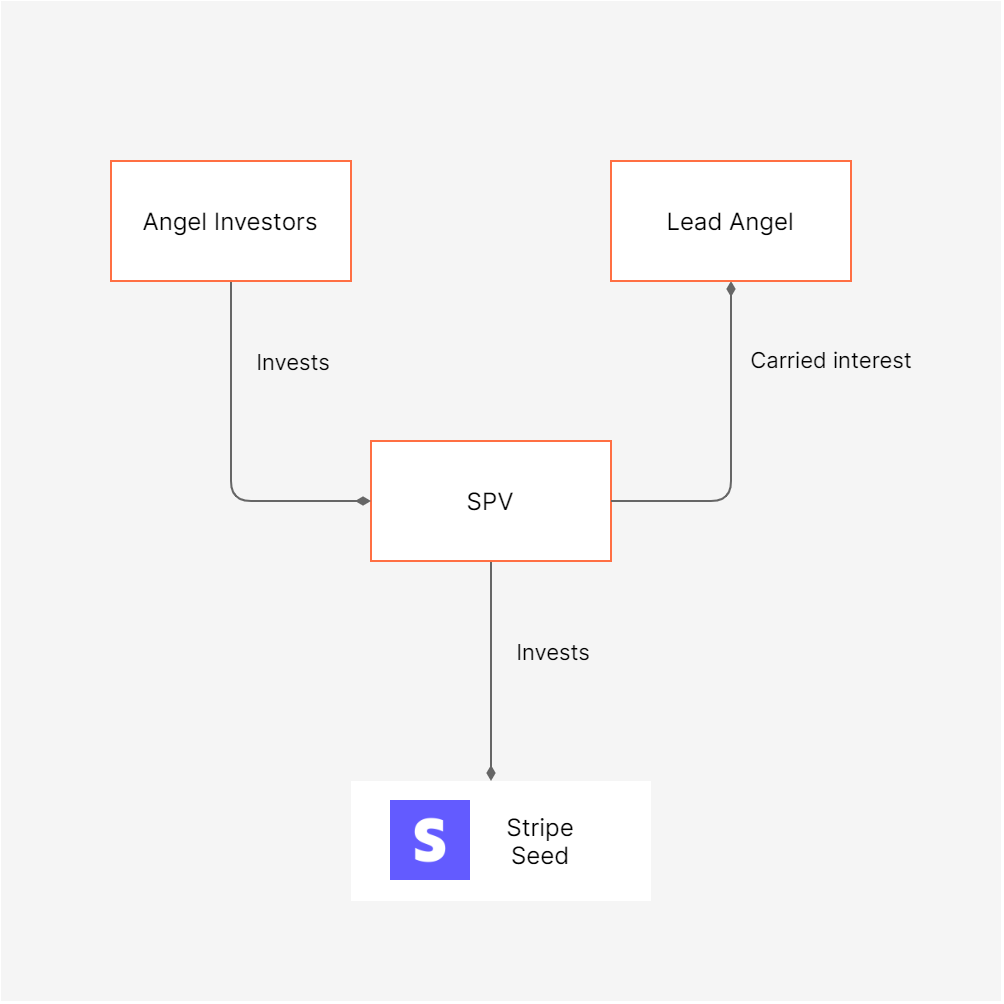

Align interests in your network

Closing a deal among a group of angel investors requires a lot of coordination: finding the best startups, conducting due diligence and raising capital. A more professionalized syndicate can appoint a person to handle all the deal sourcing and due diligence in exchange for a carried interest, so that the angels group only has to provide capital and approve the transaction. You can also reward everyone's work by dividing the carried interest between the person sourcing the deal and the person doing the analysis.

Simplify founders life

When approaching startups, being backed by a syndicate streamlines the discussions. The founders have only one person to speak to. It looks more professional and the process is more straightforward than having to deal individually with each investor. On top of that, the cap table is cleaner with just one SPV showing up among the other investors in the round. The founders will appreciate it.

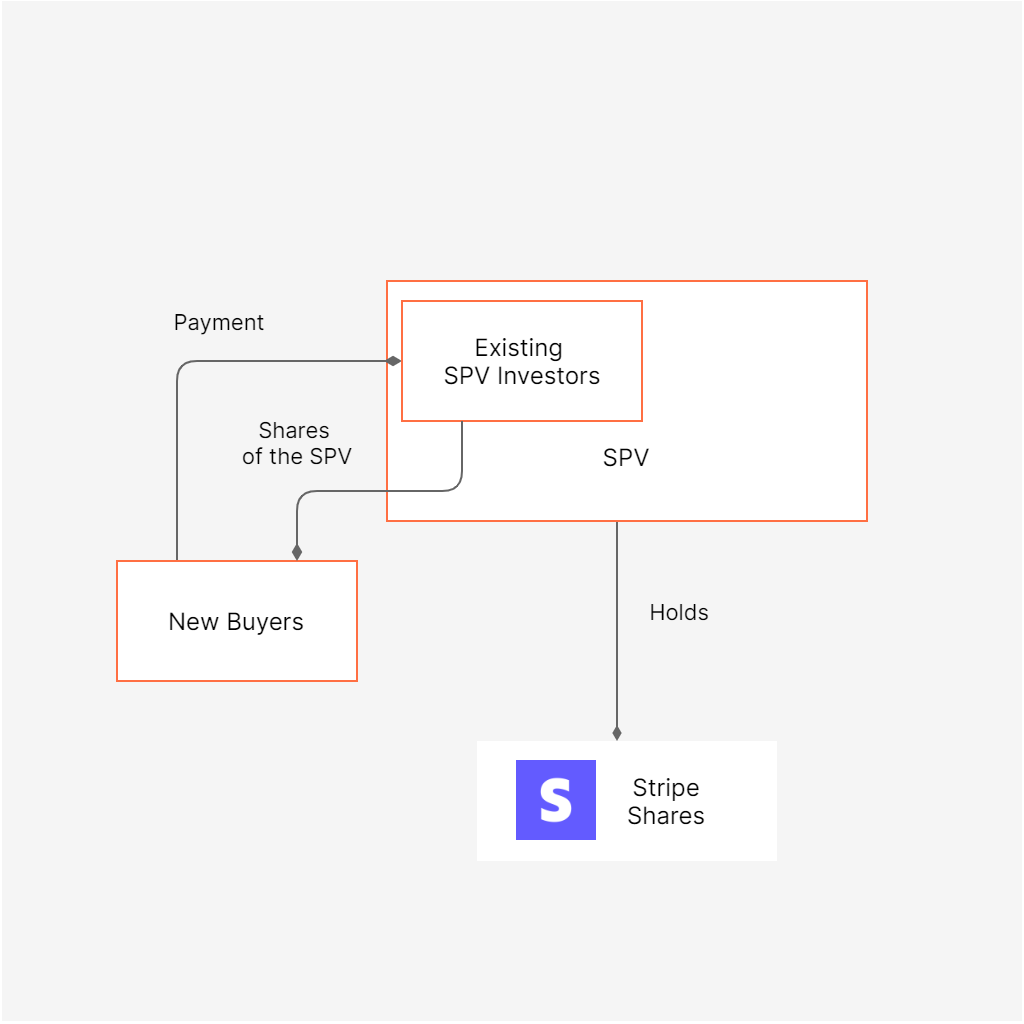

Provide greater liquidity

Liquidity is the lifeblood of angels, their biggest question is always “How do I get a return on my investment?”.Selling direct interest in a startup is often a challenge where you need to get the approval of the directors. By using an SPV you can sell the shares of the SPV allowing the buyer to have interest in the underlying company without having to ask permission to the startup. Your angels will thank you for that