The Series A

We're hitting a whole new level of startup fundraising in this section. Understand the difference between pre-seed and Series A funding and what to look for in a term sheet. Plus, we'll do a deeper dive into dilution as well as pre and post-money valuations.

Start section 4 now, or explore more sections below .

Continue learning

4 sections • 17 videos • 2h 10m total length

Section 1: Fundraising basics

Discover different types of pre-seed funding and the importance of product-market fit.

|

6:04 | |

|

9:52 | |

|

3:43 | |

|

6:32 | |

|

5:13 | |

|

3:49 |

Section 2: Early-stage deal mechanics

Ramp up your startup fundraising by getting to know SAFEs, convertible notes, valuation caps, and dilution.

|

11:54 | |

|

11:38 | |

|

2:47 | |

|

12:56 | |

|

3:48 |

Section 3: The pitch deck and funnel process

Understand the pitching process and build an efficient fundraising funnel—step-by-step.

|

6:16 | |

|

4:16 | |

|

4:11 | |

|

Lesson 4: The fundraising process: Meetings, pitches, and follow-ups |

13:44 |

Section 4: The Series A

Now playing

Prepare yourself for this new level of startup fundraising as we go over converting SAFEs, term sheets, and more.

|

11:55 | |

|

9:55 |

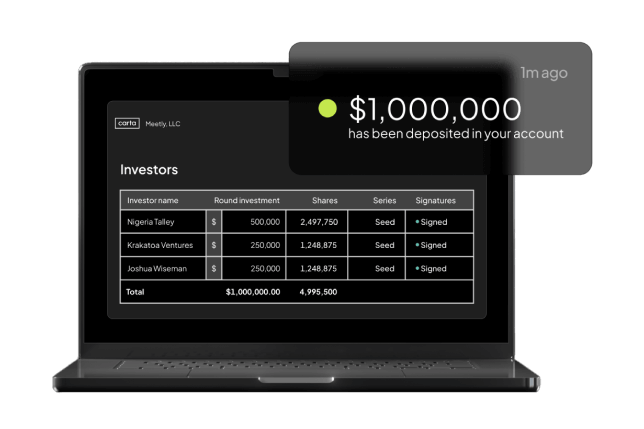

Get tools and services for an easier and more cost-effective fundraise.

Start fundraising on Carta

Save time and money during your fundraise by leveraging the best and most comprehensive set of tools and services.