The start of a business journey is a rollercoaster ride. Just when you’ve put one bump behind you, you find yourself climbing a hill towards the next thrilling episode. A big part of the action is decision-making, and what you choose to do in the early stages of a startup has long-lasting consequences.

If you’ve chosen to build a company alongside co-founders, one of the big early decisions to make is how to split startup equity. Only about one-third of companies grant the same amount of equity to each co-founder, according to Carta data, while the majority of companies decide to vary their equity split between co-founders. But how do you determine what that division should be?

The answer depends on details about the business and each founder, their roles, and the experience they each bring.

Striving for a fair split

How equity in a business is divided codifies the relationship between co-founders in a financial agreement and sets the tone for future collaboration. To maintain a healthy relationship, the process should be driven by what’s fair – which is easier said than done.

Being fair is not the same as being equal. If one co-founder is putting more into the business and achieving better results, is it fair they receive the same amount of equity as a co-founder contributing less?

Over time co-founders may also grow unhappy with the original split.

To combat and resolve these issues and avoid disharmony later down the line, careful consideration, clear-cut communication and extensive discussion are essential. It’s better to air potential concerns than let them simmer and re-emerge in future business operations.

Timing the equity split just right

The timing of your decision will affect who gets what. The longer you wait, the more information you have at your disposal to determine a fair split. On the other hand, there’s also more chance of disagreements later on. Research shows that the longer co-founders deliberate on the right equity split, the more likely it is to be uneven – which is not necessarily a bad thing.

When it comes down to it, there is no right or wrong time to make the decision and it will vary from startup to startup. Some founders split evenly at the beginning to avoid the possibility of extensive negotiations and conflict. But if you wait, you’ll get to know the dynamic between founders and be able to bring a more comprehensive understanding of the role each founder plays to the decision.

Each founder naturally takes on different positions within an organization, ranging across the C-suite. This brings up many questions: should a CEO co-founder be awarded an equal share to a co-founder who’s acting as CFO? Does the number of co-founders affect the decision? Two co-founders may be able to split the workload fairly but are four co-founders all going to assume an equal share of the responsibility?

There isn’t a one-size-fits-all solution as to when or how to split startup equity but there are several cookie-cutter options to consider. Here are the top three:

How to split startup equity between co-founders

There are a few different routes you can go down to split equity among co-founders. Before entering into any final decisions seek the help of a legal or financial advisor.

Flat split

Each co-founder gets an equal share of the company. This method is the simplest as it doesn't require any valuation or calculation.

Research from Harvard Business School professors also shows that investors are less likely to invest in startups with a flat split. Dividing equity equally may signal that the co-founders aren’t willing negotiators or that they’re not prepared to risk conflict or disagreement to resolve important issues.

Value-based split

Founders are assigned equity based on the value of their contributions to the company. This could include how much funding they bring to the table, how much time they dedicate to the business, the value of their professional contacts and previous experience.

Supply and demand split

A supply and demand split is based on the idea that the market rate for each specific role should determine how much each co-founder receives. For instance, the market rate for a CEO is higher than that of a CFO and the equity split should reflect this.

This method is also useful for assigning equity when the startup hires people for these roles later in the startup journey. The value of the equity granted to a new senior employee is often calculated by reference to market-rate salaries. As startups can’t usually match the salaries paid by more established companies, the difference is made up in stock options.

It’s not just about the split

In an ideal world, a co-founder equity split is simple. The reality is thorny with differing opinions and factors to take into consideration.

How do you cater to a co-founder that would rather take a higher basic salary than a substantial chunk of equity? While there are good reasons for demanding a higher base salary (an individual’s financial situation, for example), holding equity demonstrates a certain commitment to the business which a high base salary cannot.

This could be problematic when facing investors who are in it for a long-term return on investment. Would the investment seem as appealing for an injection of capital into a startup that’s run by founders who have less of a financial stake in the company?

On the other side of the spectrum, the rise of secondary transactions facilitates exits for co-founders, employees and angel investors making startups more agile and more able to respond to changing circumstances.

The importance of vesting

In the startup ecosystem, a vesting schedule for employee equity is common practice as it encourages long-term commitment.

At a founder level, despite being a sensitive topic, vesting schedules are necessary – especially when dealing with multiple co-founders. When approaching investors for capital, this is something they will have an eye out for.

Founder vesting, much like with other shares relies on the process of reverse vesting. Shares are awarded with immediate benefits but with certain conditions set by the vesting schedule. If a schedule has been set to four years and a founder leaves after one year, the company is entitled to repurchase 75% of the shares and prevent that shareholder departing with a large stake in the business.

Put simply, founder vesting incentivizes co-founders to stay and protects the company in case any of them leave.

Setting the tone for future decisions

An equity split also influences important, company-defining decisions going forwards. An even split means there’s no deciding vote should it be impossible to reach a consensus. Some co-founders prefer the idea that, no matter how tricky the matter is to solve, a consensus has to be reached for a decision to be made. Others value the speed and agility of a weighted split – even if it means there’s one dominant force who can overrule the others.

When it comes time for you to make the decision, start an open and honest conversation with your co-founders and consider what a fair split means to each of you. It may be that an equal split is the fairest option. You may come to another conclusion. What’s most important is that you all walk away feeling your voice has been heard and a reasonable decision has been reached.

To learn more about managing your cap table or using equity, check out Carta Classroom or speak to a member of our team today about our equity management solutions.

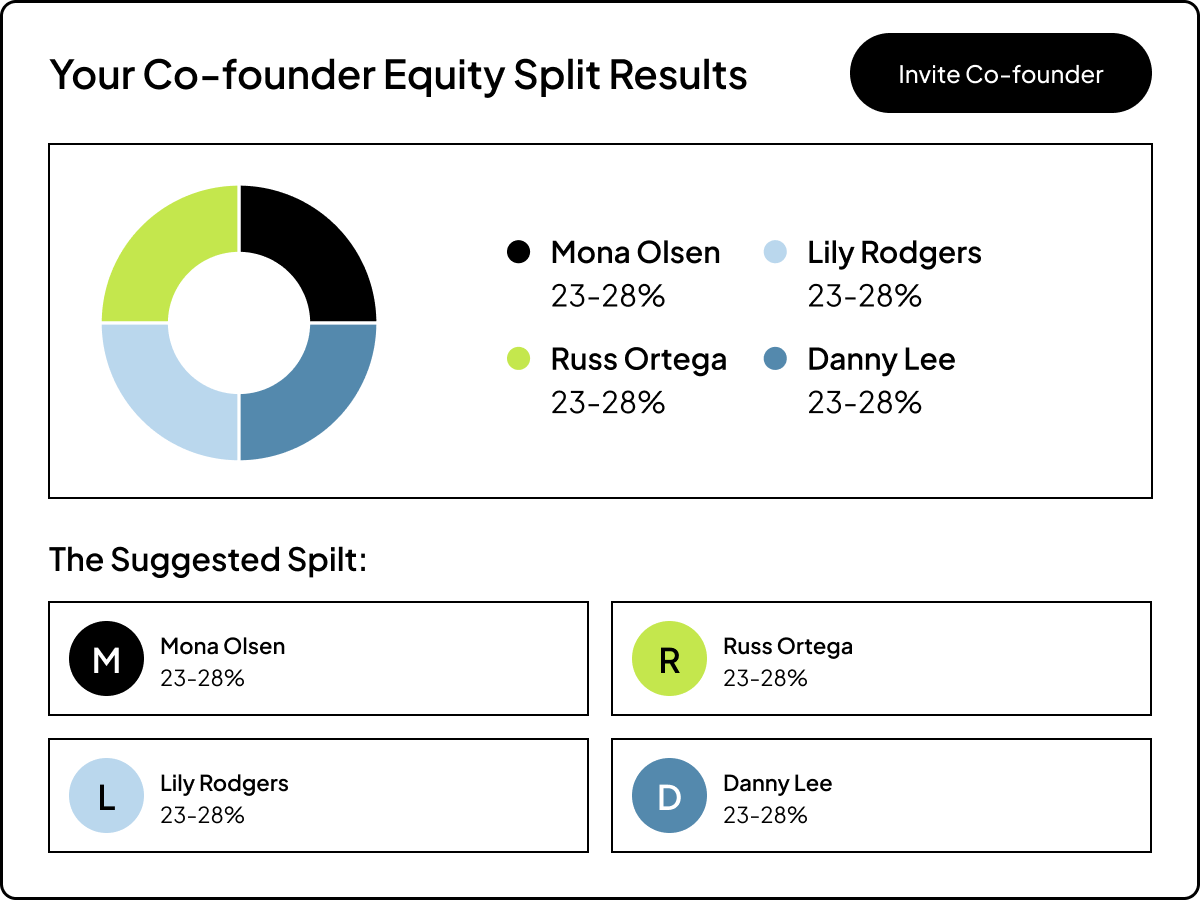

Co-founder equity split calculator

Carta’s co-founder equity split calculator is a dynamic tool that asks questions about the company and each founder—their roles, responsibilities, skill sets, and other factors—to model a recommended founder equity breakdown. Here’s what the co-founder equity split calculator looks like in action:

To calculate the best way to split founder equity, you can input details into the tool about your company and each founder. The final results are helpful, but it’s the act of going through the process and asking yourself (and each other) the hard questions that truly pays off.

The Carta founder equity calculator makes it easier to have these conversations, and it supports the co-founders in making this consequential decision.

Getting this decision right is important. Determining founder equity split is often a blocker for incorporation and, in turn, raising funding. The tool is available exclusively in the Carta Founder Studio—sign in here.